Ablation Technology Market Size & Share, Forecast to 2034

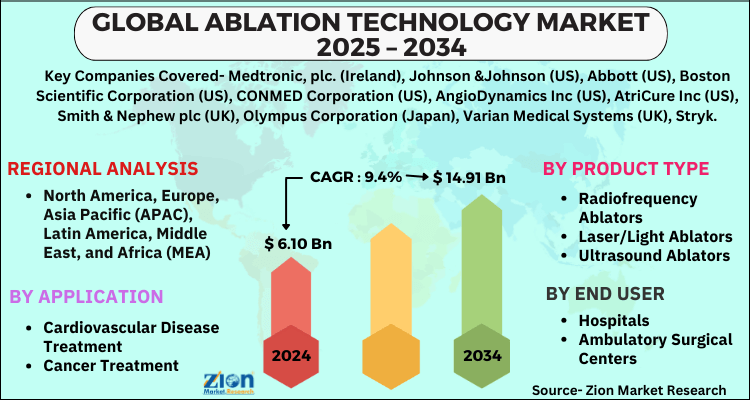

Ablation Technology Market - By Application (Cardiovascular Disease Treatment, Cancer Treatment, Ophthalmologic Treatment, Pain Management, Gynecological Treatment, Urological Treatment, Orthopedic Treatment, Cosmetic/Aesthetic Surgery, and Others), By Product Type (Radiofrequency Ablators, Laser/Light Ablators, Ultrasound Ablators, Electrical Ablators, Cryoablation Devices, Microwave Ablators, and Hydrothermal/Hydromechanical Ablators), By End-User (Hospitals, Ambulatory Surgical Centers, Medical Spas & Aesthetic Clinics, Ablation Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

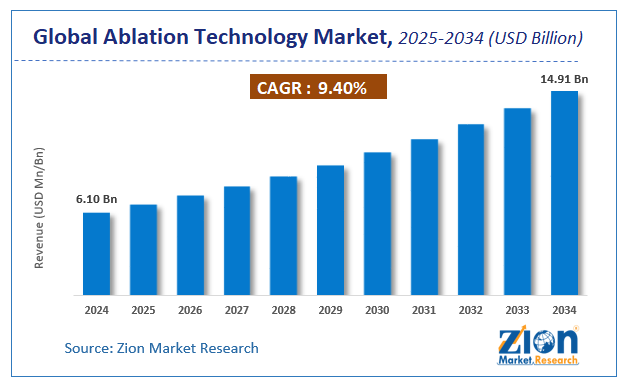

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.10 Billion | USD 14.91 Billion | 9.4% | 2024 |

Ablation Technology Market: Industry Perspective

The global ablation technology market size was worth around USD 6.10 Billion in 2024 and is predicted to grow to around USD 14.91 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.4% between 2025 and 2034. The report analyzes the global ablation technology market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ablation technology industry.

The report analyzes the global ablation technology market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the ablation technology industry.

Ablation Technology Market: Overview

The ablation technology is used for the treatment of several healthcare problems which include cancer, cardiovascular problems, orthopedics, pain management, urology, gynecology, and many others. The treatment based on ablation technology involves negligible invasion along with minimum damage to the tissues and organs surrounding the infected organ. The inclination of the patients towards the advanced technology-based treatment which gives instant results with minimum side effects is projected to drive the ablation technology market over the forecast period.

Ablation technology is widely used for the treatment of cancer patients and is a relatively new technology in the world of cancer treatments. Rising focus on improving the global healthcare infrastructure and increasing technological proliferation in healthcare are expected to be major trends driving the ablation technology market growth in the long run.

The rising geriatric population, increasing research and development activity in the healthcare industry, growing instances of cancer among the population, and increasing demand for minimally invasive procedures are some major factors that will propel ablation technology market growth over the forecast period.

However, the lack of awareness, concerns regarding the efficacy of the ablation technology, and frequent product recalls of ablation technology treatment products are expected to have a hindering effect on the ablation technology market potential through 2028.

Key Insights

- As per the analysis shared by our research analyst, the global ablation technology market is estimated to grow annually at a CAGR of around 9.4% over the forecast period (2025-2034).

- Regarding revenue, the global ablation technology market size was valued at around USD 6.10 Billion in 2024 and is projected to reach USD 14.91 Billion by 2034.

- The ablation technology market is projected to grow at a significant rate due to rising prevalence of chronic diseases, increasing demand for minimally invasive procedures, advancements in radiofrequency and laser ablation technologies, and growing adoption in oncology and cardiology treatments.

- Based on Application, the Cardiovascular Disease Treatment segment is expected to lead the global market.

- On the basis of Product Type, the Radiofrequency Ablators segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Hospitals segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Ablation Technology Market: Growth Drivers

Increasing Popularity of minimally invasive procedures

Minimally invasive surgeries and procedures have gained massive popularity over recent years owing to the fast recovery and less inconvenience that they offer against invasive procedures. Increasing preference of patients for less hospitalization, rising focus on patient safety, and increasing instances of hospital-acquired infections are some factors that will favor the ablation technology market growth over the forecast period.

The use of ablation technology will also reduce the costs of surgeries and hence will be a major factor that will positively influence the ablation technology market growth in the long run.

As per the World Health Organization, cardiovascular diseases are one of the main causes of death worldwide. About 17.5 million people died due to cardiovascular disease in 2015 representing 31% of all global deaths. Additionally, as per the World Health Organization estimates, 8.8 million deaths resulted due to cancer in 2015. Globally, approximately 1 in 6 deaths is because of cancer. Also, the global burden of these disorders is increasing further owing to the increasing geriatric population base across the world. According to the World Health Organization, the number of people aged 60 or above is expected to be doubled by 2050 growing from 962 million globally in 2017 to 2.1 billion in 2050. Thus, the ablation technology market has vast potential in terms of a large patient pool and an upsurge need for significant treatment.

Ablation Technology Market: Restraints

Presence of alternative treatment procedures

Ablation Technology is not as popular as the alternative procedures that are present for cancer treatment are more preferred by patients owing to high awareness and proven efficacy in treatment. Lack of awareness, less availability, and regulatory concerns regarding the use of ablation technology in treatment are expected to majorly hamper the ablation technology market growth.

Ablation technology companies can focus on creating awareness and boosting their revenue potential over the forecast period. Government initiatives to boost awareness for the use of novel treatments will also help the ablation technology market overcome these restraints through 2028.

Global Ablation Technology Market: Segmentation

The global Ablation Technology market is segregated based on application, product type, end-user, and region.

By Application, the Ablation Technology market is segmented into Cardiovascular Disease Treatment, Cancer Treatment, Ophthalmologic Treatment, Pain Management, Gynecological Treatment, Urological Treatment, Orthopedic Treatment, Cosmetic/ Aesthetic Surgery, and Others. The cardiovascular treatment segment is expected to have a bright outlook over the forecast period. Increasing instances of cardiovascular diseases and increasing advancements in cardiovascular treatments are expected to propel this segment's growth through 2028.

By Product type, the market is divided into Radiofrequency Ablators, Laser/Light Ablators, Ultrasound Ablators, Electrical Ablators, Cryoablation Devices, Microwave Ablators, and hydrothermal/Hydromechanical Ablators. The radiofrequency ablators segment is expected to have a dominant outlook over the forecast period owing to rapid adoption by multiple ablation technology companies.

Ablation Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ablation Technology Market |

| Market Size in 2024 | USD 6.10 Billion |

| Market Forecast in 2034 | USD 14.91 Billion |

| Growth Rate | CAGR of 9.4% |

| Number of Pages | 180 |

| Key Companies Covered | Medtronic, plc. (Ireland), Johnson &Johnson (US), Abbott (US), Boston Scientific Corporation (US), CONMED Corporation (US), AngioDynamics Inc (US), AtriCure Inc (US), Smith & Nephew plc (UK), Olympus Corporation (Japan), Varian Medical Systems (UK), Stryk, and others. |

| Segments Covered | By Application, By Product Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ablation Technology Market: Regional Analysis

The Asia Pacific region will provide highly lucrative opportunities for the Ablation Technology market over the forecast period. The increasing prevalence of multiple diseases, increasing focus on healthcare, and increasing use of technology are expected to be the major factors propelling the ablation technology market growth in this region through 2028. India and China are expected to be the most prominent markets in this region.

The ablation technology market in North America is also anticipated to have a bright outlook owing to the presence of developed healthcare infrastructure and the rising popularity of minimally invasive surgeries will drive the market growth. The United States will be the most prominent market in this region over the forecast period.

Recent Developments

- In June 2021 – Boston Scientific, a leading name in the healthcare industry announced the acquisition of FARAPULSE whose notable pulsed-field ablation technology will now be a part of Boston's product portfolio.

Ablation Technology Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the ablation technology market on a global and regional basis.

The global ablation technology market is dominated by players like:

- Medtronic, plc. (Ireland)

- Johnson &Johnson (US)

- Abbott (US)

- Boston Scientific Corporation (US)

- CONMED Corporation (US)

- AngioDynamics, Inc. (US)

- AtriCure, Inc. (US)

- Smith & Nephew plc (UK)

- Olympus Corporation (Japan)

- Varian Medical Systems (UK)

- Stryker (US)

- Dornier MedTech(Germany)

- Cynosure (US)

- InMode (US)

The global ablation technology market is segmented as follows;

By Application

- Cardiovascular Disease Treatment

- Cancer Treatment

- Ophthalmologic Treatment

- Pain Management

- Gynecological Treatment

- Urological Treatment

- Orthopedic Treatment

- Cosmetic/ Aesthetic Surgery

- Others

By Product Type

- Radiofrequency Ablators

- Laser/Light Ablators

- Ultrasound Ablators

- Electrical Ablators

- Cryoablation Devices

- Microwave Ablators

- Hydrothermal/Hydromechanical Ablators

By End User

- Hospitals

- Ambulatory Surgical Centers

- Medical Spas & Aesthetic Clinics

- Ablation Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed