Aquafeed Market Trend, Share, Growth, Size, Analysis and Forecast 2032

Aquafeed Market By Source (Soybean, Fishmeal, Fish Oil, Corn, Additives, & Others) By End-User (Mollusks, Carp, Crustaceans, Carp, Tilapia, Catfish, Salmon, And Others): Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends And Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 50.88 Billion | USD 74.45 Billion | 4.32% | 2023 |

Global Aquafeed Market Insights

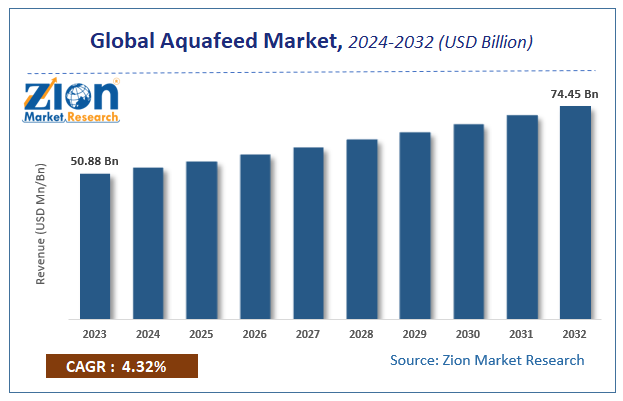

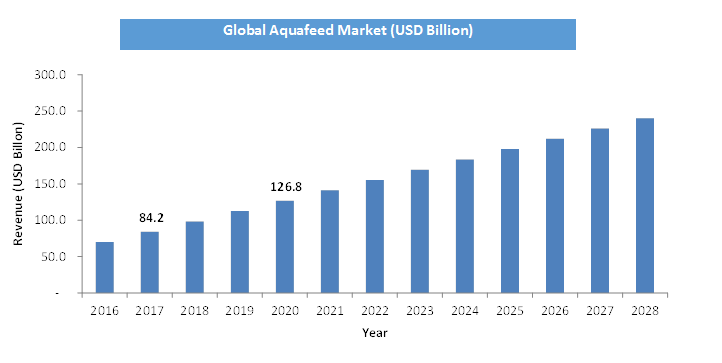

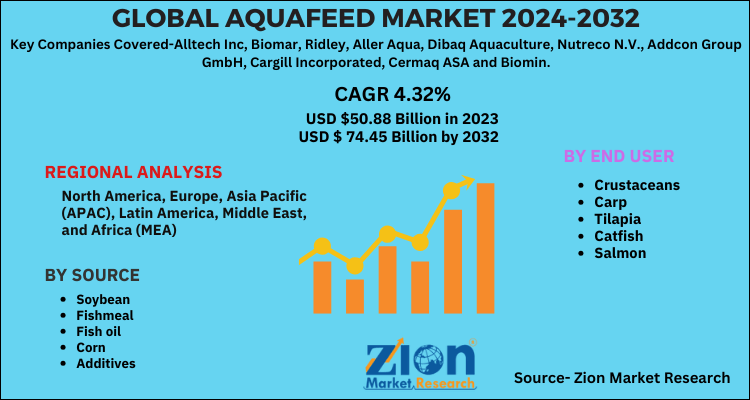

Zion Market Research has published a report on the global Aquafeed Market, estimating its value at USD 50.88 Billion in 2023, with projections indicating that it will reach USD 74.45 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.32% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Aquafeed Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Aquafeed Market: Overview

Aquafeed is compounded meal intended for consumption by aquatic animals, which is produced by mixing various raw materials and additives. These aquafeeds are prepared consistent with the specific requirements of the aquatic animals and the age of the animal. High-quality aquafeed is useful to fish, mollusks, crustaceans & other aquatic animals than farm-made feed due to its balanced and wish-specific composition.

Increasing demand for aqua products along with Growth indirect human consumption of seafood is expected to fuel the industry growth over the forecast period. The market is anticipated to be driven by ascending demand for animal by-products, like fish meals, shrimp meals, and squid meals, in feed applications, especially within the emerging economies of Asia Pacific, including India, China, and Vietnam. Moreover, growth within the developed economies is often attributed to gradual technological advancements in feed formulation. Such factors have bolstered the aquafeed demand on an outsized scale.

Aquafeed Market: Growth Factors

The Aquafeed market has been witnessing growth in terms of rushing urbanization and growing the income of people which has led to a rise in the consumption of protein-rich meats. Moreover, fish may be a rich source of vitamins and proteins, therefore it's primarily used for direct human consumption. Fish consumption has observed a rise on account of several factors, like increasing availability of a spread of fishes within the retail market and consumers’ preference for a spread of flavors. The aforementioned factors have resulted in a boost in the demand for fish and fish products, which, in turn, is anticipated to boost the industry.

Aquaculture is the fastest growing industry producing animal protein. Aquafeed is an important segment in aquaculture. Providing good quality aquafeed is of prime importance for aquaculture. Aquafeed is a mixture of various kinds of additives and raw materials. This preparation is prepared to suit specific requirement of different kind of aquatic animals and age of the animal.

The global aquafeed market is expected to witness substantial growth within the forecast period. The market is mainly driven by rising demand for sea food coupled with consumer awareness regarding the quality of seafood products. Moreover, increasing per capita income in developing countries is expected to propel the market growth in the near future. Aquafeed ingredients including soybean and fishmeal are among the widely used products in Asia-Pacific due to the change in aquafeed consumption and production pattern witnessed in this region. However, increasing the cost of raw material is expected to hinder the market growth over the forecast period. Nonetheless, high demand for conventional and functional aquafeed emerging economics especially in China and Rest of Asia is expected to open up new growth avenues in the near future.

Aquafeed Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aquafeed Market |

| Market Size in 2023 | USD 50.88 Billion |

| Market Forecast in 2032 | USD 74.45 Billion |

| Growth Rate | CAGR of 4.32% |

| Number of Pages | 110 |

| Key Companies Covered | Alltech Inc, Biomar, Ridley, Aller Aqua, Dibaq Aquaculture, Nutreco N.V., Addcon Group GmbH, Cargill Incorporated, Cermaq ASA and Biomin |

| Segments Covered | By Source, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Source Segment Analysis Preview

Soybean is among the non-fish sources of omega-3 fatty acids, proteins, and unsaturated fats. Soy protein is fed to farm-reared fish and shellfish to reinforce their overall growth and development. A number of the commonly used soybean products in aquafeed include heat-processed full-fat soybean, mechanically extracted soybean cake, solvent-extracted soybean flour, and dehulled solvent-extracted soybean flour. Since soybean flour is priced significantly lesser than fishmeal, the consumption of soybean flour is high.

End-User Segment Analysis Preview

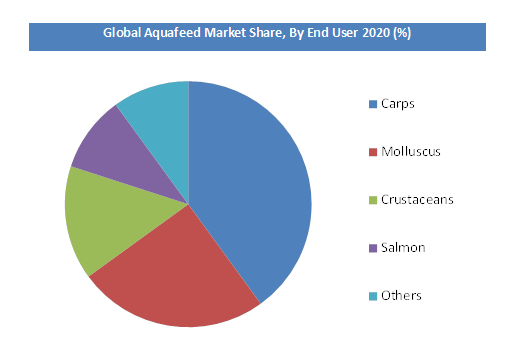

The market, by species, is segmented into fish, crustaceans, mollusks, et al. (turtles and sea urchins). Fish farming in ponds, lakes, rivers, and coastal waters is increasing to fill the gap between demand and provide. The rise in fish farming activities and aquaculture has led to the increased demand for fish feed. Among fish, carp and tilapia are high consumers of aquafeed. Also, carps are being extensively reared, due to their adaptability to changing climates, while Tilapia culturing has increased in recent years thanks to the growing supply of high-quality protein tilapia species at lower prices.

Regional Segment Analysis Preview

The marketplace for aquafeed in Asia-Pacific registered a share of over 60% of the general consumption in 2016. This growth is especially attributed to increasing aquaculture production and growing seafood consumption during this region. Europe is anticipated to point out noticeable growth due to the presence of favorable regulations and rules. In 2015, Norway constitutes large chunk market share the entire European aquafeed market thanks to high demand for salmon fish feed. Latin America is another key important regional market and is predicted to witness substantial growth within the forecast period.

Aquafeed Market: Key Players & Competitive Landscape

Key players present in this market include-

- Alltech Inc

- Biomar

- Ridley

- Aller Aqua

- Dibaq Aquaculture

- Nutreco N.V.

- Addcon Group GmbH

- Cargill Incorporated

- Cermaq ASA and Biomin

The global Aquafeed Market is segmented as follows:

By Source

- Soybean

- Fishmeal

- Fish oil

- Corn

- Additives

- Others

By End User

- Crustaceans

- Carp

- Tilapia

- Catfish

- Salmon

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Aquafeed Market was valued at USD 50.88 billion in 2023.

The global Aquafeed Market is expected to reach USD 74.45 billion by 2032, growing at a CAGR of 4.32% between 2024 to 2032.

Increasing urbanization and increasing the income of individuals has led to an increase in the consumption of protein-rich meats, the industry is expected to have a positive impact on the demand.

Asia Pacific is the leading market for Aquafeed and is expected to witness rapid growth due to cheap labor, appropriate climatic conditions, and the availability of natural resources in this region.

Key players present in this market include Alltech Inc, Biomar, Ridley, Aller Aqua, Dibaq Aquaculture, Nutreco N.V., Addcon Group GmbH, Cargill Incorporated, Cermaq ASA and Biomin.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed