Advantame Market Size, Share, Trends, Growth & Forecast 2034

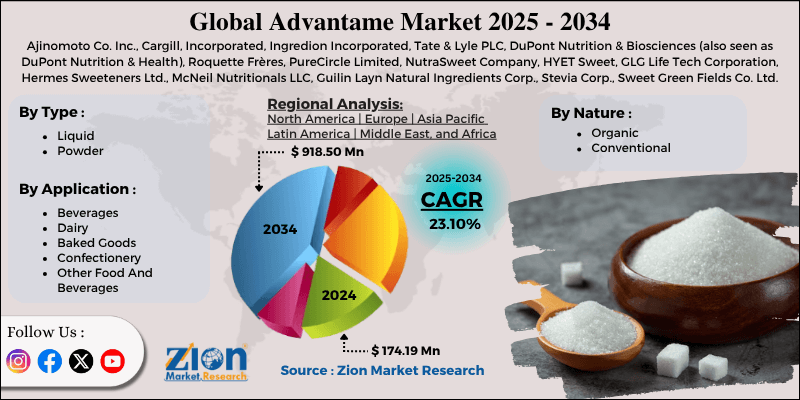

Advantame Market By Type (Liquid, Powder), By Application (Beverages, Dairy, Baked Goods, Confectionery, Other Food And Beverages), By Nature (Organic, Conventional), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

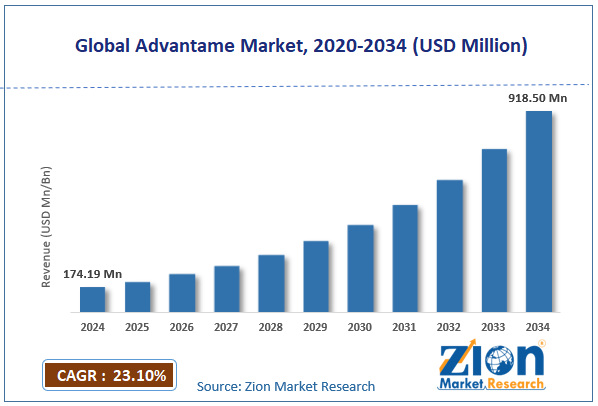

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 174.19 Million | USD 918.50 Million | 23.10% | 2024 |

Advantame Industry Perspective:

The global advantame market size was approximately USD 174.19 million in 2024 and is projected to reach around USD 918.50 million by 2034, with a compound annual growth rate (CAGR) of roughly 23.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global advantame market is estimated to grow annually at a CAGR of around 23.10% over the forecast period (2025-2034)

- In terms of revenue, the global advantame market size was valued at around USD 174.19 million in 2024 and is projected to reach USD 918.50 million by 2034.

- The advantame market is projected to grow significantly due to increasing health consciousness and concerns about obesity and diabetes, as well as demand for low-calorie and sugar-free food & beverages, along with regulatory approvals and support for non-saccharide sweeteners.

- Based on type, the powder segment is expected to lead the market, while the liquid segment is expected to grow considerably.

- Based on application, the beverages segment is the largest, while the baked goods segment is projected to experience substantial revenue growth over the forecast period.

- Based on nature, the conventional segment is expected to lead the market compared to the organic segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Advantame Market: Overview

Advantame is a non-calorie, extremely high-intensity artificial sweetener derived from vanillin and aspartame. Permitted by key food-safety authorities, it is nearly 20 times sweeter than sugar, hence only small amounts are required to sweeten foods and beverages. The global advantame market is projected to witness substantial growth, driven by the growing health consciousness, sugar reduction, ultra-high sweetness potency, and pH and heat stability. Rising awareness of the adverse effects of excessive sugar intake is motivating individuals to choose healthier alternatives. Food manufacturers are reformulating products to support these preferences. Advantame benefits from this shift as a potent, calorie-free sweetening option. Advantame’s extreme sweetness allows tiny quantities to deliver strong results. This allows cost-efficient formulations without adding calories. Manufacturers value its ability to offer intense sweetness while maintaining product consistency. Furthermore, its stability during high-temperature processing makes advantame ideal for confectionery and baked goods. It also performs well in different pH levels, allowing use in various food systems. This versatility raises its adoption in complex formulations.

Although drivers exist, the global market is challenged by factors such as consumer skepticism toward artificial sweeteners and a varied and complex regulatory landscape. Some consumers mistrust synthetic sweeteners because of perceived health concerns. This may restrict acceptance, even in safety-critical situations. Companies should address these perceptions through communication and branding. Regulations vary from region to region, creating challenges for the global adoption of these standards. Companies should navigate approval processes that can be lengthy and time-consuming. This increases compliance pressure and slows market entry. Likewise, producing high-purity advantame can be expensive, particularly on smaller scales, which can make it unaffordable for some manufacturers. If demand doesn't scale speedily, high manufacturing costs may hamper margins or restrict broader commercial use.

Even so, the global advantame industry is well-positioned due to new product innovations and blended formulations, as well as growth in the nutraceutical and pharmaceutical sectors, and significant growth potential in developing markets. Creating sweetener blends can enhance functionality and taste while lowering cost. Advantame works well in combination with natural and other sweeteners. This offers fresh avenues to consumer-friendly and innovative formulations. Its strong sweetness profile makes advantame valuable for masking bitterness. This is progressively crucial in over-the-counter and pediatric products. The growing health product industry supports greater use.

Additionally, growing urbanization and increased consumption of processed foods amplify the demand for advanced sweeteners. Advantame can help companies create healthier products for these markets. Local collaborations may accelerate adoption.

Advantame Market Dynamics

Growth Drivers

How is regulatory support for non‑nutritive sweeteners driving the advantame market?

Regulatory approval and safety recognition form a vital foundation for the advantame market. Global food safety bodies, such as EFSA in Europe and the FDA in the U.S., have assessed and permitted advantame for use, offering manufacturers confidence to integrate it into specialty and mainstream products. This favorable regulatory architecture helps reduce obstacles to its adoption in different geographies.

Additionally, in several regions, governments are implementing sugar-reduction initiatives, which indirectly promote the use of high-intensity sweeteners. As more areas tighten sugar consumption policies or launch sugar levies, advantame stands to benefit from being a reliable and approved substitute.

How is the advantame market propelled by the expansion into pharmaceutical & nutraceutical applications?

Beyond drinks and food, advantame is increasingly used in pharmaceuticals (mainly syrups, oral medications, and chewables) due to its clean sweetness and ability to mask unpleasant tastes. In geriatric and pediatric medicines, taste is a significant factor for compliance; advantame offers a practical solution without adding sugar. There is also growing interest from the nutraceutical and dietary supplement industries, where advantame can be used to sweeten tablets, gummies, or effervescent tablets without compromising on health claims. This cross-industry adoption offers high-value and new markets, diversifying demand beyond just beverages and foods.

Restraints

Taste profile & sensory limitations adversely impact the market progress

Though advantame is highly sweet, formulators mostly struggle with its sensory profile. Some formulators and studies have noted degradation or instability under certain conditions (for instance, at high temperatures or in highly acidic beverages), which may impact the consistency of sweetness.

Also, when used solely, advantame may not wholly replicate the 'sweetness curve' of sucrose or mouthfeel, so companies usually need to blend it with other sweeteners – adding complexity to formulation. Additionally, consumer acceptance is challenging in regions that prioritize natural ingredients; synthetic sweeteners (even effective ones) may be less preferred than natural substitutes like monk fruit or stevia.

Opportunities

How are innovation & sweetener blends offering advantageous conditions for the advantame market development?

There is an opportunity in the advantame industry to develop hybrid formulations combining advantame with other sweeteners, such as monk fruit, stevia, or sugar alcohols, to balance sweetness, cost, and taste profile. These blends can mitigate downsides like mouthfeel or aftertaste.

According to market intelligence, research and development are actively focused on co-crystallization, novel delivery systems, and micro-encapsulation to optimize advantame’s performance. These innovations appeal to manufacturers seeking low-sugar and cleaner labels without compromising sweetness or functionality.

Challenges

Public health & consumer perception risk limit the market growth

Growing skepticism about artificial sweeteners remains a significant challenge. Even with regulatory approvals, most consumers remain distrustful of synthetic sweeteners due to concerns about their long-term health effects.

Conversely, evolving negative media coverage or public health advisories may erode confidence in advantame. Market analysis cite that consumer distrust is a significant obstacle, and educating consumers on the benefits and safety of advantame is not insignificant.

Advantame Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Advantame Market |

| Market Size in 2024 | USD 174.19 Million |

| Market Forecast in 2034 | USD 918.50 Million |

| Growth Rate | CAGR of 23.10% |

| Number of Pages | 214 |

| Key Companies Covered | Ajinomoto Co. Inc., Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, DuPont Nutrition & Biosciences (also seen as DuPont Nutrition & Health), Roquette Frères, PureCircle Limited, NutraSweet Company, HYET Sweet, GLG Life Tech Corporation, Hermes Sweeteners Ltd., McNeil Nutritionals LLC, Guilin Layn Natural Ingredients Corp., Stevia Corp., Sweet Green Fields Co. Ltd., and others. |

| Segments Covered | By Type, By Application, By Nature, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Advantame Market: Segmentation

The global advantame market is segmented based on type, application, nature, and region.

Based on type, the global advantame industry is categorized into liquid and powder forms. The powder segment held a dominant market share due to its long shelf life and high stability. It allows easy storage, transport, and handling in bulk quantities. Its concentrated nature assures cost-effective use in formulations. The powder is significantly versatile, suitable for a broader range of beverages, food, and pharmaceutical products. Manufacturers favor it for accurate and controlled sweetness in semi-solid and solid applications.

Based on application, the global advantame market is segmented into beverages, dairy, baked goods, confectionery, and other food and beverages. The beverages segment held a leading share, as sugar-free and low-calorie drinks are the key use cases. Advantame’s high sweetness potency makes it suitable for soft drinks, ready-to-drink functional beverages, and juices. Its excellent solubility promises uniform sweetness even in dilute liquid systems. Manufacturers prefer to reformulate classic beverages into 'diet' versions, while maintaining the best taste.

Based on nature, the global market is segmented into organic and conventional. The conventional segment holds a leading position in the market, as the sweetener is primarily used synthetically in beverages, confectionery, and products with high sweetness potency, offering cost efficiency and quality. Manufacturers use it for large-scale production because of regulatory approvals and ease of formulation. Its dominance reflects the broader adoption of synthetic sweeteners in mainstream food and drink products.

Advantame Market: Regional Analysis

What enables North America to have a strong foothold in the global Advantame Market?

North America is likely to maintain its leadership in the advantame market due to increased health awareness, sugar reduction, regulatory approvals, and advanced food processing infrastructure. Growing diabetes, obesity, and lifestyle-related health issues are triggering consumers to prefer sugar-free and low-calorie products. Food and beverage manufacturers are responding with reformulated recipes. Advantame’s zero-calorie profile and high sweetness meet these demands. This creates strong adoption in multiple product categories.

Moreover, DA approval and a clear regulatory architecture offer manufacturers confidence to use advantame in a broader range of applications. Compliance is direct, reducing product development risks. This motivates speedy adoption in baked goods, beverages, and confectionery. The regulatory clarity also supports industry expansion and innovation.

Furthermore, North America has well-established distribution and food processing networks. These allow effective integration of advantame into large-scale manufacturing lines. Companies can maintain consistent product dosage and quality. This infrastructure aids faster time-to-market and innovation.

Europe continues to hold the second-highest share in the advantame industry, driven by regulatory support, safety confidence, sugar-reduction policies & public health initiatives, as well as a health-conscious consumer base. Europe's strict food safety norms and approval of advantame offer strong confidence for consumers and manufacturers. Companies can use it in multiple drinks and food categories without regulatory concerns. This clarity motivates consistent adoption and supports the launch of new products. This regulatory architecture promises safety and industry stability.

Moreover, European nations are actively promoting initiatives to reduce sugar consumption and improve public health. Food & beverage companies are reformulating products to support these policies. Advantame serves as the best high-intensity sweetener in this context. This creates significant demand in multiple applications.

Furthermore, European consumers are highly aware of the health impacts of calories and sugar. They progressively prefer calorie-reduced and low-sugar products. Advantame meets these preferences by delivering high sweetness with the least calorie impact. This fuels continuous adoption in functional and diet products.

Advantame Market: Competitive Analysis

The leading players in the global advantame market are:

- Ajinomoto Co. Inc.

- Cargill

- Incorporated

- Ingredion Incorporated

- Tate & Lyle PLC

- DuPont Nutrition & Biosciences (also seen as DuPont Nutrition & Health)

- Roquette Frères

- PureCircle Limited

- NutraSweet Company

- HYET Sweet

- GLG Life Tech Corporation

- Hermes Sweeteners Ltd.

- McNeil Nutritionals LLC

- Guilin Layn Natural Ingredients Corp.

- Stevia Corp.

- Sweet Green Fields Co. Ltd.

Advantame Market: Key Market Trends

Formulation innovation & sweetener blends:

Manufacturers are developing hybrid sweetener systems by blending advantame with other sweeteners (synthetic or natural) to enhance cost, taste, and performance. Microencapsulation and novel delivery technologies are enhancing stability, particularly in complex formulations. These advances help reduce off-notes and improve overall product appeal.

Sugar‑reduction & health‑driven reformulations:

Growing consumer health consciousness and regulatory initiatives targeting sugar reduction are driving food and beverage companies to reformulate their products. Advantame’s ultra-high sweetness potency enables brands to reduce sugar while maintaining sweetness significantly. This trend is primarily observed in diet foods and low-calorie beverages.

The global advantame market is segmented as follows:

By Type

- Liquid

- Powder

By Application

- Beverages

- Dairy

- Baked Goods

- Confectionery

- Other Food And Beverages

By Nature

- Organic

- Conventional

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Advantame is a non-calorie, extremely high-intensity artificial sweetener derived from vanillin and aspartame. Permitted by key food-safety authorities, it is nearly 20 times sweeter than sugar, hence only small amounts are required to sweeten foods and beverages.

The global advantame market is projected to grow due to the increasing use in pharmaceuticals (for taste masking), clean-label trends, and the desire for "healthier" ingredients, as well as technological advancements in formulation and production.

According to study, the global advantame market size was worth around USD 174.19 million in 2024 and is predicted to grow to around USD 918.50 million by 2034.

The CAGR value of the advantame market is expected to be approximately 23.10% from 2025 to 2034.

Technological advancements are enhancing Advantame’s formulation versatility, stability, and large-scale production efficiency, driving broader adoption in food, beverage, and pharmaceutical products.

North America is expected to lead the global advantame market during the forecast period.

The United States is a key contributor to the global Advantame market, driven by high demand for the ingredient in baked goods, beverages, and low-calorie products.

The key players profiled in the global advantame market include Ajinomoto Co., Inc., Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, DuPont Nutrition & Biosciences (also seen as DuPont Nutrition & Health), Roquette Frères, PureCircle Limited, NutraSweet Company, HYET Sweet, GLG Life Tech Corporation, Hermes Sweeteners Ltd., McNeil Nutritionals, LLC, Guilin Layn Natural Ingredients Corp., Stevia Corp., and Sweet Green Fields Co., Ltd.

Stakeholders should focus on strategic partnerships, product innovation, geographic expansion, and reformulation to reduce sugar content, thereby staying competitive in the Advantame market.

The report examines key aspects of the advantame market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed