Global Airborne LiDAR Market Size, Share, Trends by 2034

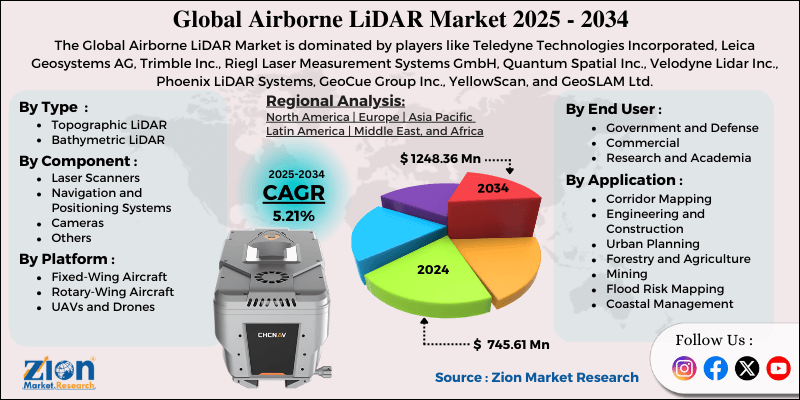

Airborne LiDAR Market By Type (Topographic LiDAR, Bathymetric LiDAR), By Component (Laser Scanners, Navigation and Positioning Systems, Cameras, and Others), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, UAVs and Drones), By Application (Corridor Mapping, Engineering and Construction, Urban Planning, Forestry and Agriculture, Mining, Flood Risk Mapping, Coastal Management), By End-User (Government and Defense, Commercial, Research and Academia), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

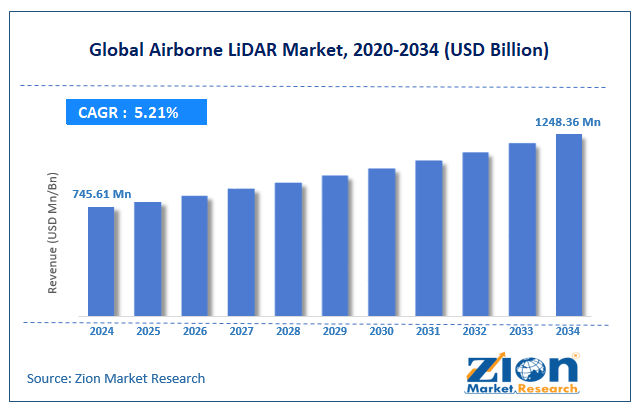

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 745.61 Million | USD 1248.36 Million | 5.21% | 2024 |

Airborne LiDAR Industry Perspective

The global airborne LiDAR market size was worth approximately USD 745.61 Million in 2024 and is projected to grow to around USD 1248.36 Million by 2034, with a compound annual growth rate (CAGR) of roughly 5.21% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global airborne LiDAR market is estimated to grow annually at a CAGR of around 5.21 % over the forecast period (2025-2034).

- In terms of revenue, the global airborne LiDAR market size was valued at approximately USD 745.61 Million in 2024 and is projected to reach USD 1248.36 Million by 2034.

- The airborne LiDAR market is projected to grow significantly due to the rising infrastructure development, increasing adoption of autonomous vehicles requiring detailed maps, growing environmental monitoring needs, and expanding use of drones for commercial applications.

- Based on type, the topographic LiDAR segment is expected to lead the airborne LiDAR market, while the bathymetric LiDAR segment is anticipated to experience significant growth.

- Based on component, the laser scanners segment is expected to lead the airborne LiDAR market, while the navigation and positioning systems segment is anticipated to witness notable growth.

- Based on the platform, the fixed-wing aircraft segment is the dominating segment, while the UAVs and drones segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the corridor mapping segment is expected to lead the market compared to the urban planning segment.

- Based on the end-user, the government and defense segment is expected to have the largest market share during the forecast period.

- Based on region, North America is projected to dominate the global airborne LiDAR market during the estimated period, followed by Europe.

Airborne LiDAR Market: Overview

Airborne LiDAR is an advanced remote sensing technology that uses laser pulses from aircraft-mounted sensors to generate highly accurate 3D models of terrain, water bodies, infrastructure, and vegetation. These systems integrate laser scanners, GPS units, and inertial measurement systems to determine the precise geographic coordinates of each laser return. The system sends rapid laser pulses toward the ground while the aircraft moves across an area, and sensors measure the time each pulse takes to return, producing millions of data points with high precision. Modern systems use GPS and motion sensors to track aircraft position and movement, thereby determining the exact location of each laser measurement.

Topographic LiDAR uses near-infrared lasers to map land surfaces, including buildings, roads, and vegetation, for engineering, planning, and environmental studies. Bathymetric LiDAR uses green lasers to measure shallow underwater areas such as rivers, lakes, and coastal zones. The technology can record several reflections from a single pulse, allowing measurements of tree tops, branches, and ground levels through dense forests. Processing software converts raw point clouds into elevation models, surface models, and classified maps used for construction, mining, utilities, archaeology, and disaster planning. As costs fall and data accuracy improves, airborne LiDAR becomes useful for many industries, including agriculture, insurance, and real estate. The increasing demand for accurate geospatial data and growing infrastructure development activities are expected to drive growth in the airborne LiDAR market throughout the forecast period.

Airborne LiDAR Market: Technology Roadmap 2025 to 2034

The airborne LiDAR market is poised for rapid transformation as advancements in sensors, AI-driven processing, automation, and regulatory frameworks reshape global mapping capabilities. The following is the technology roadmap divided into development phases expected to unfold through 2034.

2025–2027: Early Acceleration Phase

- AI-powered point cloud automation lowers processing time and project costs.

- Hybrid LiDAR–photogrammetry systems strengthen engineering accuracy and delivery speed.

- BVLOS drone operations expand, increasing survey efficiency and reducing reliance on crewed aircraft.

2028–2031: Expansion and Integration Phase

- Multi-wavelength LiDAR gains use in forestry, coastal, and environmental projects.

- Cloud-based geospatial pipelines enable real-time processing and collaboration.

- Lightweight UAV LiDAR platforms replace aircraft for many local and mid-scale surveys.

2032–2034: Maturity and Automation Phase

- Quantum-enhanced LiDAR delivers millimeter precision for advanced scientific and defense applications.

- Autonomous LiDAR fleets support continuous corridor and urban mapping.

- Digital twin ecosystems require frequent LiDAR updates, establishing real-time 3D monitoring as a global norm.

Airborne LiDAR Market Dynamics

Growth Drivers

How are infrastructure development and urban planning needs driving the airborne LiDAR market growth?

The airborne LiDAR market is growing quickly as public agencies and private developers need accurate terrain data for planning transport corridors, managing city growth, and designing major infrastructure across wide regions. Highway teams use LiDAR surveys to study terrain, select suitable routes, reduce earthwork, and prepare detailed engineering plans, thereby lowering design risk. Railway planners rely on precise elevation profiles over long distances, helping trains operate safely across flat and hilly terrain. Urban development groups use LiDAR maps to study topography before planning roads, drainage systems, building sites, and stormwater layouts, reducing flood concerns.

Power line planners depend on corridor models showing terrain, vegetation, and structures along proposed routes, supporting faster and safer mapping. Pipeline designers use elevation models to locate optimal paths across streams, slopes, and sensitive areas, controlling construction costs. Airport planners use LiDAR to study nearby terrain, helping maintain clear approach paths and identify obstacles. Bridge designers use LiDAR to measure river channels, floodplains, and nearby land supporting safe structures.

Environmental monitoring and climate change applications

The global airborne LiDAR market is growing steadily as environmental groups and research teams use the technology to study ecosystems, measure environmental change, and support climate planning with accurate three-dimensional data. Forest managers use LiDAR to measure tree height, estimate biomass, calculate carbon levels, and monitor forest loss with far better detail than satellite images. Coastal experts run repeated LiDAR surveys to measure dune movement, track storm damage, and plan protection for shorelines facing rising sea levels. Wetland scientists use LiDAR to study small elevation differences controlling water flow and plant growth across sensitive landscapes.

Farming operations use elevation models to guide irrigation, locate drainage issues, and improve yields while saving water and energy. Glacier researchers measure ice thickness, track melting rates, and forecast water supply for nearby communities. Landslide teams use LiDAR to identify unstable slopes and monitor ground deformation, thereby warning of potential future failures. Earthquake experts map small surface changes along faults, improving risk studies for cities and vital infrastructure. Flood planners use LiDAR elevation data to create accurate flood maps that support insurance and emergency planning. Archaeologists use LiDAR to detect hidden sites under forest cover, supporting cultural preservation.

Restraints

High equipment costs and operational expenses are limiting adoption

The airborne LiDAR market faces a major challenge because large investments are required in sensors, aircraft, processing systems, and trained staff, creating barriers for smaller groups and developing regions. Survey-grade LiDAR sensors cost significant amounts, making it difficult for new users to invest without steady project work. Aircraft operation adds high expenses, as pilots, fuel, maintenance, insurance, and storage fees increase the cost of every flight across wide areas. Positioning systems require GPS ground stations, which need equipment, field setup, and monitoring to support accurate measurements.

Data processing requires strong computers, licensed software, and experienced analysts who convert raw point clouds into usable maps and models. Storage requirements increase with each flight, as large datasets are produced that require secure backups and long-term access. Workforce shortages slow market growth because few professionals have the skills to operate sensors and process complex data. Project setup costs increase when teams transport equipment, prepare field bases, and install control points for reliable mapping. Weather delays disrupt planned surveys, causing rescheduling and added expenses during long campaigns.

Opportunities

How is autonomous vehicle development creating new opportunities?

The airborne LiDAR industry is eyeing strong growth, as autonomous vehicle projects need very detailed maps showing road shapes, lane positions, traffic signs, and roadside features with high accuracy. Self-driving systems use three-dimensional maps and onboard sensors to locate their position, plan safe routes, and make driving choices in real time. Map coverage needs to stretch across long city roads and major highways, supporting future autonomous travel across wide regions. Regular updates are important because new construction, sign changes, and lane shifts must appear in maps used by automated vehicles.

Global testing and expansion of autonomous technology increase survey needs across many countries as companies prepare large networks. Delivery robots use LiDAR-based sidewalk maps to move safely in crowded urban spaces, supporting modern logistics work. Autonomous trucks depend on detailed highway maps to help with lane-keeping and smooth travel during long trips. Parking garages need precise maps supporting automated parking systems, guiding vehicles through tight spaces. Construction sites use LiDAR surveys guiding autonomous machines during earth-moving work. Farming teams rely on field maps guiding automated tractors and harvesters around obstacles and along planned paths. Mining sites use updated maps supporting autonomous trucks and drills as terrain changes.

Challenges

How are data processing complexities and skilled workforce shortages creating challenges for the airborne LiDAR industry?

The airborne LiDAR market faces major obstacles because skilled knowledge is required to process survey data, and few trained professionals can work across technical and industry needs. Point cloud classification requires analysts who can separate ground surfaces from trees, buildings, and other features using careful workflows and manual checks. Noise filtering removes incorrect points from birds or weather without losing small terrain details needed for important applications.

Accuracy checks require a strong understanding of errors caused by GPS issues, sensor settings, and atmospheric effects during flights. Different industries need custom outputs as engineers request elevation models, foresters need canopy data, and archaeologists look for small land patterns. Complex software tools require extended training periods because each program encompasses multiple stages, from data cleaning to final product creation. Quality checks require manual review of processed files to identify errors and verify high accuracy prior to client delivery.

Airborne LiDAR Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Airborne LiDAR Market |

| Market Size in 2024 | USD 745.61 Million |

| Market Forecast in 2034 | USD 1248.36 Million |

| Growth Rate | CAGR of 5.21% |

| Number of Pages | 220 |

| Key Companies Covered | Teledyne Technologies Incorporated, Leica Geosystems AG, Trimble Inc., Riegl Laser Measurement Systems GmbH, Quantum Spatial Inc., Velodyne Lidar Inc., Phoenix LiDAR Systems, GeoCue Group Inc., YellowScan, and GeoSLAM Ltd. |

| Segments Covered | By Type, By Component, By Platform, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Airborne LiDAR Market: Segmentation

The global airborne LiDAR market is segmented based on type, component, platform, application, end-user, and region.

Based on type, the global airborne LiDAR market is segregated into topographic LiDAR and bathymetric LiDAR. Topographic LiDAR leads the market due to its broad range of land-based applications, including infrastructure development, environmental monitoring, and urban planning, and the larger geographic areas requiring terrestrial mapping.

Based on component, the airborne LiDAR industry is segmented into laser scanners, navigation and positioning systems, cameras, and others. Laser scanners are expected to lead the market during the forecast period due to their role as the primary data-acquisition component and their substantial value content compared to other system elements.

Based on platform, the global airborne LiDAR market is classified into fixed-wing aircraft, rotary-wing aircraft, and UAVs and drones. Fixed-wing aircraft hold the largest market share due to their efficiency for large-area surveys and their higher flying speeds and altitudes, enabling greater productivity.

Based on application, the global market is divided into corridor mapping, engineering and construction, urban planning, forestry and agriculture, mining, flood risk mapping, and coastal management. Corridor mapping holds the largest market share due to ongoing infrastructure development in transportation and utilities and recurring revenue from monitoring pipelines, power lines, and transportation corridors.

Based on end-user, the global market is categorized into government and defense, commercial, and research and academia. Government and defense sectors hold the largest market share due to substantial public investments in infrastructure mapping and security and defense applications that require terrain intelligence.

Airborne LiDAR Market: Regional Analysis

What factors are contributing to North America's dominance in the global airborne LiDAR market?

North America accounted for an estimated 42 percent market share in 2025, reflecting strong adoption and large-scale LiDAR deployment. North America leads the airborne LiDAR market due to strong technological development, substantial infrastructure investment, extensive service networks, and early adoption across the public and private sectors, which together support steady, long-term growth. The United States hosts leading sensor manufacturers, aircraft operators, and mapping firms that shaped the industry and continue advancing new systems and services. Federal mapping programs collect LiDAR data across the country, creating elevation datasets used widely for planning, research, and development projects.

State and local agencies use LiDAR for flood studies, road planning, land management, and environmental monitoring, creating ongoing demand for new surveys and updates. Transportation teams use LiDAR to support highway upgrades, safety studies, and expansion work along major corridors across busy regions. Utility companies depend on LiDAR for power line inspections, pipeline planning, and site selection for renewable energy projects, supporting reliable operations. Forestry groups use LiDAR in the Pacific Northwest and southern states for timber inventory, harvest planning, and compliance work supporting sustainable forest use. Coastal agencies along all major shorelines use LiDAR to measure erosion, study flood risk, and plan climate adaptation. Oil and gas teams use LiDAR for facility planning, terrain mapping, and pipeline monitoring in difficult landscapes.

Farmers use LiDAR data to guide irrigation, plan drainage, and support precision field management, increasing yields and saving resources. Universities expand research and training supporting new sensors, improved algorithms, and next-generation applications. Aviation regulations support drone operations, including extended flights, helping broaden LiDAR use across many industries. Canada shows similar strength using LiDAR for resource planning, infrastructure mapping, and environmental stewardship across wide northern regions.

Europe maintains a substantial market presence

Europe accounted for an estimated 31 percent market share in 2025, supported by extensive national mapping and environmental monitoring efforts. Europe maintains a strong position in the airborne LiDAR market due to strict environmental rules, advanced research capacity, national mapping programs, and wide use across varied landscapes and industries. Germany supports major LiDAR programs that cover the entire country, providing high-resolution data for urban planning, flood studies, and infrastructure development. The Netherlands relies on precise LiDAR elevation data for water management in low-lying regions, supporting flood defense and land reclamation work.

The United Kingdom collects national LiDAR datasets managed by the Environment Agency, offering free public access for planning, research, and commercial use. Scandinavian countries use LiDAR for forest inventory, hydropower planning, and infrastructure monitoring across remote mountain regions and northern territories. France uses LiDAR for cultural heritage work, archaeological studies, and hazard mapping across coastlines, river valleys, and Alpine areas. Spain applies LiDAR for renewable energy planning with detailed terrain data supporting wind and solar site selection. Alpine countries, including Switzerland and Austria, rely on LiDAR for avalanche mapping, ski resort planning, and monitoring of mountain infrastructure in steep, high-altitude landscapes. European Union environmental directives require habitat surveys, water monitoring, and climate planning, increasing demand for LiDAR data across member states.

Archaeological research benefits from LiDAR since hidden features beneath forests become visible, revealing historic settlements and field systems. Smart city programs across Europe employ LiDAR-based digital twins to support planning, asset management, and long-term development. Offshore wind expansion depends on bathymetric LiDAR to study coastal waters and plan safe cable routes supporting renewable energy projects. Asia Pacific is experiencing significant growth

Recent Developments

- In October 2025, GeoCue Group unveiled the TrueView 641 aerial LiDAR sensor at INTERGEO 2025, offering NDAA-compliant engineering-grade performance for professional UAV and airborne mapping customers worldwide.

- In October 2025, Hesai Technology announced it had become the first LiDAR company in the world to produce one million LiDAR units in a single year, underscoring large-scale manufacturing growth across surveying and mapping markets.

Airborne LiDAR Market: Competitive Analysis

The leading players in the global airborne LiDAR market are-

- Teledyne Technologies Incorporated

- Leica Geosystems AG

- Trimble Inc.

- Riegl Laser Measurement Systems GmbH

- Quantum Spatial Inc.

- Velodyne Lidar Inc.

- Phoenix LiDAR Systems

- GeoCue Group Inc.

- YellowScan

- GeoSLAM Ltd.

The global airborne LiDAR market is segmented as follows:

By Type

- Topographic LiDAR

- Bathymetric LiDAR

By Component

- Laser Scanners

- Navigation and Positioning Systems

- Cameras

- Others

By Platform

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

- UAVs and Drones

By Application

- Corridor Mapping

- Engineering and Construction

- Urban Planning

- Forestry and Agriculture

- Mining

- Flood Risk Mapping

- Coastal Management

By End User

- Government and Defense

- Commercial

- Research and Academia

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed