Antimicrobial Plastic Market Size, Share, And Growth Report 2032

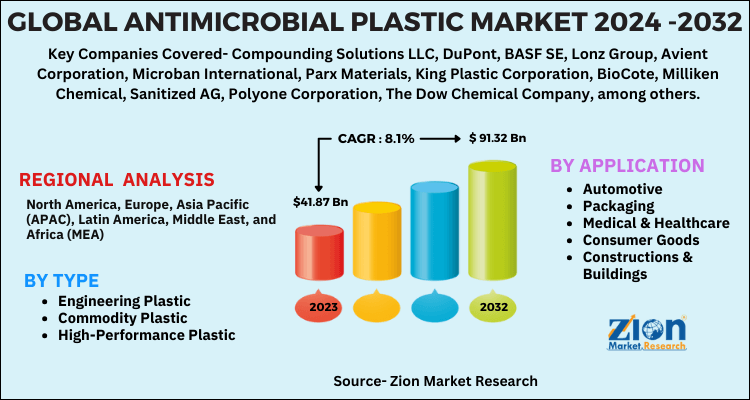

Antimicrobial Plastic Market By Type (Engineering Plastic, Commodity Plastic, and High-Performance Plastic), By Application (Automotive, Packaging, Medical & Healthcare, Consumer Goods, and Constructions & Buildings), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

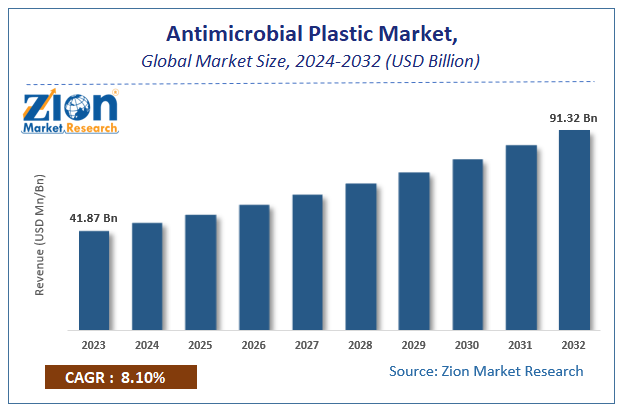

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 41.87 Billion | USD 91.32 Billion | 8.1% | 2023 |

Antimicrobial Plastic Market Size

According to a report from Zion Market Research, the global Antimicrobial Plastic Market was valued at USD 41.87 Billion in 2023 and is projected to hit USD 91.32 Billion by 2032, with a compound annual growth rate (CAGR) of 8.1% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Antimicrobial Plastic Market industry over the next decade.

Antimicrobial Plastic Market: Overview

Tonnes of Plastic wastes have been produced per year and at an alarming rate. Antimicrobial Plastic technologies are being introduced in plastic products to win the war over plastic pollution. These plastics last longer and minimizes the presence of bacteria. These are more durable and are more hygienic to use. A wide variety of plastics are suitable for antimicrobial layerings such as Food Processing and handling machinery, Medical devices, Textile films and fibers, and general household goods. The market is primarily driven by the increasing penetration in the food packaging, automobiles, consumer products, and healthcare industries. The rising interest in a healthy lifestyle and consumer awareness of pandemic diseases has caused a surge in demand for antimicrobial plastics. The food industry has started penetrating using antimicrobial plastics for better food preservation, quality maintenance, and safety. This trend is expected to continue over the forecast period.

Antimicrobial Plastic Market: Growth Factors

The growing need for antibacterial polymer packaging in the food industry and healthcare is anticipated to augment over the forecast period, and these plastics will help decrease microbic growth. The repeated use of non-antimicrobial plastics over a certain period helps the harmful bacteria to grow and raises contamination problems. Thus, the use of antimicrobials in plastics for packaging will help kill and control unwanted bacteria. This trend will stay for the forecasted period.

The additives used in the antimicrobials offer long-lasting protection from pathogens and microbes and increase the plastic's lifetime. It helps the plastic not degrade and makes it more durable, stainless, and suitable for all applications. The properties that antimicrobial plastics possess help them cater to every sector, which is one of the many reasons for the growth.

Antimicrobial Plastic Market: Segmentation

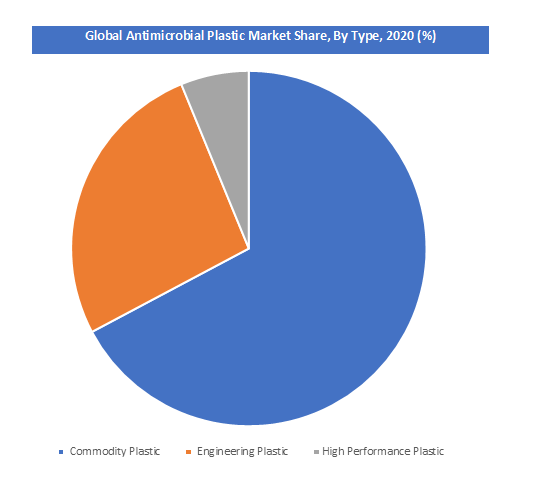

Type Segment Analysis Preview

The Commodity plastic segment is projected to grow at a CAGR of around 11.9% from 2021 to 2028. These plastics are produced high in volumes for applications like food and packaging, construction, and healthcare. It is expected to drive the market over the forecasted year due to the increasing population and their needs in these end-use industries. Polyethylene and polypropylene are types of antimicrobial plastics used in commodity plastic segments. The emergence of e-commerce has boosted the growth of the packaging industry, thereby increasing the demand for commodity plastics. It helps increase the durability and lifespan of the plastic.

Engineering Plastics Segment is also anticipated to grow in the market for the forecasted period due to its properties such as stability in thermal, chemical, mechanical, and electrical, which provides resistance to high temperatures and chemicals. The ever-increasing trend of using lightweight vehicles and reducing vehicle emissions are supposed to drive the market segment.

Application Segment Analysis Preview

The medical & healthcare segment held a significant share in 2020. This is accredited to the rising awareness and demand for medical devices as the other regular plastic would create infections. The advantages are low cost, sterility, ease of use, and the rising need to recycle disposable products over conventional ones, increasing the demand. These plastics are generally used to manufacture medical devices, like connectors, tubes (pipes), and beds which will improve overall healthcare infrastructures. Infection risks are high during dental surgeries, and to prevent, antimicrobial plastics will definitely be used and boost the market.

The packaging segment is anticipated to grow in the Antimicrobial Plastic market. Packaging in food industries significantly increases the shelf life of the food, thereby allowing efficiency in the food supply chain and increasing the sustainability of food production. There has been a growing demand for food preservatives, and antimicrobial plastics offers that without being in direct contact with the food product. Packaging used in trolley bags prevents bacteria growth and allows the bags to stay a lifetime.

Automotive, Consumer Goods, and Constructions & Buildings form the application segment of Antimicrobial Plastics.

Antimicrobial Plastic Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Antimicrobial Plastic Market |

| Market Size in 2023 | USD 41.87 Billion |

| Market Forecast in 2032 | USD 91.32 Billion |

| Growth Rate | CAGR of 8.1% |

| Number of Pages | 150 |

| Key Companies Covered | Compounding Solutions LLC, DuPont, BASF SE, Lonz Group, Avient Corporation, Microban International, Parx Materials, King Plastic Corporation, BioCote, Milliken Chemical, Sanitized AG, Polyone Corporation, The Dow Chemical Company, among others |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Antimicrobial Plastic Market: Regional Analysis

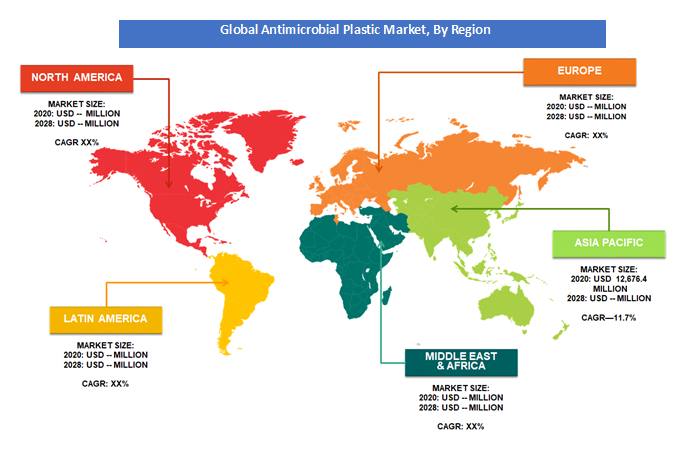

Asia Pacific is projected to grow at a CAGR of 11.7% during the forecast period. Asia Pacific Antimicrobial Plastic market is likely to witness a significant increase in the automobile industry to which the engineering plastics would be used in high demand. Stable economic growth, urbanization, and industrialization have changed consumer buying behavior. The increase in demand for transportation, packaging, consumer appliances in China, Indonesia, Taiwan, Japan, and India will boost the Antimicrobial Plastic market.Many APAC countries have a high demand for antimicrobial packaging, and companies are investing more in research and innovation.

The European market is supported by its innovations done. Europe is expected to be the second largest contributor to Antimicrobial Plastic Market due to many companies originating from the region. Polyethylene (PE) and Polypropylene (PP) are most in-demand for packaging industries. This trend will boost the market in Europe. There has been a significant rise in the commodity plastic market in this region which is among the many reasons behind the growth of the Antimicrobial Plastic market.

Antimicrobial Plastic Market: Competitive Players

Some of the key players in the Antimicrobial Plastic market include:

- Compounding Solutions LLC

- DuPont

- BASF SE

- Lonz Group

- Avient Corporation

- Microban International

- Parx Materials

- King Plastic Corporation

- BioCote

- Milliken Chemical

- Sanitized AG

- Polyone Corporation

- The Dow Chemical Company

- Among others

The market is split into medium and large industry players catering to global and local demands. There have been mergers between the companies across all the stages to increase the supply chain and reduce the manufacturing costs. The market players adopt strategies like New Product Developments and its specifications to capture the market share.

The global Antimicrobial Plastics market is segmented as follows:

By Type

- Engineering Plastic

- Commodity Plastic

- High-Performance Plastic

By Application

- Automotive

- Packaging

- Medical & Healthcare

- Consumer Goods

- Constructions & Buildings

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Antimicrobial plastic is a type of plastic material infused with antimicrobial agents that inhibit the growth of bacteria, fungi, and other microorganisms. It is commonly used in healthcare, food packaging, and consumer goods to enhance hygiene, reduce contamination, and extend product lifespan.

According to study, the Antimicrobial Plastic Market size was worth around USD 41.87 billion in 2023 and is predicted to grow to around USD 91.32 billion by 2032.

The CAGR value of Antimicrobial Plastic Market is expected to be around 8.1% during 2024-2032.

Asia Pacific has been leading the Antimicrobial Plastic Market and is anticipated to continue on the dominant position in the years to come.

The Antimicrobial Plastic Market is led by players like Compounding Solutions LLC, DuPont, BASF SE, Lonz Group, Avient Corporation, Microban International, Parx Materials, King Plastic Corporation, BioCote, Milliken Chemical, Sanitized AG, Polyone Corporation, The Dow Chemical Company, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed