Global Air Charter Services Market Size, Share, Report 2034

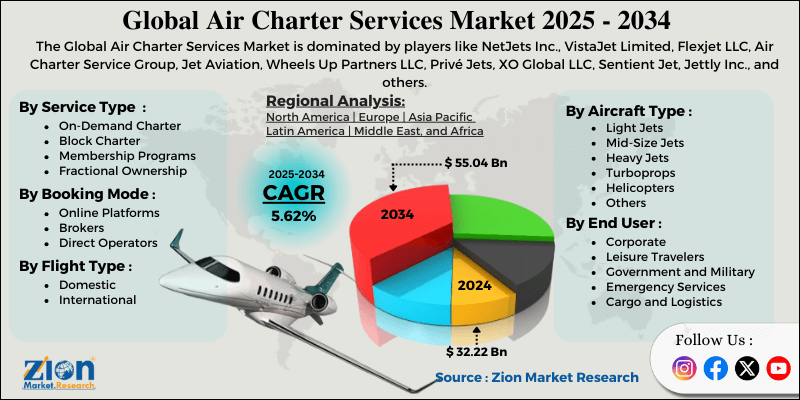

Air Charter Services Market By Aircraft Type (Light Jets, Mid-Size Jets, Heavy Jets, Turboprops, Helicopters, and Others), By Service Type (On-Demand Charter, Block Charter, Membership Programs, Fractional Ownership), By End-User (Corporate, Leisure Travelers, Government and Military, Emergency Services, Cargo and Logistics), By Booking Mode (Online Platforms, Brokers, Direct Operators), By Flight Type (Domestic, International), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

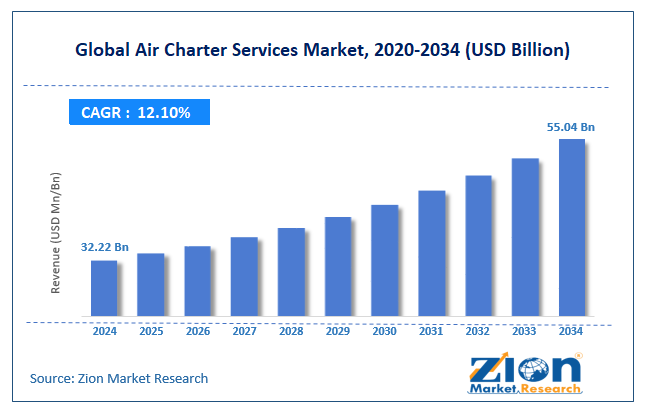

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.22 Billion | USD 55.04 Billion | 5.62% | 2024 |

Air Charter Services Industry Perspective

The global air charter services market size was worth approximately USD 32.22 billion in 2024 and is projected to grow to around USD 55.04 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.62 % between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global air charter services market is estimated to grow annually at a CAGR of around 5.62 % over the forecast period (2025-2034).

- In terms of revenue, the global air charter services market size was valued at approximately USD 32.22 billion in 2024 and is projected to reach USD 55.04 billion by 2034.

- The air charter services market is projected to grow significantly due to the rising number of high-net-worth individuals, increasing business aviation demand, growing need for medical evacuation services, and expanding tourism to remote destinations requiring private aviation access.

- Based on aircraft type, the mid-size jets segment is expected to lead the air charter services market, while the helicopters segment is anticipated to experience significant growth.

- Based on service type, the on-demand charter segment is expected to lead the air charter services market, while the membership programs segment is anticipated to witness notable growth.

- Based on end-user, the corporate segment is the dominating segment, while the leisure travelers segment is projected to witness sizeable revenue over the forecast period.

- Based on the booking mode, the brokers segment is expected to lead the market compared to the online platforms segment.

- Based on region, North America is projected to dominate the global air charter services market during the estimated period, followed by Europe.

Air Charter Services Market: Overview

Air charter services are private air transportation in which individuals, businesses, or groups rent an entire aircraft for a specific trip rather than purchasing tickets on commercial airlines. These services provide full flexibility by allowing customers to choose their departure time, destination airport, preferred aircraft type, and cabin setup. Operators offer a wide range of aircraft, from small turboprops for a few passengers to large business jets with meeting areas and sleeping spaces. Business travelers use charters to visit multiple cities in one day, hold confidential discussions, and avoid long security lines.

Leisure travelers choose charters for vacations and special events where privacy and convenience are important. Charters also support medical emergencies, government travel, military needs, and urgent cargo transport. Customers can book flights on demand or through programs such as block hours, memberships, and fractional ownership, while digital platforms make booking faster and more transparent. The growing demand for time-efficient travel and the increasing number of high-net-worth individuals are expected to drive growth in the air charter services market over the forecast period.

Air Charter Services Market Dynamics

Growth Drivers

Corporate travel efficiency

The air charter services market is growing quickly because companies see executive time as a key resource, making private aviation a practical choice compared to commercial flights with long delays and inefficient connections. Multinational firms deploy teams to multiple sites in a single day, using charter aircraft that land at airports near each location, enabling schedules that commercial airlines cannot accommodate. Confidential travel for merger teams is facilitated by charters, which provide quiet, discreet movement without attracting public attention, unlike commercial bookings.

Board meetings in remote cities become more accessible through charters landing near meeting venues, reducing long travel times from major airports. Site inspections at factories or retail locations benefit from flexible departures supporting extended meetings without risks of missing flights. Technology leaders improve productivity with charters departing once discussions finish, preventing rushed endings. Sales teams gain more client time by avoiding hub connections during trips across large regions. Emergency situations requiring immediate executive presence depend on the availability of rapid charter services.

How are leisure travel and experiential tourism growth driving the air charter services market growth?

The global air charter services industry is expanding as affluent travelers seek unique experiences, convenient family travel, and exclusive access to premium destinations where private aviation offers clear advantages. Destination weddings in remote locations often use group charters carrying entire wedding parties to resorts or private islands, where commercial logistics create significant challenges. Multi-generational vacations rely on charters providing flexible schedules supporting elderly grandparents and young children while avoiding crowded terminals and long airport lines, causing unnecessary stress. Major sporting events create strong charter demand from fans willing to pay premiums, avoiding sold-out flights and heavy game-day airport congestion.

Luxury safari trips begin with chartered flights reaching remote airstrips without scheduled airline service, making private aviation an essential part of the overall experience. Ski holidays during peak seasons use charters landing near mountain airports, reducing long transfers from distant commercial hubs. Adventure tourism, yacht trips, photography tours, and spontaneous luxury travel also depend on charters offering direct access, time savings, and unmatched convenience.

Restraints

How are high operational costs and price sensitivity limiting market expansion, restricting the growth of the air charter services market?

A major challenge for the air charter services market is high operating costs, which create a strong price premium relative to commercial aviation and reduce adoption among non-corporate users and wealthy travelers. Aircraft purchases require large investments, pushing operators to generate high revenue per aircraft to cover capital expenses and long-term depreciation. Pilot salaries create fixed costs because each aircraft needs two experienced crew members earning substantial compensation regardless of flight activity. Fuel costs add significant financial pressure, as business jets consume expensive jet fuel during every hour of operation.

Maintenance requirements create ongoing costs through frequent inspections, scheduled overhauls, and unexpected repairs needed to keep aircraft in a safe condition. Insurance premiums add yearly expenses covering hull protection and liability risks for operators handling premium assets. Hangar storage at major airports increases fixed costs because aircraft require protected space between flights. Crew travel costs rise when pilots remain overnight away from home bases during multi-day assignments.

Opportunities

Limited commercial connectivity is boosting charter adoption

The air charter services industry is seeing strong growth as rising wealth in emerging economies creates new users, while limited commercial aviation in many regions increases demand for private travel solutions. High-net-worth individuals in China, India, and Southeast Asia use private aviation to support their luxury experiences and fast travel needs. Business expansion in frontier markets depends on charters reaching locations where commercial flights remain unreliable or unavailable for routine executive travel. Mining and energy companies rely on charter aircraft to transport staff and essential equipment to remote regions unreachable by regular airlines. Tourism growth at isolated natural destinations benefits from charters offering direct access to areas without scheduled service.

Medical evacuation services use air ambulances to move critical patients to advanced hospitals at regional hubs. Government travel in developing countries uses charters, supplementing limited state aircraft fleets for official missions. NGOs providing humanitarian aid depend on charters accessing regions affected by disasters or by weak infrastructure. Technology entrepreneurs in fast-growing cities use charters to improve travel efficiency across expanding markets.

Challenges

How are regulatory complexity and safety concerns creating challenges for the air charter services industry?

The air charter services market faces major challenges from varied regulations, strict safety rules, and increased global scrutiny, creating higher compliance costs for operators serving international markets. Pilot qualification rules differ across countries, with some regions requiring extensive extra training before foreign crew members can fly in local airspace. Aircraft certification standards vary widely, with certain nations requesting added modifications or documentation before specific aircraft receive operating approval.

The processes for obtaining operating certificates for new charter companies remain lengthy and expensive in markets with developing aviation oversight. Customs and immigration procedures create administrative delays when airports have limited general aviation facilities supporting charter traffic. Safety management programs require formal documentation and reporting systems, increasing administrative workloads for small operators. Accident investigations place greater scrutiny on maintenance records and crew qualifications, increasing compliance pressure.

Air Charter Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Air Charter Services Market |

| Market Size in 2024 | USD 32.22 Billion |

| Market Forecast in 2034 | USD 55.04 Billion |

| Growth Rate | CAGR of 5.62% |

| Number of Pages | 230 |

| Key Companies Covered | NetJets Inc., VistaJet Limited, Flexjet LLC, Air Charter Service Group, Jet Aviation, Wheels Up Partners LLC, Privé Jets, XO Global LLC, Sentient Jet, Jettly Inc., and others. |

| Segments Covered | By Aircraft Type, By Service Type, By End User, By Booking Mode, By Flight Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Air Charter Services Market: Segmentation

The global air charter services market is segmented based on aircraft type, service type, end user, booking mode, flight type, and region.

Based on aircraft type, the global air charter services industry is categorized into light jets, mid-size jets, heavy jets, turboprops, helicopters, and others. Mid-size jets lead the market due to an optimal balance of range, passenger capacity, and operating costs; suitability for most common business mission profiles; and extensive availability within operator fleets.

Based on service type, the industry is segregated into on-demand charter, block charter, membership programs, and fractional ownership. On-demand charter is expected to lead the market during the forecast period due to its flexibility, which provides customers with no ongoing commitments, and its suitability for occasional users with unpredictable travel patterns.

Based on end-user, the global air charter services market is divided into corporate, leisure travelers, government and military, emergency services, and cargo and logistics. Corporate holds the largest market share due to substantial business aviation demand among companies that value executive productivity and can justify costs through time savings.

Based on booking mode, the global market is segmented into online platforms, brokers, and direct operators. Brokers hold the largest market share due to their established relationships with multiple operators, their ability to negotiate favorable rates through volume, and value-added services, including trip planning and coordination, that customers appreciate despite the associated commission costs.

Based on flight type, the global air charter services market is classified into domestic and international. Domestic holds the largest market share due to simpler regulatory requirements, the avoidance of customs procedures, and shorter flight distances that suit light and mid-size aircraft.

Air Charter Services Market: Regional Analysis

What factors are contributing to North America's dominance in the global air charter services market?

North America recorded an estimated 8.5 percent CAGR in 2025, driven by mature corporate aviation use, large fleet availability, and widespread airport infrastructure. North America leads the air charter services market because mature business aviation culture, strong airport networks, favorable regulations, and a large high-net-worth population, which create ideal conditions for rapid industry growth. The United States operates the world’s largest business aviation fleet with thousands of charter aircraft serving corporate users and leisure travelers across major regions. Airport networks include thousands of public and private airfields offering convenient access to communities where commercial airlines provide limited service.

Regulatory support from the Federal Aviation Administration enables efficient charter activity with clear certification steps and consistent operational guidelines. Silicon Valley wealth produces strong demand from technology executives who rely on private aviation for flexible schedules and fast business travel. Energy operations in Texas and across North America create steady charter use for transporting personnel and equipment to remote sites. The entertainment sector in Los Angeles depends on charter flights supporting celebrities and production teams with discreet and reliable travel.

Financial firms in New York generate significant demand as executives use charters for deal meetings across multiple cities. Sports teams rely on dedicated aircraft transporting players, staff, and gear between competitive events. Political campaigns increase charter usage during election seasons as candidates cover wide regions each day. Medical evacuation operators run extensive air ambulance networks providing rapid patient transfers across large distances. Mexico exhibits rising demand, driven by increasing business aviation use among corporations and wealthy travelers. Canada maintains strong charter activity serving remote northern communities and major resource extraction regions.

Europe maintains a substantial market presence

Europe recorded an estimated 7.2 percent CAGR in 2025, supported by strong business aviation demand, luxury tourism growth, and expanding private travel networks. Europe holds a strong position in the air charter services market because wealthy populations, major business hubs, international travel patterns, and advanced aviation infrastructure support stable and diverse charter demand. The United Kingdom maintains the region’s largest charter market with London serving financial, corporate, and global business travelers who rely on efficient private aviation access. France supports steady charter activity through luxury tourism, business travel, and seasonal demand across Riviera destinations, attracting affluent visitors each year. Germany has significant charter use by major corporations, manufacturing industries, and trade sectors centered in Frankfurt and Munich. Switzerland combines banking wealth and mountain tourism, creating strong winter charter demand as affluent travelers use jets and helicopters to reach exclusive ski resorts.

Monaco and the Côte d’Azur generate large summer charter volumes as ultra-high-net-worth individuals arrive for the yachting season and social events. Italy experiences diverse demand from the fashion industry, manufacturing sectors, and tourism hotspots, necessitating flexible business and leisure travel options throughout the year. Spain benefits from strong charter activity as tourists and property owners reach coastal resorts and island destinations with direct private aviation access. Russia’s European region historically supported high charter demand from wealthy business groups, though current geopolitical conditions influence activity levels. Scandinavian countries rely on charter flights connecting remote northern regions and resource operations where commercial services remain limited. Middle East connections also increase European charter use as wealthy travelers maintain holiday properties and business interests across key European cities.

Recent Developments

- In October 2025, Luxaviation Group introduced a dedicated division called Luxaviation One focused exclusively on private jet charter and flight brokerage services.

- In November 2025, Fetch Air launched its Part 135 charter operations from Southern California, offering dual-pilot flights and pet-friendly private aviation options.

- In December 2025, Jazeera Airways and Beond were selected by Saudi civil aviation authorities to establish new on-demand charter carriers in the Saudi market, opening fresh private aviation opportunities.

Air Charter Services Market: Competitive Analysis

The leading players in the global air charter services market are-

- NetJets Inc.

- VistaJet Limited

- Flexjet LLC

- Air Charter Service Group

- Jet Aviation

- Wheels Up Partners LLC

- Privé Jets

- XO Global LLC

- Sentient Jet

- Jettly Inc.

The global air charter services market is segmented as follows:

By Aircraft Type

- Light Jets

- Mid-Size Jets

- Heavy Jets

- Turboprops

- Helicopters

- Others

By Service Type

- On-Demand Charter

- Block Charter

- Membership Programs

- Fractional Ownership

By End User

- Corporate

- Leisure Travelers

- Government and Military

- Emergency Services

- Cargo and Logistics

By Booking Mode

- Online Platforms

- Brokers

- Direct Operators

By Flight Type

- Domestic

- International

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed