Automated Breast Ultrasound Systems Market Trend, Share, Growth, Size, Analysis and Forecast 2034

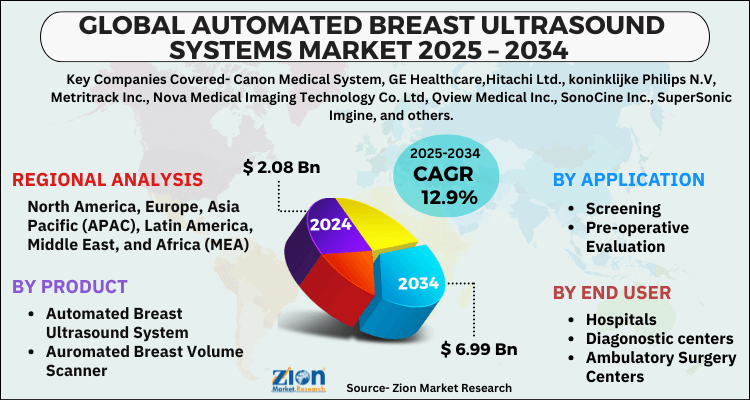

Automated Breast Ultrasound Systems Market By Product (Automated Breast Ultrasound System, Automated Breast Volume Scanner), By Application (Screening, Pre-operative Evaluation), End User (Hospitals, Diagnostic centers, Ambulatory Surgery Centers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2025 - 2034

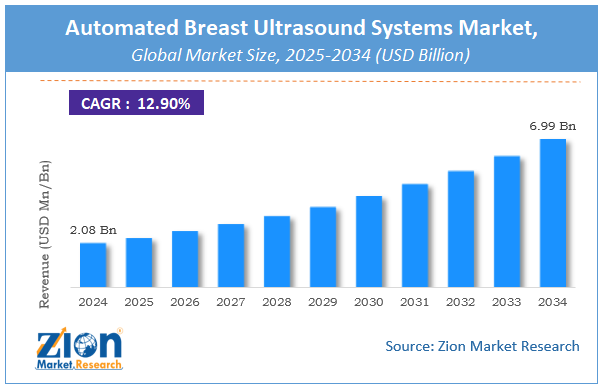

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.08 Billion | USD 6.99 Billion | 12.9% | 2024 |

Automated Breast Ultrasound Systems Market Size

The global automated breast ultrasound systems market size was worth around USD 2.08 Billion in 2024 and is predicted to grow to around USD 6.99 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 12.9% between 2025 and 2034. The report analyzes the global automated breast ultrasound systems market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the automated breast ultrasound systems industry.

Automated Breast Ultrasound Systems Market: Overview

Breast cancer is one of the most frequent cancers in the world, and it is a severe health concern because it is the most common cancer in women. As a result, healthcare practitioners place a premium on early detection in order to lower morbidity and mortality rates and improve survival rates. Mammography and ultrasound are well-known tools for breast cancer screening and early detection. When used in conjunction with mammography, the breast ultrasound system has shown encouraging results in the diagnosis of tumours in women with thick breasts. Both mammography and conventional breast ultrasonography, on the other hand, had some technical limitations, paving the path for the development of ABUS.

The automated breast ultrasound (ABUS) system is a new technological advancement in the field of ultrasound imaging that was created to provide an operator-free system. ABUS is a repeatable system that produces high-resolution three-dimensional imaging. ABUS is known for its comfort, accuracy, and efficiency in handling. ABUS has been shown in several studies and research to have higher sensitivity, cancer detection rates, diagnostic accuracy rates, and picture quality. With the use of high-frequency transducers, recent improvements in ABUS systems have made it possible to reproduce superior quality images in a short amount of time.

The demand for automated breast ultrasound systems is being fueled by rising breast cancer prevalence and occurrences, a developing radiology market, and greater patient knowledge of the link between breast density and breast cancer. Furthermore, technological advancements in the development of improved imaging techniques, as well as increased government funding for breast cancer awareness, should boost market demand. Furthermore, heavy investments and extensive research, as well as the advantages of automated breast ultrasound systems such as 3D imaging, high quality imaging, coronal view, and rapid results with assurance of improved diagnostic results, are propelling the market for automated breast ultrasound systems forward. With an increase in the number of instances of breast cancer each year, particularly among women, and rising healthcare costs, the market for automated breast ultrasound systems (ABUS) is expected to rise rapidly in the future years.

Key Insights

- As per the analysis shared by our research analyst, the global automated breast ultrasound systems market is estimated to grow annually at a CAGR of around 12.9% over the forecast period (2025-2034).

- Regarding revenue, the global automated breast ultrasound systems market size was valued at around USD 2.08 Billion in 2024 and is projected to reach USD 6.99 Billion by 2034.

- The automated breast ultrasound systems market is projected to grow at a significant rate due to increasing demand for early and accurate detection, rising breast cancer prevalence, advancements in imaging technology, and growing adoption of automated screening solutions.

- Based on Product, the Automated Breast Ultrasound System segment is expected to lead the global market.

- On the basis of Application, the Screening segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Automated Breast Ultrasound Systems Market: Growth Drivers

Demands for automated breast ultrasound systems to drive global market growth

Breast cancer is the fifth biggest cause of mortality among women from cancer. Breast cancer affects as least one out of every four women diagnosed with cancer, and this worrying increase has prompted the need for efficient therapy. The ever-increasing prevalence of breast cancer around the world has sparked a spike in demand for automated breast ultrasonography equipment. The market for automated breast ultrasonography systems is growing due to an increase in the incidence of hereditary illnesses in women, as well as rising healthcare spending and favorable government regulations. According to the American Cancer Society, roughly 1.7 million new cancer cases are expected to be diagnosed by 2018, with over 600,000 Americans expected to die from cancer. The market for automated breast ultrasound systems has been boosted by increased R&D spending. Cancer Research UK has invested USD 518 million in cancer research across the country, with the goal of increasing cancer survival rates by 75% by 2034. By 2023, the group wants to spend up to 2.6 percent of GDP on cancer research. In addition, rising per capita income, favorable reimbursement policies, and increased knowledge of diagnostic system availability have supported the expansion of the automated breast ultrasound systems market.

Automated Breast Ultrasound Systems Market: Restraints

Stringent regulations in various countries in Automated Breast Ultrasound Systems to hamper the market growth

The use of imaging techniques has been restricted in a number of countries due to strict laws. Furthermore, the high cost of ultrasound systems compared to traditional cancer screening methods is expected to limit the growth of the global automated breast ultrasound system (ABUS) market. A new ABUS, for example, can cost around $300,000 on average. Although ultrasonography is quick and effective in detecting cancer, it is prone to false-positive biopsies, which is expected to slow market growth.

Automated Breast Ultrasound Systems Market: Opportunities

Demands for automated breast ultrasound systems to bring growth opportunities for global market

The number of patients is growing, and to diagnose any sort of cancer, an ultrasound or MRI is required to determine the cause or which body part is afflicted, which is positively impacting demand for breast ultrasound systems. Furthermore, the automated breast ultrasound systems market is influenced by the rise in healthcare expenditure, advancements in technology provided by different market players, advancements in healthcare infrastructure, and ore portable and less expensive diagnostic imaging tool, as compared to CT and MRI, breast associated disorder.

Global Automated Breast Ultrasound Systems Market: Segmentation

The global Automated Breast Ultrasound Systems market is segregated based on product, application, end user and region.

By product, the market is classified into Automated Breast Ultrasound System amd Automated Breast Volume Scanner. By 2028, the automated breast ultrasound system segment is expected to grow at a faster rate. One of the primary factors boosting the worldwide automated breast ultrasound system is technological advances in breast cancer detection equipment. Several additional technologies are being developed by companies to improve cancer screening in people with thick breasts, enhancing the efficiency of breast cancer detection. ABUS innovations are also expected to solve flaws in traditional systems. Customer acceptance of improved cancer imaging will increase as a result of such technological advancements, boosting industry growth..

By end user, the Automated Breast Ultrasound Systems market is segmented into hospitals,diagonostic centers and ambulatory surgery centers. The diagnostic imaging centres segment will have a larger share in the forecasted period. The segmental growth will be accelerated by the expansion of diagnostic centre facilities for early identification and detection of malignant cells in the body. Breast cancer detection technologies will be adopted at a faster pace as specialist diagnosis tools and technology become more widely available. Furthermore, throughout the forecast period, improving infrastructure in diagnostic imaging centres in developing countries will support segmental growth.

Automated Breast Ultrasound Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Breast Ultrasound Systems Market |

| Market Size in 2024 | USD 2.08 Billion |

| Market Forecast in 2034 | USD 6.99 Billion |

| Growth Rate | CAGR of 12.9% |

| Number of Pages | 160 |

| Key Companies Covered | Canon Medical System, GE Healthcare,Hitachi Ltd., koninklijke Philips N.V, Metritrack Inc., Nova Medical Imaging Technology Co. Ltd, Qview Medical Inc., SonoCine Inc., SuperSonic Imgine, and others. |

| Segments Covered | By Product, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- November 2021-QView Medical, a leading breast cancer detection company based in the United States, has partnered with GE Healthcare, a well-known producer of cutting-edge medical technology. The former would be able to launch its QVCAD software on the latter's Invenia ABUS 2.0 platform as a result of this agreement (Automated Breast Ultrasound). Invenia ABUS 2.0 has an open platform technology that allows third-party AI technologies to be integrated. The product is a cancer-detecting supplementary breast screening technology that has been approved by the FDA.

- October 2019 - GE Healthcare and Premier Inc. worked to establish a concept for bringing same-day breast cancer diagnosis and treatment to the United States.

- December 2019 - At the 105th Annual Radiological Society of North America (RSNA) meeting, Ikonopedia showed improvements to its breast biopsy reporting tool aimed at increasing efficiency and clinical utility.

Automated Breast Ultrasound Systems Market: Regional Landscape

According to the American Society of Cancer, about 281,550 new instances of breast cancer will be discovered in women in 2021, with 43,600 women dying from the disease. Breast cancer is becoming more common, which will increase the demand for better breast imaging technology and therapies. The ABUS market in the United States will be boosted by increased government programmes to raise awareness and educate women about breast cancer and the necessity of screening. The American Society of Cancer's National Breast Cancer Awareness (NBCA) month, the National Breast Cancer Foundation's awareness campaigns, and the Susan Komen Foundation’s. These factors will boost demand for automated breast ultrasonography devices for breast cancer screening in dense breast tissue.

Automated Breast Ultrasound Systems Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the automated breast ultrasound systems market on a global and regional basis.

Some of the main competitors dominating the global Automated Breast Ultrasound Systems market include -

- Canon Medical System

- GE Healthcare,Hitachi Ltd.

- koninklijke Philips N.V

- Metritrack Inc.

- Nova Medical Imaging Technology Co. Ltd

- Qview Medical Inc.

- SonoCine Inc.

- SuperSonic Imgine

Global Automated Breast Ultrasound Systems market is segmented as follows:

By Product

- Automated Breast Ultrasound System

- Auromated Breast Volume Scanner

Application

- Screening

- Pre-operative Evaluation

End User

- Hospitals

- Diagonostic centers

- Ambulatory Surgery Centers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global automated breast ultrasound systems market is expected to grow due to rising breast cancer prevalence, advancements in AI-powered imaging, increasing demand for early and accurate diagnostics, and growing adoption of supplemental screening tools for dense breast tissue.

According to a study, the global automated breast ultrasound systems market size was worth around USD 2.08 Billion in 2024 and is expected to reach USD 6.99 Billion by 2034.

The global automated breast ultrasound systems market is expected to grow at a CAGR of 12.9% during the forecast period.

North America is expected to dominate the automated breast ultrasound systems market over the forecast period.

Leading players in the global automated breast ultrasound systems market include Canon Medical System, GE Healthcare,Hitachi Ltd., koninklijke Philips N.V, Metritrack Inc., Nova Medical Imaging Technology Co. Ltd, Qview Medical Inc., SonoCine Inc., SuperSonic Imgine, among others.

The report explores crucial aspects of the automated breast ultrasound systems market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed