Pain Management Therapeutics Market Size, Share & Forecast 2034

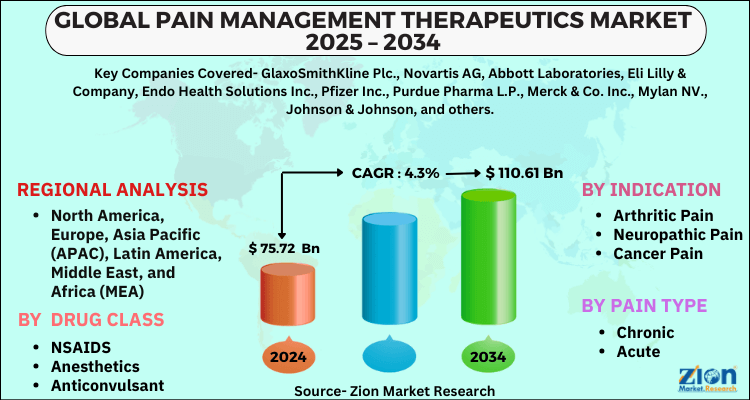

Pain Management Therapeutics Market By Drug Class, (NSAIDS, Anesthetics, Anticonvulsant, Anti-Migraine Drugs, Antidepressant Drugs, Opioids, Non-Narcotics, and Analgesics), By Indication (Arthritic Pain, Neuropathic Pain, Cancer Pain, Chronic Pain, Post-Operative Pain, Migraine, Fibromyalgia, Bone Fracture, Muscle Sprain/Strain, Acute Appendicitis, and Other Indications), By Pain Type (Chronic and Acute), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

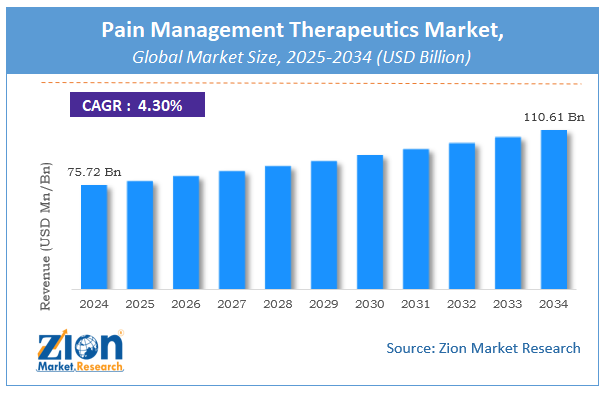

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 75.72 Billion | USD 110.61 Billion | 4.3% | 2024 |

Pain Management Therapeutics Market: Industry Perspective

The global pain management therapeutics market size was worth around USD 75.72 Billion in 2024 and is predicted to grow to around USD 110.61 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.3% between 2025 and 2034. The report analyzes the global pain management therapeutics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the pain management therapeutics industry.

Pain Management Therapeutics Market: Overview

Pain is a stressful emotional and sensory experience that occurs as a result of tissue injury or illness. Various conditions, such as multiple sclerosis, stomach ulcers, osteoarthritis, diabetic neuropathy, chronic arthritis, fibromyalgia, and cancer can also cause discomfort. The duration of the pain varies from short-term acute pain to long-term chronic pain. Acute pain might be modest and last a few seconds or weeks or months.

Chronic pain can occur due to elderly joints and bone, nerve loss, or injury. Pain caused by tissue injury, nerve damage, or nociceptive pain is treated with a range of medicines. The majority of medications work by binding to protein targets on cell membranes and influencing the body's metabolic processes.

Pain is a multifarious medical condition, which not only affects the mental but also physical well-being of an individual. The intensity of pain caused due to tissue damage or trauma depends on person to person. The pain is categorized into two main categories, acute and chronic. Depending on the level or condition, the treatment differs.

Key Insights

- As per the analysis shared by our research analyst, the global pain management therapeutics market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2025-2034).

- Regarding revenue, the global pain management therapeutics market size was valued at around USD 75.72 Billion in 2024 and is projected to reach USD 110.61 Billion by 2034.

- The pain management therapeutics market is projected to grow at a significant rate due to increasing prevalence of chronic pain conditions, an aging population, and advancements in pain management therapies and drug development.

- Based on Drug Class, the NSAIDS segment is expected to lead the global market.

- On the basis of Indication, the Arthritic Pain segment is growing at a high rate and will continue to dominate the global market.

- Based on the Pain Type, the Chronic segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Pain Management Therapeutics Market: Growth Drivers

Demand for pain management therapeutics is expected to rise as osteoarthritis, chronic diseases, and sports or accident injuries become more common.

According to research by the World Health Organization, rheumatoid arthritis affects 0.2 to 1% of the world's 7.9 billion people. Rheumatoid arthritis is an inflammatory disease that causes a variety of symptoms ranging from joint pain to immunological problems. This proportion is expected to rise dramatically in the near future. Furthermore, as a result of the prevalent sports culture, sports injuries are on the rise.

According to WHO research, nearly 1 million people are killed or injured in road accidents each year, with the bulk of these deaths occurring in poor and developing nations. As a result, the number is expected to exceed 2 to 2.5 million as people's spending power rises and they become more affluent. Moreover, the rapid increase in the geriatric population also contributes to the expansion of the global pain management therapeutics market.

The increasing geriatric population, rising prevalence of chronic disease, and favorable regulatory scenario are the key factors contributing towards the growth of pain management therapeutics market globally. The advancement in new drug development for pain management and an untapped market in developing economies are expected to generate immense opportunity for the growth of the market over the forecast period.

Pain Management Therapeutics Market: Restraints

The availability of alternate pain management systems may hamper the market growth.

The rise in issues about drug exploitation, as well as the expiration of patents on prescription pain medicine pharmaceuticals, are likely to impede the expansion of the pain management therapeutics market. In addition to that, the availability of replacements such as pain relief devices is expected to pose a barrier to the global pain management therapeutics market.

Pain Management Therapeutics Market: Opportunities

The launch of affordable and more effective drugs is expected to offer better growth opportunities for market growth.

The biggest cause of impairment in the world is pain, which is the most prevalent reason individuals seek medical attention. Chronic pain for instance is defined as pain that lasts longer than three months and affects more than one-third of the world's population.

However, the advent of the pharmaceutical sector and increased research activities have boosted the market reach in emerging countries. New affordable drug therapeutics launched by Hisamitsu, GSK, Novartis, and AstraZeneca are further expected to drive market growth during the forecast period.

Pain Management Therapeutics Market: Challenges

Market growth is expected to be slowed by a slew of opioid-related side effects.

Opioids are used to treat a variety of conditions including joint pain, back pain, stiffness, headaches, pain linked with cancer, and so on, but they also have a number of dangerous side effects such as nausea, minor concussions, breathing problems, and so on. Apart from that, one of the major drawbacks of these medicines is addiction. When people quit using potentially fatal substances, they get restless.

Pain Management Therapeutics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pain Management Therapeutics Market |

| Market Size in 2024 | USD 75.72 Billion |

| Market Forecast in 2034 | USD 110.61 Billion |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 188 |

| Key Companies Covered | GlaxoSmithKline Plc., Novartis AG, Abbott Laboratories, Eli Lilly & Company, Endo Health Solutions Inc., Pfizer Inc., Purdue Pharma L.P., Merck & Co. Inc., Mylan NV., Johnson & Johnson, and others. |

| Segments Covered | By Drug Class, By Indication, By Pain Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pain Management Therapeutics Market: Segmentation

The global pain management therapeutics market is bifurcated based on drug class, indication, pain type, and region. Based on drug class, the market is split into anticonvulsants, NSAIDS, anesthetics, anti-migraine drugs, non-narcotics, antidepressant drugs, opioids, and analgesics.

By indication, the market is categorized into chronic pain, neuropathic pain, arthritic pain, bone fracture, cancer pain, migraine, fibromyalgia, post-operative pain, acute appendicitis, muscle sprain/strain, and other indications. The pain type segment of the market is divided into acute and chronic.

Recent Developments

- In March 2021, the market was introduced to "Salonpas," a pain-relieving gel for individuals suffering from arthritis (knee, ankles, hands, etc.). Hisamitsu America is the company that created the topical gel. The results of Hisamitsu America's newest clinical research were recently announced, supporting the argument for topical pain medications as first-line therapy for pain. Furthermore, it is a non-greasy gel that aids in the reduction of inflammation and gives relief from discomfort.

- In June 2020, GSK Consumer Healthcare teamed up with Paula Abdul to promote the medicine "Voltaren Arthritis Pain Gel," which has been approved by the FDA for use as an over-the-counter drug.

Pain Management Therapeutics Market: Regional Landscape

North America to dominate the global market during the forecast period.

In 2021, North America had the biggest market share, accounting for 36 percent of the global pain management therapeutics market. The growth of this region is due to factors such as a healthy conversant population; excellent healthcare infrastructures such as top-tier hospitals, well-equipped laboratories with world-class centers in the United States and Canada; and a vast network of retail pharmacies in every state. Furthermore, the aging population is on the cusp of becoming quite powerful. Adults aged 65 and above, for example, might account for up to 24 percent of the population by 2060, up from around 16 percent now.

However, Asia Pacific is anticipated to witness the fastest market growth throughout the projected period. This increase is due to the rise in the older population in various Asian countries, particularly Japan, India, and China, as well as an increase in chronic illnesses and joint disorders along with increased healthcare spending, and the refinement of the healthcare system.

Pain Management Therapeutics Market: Competitive Landscape

Key players operating in the global pain management therapeutics market include;

- GlaxoSmithKline Plc.

- Novartis AG

- Abbott Laboratories

- Eli Lilly & Company

- Endo Health Solutions, Inc.

- Pfizer, Inc.

- Purdue Pharma L.P.

- Merck & Co. Inc.

- Mylan NV.

- Johnson & Johnson

The global pain management therapeutics market is segmented as follows:

By Drug Class

- NSAIDS

- Anesthetics

- Anticonvulsant

- Anti-Migraine Drugs

- Antidepressant Drugs

- Opioids

- Non-Narcotics

- Analgesics

By Indication

- Arthritic Pain

- Neuropathic Pain

- Cancer Pain

- Chronic Pain

- Post-Operative Pain

- Migraine

- Fibromyalgia

- Bone Fracture

- Muscle Sprain/Strain

- Acute Appendicitis

- Other

By Pain Type

- Chronic

- Acute

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global pain management therapeutics market is expected to grow due to rising prevalence of chronic pain conditions, advancements in pain relief therapies, increasing demand for personalized medicine, and the growing focus on non-opioid treatment options to address the opioid crisis.

According to a study, the global pain management therapeutics market size was worth around USD 75.72 Billion in 2024 and is expected to reach USD 110.61 Billion by 2034.

The global pain management therapeutics market is expected to grow at a CAGR of 4.3% during the forecast period.

North America is expected to dominate the pain management therapeutics market over the forecast period.

Leading players in the global pain management therapeutics market include GlaxoSmithKline Plc., Novartis AG, Abbott Laboratories, Eli Lilly & Company, Endo Health Solutions Inc., Pfizer Inc., Purdue Pharma L.P., Merck & Co. Inc., Mylan NV., Johnson & Johnson, among others.

The report explores crucial aspects of the pain management therapeutics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed