Joint Replacement Devices Market Size, Share, Growth, Trends, and Forecast 2032

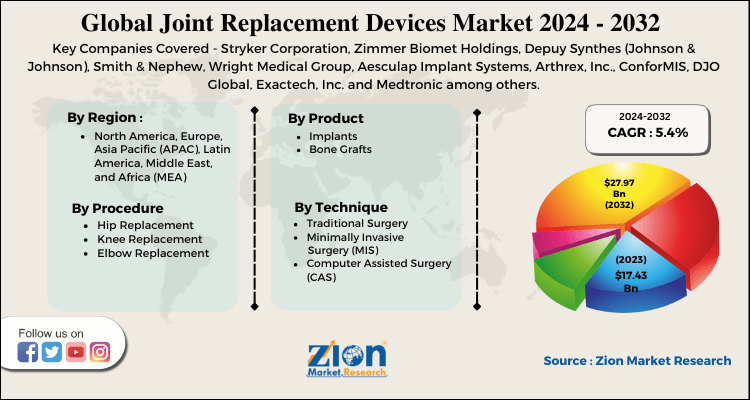

Joint Replacement Devices Market by Procedure (Hip Replacement, Knee Replacement, Elbow Replacement, and Others), by Products (Implants, Bone Grafts, and Others) by Technique (Traditional Surgery, Minimally Invasive Surgery, Computer Assisted Surgery): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

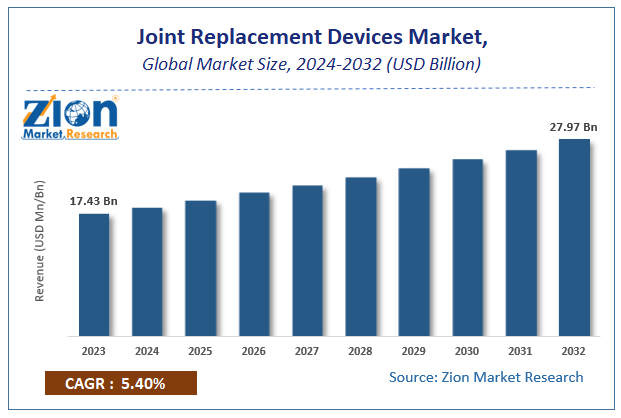

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.43 Billion | USD 27.97 Billion | 5.4% | 2023 |

Joint Replacement Devices Market Insights

Zion Market Research has published a report on the global Joint Replacement Devices Market, estimating its value at USD 17.43 Billion in 2023, with projections indicating that it will reach USD 27.97 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.4% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Joint Replacement Devices Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

Joint replacement devices are implantable medical devices that are intended to be used as a replacement, in whole or in part for joints such as shoulder joint, hip joint or knee joint. Joint implants are utilized to replace damaged joint ligaments and restore the patient's joint functionality and reduce pain.

The growing geriatric population, as well as increasing success of hip and knee implant procedures is expected to drive joint replacement device market trends in the future. Technological advancements in this area have given rise to minimally invasive join replacement surgeries and robotic surgeries. Patient specific 3D implants are becoming more widely accepted and expected to drive future market trends.

Growth Factors

High prevalence of osteoarthritis and rising cases of orthopaedic injury are fueling the need for joint replacement devices. Osteoarthritis, one of the most common type of arthritis, plays a significant role in driving the joint replacement devices market. A rise in geriatric population is also supplementing the market growth due to increased incidences of joint injuries.

Technological breakthroughs in joint replacement surgeries such as robotic surgeries and 3D implants are also expected to boost the growth. Growing patient population, lucrative demand for customized joint implants, and the introduction of new government schemes may also be able to present profitable growth opportunities for the joint replacement devices market.

Joint Replacement Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Joint Replacement Devices Market |

| Market Size in 2023 | USD 17.43 Billion |

| Market Forecast in 2032 | USD 27.97 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 150 |

| Key Companies Covered | Stryker Corporation, Zimmer Biomet Holdings, Depuy Synthes (Johnson & Johnson), Smith & Nephew, Wright Medical Group, Aesculap Implant Systems, Arthrex, Inc., ConforMIS, DJO Global, Exactech, Inc. and Medtronic among others |

| Segments Covered | By Procedure, By Products, By Technique and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

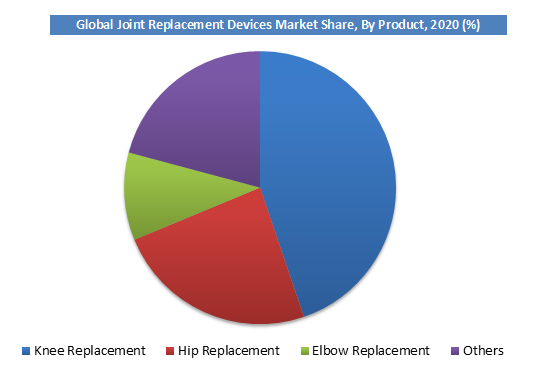

Procedure Segment Analysis Preview

Knee Replacement segment held a share of around 43% in 2020. This is attributable to the rise in the number of knee replacement surgeries, robot assisted knee replacement surgeries, and the introduction of latest knee implants by major players. Additionally, rise in the number of successful knee implant surgeries, particularly among the elder population are also expected to contribute to the growth of the market.

Products Segment Analysis Preview

Implants segment will grow at a CAGR of around 4.5% from 2021 to 2032. Owing to their wide availability and range of sizes offered, artificial implants are becoming more popular. Also, their easy installation and less time required for installation as compared to bone grafts is expected to further boost this segment.

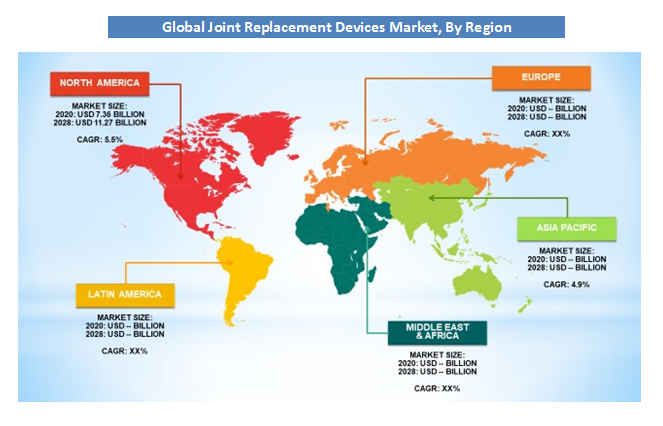

Regional Analysis Preview

The North American region held a share of over 35.1% in 2020. This is attributable to the presence of technologically advanced joint implants, state of the art healthcare system and higher awareness among consumers about the available options. Hip, knee, and other joint replacement surgeries are among the most commonly performed elective surgeries in the United States. As per the American Academy of Orthopedic Surgeons, total knee replacement surgeries are projected to grow by 673% to 3.5 million procedures per year by 2030.

The Asia Pacific region is projected to grow at a CAGR of over 4.9% over the forecast period. The Asia Pacific area is expected to grow at the fastest rate over the projected period due to its high population, emerging economy, and growing need for sophisticated therapeutic choices. The market in the region is also expected to be fueled owing to a high prevalence of orthopaedic problems needing joint replacements and an overall rise in geriatric population in developing nations such as China and India.

Key Market Players & Competitive Landscape

Some of key players in automated sortation system market are -

- Stryker Corporation

- Zimmer Biomet Holdings

- Depuy Synthes (Johnson & Johnson)

- Smith & Nephew

- Wright Medical Group

- Aesculap Implant Systems

- Arthrex

- ConforMIS

- DJO Global

- Exactech

- Medtronic among others.

Various market advancements have recently occurred, and market players are actively participating in new product launches, developments, and collaborations in order to increase their market share. For instance, Stryker in September 2020 announced the launch of the software Mako Total Hip 4.0 for robotic hip replacement surgeries. The software will enable physicians to better plan the position of a patient’s hip implant.

The global joint replacement devices market is segmented as follows:

By Procedure

- Hip Replacement

- Knee Replacement

- Elbow Replacement

- Others

By Products

- Implants

- Bone Grafts

- Others

By Technique

- Traditional Surgery

- Minimally Invasive Surgery (MIS)

- Computer Assisted Surgery (CAS)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Joint Replacement Devices Market market size valued at US$ 17.43 Billion in 2023

Joint Replacement Devices Market market size valued at US$ 17.43 Billion in 2023, set to reach US$ 27.97 Billion by 2032 at a CAGR of about 5.4% from 2024 to 2032.

Some of the key factors driving the global joint replacement devices market growth are growing geriatric population and increasing success of hip and knee implant procedures.

North America region held a substantial share of the joint replacement devices market in 2020. This is attributable to a highly developed healthcare system and high awareness about elective joint implant procedures. Asia Pacific region is projected to grow at a significant rate owing to the rising demand for joint replacement devices in developing economies such as China and India.

Some of the major companies operating in the joint replacement devices market are Stryker Corporation, Zimmer Biomet Holdings, Depuy Synthes (Johnson & Johnson), Smith & Nephew, Wright Medical Group, Aesculap Implant Systems, Arthrex, Inc., ConforMIS, DJO Global, Exactech, Inc. and Medtronic among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed