Artificial Intelligence (AI) In Drug Discovery Market Size, Share, Growth 2032

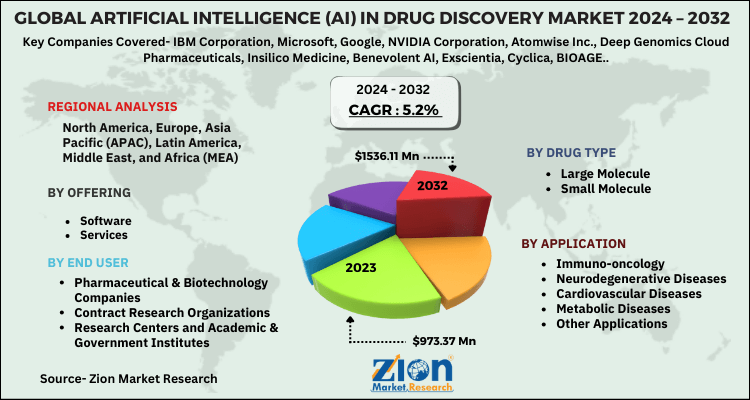

Artificial Intelligence (AI) In Drug Discovery Market By Drug Type (Large Molecule, Small Molecule), By Offering (Software, Services), By Application (Immuno-oncology, Neurodegenerative Diseases, Cardiovascular Diseases, Metabolic Diseases, Other Applications), By End User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Research Centers and Academic & Government Institutes) - Global Industry Perspective, Comprehensive Analysis And Forecast, 2024-2032

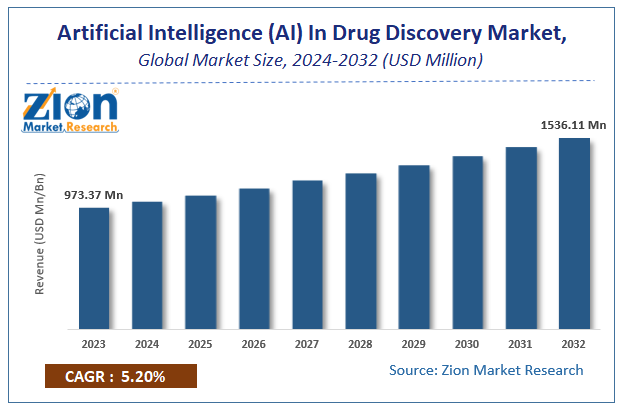

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 973.37 Million | USD 1536.11 Million | 5.2% | 2023 |

Artificial Intelligence (AI) In Drug Discovery Market Insights

According to Zion Market Research, the global Artificial Intelligence (AI) In Drug Discovery Market was worth USD 973.37 Million in 2023. The market is forecast to reach USD 1536.11 Million by 2032, growing at a compound annual growth rate (CAGR) of 5.2% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Artificial Intelligence (AI) In Drug Discovery Market industry over the next decade.

Artificial Intelligence (AI) In Drug Discovery Market: Overview

AI is getting sophisticated at doing what humans do, but in an efficient, quicker manner and at a lower cost. The potential for Artificial Intelligence in healthcare is vast. AI has the potential to help researchers create drugs as well. Various robot scientists using AI can test more compounds with improved accuracy, reproducibility, and exhaustive record keeping. With the decline in the new drug discovery rate and rise in expenditure for drug trials, companies are now switching to AI platforms for drug inventions and drug trials. Machine learning and natural language processing are two AI platforms used in drug discovery. AI virtually screens the molecule, designs molecule models, and analyses and predicts how likely a drug is to have the right properties to be non-toxic in the body.

Various AI solutions are being developed to identify new potential therapies from vast databases of information on existing medicines, which could be redesigned to target critical diseases such as the Ebola virus. This could improve the efficiency and success rate of drug development, stimulating the process to bring new drugs to market in response to deadly disease threats.

Several research organizations are using artificial intelligence in drug design. For instance, in 2016, IBM Watson partnered with Pfizer in their drug discovery research. Pfizer is using IBM Watson to identify new drugs for their immune-oncology research. GNS Healthcare has partnered with Genentech, a member of the Roche group, to use machine learning for drug discovery. Their focus is on developing personalized medicine approaches using AI, especially for cancer treatments. Sanofi has signed a deal to use UK start-up Exscientia’s artificial intelligence (AI) platform to search for metabolic-disease therapies.

COVID-19 Impact Analysis

The outbreak of novel coronavirus disease became a pandemic and has disastrously affected world economics. The effect of COVID-19 on the global economy is so huge that all the sectors are suffering backlash including the pharmaceutical, biotechnology, and AI sectors. While suffering through the impact, many pharmaceutical, biopharmaceutical, and AI companies are supporting regional governments to address the unmet COVID-19 needs, which has started putting a financial burden on the research & development sector.

COVID-19's impact on the pharmaceutical and biopharmaceutical sector starts right from disruption in research & development activities and goes till the very end of the pharmaceutical products supply chain, which has severely hampered demand for AI in drug discovery. Whether the supply chain is integral or outsourced, it is handling immense pressure. Supply of the pharmaceutical drugs and other pharmaceutical products has narrowed down while the demand is burgeoning, creating a huge demand-supply gap.

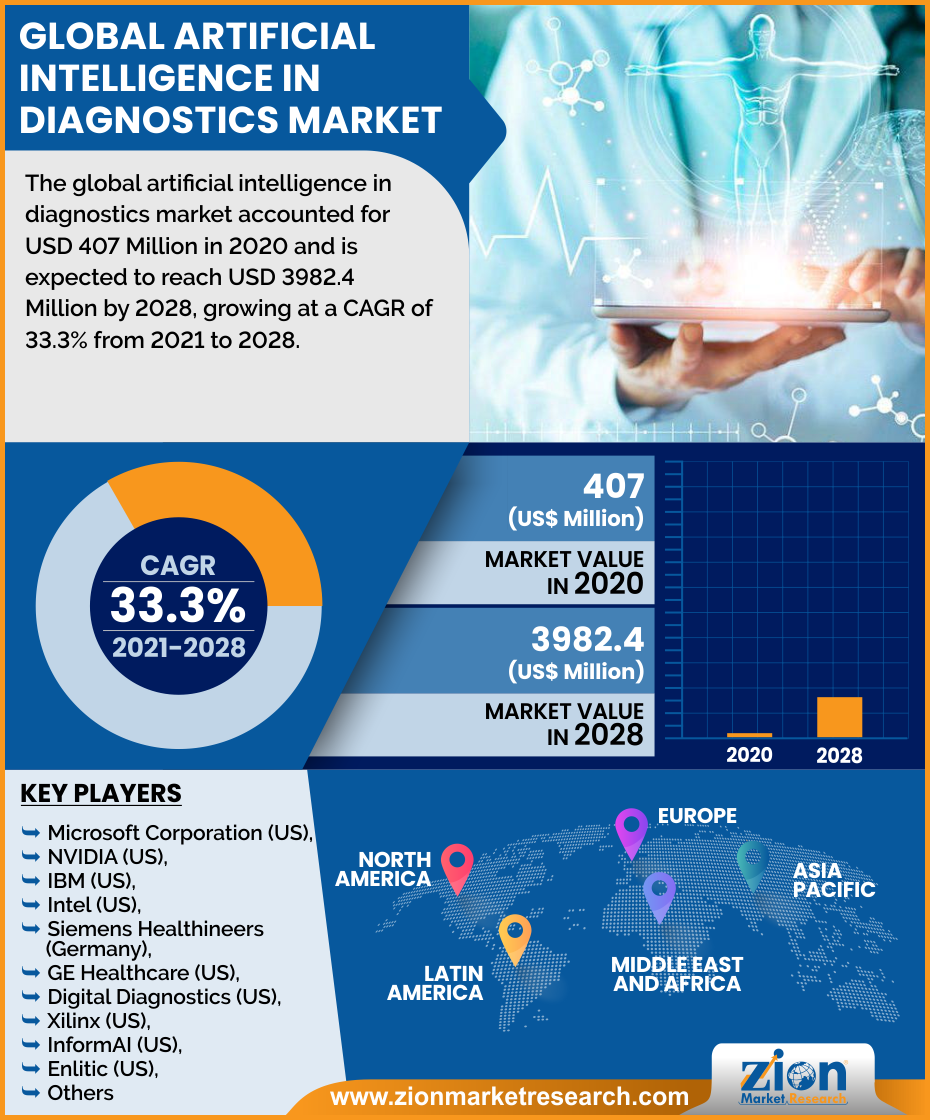

COVID-19's impact on all the application sectors of AI including imaging diagnostics, drug discovery, lifestyle management & monitoring, emergency room and hospital management, wearables, insights & risk analytics, and virtual assistance has severely impacted the global artificial intelligence market.

Artificial Intelligence (AI) In Drug Discovery Market: Growth Factors

The healthcare sector is being transformed with the emergence of AI, which offers the ability to manage massive amounts of valuable data about hits, molecules, and clinical trial subjects, which may be impossible for human beings to analyze. Here, AI offers a technique to automatically find patterns in data, which enables researchers to focus on the essential part of drug discovery by effectively managing time and minimizing errors.

Technological advances in drug discovery processes and innovations have revolutionized the field of oncology and given birth to highly effective treatment options. Several diagnostic techniques such as CT scans, 3D mammograms, and targeted radiation therapy have enhanced the understanding of cancer with early and effective diagnosis. Moreover, constantly growing investments in oncology drugs R&D and huge expenditures by leading pharmaceutical and biotechnology companies on better outputs are giving a push to the overall AI in drug discovery market growth. Growing emphasis on the research & development of oncology drugs is expected to benefit the global AI in drug discovery market growth.

Financial challenge is affecting the potential of artificial intelligence in the healthcare sector worldwide, As AI technology is in the nascent stage and various organizations and players are still in the R&D phase over its implementation in their products and services depends on funding. Hence, these are some factors that can act as restraints to the global AI in the drug discovery market.

Drug Type Segment Analysis Preview

On the basis of drug types, the market is segmented into small molecules and large molecules. Large molecule holds the major share of the market. Large molecules are large and complex, generally consisting of heterogeneous mixtures. Manufacturing large molecules is more challenging than for traditional small-molecule drugs. Even minor changes in the manufacturing process result in severe or significant changes in immunogenicity or efficacy. Discovery for large molecules is generally more expensive than that of a small molecule. Being expensive, adoption of the large molecules has lowered in the last few years, hampering the segment growth.

Combining the efficacies of therapies and treatments, small molecule drug types are expected to drive the overall AI in the drug discovery market. With significant development in overall therapies and treatment options, small molecules are expected to outgrow the efficacies of large molecules and take over AI in drug discovery. Small molecules are expected to benefit from their cross-membrane ability to reach greater intracellular targets. Increased level of efficacy of the small molecule through extensive research & development is expected to boost the overall small molecule segment in global AI in the drug discovery market.

End-User Segment Analysis Preview

On the basis of end users, the global market is segmented into pharmaceutical & biopharmaceutical companies, academic & research institutions, and others. Pharmaceutical companies such as GlaxoSmithKline, Pfizer, AstraZeneca, and Eli Lilly & Company are implementing AI to streamline the whole drug development process. AI is also used to predict adverse drug reactions among patients. Hence, pharmaceutical & biopharmaceutical companies, and academic & research institutions are anticipated to boost the overall End-User segment in the global AI in the drug discovery market.

Artificial Intelligence (AI) In Drug Discovery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Artificial Intelligence (AI) In Drug Discovery Market |

| Market Size in 2023 | USD 973.37 Million |

| Market Forecast in 2032 | USD 1536.11 Million |

| Growth Rate | CAGR of 5.2% |

| Number of Pages | 170 |

| Key Companies Covered | IBM Corporation, Microsoft, Google, NVIDIA Corporation, Atomwise Inc., Deep Genomics Cloud Pharmaceuticals, Insilico Medicine, Benevolent AI, Exscientia, Cyclica, BIOAGE. |

| Segments Covered | By Drug Type, By Offering, By Application, By End User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Artificial Intelligence (AI) In Drug Discovery Market: Regional Analysis Preview

North America holds the largest share of the market for AI in drug discovery owing to technological advancements and early adoption of artificial intelligence platforms in developed countries such as the U.S. and Canada. North America is one of the most technologically advanced application markets for AI due to the active involvement of tech giants in the field of artificial intelligence. Moreover, high adoption rate of AI in North America coupled with the development & growth of research & development activities and investments by government and private organizations in the pharmaceutical and biotechnology companies is further stimulating the market growth.

Furthermore, the increasing prevalence of various chronic, metabolic, infectious, and life-threatening diseases has boosted demand for novel treatment therapies and drugs through AI in drug discovery, fueling the overall North American AI in the drug discovery market. Asia-Pacific region is anticipated to grow at the fastest CAGR of XX% over the forecast period. The growing population, increasing patient pool base, rising adoption of cloud computing techniques, growing aged population, and various government initiatives favoring AI for drug discovery are the major driving factors for the regional market.

Artificial Intelligence (AI) In Drug Discovery Market Players & Competitive Landscape

Some of the key players in Artificial Intelligence (AI) In the Drug Discovery Market are,

- IBM Corporation

- Microsoft

- NVIDIA Corporation

- Atomwise, Inc.

- Deep Genomics

- Cloud Pharmaceuticals

- Insilico Medicine

- Benevolent AI

- Exscientia

- Cyclica

- BIOAGE

The Artificial Intelligence (AI) In Drug Discovery Market is segmented as follows:

By Drug Type

- Large Molecule

- Small Molecule

By Offering

- Software

- Services

By Application

- Immuno-oncology

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Other Applications

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Research Centers and Academic & Government Institutes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to Zion Market Research, the global Artificial Intelligence (AI) In Drug Discovery Market was worth USD 973.37 Million in 2023. The market is forecast to reach USD 1536.11 Million by 2032.

According to Zion Market Research, the global Artificial Intelligence (AI) In Drug Discovery Market a compound annual growth rate (CAGR) of 5.2% during the forecast period 2024-2032.

Artificial Intelligence (AI) In Drug Discovery Market AI offers a technique to automatically find patterns about data, which enables researchers to focus on the essential part of drug discovery by effectively managing time and minimizing errors.

North America held a substantial share of the Artificial Intelligence (AI) In Drug Discovery Market in 2023.

Some of the major companies operating in the Artificial Intelligence (AI) In Drug Discovery Market are IBM Corporation, Microsoft, Google, NVIDIA Corporation, Atomwise, Inc., Deep Genomics Cloud Pharmaceuticals, Insilico Medicine, Benevolent AI, Exscientia, Cyclica, BIOAGE.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed