Global Absorbable Hemostats Market Size, Share, Report 2034

Absorbable Hemostats Market By Product Type (Gelatin-Based Hemostats, Collagen-Based Hemostats, Oxidized Regenerated Cellulose-Based Hemostats, Polysaccharide-Based Hemostats, Combination Hemostats, and Others), By Form (Sponge, Powder, Sheet, Gel, and Flowable), By Application (Cardiovascular Surgery, General Surgery, Orthopedic Surgery, Neurological Surgery, Gynecological Surgery, and Trauma Surgery), By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Emergency Care Centers), By Distribution Channel (Direct Sales, Medical Distributors, and Online Platforms), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

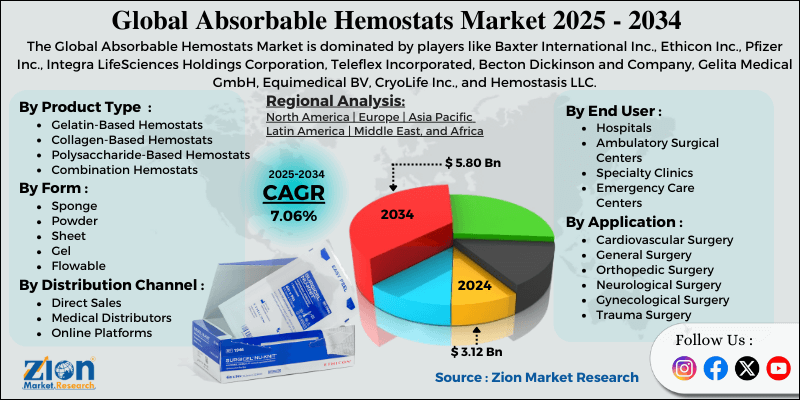

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.12 Billion | USD 5.80 Billion | 7.06% | 2024 |

Absorbable Hemostats Industry Perspective

The global absorbable hemostats market size was worth approximately USD 3.12 billion in 2024 and is projected to grow to around USD 5.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.06 % between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global absorbable hemostats market is estimated to grow annually at a CAGR of around 7.06 % over the forecast period (2025-2034).

- In terms of revenue, the global absorbable hemostats market size was valued at approximately USD 3.12 billion in 2024 and is projected to reach USD 5.80 billion by 2034.

- The absorbable hemostats market is projected to grow significantly due to the rising surgical procedure volumes, increasing prevalence of chronic diseases requiring surgery, growing aging population, and expanding adoption of minimally invasive surgical techniques.

- Based on product type, the collagen-based hemostats segment is expected to lead the absorbable hemostats market, while the combination hemostats segment is anticipated to experience significant growth.

- Based on form, the sponge segment is expected to lead the absorbable hemostats market, while the flowable segment is anticipated to witness notable growth.

- Based on application, the cardiovascular surgery segment is the dominating segment, while the trauma surgery segment is projected to witness sizeable revenue over the forecast period.

- Based on end user, the hospitals segment is expected to lead the market compared to the ambulatory surgical centers segment.

- Based on distribution channel, direct sales hold the largest segment in the absorbable hemostats market.

- Based on region, North America is projected to dominate the global absorbable hemostats market during the estimated period, followed by Europe.

Absorbable Hemostats Market: Overview

Absorbable hemostats are medical materials used in surgery to control bleeding by helping the blood clot quickly and then dissolving naturally inside the body without needing removal. These products work by creating a surface for clot formation, supporting the body’s natural coagulation process, soaking up blood to concentrate clotting factors, and applying gentle pressure on the bleeding area. Surgeons place them directly on bleeding tissues where they form stable clots within minutes while healing begins. They are made from collagen, cellulose, or synthetic polymers and shaped into sponges, powders, sheets, gels, or flowable materials for easy use during different procedures. These hemostats fully break down over days or weeks as the surgical site heals.

Various formulations support different needs, and they are used in heart surgery, orthopedic operations, brain procedures, and trauma care. Growing surgical volumes and minimally invasive techniques continue to increase global demand for these products. The increasing number of surgical procedures and growing emphasis on patient safety are expected to drive growth in the absorbable hemostats market throughout the forecast period.

Absorbable Hemostats Market Dynamics

Growth Drivers

How is the increasing volume of surgical procedures driving market growth?

The absorbable hemostats market is growing quickly as increasing surgical volumes create steady demand for bleeding control products used to improve patient outcomes in many procedures. Cardiovascular surgeries such as bypass grafting, valve replacements, and vascular repairs involve highly vascular tissues where even mild bleeding increases risks during complex operations. Orthopedic procedures, including joint replacements, spinal fusions, and fracture repairs, often produce bone bleeding that standard techniques struggle to control in busy surgical settings.

Cancer surgeries removing tumors from major organs require fast hemostasis in areas with complex blood supply to maintain clear visibility throughout the operation. Liver resections involve heavy bleeding because liver tissue cannot hold sutures effectively in high-risk surgical environments. Trauma surgeries treating severe injuries require immediate bleeding control in emergencies where rapid action influences survival outcomes. Bariatric procedures for weight loss involve vascular digestive tissues, where reliable bleeding prevention helps reduce complications for patients recovering.

An aging population and chronic disease prevalence

The global absorbable hemostats market is growing steadily as aging populations increase surgical needs across regions, with expanding demand for safe bleeding control products. Elderly patients over sixty-five undergo more surgeries due to cardiovascular disease, cancer, and joint disorders requiring operative treatment across many healthcare systems worldwide. Older individuals often use anticoagulant medicines for heart conditions or stroke prevention, increasing bleeding risks during surgery and creating a higher demand for dependable hemostatic materials. Diabetes complications drive vascular surgeries, foot amputations, and wound procedures, where effective bleeding control supports healing and improves overall recovery outcomes.

Obesity increases bariatric surgery volumes involving tissues prone to bleeding, making reliable hemostatic support important for patient safety and postoperative stability. Cancer incidence rises with age, increasing tumor removals, organ resections, and reconstructive operations, where steady bleeding control strengthens surgical success and patient recovery. Cardiovascular, neurological, and respiratory surgeries also benefit from absorbable hemostats because these procedures involve delicate tissues requiring precise and consistent bleeding management.

Restraints

High product costs and reimbursement challenges are affecting adoption

A major challenge for the absorbable hemostats market is the high cost of advanced products compared with simple methods used in many healthcare environments worldwide. Premium hemostatic agents often cost hundreds of dollars per unit, creating financial strain during complex surgeries using multiple units for bleeding control. Hospital budgets face strong pressure to manage expenses while maintaining reliable care, making costly single-use products subject to strict evaluation by purchasing teams. Reimbursement gaps prevent hospitals from recovering full product expenses through procedure payments, forcing facilities to cover remaining costs and limit wider usage.

Developing countries with restricted budgets struggle to access advanced options despite clinical need, slowing market growth in regions with large surgical populations. Lower-cost alternatives remain common because they reduce spending even when offering weaker performance in demanding surgical conditions. Product waste increases expenses when opened packages remain unused, leading hospitals to apply stricter controls, reducing unnecessary usage.

Opportunities

How is the expansion of minimally invasive surgery creating new opportunities?

The absorbable hemostats industry is seeing strong growth as minimally invasive surgical techniques expand globally and create steady demand for products suited for small incisions and narrow instruments. Laparoscopic procedures use tiny abdominal openings and require hemostatic agents that pass through narrow trocars while allowing precise application with limited instrument movement. Robotic surgeries support complex operations through small access points and depend on hemostatic materials compatible with robotic arms performing delicate tasks inside confined spaces. Endoscopic procedures use natural openings and need hemostatic agents that travel through flexible tubes and reach bleeding areas in tight anatomical regions.

Thoracoscopic surgeries in the chest benefit from products designed for lung tissue, where direct pressure is difficult in inflated environments. Arthroscopic joint surgeries rely on hemostatic agents that perform well in fluid-filled spaces where bleeding reduces visibility during guided movements. Neurosurgical and spine procedures done through small openings require hemostatic options fitting narrow corridors while controlling bleeding in delicate structures.

Challenges

How are product differentiation and clinical evidence development creating challenges for the industry?

The absorbable hemostats industry faces major challenges because strong competition and strong evidence requirements increase costs for companies working to prove product value in crowded markets. Many hemostatic products share similar features and mechanisms, making it difficult for manufacturers to stand out when surgeons view options as nearly equal in everyday procedures. Clinical trials for medical devices require large investments, pushing companies to spend millions comparing performance against competitors and older techniques in demanding surgical settings.

Regulatory rules add further pressure by requiring extensive safety and effectiveness data before approvals, extending development timelines, and delaying revenue for new products. Surgeon preferences often remain fixed due to long-term familiarity with trusted options, creating reluctance to test new alternatives during routine operations. Hospital formularies limit available choices and increase competition for placement on approved lists, reducing opportunities for newer products seeking broader adoption across healthcare facilities.

Absorbable Hemostats Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Absorbable Hemostats Market |

| Market Size in 2024 | USD 3.12 Billion |

| Market Forecast in 2034 | USD 5.80 Billion |

| Growth Rate | CAGR of 7.06% |

| Number of Pages | 250 |

| Key Companies Covered | Baxter International Inc., Ethicon Inc., Pfizer Inc., Integra LifeSciences Holdings Corporation, Teleflex Incorporated, Becton Dickinson and Company, Gelita Medical GmbH, Equimedical BV, CryoLife Inc., and Hemostasis LLC. |

| Segments Covered | By Product Type, By Form, By Application, By End User, By Distribution Channel and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America,The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Absorbable Hemostats Market: Segmentation

The global absorbable hemostats market is segmented based on product type, form, application, end user, distribution channel, and region.

Based on product type, the global absorbable hemostats industry is divided into gelatin-based hemostats, collagen-based hemostats, oxidized regenerated cellulose-based hemostats, polysaccharide-based hemostats, combination hemostats, and others. Collagen-based hemostats lead the market due to their strong structural properties that support clot formation and broad applicability across diverse surgical specialties and bleeding scenarios.

Based on form, the industry is classified into sponge, powder, sheet, gel, and flowable. Sponge forms are expected to lead the market during the forecast period due to their ease of handling by surgeons, ability to conform to irregular bleeding surfaces, and strong absorbent capacity that concentrates clotting factors.

Based on application, the global absorbable hemostats market is segregated into cardiovascular surgery, general surgery, orthopedic surgery, neurological surgery, gynecological surgery, and trauma surgery. Cardiovascular surgery holds the largest market share due to the high bleeding risks associated with heart and vascular procedures, and the critical importance of rapid hemostasis in cardiac operations.

Based on end user, the global market is divided into hospitals, ambulatory surgical centers, specialty clinics, and emergency care centers. Hospitals hold the largest market share due to the concentration of complex surgical procedures in hospital settings, the availability of specialized surgical equipment and expertise, and the comprehensive insurance coverage typically supporting hospital-based surgical care.

Based on distribution channel, the global market is categorized into direct sales, medical distributors, and online platforms. Direct sales hold the largest market share due to the relationship-driven nature of medical device procurement and the customized contracting arrangements typical in hospital purchasing.

Absorbable Hemostats Market: Regional Analysis

What factors are contributing to North America's dominance in the global market?

North America leads the absorbable hemostats market because advanced healthcare infrastructure, high surgical activity, strong reimbursement systems, and early technology adoption create steady support for product growth and innovation. The United States performs millions of surgical procedures each year across cardiovascular, orthopedic, general surgery, and other specialties, creating consistent demand for hemostatic products used in these operations. Advanced healthcare facilities, including academic medical centers, specialty hospitals, and well-equipped community hospitals, rely on modern hemostatic technologies during routine and complex procedures. Medical device industry concentration across the region promotes innovation as companies compete to create improved hemostatic solutions for surgeons.

Research universities and teaching hospitals support clinical trials evaluating new products while training surgeons on proper usage in modern surgical environments. Aging demographics increase surgical volumes as elderly Americans undergo joint replacements, cardiovascular procedures, cancer operations, and other treatments requiring dependable bleeding control. Obesity prevalence drives bariatric surgery demand, involving tissues prone to bleeding, increasing reliance on hemostatic agents across these procedures. Trauma centers treating severe injuries rely heavily on rapid hemostatic products for bleeding control during critical moments. Minimally invasive surgery adoption creates demand for hemostatic products suited for laparoscopic, robotic, and endoscopic applications in confined spaces.

Canadian healthcare systems share similar features with strong surgical capabilities and broad adoption of innovative hemostatic technologies across major hospitals. Growing awareness of patient safety standards increases surgeon preference for advanced hemostatic products offering reliable performance in diverse clinical settings. Strong investment in medical research encourages continuous development of next-generation hemostatic materials across North American laboratories.

Europe maintains a substantial market presence

North America leads the absorbable hemostats market because advanced healthcare systems, high surgical volumes, strong reimbursement support, and early use of new technologies create steady demand for modern hemostatic products. The United States performs millions of cardiovascular, orthopedic, cancer, and general surgery procedures each year, increasing the need for reliable hemostatic agents used during complex operations. Major academic hospitals, specialty surgical centers, and community facilities rely on updated hemostatic materials during procedures requiring stable bleeding control across many medical fields. Reimbursement through Medicare, Medicaid, and private insurance helps cover hemostatic product expenses, reducing financial pressure on hospitals using premium agents during routine and advanced surgeries.

FDA approval pathways support efficient product introduction while maintaining strong safety standards, encouraging manufacturers to invest in new hemostatic formulations. Medical device companies based in the region compete to develop improved products, creating strong innovation clusters supporting rapid technological progress. Research universities and teaching hospitals conduct clinical trials that generate evidence for adoption while training surgeons in proper application techniques during diverse surgical situations. Aging populations increase surgical needs as elderly patients undergo joint replacements, heart surgeries, cancer operations, and other procedures requiring dependable bleeding control.

Obesity increases bariatric surgery volumes involving bleeding-prone tissues, creating additional demand for reliable hemostatic solutions during these operations. Trauma centers performing emergency surgeries rely on fast-acting hemostatic products that control severe bleeding in critical situations. High adoption of minimally invasive techniques increases the need for hemostatic agents suited for laparoscopic, robotic, and endoscopic procedures.

Recent Developments

- In April 2025, Baxter International Inc. announced a new version of its Hemopatch Sealing Hemostat featuring room-temperature storage.

Absorbable Hemostats Market: Competitive Analysis

The leading players in the global absorbable hemostats market are-

- Baxter International Inc.

- Ethicon Inc.

- Pfizer Inc.

- Integra LifeSciences Holdings Corporation

- Teleflex Incorporated

- Becton Dickinson and Company

- Gelita Medical GmbH

- Equimedical BV

- CryoLife Inc.

- Hemostasis LLC.

The global absorbable hemostats market is segmented as follows:

By Product Type

- Gelatin-Based Hemostats

- Collagen-Based Hemostats

- Oxidized Regenerated Cellulose-Based Hemostats

- Polysaccharide-Based Hemostats

- Combination Hemostats

- Others

By Form

- Sponge

- Powder

- Sheet

- Gel

- Flowable

By Application

- Cardiovascular Surgery

- General Surgery

- Orthopedic Surgery

- Neurological Surgery

- Gynecological Surgery

- Trauma Surgery

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Emergency Care Centers

By Distribution Channel

- Direct Sales

- Medical Distributors

- Online Platforms

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed