Global Apolipoprotein E Genotype Test Kit Market Size, Share, Trends by 2034

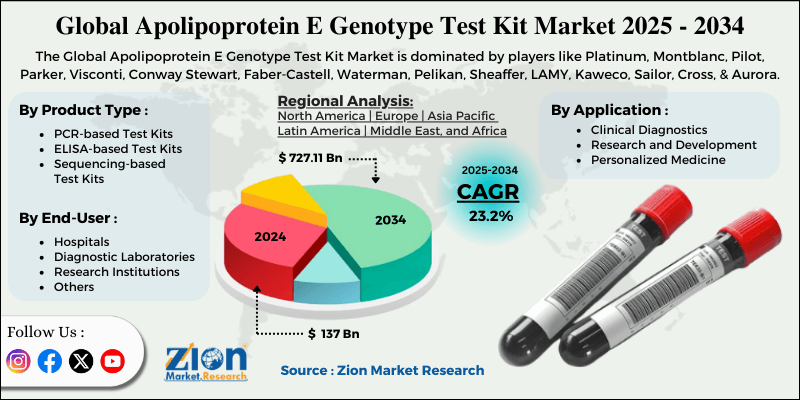

Apolipoprotein E Genotype Test Kit Market By Product Type (PCR-based Test Kits, ELISA-based Test Kits, Sequencing-based Test Kits, and Others), By Application (Clinical Diagnostics, Research and Development, Personalized Medicine), By End-User (Hospitals, Diagnostic Laboratories, Research Institutions, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

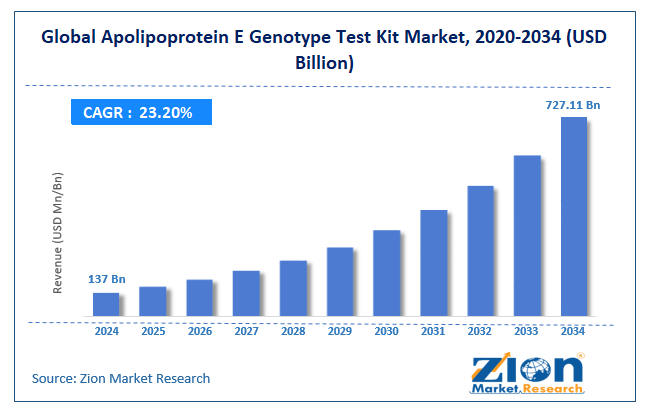

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 137 Billion | USD 727.11 Billion | 23.2% | 2024 |

Apolipoprotein E Genotype Test Kit Industry Prospective:

The global Apolipoprotein E Genotype test kit market size was worth around USD 137 billion in 2024 and is predicted to grow to around USD 727.11 billion by 2034, with a compound annual growth rate (CAGR) of roughly 23.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global Apolipoprotein E Genotype test kit market is estimated to grow annually at a CAGR of around 23.20% over the forecast period (2025-2034)

- In terms of revenue, the global Apolipoprotein E Genotype test kit market size was valued at around USD 137 billion in 2024 and is projected to reach USD 727.11 billion by 2034.

- The Apolipoprotein E Genotype test kit market is projected to grow significantly, driven by increasing demand for personalized medicine, advances in molecular diagnostics, and rising awareness of genetic risk factors among consumers and clinicians.

- Based on product type, the PCR-based test kits segment is expected to lead the market, while the Sequencing-based test kits segment is expected to grow considerably.

- Based on application, the clinical diagnostics segment is the largest, while the research and development segment is projected to record sizeable revenue over the forecast period.

- Based on end user, the hospitals segment is expected to lead the market, followed by the diagnostic laboratories segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Apolipoprotein E Genotype Test Kit Market: Overview

An Apolipoprotein E (ApoE) Genotype test kit is a genetic test that identifies which variant of the APOE gene an individual carries – most commonly ε2, ε3, or ε4. These variants influence how the body metabolizes cholesterol and are also associated with differences in risk for certain conditions, including cardiovascular disease and late-onset Alzheimer’s disease. The global Apolipoprotein E Genotype test kit market is projected to witness substantial growth, driven by rising cases of Alzheimer’s disease, advances in precision and personalized medicine, and the expansion of direct-to-consumer genetic testing. Growing worldwide Alzheimer’s incidences are surging the demand for early-risk genetic assessments. ApoE genotyping enables clinicians to assess susceptibility to late-onset Alzheimer’s disease.

With the growing awareness, more caregivers and patients are seeking predictive testing. Healthcare is moving toward individualized treatment and prevention strategies. ApoE status is useful in guiding personalized lipid management and neurological risk assessment. This trend drives the adoption of genetic test kits in consumer and clinical settings. Moreover, DTC testing platforms are streamlining access to genotyping information. The convenience of at-home sample collection aids broader use of ApoE test kits. Elevated consumer curiosity about genetic health risks augments the industry growth.

Although drivers exist, the global market is challenged by factors such as ethical and privacy concerns and the high cost of genetic testing. Genetic testing increases the potential for misuse of sensitive results and raises concerns about data security. Several patients hesitate due to stigmatization or fear of discrimination. These issues slow the broader adoption of ApoE testing. Likewise, despite technological advancements, a majority of populations may find genotyping costly. Low reimbursement further increases out-of-the-pocket expenses. Cost barriers hamper uptake in low-resource regions.

Even so, the global Apolipoprotein E Genotype test kit industry is well-positioned due to the expansion of digital health platforms and the growing adoption of home-based sample collection. Digital tools can simplify risk reporting and interpretation of ApoE results. Integration with portals and apps improves patient engagement. This trend allows scalable circulation of test results. Additionally, home test kits elevated accessibility for populations unwilling to visit clinics. Simple saliva-based testing widens customer reach. Companies can spend on the convenience-driven consumer market.

Apolipoprotein E Genotype Test Kit Market Dynamics

Growth Drivers

How is the Apolipoprotein E Genotype test kit market driven by the shift toward personalized and preventive medicine?

Personalized medicine is transforming healthcare from a reactive to a proactive model, depending on genetic insights to guide treatment. APOE genotype testing allows for individualized risk assessment and targeted therapeutic interventions or lifestyle changes. Preventive healthcare programs increasingly focus on genetic screening to detect chronic conditions early. APOE testing is now used in cardiology, neurology, and the management of metabolic disorders. Patients and clinicians are recognizing the value of risk stratification in enhancing long-term outcomes. This personalized approach is fueling the broader adoption and industry growth.

How do technological advancements and reduced costs propel the Apolipoprotein E Genotype test kit market?

Improvements in next-generation sequencing, PCR, and AI-based analysis have enhanced the reliability, accuracy, and speed of ApoE genotyping. Non-invasive sample collection techniques, comprising saliva kits, improve patient convenience and widen accessibility. Laboratory automation backs higher throughput and consistent results, lowering operational costs. Lowering the cost of genetic testing makes APOE kits more affordable for direct-to-consumer and clinical use. Faster turnaround times and enhanced efficiency are rising the adoption in healthcare and research settings. These technological advancements are vital to the expansion of the Apolipoprotein E Genotype test kit market worldwide.

Restraints

Data privacy and security concerns negatively impact market progress

The storage and collection of genetic data raise security and privacy concerns among regulators and consumers. Fear of data misuse may deter patients from undergoing tests. Direct-to-consumer models are especially vulnerable to cybersecurity risks. Companies should largely invest in secure platforms and compliance measures. Breaches in sensitive genetic information may harm trust and brand reputation. Data privacy issues are still a crucial obstacle to the industry's growth.

Opportunities

How does integration with multi-marker panels offer advantages for the development of the Apolipoprotein E Genotype test kit market?

APOE testing can be complemented by other genetic markers to provide a comprehensive risk profile. Multi-gene panels improve clinical utility in personalized and preventive medicine. Incorporation into wider diagnostic solutions raises adoption among hospitals and specialty clinics. Cross-functional applications in metabolic disorders, neurology, and cardiology widen the industry relevance. Companies can advance bundled testing services for holistic health assessments. This approach creates new revenue streams and boosts the Apolipoprotein E Genotype test kit industry's positioning.

Challenges

The risk of misuse of genetic information restricts the market growth

Improper handling of genetic data may result in privacy breaches and misuse by third parties. Confidentiality issues may deter individuals from testing. DTC platforms should ensure compliance with data protection laws and regulations. Security failures may harm brand trust and restrict adoption. Maintaining secure systems adds operational complexity for manufacturers. The risk of misuse remains a crucial challenge in the industry.

Apolipoprotein E Genotype Test Kit Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Apolipoprotein E Genotype Test Kit Market |

| Market Size in 2024 | USD 137 Billion |

| Market Forecast in 2034 | USD 727.11 Billion |

| Growth Rate | CAGR of 23.2% |

| Number of Pages | 280 |

| Key Companies Covered | Platinum, Montblanc, Pilot, Parker, Visconti, Conway Stewart, Faber-Castell, Waterman, Pelikan, Sheaffer, LAMY, Kaweco, Sailor, Cross, and Aurora. |

| Segments Covered | By Product Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Apolipoprotein E Genotype Test Kit Market: Segmentation

The global Apolipoprotein E Genotype test kit market is segmented based on product type, application, end-user, and region.

Based on product type, the global Apolipoprotein E Genotype test kit industry is divided into PCR-based test kits, ELISA-based test Kits, sequencing-based test kits, and others. The PCR-based test kit segment leads the market with a 55-65% global share due to its cost-effectiveness and high reliability. They are widely used in clinical laboratories for accurate, rapid detection of genotypes. Their ease of use and established protocols make them the highly preferred option for routine testing. Broad adoption in both research and healthcare fuels their dominating market rank.

Based on application, the global Apolipoprotein E Genotype test kit market is segmented into clinical diagnostics, research and development, and personalized medicine. Clinical diagnostics is the leading segment, accounting for approximately 55-60%, due to its crucial role in assessing genetic risk for Alzheimer’s and cardiovascular disorders. These kits are broadly used in clinics, hospitals, and diagnostic labs to support early diagnosis and personalized treatment planning. The incorporation of genetic testing into routine clinical workflows propels the segmental prominence. The rising demand for predictive healthcare is solidifying clinical diagnostics as a leading industry application.

Based on end-user, the global market is segmented into hospitals, diagnostic laboratories, research institutions, and others. The hospitals segment registers leadership with nearly 45-50% global share. This growth is fueled by the integration of ApoE genotype testing into patient diagnosis, management protocols, and disease risk assessment. Their modernized diagnostic facilities and direct access to patient populations back high test usage. Genetic testing helps clinicians detect cardiovascular and Alzheimer’s risk early. The surging adoption of precision medicine further strengthens hospitals’ leading market share.

Apolipoprotein E Genotype Test Kit Market: Regional Analysis

What gives North America a competitive edge in the global Apolipoprotein E Genotype Test Kit Market?

North America is likely to sustain its leadership in the Apolipoprotein E Genotype Test Kit market due to high regional market share and demand, advanced healthcare infrastructure and technology adoption, and high prevalence of target illnesses. North America holds the leading share, with a 10.2% CAGR driven by strong consumer and clinical adoption. Brother's awareness of cardiovascular and Alzheimer’s risk fuels consistent demand. Diagnostic labs, clinics, and hospital labs regularly use these kits for early detection. This elevated utilization sustains the region’s industry dominance.

Moreover, the region benefits from well-developed healthcare systems and access to modernized genetic testing solutions. Sequencing platforms and PCR are widely available in labs and hospitals, ensuring high throughput and accuracy. Speedy integration into clinical workflows backs routine use. This infrastructure strengthens industry leadership and accelerates adoption. Furthermore, Alzheimer’s disease and other neurodegenerative conditions are prevalent in North America. This creates strong demand for ApoE genotyping as a diagnostic and predictive tool. Clinicians use these tests to stratify risk and guide preventive strategies. Growing disease pressure directly fuels the regional market development.

Europe continues to secure the second-highest share, with a 9.8% CAGR in the Apolipoprotein E Genotype Test Kit industry. This growth is supported by expanding healthcare infrastructure and the adoption of diagnostics, increasing awareness of Alzheimer’s disease and cardiovascular disorders, and supportive reimbursement and regulatory frameworks. Europe holds a mature healthcare system with the rising integration of genetic testing into routine care. Several diagnostic centers and hospitals are equipped with modern PCR and sequencing technologies. This allows wider use of ApoE genotype kits in clinical settings. Growing diagnostics infrastructure supports increasing regional demand. Awareness of cardiovascular and neurodegenerative conditions is rising among patients and clinicians in the region.

This fuels demand for genetic risk assessment tools to inform early intervention decisions. Clinical education and public health campaigns focus on the value of predictive testing. Hence, clinicians mostly recommend ApoE genotyping. Additionally, many European nations have supportive reimbursement policies for genetic testing, reducing patients' out-of-pocket expenses. Clear regulatory pathways for the approval of diagnostic kits facilitate manufacturers' entry into multiple markets. National health systems prioritizing preventive care further encourage adoption. This environment facilitates broader use of ApoE testing.

Apolipoprotein E Genotype Test Kit Market: Competitive Analysis

The leading players in the global Apolipoprotein E Genotype test kit market are -

- 23andMe

- LabCorp

- Empower DX

- Mega Genomics

- Blueprint Genetics

- Generi-Biotech

- RxHomeTest

- CapitalBio

- Genex Diagnostics

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Bio-Rad Laboratories

- QIAGEN N.V.

- Illumina

- PerkinElmer

Apolipoprotein E Genotype Test Kit Market: Key Market Trends

Rise of Direct‑to‑Consumer (DTC) Genetic Testing:

ApoE genotyping is steadily integrated into at-home and DTC genetic test offerings, attracting consumers interested in personal health risk insights. Online platforms now bundle these tests with wider ancestry or health reports. This trend significantly widens the industry's reach beyond clinical environments. Rising consumer health awareness continues to fuel DTC adoption.

Expansion of personalized and preventive medicine use cases:

Demand is growing for personalized healthcare solutions that tailor disease treatment and prevention to genetic profiles. ApoE testing plays a vital role in risk stratification for Alzheimer’s, metabolic conditions, and cardiovascular disorders. Clinical adoption is rising as personalized medicine becomes mainstream. Preventive care strategies anchored to genotype data are improving industry relevance.

The global Apolipoprotein E Genotype test kit market is segmented as follows:

By Product Type

- PCR-based Test Kits

- ELISA-based Test Kits

- Sequencing-based Test Kits

- Others

By Application

- Clinical Diagnostics

- Research and Development

- Personalized Medicine

By End-User

- Hospitals

- Diagnostic Laboratories

- Research Institutions

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed