Alfalfa Hay Market Size, Share, Trends, Growth & Forecast 2034

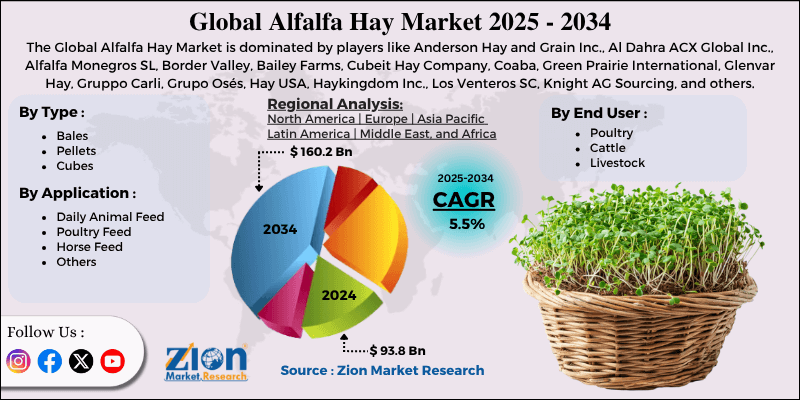

Alfalfa Hay Market By Type (Bales, Pellets, and Cubes), By Application (Daily Animal Feed, Poultry Feed, Horse Feed, and Others), By End User (Poultry, Cattle, Livestock, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 93.8 Billion | USD 160.2 Billion | 5.5% | 2024 |

Alfalfa Hay Industry Perspective:

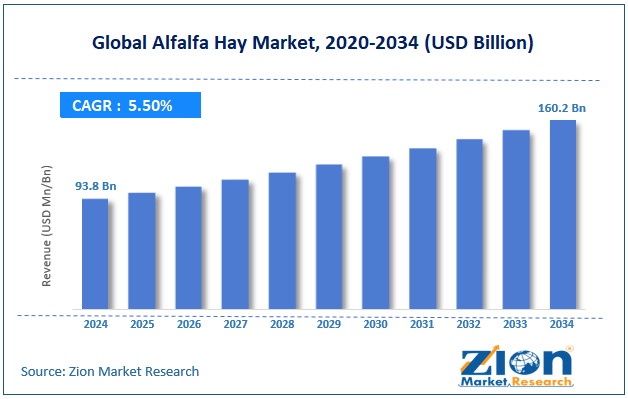

The global alfalfa hay market size was worth around USD 93.8 billion in 2024 and is predicted to grow to around USD 160.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global alfalfa hay market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2025-2034).

- In terms of revenue, the global alfalfa hay market size was valued at around USD 93.8 billion in 2024 and is projected to reach USD 160.2 billion by 2034.

- The increasing demand for sustainable feed is expected to drive the alfalfa hay market over the forecast period.

- Based on the type, the bales segment is expected to capture the largest market share over the projected period.

- Based on the application, the daily animal feed segment holds the major market share.

- Based on the end user, the cattle segment holds the major market share.

- Based on region, North America is expected to dominate the market during the forecast period.

Alfalfa Hay Market: Overview

Dried alfalfa plants (Medicago sativa) are used to make alfalfa hay. These plants are legumes that grow again every year and are full of fiber, protein, and other essential minerals. People term it the "queen of forages" since it's a main food source for animals like dairy cows, horses, and sheep, which provide a lot of milk. It contains a variety of vitamins, including A, E, D, and K, in alfalfa hay. People cultivate it all around the world because it makes a lot of hay and adds nitrogen to the soil.

Several factors are driving the alfalfa hay market, including the growing need for nutrient-dense forage, the rise of organized, large-scale livestock and dairy operations, export and trade demand, technological advances in growing, harvesting, processing, and storage, and a growing preference for organic and sustainable feed. Besides, the high costs of production and inputs are a big problem for the alfalfa hay sector.

Alfalfa Hay Market Dynamics

Growth Drivers

Why does the increasing demand for meat and dairy products drive the alfalfa hay market growth?

Livestock is a primary driver of the worldwide alfalfa hay market's growth. Developing countries are expected to increase meat and milk production by 2.4% and 2.5% per year until 2030, respectively. As a result, developing countries are expected to generate 66% more meat and 55% more milk worldwide. Furthermore, the livestock business has been under intense pressure to supply the growing demand for high-quality animal protein.

Due to changes in dairy industry production methods, China's need for alfalfa hay has increased significantly. The principal cause is an increase in the number of cows raised by modern dairy farmers, who prefer imported hay and commercial diets. To accommodate increased demand for alfalfa, the Chinese government is focusing on increasing local production of the crop. In China, the dairy industry is driving up demand for alfalfa hay. Due to its high crude protein content, alfalfa hay is utilized in animal feed, particularly for chicken feed. Over the projection period, the global alfalfa hay market is expected to continue being driven by demand for animal feed.

Restraints

How do the high production & input costs hinder the growth of the alfalfa hay market?

There are numerous ways that high production and input costs make it difficult for the alfalfa hay industry to grow. Higher input expenses, including fertilizers, labor, water, energy, and transportation, raise the overall cost of production at first, which lowers manufacturers' profit margins. If the expenses are higher than the benefits, manufacturers may have to leave the market or cut back on how much they make. Additionally, supply chain problems and changing pricing for raw materials make production costs unpredictable, which makes it hard for enterprises to plan and invest in expanding their capacity or improving their technology with confidence. This uncertainty makes the market grow more slowly.

Also, strict laws about food safety, the environment, and water consumption make it more expensive to follow the rules and may limit where crops may be grown. These rules can make things more expensive and make it less desirable to grow alfalfa hay. Thus, hampering the industry growth.

Opportunities

How do the rising several strategies, such as exhibitions, offer a potential opportunity for the Alfalfa Hay industry's growth?

Exhibitions and trade shows are excellent opportunities for the alfalfa hay market to expand, as they let people learn, make connections, and show off new ideas. Producers, industry experts, equipment makers, and buyers all join together at these gatherings to discuss best practices, new products, and market trends. For instance, in October 2024, Balco, one of Australia's major exporters of high-quality oaten hay, is set to be a silver sponsor at AgraME 2024, one of the largest agricultural fairs in the Middle East.

The event is an excellent opportunity for Balco to meet important people and discuss how Australian oaten hay can help the region's livestock and farming industries. Australian oaten hay is noted for its high fiber content, which makes it easier to digest and provides more energy. This means that animals can use the food better. A lot of people in the Middle East use the product with dry and transition cows, where taste is highly essential. When cows are lactating, feeding them oaten hay increases the amount of dry matter they consume, improves the rumen environment, and helps calves gain weight faster.

Challenges

How do the trade & tariff barriers pose a major challenge to market expansion?

Taxes and export duties make alfalfa hay more expensive for buyers in other countries, which makes it less competitive with suppliers in the US or other countries. For instance, Argentina's tariffs on alfalfa exports raise costs and lower the profits of producers, which affects the number of exports and the size of the market.

Also, exporters can't plan or invest for the long run since tariff laws change without warning. Changes to export taxes can make manufacturers less likely to produce products intended for export. Thus, the alfalfa hay market is hampered by trade and tariff barriers.

Alfalfa Hay Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alfalfa Hay Market |

| Market Size in 2024 | USD 93.8 Billion |

| Market Forecast in 2034 | USD 160.2 Billion |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 214 |

| Key Companies Covered | Anderson Hay and Grain Inc., Al Dahra ACX Global Inc., Alfalfa Monegros SL, Border Valley, Bailey Farms, Cubeit Hay Company, Coaba, Green Prairie International, Glenvar Hay, Gruppo Carli, Grupo Osés, Hay USA, Haykingdom Inc., Los Venteros SC, Knight AG Sourcing, and others. |

| Segments Covered | By Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Alfalfa Hay Market: Segmentation

The global alfalfa hay industry is segmented based on type, application, end-user, and region.

Based on the type, the global alfalfa hay market is bifurcated into bales, pellets, and cubes. The bales segment is expected to capture the largest market share over the projected period. Globally, there is an increase in demand for high-quality, protein-rich animal feed in the dairy, beef, and horse sectors. Alfalfa's high nutritional value, which includes protein, fiber, and minerals, makes it a popular forage crop, driving bale sales. Growing exports from major producers like the United States and Spain to regions with limited arable land or severe climates that require imported feed help to drive revenue growth in bale sales.

Based on the application, the global alfalfa hay industry is bifurcated into daily animal feed, poultry feed, horse feed, and others. The daily animal feed segment holds the major market share. Alfalfa hay is highly nutritious, containing protein, fiber, vitamins, and minerals, making it a popular feed for dairy cattle and other ruminants that require high-quality fodder to stay healthy and productive. The growing global demand for dairy products drives up alfalfa hay use.

Based on the end-user, the global alfalfa hay market is bifurcated into poultry, cattle, livestock, and others. The cattle hold the largest market share over the projected period. The expansion of commercial livestock farming and dairy operations, particularly in North America, the Asia-Pacific region, and Europe, increases the demand for reliable and high-quality feed sources, such as alfalfa hay.

Alfalfa Hay Market: Regional Analysis

Why does North America dominate the alfalfa hay market over the projected period?

North America is expected to dominate the global alfalfa hay market. The United States' biggest export destinations are China, Japan, Saudi Arabia, and the United Arab Emirates. China is likely to continue to be a big destination for US alfalfa hay exports, accounting for over half of total shipments. Saudi Arabia's local alfalfa production has declined. The country relies mostly on imports to meet its alfalfa demands, and it is expected to remain one of the key buyers of U.S. alfalfa hay. There are also many other livestock that consume alfalfa, including beef cattle, horses, goats, and sheep.

Due to this connection to dairy production and other enterprises, alfalfa and other feed crops have gained importance nationwide. The alfalfa crop is in high demand because of its domestic and worldwide applications. This demand is likely to grow over the predicted period.

Alfalfa Hay Market: Competitive Analysis

The global alfalfa hay market is dominated by players like:

- Anderson Hay and Grain Inc.

- Al Dahra ACX Global Inc.

- Alfalfa Monegros SL

- Border Valley

- Bailey Farms

- Cubeit Hay Company

- Coaba

- Green Prairie International

- Glenvar Hay

- Gruppo Carli

- Grupo Osés

- Hay USA

- Haykingdom Inc.

- Los Venteros SC

- Knight AG Sourcing

The global alfalfa hay market is segmented as follows:

By Type

- Bales

- Pellets

- Cubes

By Application

- Daily Animal Feed

- Poultry Feed

- Horse Feed

- Others

By End User

- Poultry

- Cattle

- Livestock

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Dried alfalfa plants (Medicago sativa) are used to make alfalfa hay. These plants are legumes that regrow every year and are rich in fiber, protein, and other essential minerals.

Several factors are driving the alfalfa hay market, including the growing need for nutrient-dense forage, the rise of organized, large-scale livestock and dairy operations, export and trade demand, technological advances in growing, harvesting, processing, and storing, and a growing preference for organic and sustainable feed.

The high costs of production and inputs are a big problem for the alfalfa hay sector.

Based on the end-user, the cattle segment is expected to dominate the industry growth during the projected period.

The increasing demand for dairy products and the rising need for nutrient-dense forage pose a major impact factor for the alfalfa hay industry's growth over the projected period.

According to the report, the global alfalfa hay market size was worth around USD 93.8 billion in 2024 and is predicted to grow to around USD 160.2 billion by 2034.

The global alfalfa hay market is expected to grow at a CAGR of 5.5% during the forecast period.

The global alfalfa hay industry growth is expected to be driven by the North American region. It is currently the world’s highest-revenue-generating market due to the presence of major players and significant exporters.

The global alfalfa hay market is dominated by players like Anderson Hay and Grain Inc., Al Dahra ACX Global Inc., Alfalfa Monegros SL, Border Valley, Bailey Farms, Cubeit Hay Company, Coaba, Green Prairie International, Glenvar Hay, Gruppo Carli, Grupo Osés, Hay USA, Haykingdom Inc., Los Venteros SC, and Knight AG Sourcing, among others.

The alfalfa hay market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed