Analog Integrated Circuits ICs Market Size, Share, And Growth Report 2032

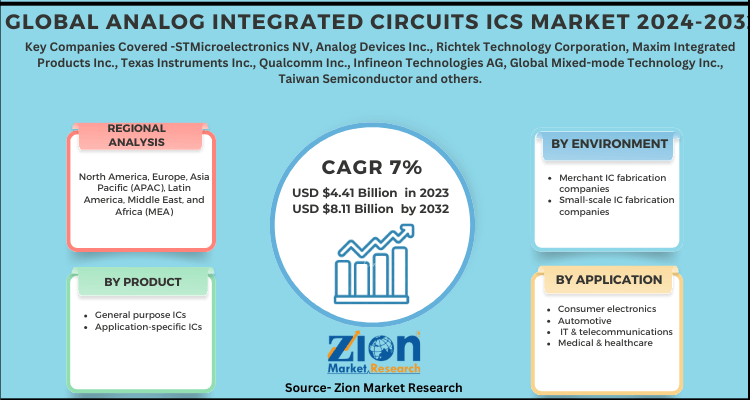

Analog Integrated Circuits ICs Market By Products (General purpose ICs, and Application-specific), Environment (Merchant IC fabrication companies and Small-scale IC fabrication companies), By Application (Consumer electronics, Automotive, IT & telecommunications, Medical & healthcare, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

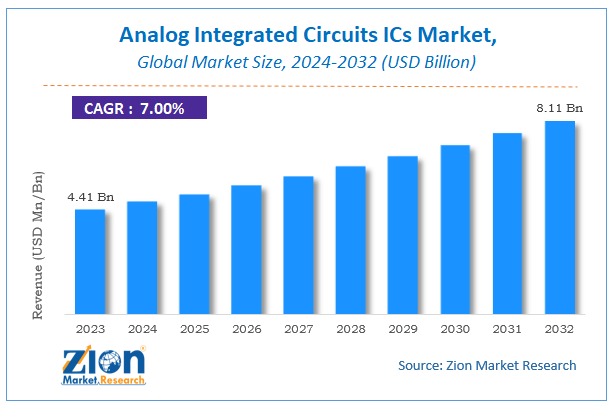

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.41 Billion | USD 8.11 Billion | 7% | 2023 |

Analog Integrated Circuits ICs Market Size

Zion Market Research has published a report on the global Analog Integrated Circuits ICs Market, estimating its value at USD 4.41 Billion in 2023, with projections indicating that it will reach USD 8.11 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Analog Integrated Circuits ICs Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Analog Integrated Circuits ICs Market: Overview

Analog ICs is a set of electronic circuits that are interconnected components manufactured over a single wafer of semiconducting material. Contradictory to digital ICs that operates only on two levels of input and output voltages i.e. binary analog ICs operate on continuous range of input levels Analog IC is used to process, receive and generate a various levels of continuous signals as device operates. Electronic devices that require multi-vibrators, DC amplifiers, audio amplifiers, and oscillators always make use of analog ICs, which is categorized by continuous and equal output and input signal levels.

The market growth of analog ICs is fuelled by increased adoption of smartphone that is observed to be the most prominent application of analog ICs. The arrival and proliferation of the IoT prime technology are likely to drive market growth as IoT requires analog ICs for signal processing and efficient power consumption to create an ecosystem of automated devices. However, such analog ICs pose monetary and physical limits of integrating such components in the small-scale devices which are anticipated to hinder market growth in the coming years. Therefore, there is need to increase R&D to overcome such limitations. Moreover, the range of opportunities lies for analog ICs in the market due to growing consumer electronics adoption and rising vehicle automation demand.

COVID-19 Impact Analysis:

The global Analog Integrated Circuits ICs market has witnessed a decrease in the sales for beverages products due to the lockdown enforcement placed by governments in order to contain COVID spreading. People had no option but to remain indoor, so the consumption of beverages product’s had decrease drastically. The restrictions imposed by various nations to contain COVID had stopped the production resulting in a disruption across the whole supply chain. However, the world markets are slowly opening to their full potential and theirs a surge in demand of Analog Integrated Circuits ICs. The market would remain bullish in upcoming year.

Analog Integrated Circuits ICs Market: Growth Factors

In a major boost to analog integrated circuits industry, in August 2018, Foxconn Technology Group decided to team up with Chinese city Zhuhai to jointly construct a factory in Pearl River Delta. Individuals well-acquainted with the deal stated that Foxconn is entering a new product spectrum of semiconductors by collaborating with regional government. Reportedly, city of Zhuhai declared on its website that they will jointly work to design chip & semiconductor device. Analysts claim that the project will assist Foxconn to fulfill the escalating demand for integrated circuits that find wide applications in industrial internet. The main types available in this analog integrated circuits market are application-specific integrated circuits and general-purpose integrated circuits. Among them, the demand for general-purpose integrated circuits is relatively higher and the trend is anticipated to remain so over the next few years, notes the research report. Short product life cycle, design complexity, miniaturization, and fluctuations in demand & supply of products are anticipated to hinder the amplification of analog integrated circuits market in the ensuing years. Nonetheless, inception of new technologies along with high need for effective equipment will favorably leverage the growth of analog integrated circuits market in the upcoming years. This is going to normalize the impact of hindrances on the analog integrated circuits market, reports the study.

Analog Integrated Circuits ICs Market: Segmentation

Analog ICs market is segmented on the basis of types, environment, application, and region.

Global analog ICs market on the basis of its type is segmented into general purpose ICs and application-specific ICs. General purpose analog ICs are utilized for multiple applications such as data converters, comparators, and amplifiers, among others. Whereas application specific analog ICs are utilized to execute specific functions such as timing control, display drivers, touch sensors, RF transceivers, LED drivers, serializer/deserializer, and others.

Market environment segment is further bifurcated to merchant IC and small-scale IC fabrication companies. Merchant vendors include defined strategies to uphold their legacy in the analog ICs market like competitive price, special product design skills and widespread range of product sets. Small-scale IC fabrication companies are new entrants who focus to deal on the particular product category.

Application wise the market is subdivided into consumer electronics, automotive, IT & telecommunications, medical & healthcare and other applications.

Analog Integrated Circuits ICs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Analog Integrated Circuits ICs Market |

| Market Size in 2023 | USD 4.41 Billion |

| Market Forecast in 2032 | USD 8.11 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 140 |

| Key Companies Covered | STMicroelectronics NV, Analog Devices Inc., Richtek Technology Corporation, Maxim Integrated Products Inc., Texas Instruments Inc., Qualcomm Inc., Infineon Technologies AG, Global Mixed-mode Technology Inc., Taiwan Semiconductor and others. |

| Segments Covered | By Products, By Environment, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Analog Integrated Circuits ICs Market: Regional Analysis

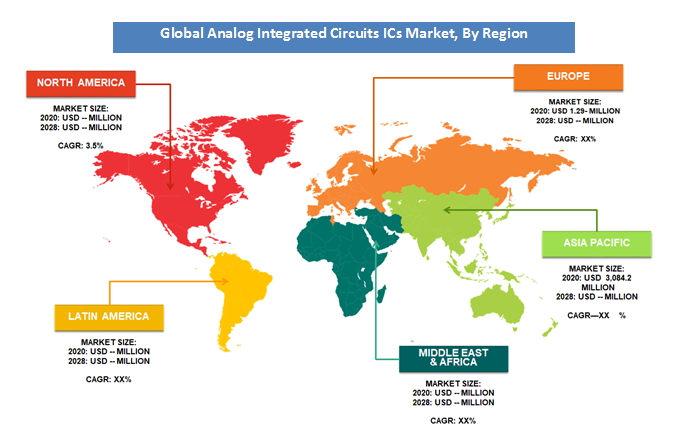

Geographically analog ICs have been divided into five regions North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. Regionally, the analog ICs market in North America is presently fueled by the rising infrastructure and numerous industrial applications. The analog IC market in Europe is driven by the existence of numerous automobile manufacturers with their vast product units. The Asia Pacific is projected to dominate the global market on account of the concentration of electronic component manufacturers and escalating tech-savvy consumer base.

Analog Integrated Circuits ICs Market: Competitive Players

Some of key players in Analog Integrated Circuits ICs market are:

- STMicroelectronics NV

- Analog Devices Inc.

- Richtek Technology Corporation

- Maxim Integrated Products Inc.

- Texas Instruments Inc.

- Qualcomm Inc.

- Infineon Technologies AG

- Global Mixed-mode Technology Inc.

- Taiwan Semiconductor

The Global Analog Integrated Circuits ICs Market is segmented as follows:

By Products

- General purpose ICs

- Application-specific ICs

By Environment

- Merchant IC fabrication companies

- Small-scale IC fabrication companies

By Application

- Consumer electronics

- Automotive

- IT & telecommunications

- Medical & healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Analog Integrated Circuits (ICs) are electronic chips designed to process continuous signals, such as sound, light, or temperature. They are used in amplifiers, sensors, and power management systems, enabling real-world data interaction in devices like radios, medical equipment, and smartphones.

According to study, the Analog Integrated Circuits ICs Market size was worth around USD 4.41 billion in 2023 and is predicted to grow to around USD 8.11 billion by 2032.

The CAGR value of Analog Integrated Circuits ICs Market is expected to be around 7% during 2024-2032.

North America has been leading the Analog Integrated Circuits ICs Market and is anticipated to continue on the dominant position in the years to come.

The Analog Integrated Circuits ICs Market is led by players like STMicroelectronics NV, Analog Devices Inc., Richtek Technology Corporation, Maxim Integrated Products Inc., Texas Instruments Inc., Qualcomm Inc., Infineon Technologies AG, Global Mixed-mode Technology Inc., Taiwan Semiconductor and others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed