5G Smart Antenna Market Size, Share, Industry Trends 2034

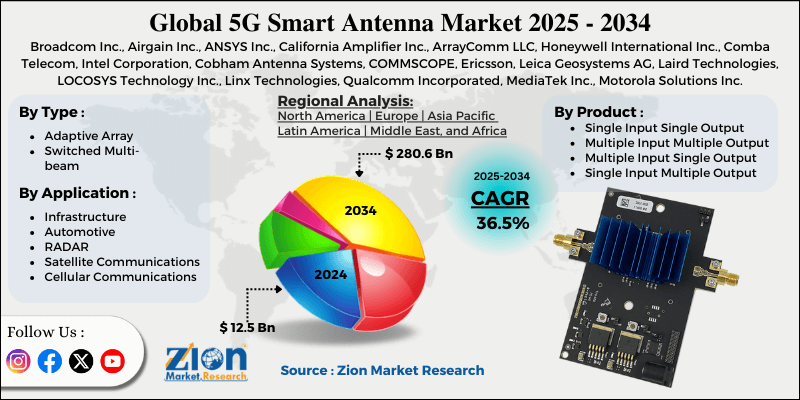

5G Smart Antenna Market By Type (Adaptive Array and Switched Multi-beam), By Product (Single Input Single Output, Multiple Input Multiple Output, Multiple Input Single Output, and Single Input Multiple Output), By Application (Infrastructure, Automotive, RADAR, Satellite Communications, Cellular Communications, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

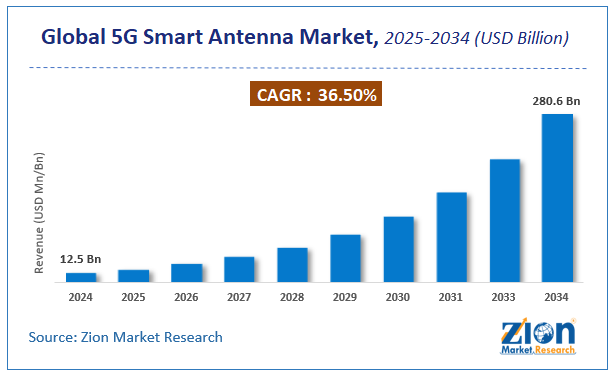

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.5 Billion | USD 280.6 Billion | 36.5% | 2024 |

5G Smart Antenna Industry Prospective

The global 5G Smart Antenna market size was worth around USD 12.5 billion in 2024 and is predicted to grow to around USD 280.6 billion by 2034, with a compound annual growth rate (CAGR) of roughly 36.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global 5G Smart Antenna market is estimated to grow annually at a CAGR of around 36.5% over the forecast period (2025-2034).

- In terms of revenue, the global 5G Smart Antenna market size was valued at around USD 12.5 billion in 2024 and is projected to reach USD 280.6 billion by 2034.

- Investment in 5G infrastructure is expected to drive the 5G Smart Antenna market over the forecast period.

- Based on the type, the adaptive array segment is expected to capture the largest market share over the projected period.

- Based on the product, the single-input single-output segment is expected to capture the largest market share over the projected period.

- Based on the application, the healthcare segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

5G Smart Antenna Market: Overview

A 5G smart antenna is a high-tech group of transceiver components that can adjust how it sends and receives signals in real time through advanced signal processing. This produces small beams that can be directed toward specific people or equipment. These systems use beamforming and massive MIMO to boost signals, reduce interference, and improve coverage in areas with a lot of people or cars, such as busy cities. Regular fixed antennas broadcast signals in all directions; however, this is not the case. This feature addresses 5G's need for very fast data speeds, low latency, and a large number of connections by combining multiple signals and allocating resources to many users simultaneously.

The 5G smart antenna market is being driven by several factors, including rapid deployment and expansion of 5G networks, the growing need for high-speed data and connectivity, technological innovation in antenna systems, the expansion of IoT, M2M communications, and smart devices, and investment in telecom infrastructure. However, the technical complexity and integration challenges pose a significant obstacle to industry expansion.

5G Smart Antenna Market Dynamics

Growth Drivers

How does the rapid deployment and expansion of 5G networks propel the 5G smart antenna industry growth?

The 5G smart antenna market is growing rapidly as 5G networks are being built and expanded. This is because 5G technology needs updated antenna systems to work as intended. 5G needs to be very fast, have very low latency, connect a lot of devices, and always be available in crowded urban and indoor areas. This is different from past generations. To do this, network operators are increasingly utilizing intelligent antennas that employ technologies such as beamforming, massive MIMO, and adaptive signal processing. As additional 5G base stations, small cells, and mmWave nodes are deployed, each one requires many smart antennas to manage spectrum, mitigate interference, and deliver data to customers effectively.

Smart antennas also help improve network performance while reducing the need for additional equipment as operators expand 5G coverage into suburban, rural, and industrial areas. 5G rollout and antenna capability are closely related. Each phase of 5G expansion—new sites, network densification, capacity enhancements, and the transition to 5G-Advanced—increases the adoption of smart antenna solutions, thereby driving growth in the 5G smart antenna market. For instance, according to GSMA data, 5G will account for up to 1.2 billion connections by 2025.

Restraints

Do the high development, production & deployment costs pose a major restraint to the 5G smart antenna market growth?

Making 5G smart antennas requires advanced technologies such as massive MIMO, beamforming, phased-array designs, and advanced RF components. All of these factors significantly increase research and development and production costs. These antennas are also more expensive than regular ones, as they require very precise materials and extensive calibration. When it comes to deployment, installation often means redesigning the network, making site changes, rolling out many small cells, and hiring trained workers, all of which increase costs for the telecom companies. In developed markets, big companies often view these costs as fair and worthwhile because they lead to long-term improvements in performance.

But for small and medium-sized businesses, private network providers, and deployments in developing countries, the high initial cost may deter people from using it. So, even though there is strong demand for 5G connections, the high cost of deploying them slows the process and makes it hard for the market to grow. Over time, costs are expected to decline due to economies of scale, improved technology, and greater competition. However, high costs for development, manufacturing, and deployment remain a significant barrier to the overall growth of the 5G smart antenna industry.

pportunities

How does the product expansion by the key market player offer a potential opportunity for the 5G smart antenna industry growth?

The growing product expansion in the market is expected to offer a potential opportunity to the 5G smart antenna market during the analysis period. For instance, in April 2025, Ericsson intends to make all of its EAS passive antennas for the Indian market in India by June 2025. This strategic investment helps India become more digitally enabled by accelerating time-to-market, strengthening relationships with local partners, and better meeting client demands. This work speeds up India's 5G rollout and enables Ericsson to better adapt to changing market needs, both in India and around the world. EAS is starting to make local passive antennas in India with VVDN Technologies, a well-known technical partner. This move adds India to Ericsson's worldwide manufacturing portfolio, which already includes sites in Mexico, Romania, and China. This makes the company's supply chain more diverse and less likely to break.

Challenges

How do workforce skill gaps pose a major challenge to market expansion?

Workforce skill gaps are a major obstacle to expanding the 5G smart antenna business, as designing, deploying, and optimizing these systems requires highly specialized technical skills. Smart antennas require a range of skills, including RF engineering, beamforming algorithms, massive MIMO design, signal processing, and network optimization. All of these things need people who know a lot about both hardware and software. However, there are insufficiently educated engineers and technicians in many places, especially in developing countries, to operate these complex systems. This skill gap makes it take longer to set up, costs more to run, and even makes antennas work worse if systems aren't designed or serviced effectively.

Network operators and equipment makers can't implement 5G infrastructure, upgrade networks, or deploy advanced antenna technology as quickly because they don't have enough qualified people. Even with strong demand for 5G connections and smart antenna solutions, the fact that many workers lack the right skills remains a major obstacle to the sector's rapid growth.

5G Smart Antenna Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 5G Smart Antenna Market Research Report |

| Market Size in 2024 | USD 12.5 Billion |

| Market Forecast in 2034 | USD 280.6 Billion |

| Growth Rate | CAGR of 36.5% |

| Number of Pages | 220 |

| Key Companies Covered | Broadcom Inc., Airgain Inc., ANSYS Inc., California Amplifier Inc., ArrayComm LLC, Honeywell International Inc., Comba Telecom, Intel Corporation, Cobham Antenna Systems, COMMSCOPE, Ericsson, Leica Geosystems AG, Laird Technologies, LOCOSYS Technology Inc., Linx Technologies, Qualcomm Incorporated, MediaTek Inc., Motorola Solutions Inc., NEC Corporation, Nokia Corporation, NXP Semiconductors, PCTEL Inc., Samsung Electronics Co. Ltd., and Sierra Wireless (Accel Networks) |

| Segments Covered | By Type, By Product, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

5G Smart Antenna Market: Segmentation

The global 5g smart antenna market is segmented based on type, product, application, and region.

By Type, the adaptive array segment dominates the market because adaptive arrays provide better performance attributes that are very useful for 5G installations. Adaptive array antennas change the way they send out signals in real time to adapt to the changing signal environment. This allows them to focus signals on active users, reduce interference, and maximize the network's coverage and capacity. This flexibility is important in crowded regions and on busy roads, where conventional fixed-pattern antennas struggle to keep up with high data rates.

By Product, The single input single output segment is expected to hold the largest revenue share over the projected period. SISO antennas are usually easier to make and set up than multi-antenna solutions, which makes them a good choice for basic 5G setups, cost-sensitive deployments, and some IoT devices or low-data-rate applications where MIMO's full capabilities aren't strictly necessary. This pricing and ease of integration help drive market demand into areas that emphasize low-cost, simple designs, such as micro cells, rural deployments, and entry-level consumer devices. The SISO segment helps drive total revenue growth by broadening the addressable market and enabling use in situations where more advanced antenna technologies may be too expensive or difficult to deploy.

By Application, the cellular communications segment is expected to capture a substantial market share. As 5G networks expand worldwide, demand for more intelligent and effective antenna systems has increased. This is because the available antennas can't meet the performance requirements of next-generation mobile communications. Smart antennas, especially those that use technologies such as beamforming and massive MIMO, improve signal clarity, speed up data transfer, reduce interference, and make better use of the spectrum.

To have rapid, low-latency 5G mobile services, all of these things are needed. As 5G cellular infrastructure grows, network operators are deploying better antennas at base stations and tiny cells to ensure coverage and capacity remain consistent in both densely populated urban areas and vast geographic regions. People want improved cell phone connections, which directly leads to greater sales and use of 5G smart antennas. This drives up market revenue.

5G Smart Antenna Market: Regional Analysis

North America is dominated to market

North America is expected to capture the largest share of 38% the 5G smart antenna market over the forecast period. The area quickly adopted 5G technology, due in part to large investments in telecom infrastructure. The United States is leading the market. Major telecom companies are still building and upgrading 5G base stations, small cells, and mmWave networks. All of these networks rely heavily on smart antenna technologies such as beamforming and massive MIMO to deliver high data speeds, low latency, and greater network capacity. North America also has a robust technology ecosystem, with leading antenna makers, semiconductor companies, and strong research and development capabilities that help new antenna solutions reach the market faster.

Additionally, adoption is helped by supportive regulatory frameworks, timely spectrum allocation, and the growing need for high-performance mobile broadband, enterprise connectivity, private 5G networks, and IoT applications.

5G Smart Antenna Market: Competitive Analysis

The global 5G Smart Antenna market is dominated by players like

- Broadcom Inc

- Airgain Inc

- ANSYS Inc

- California Amplifier Inc

- ArrayComm LLC

- Honeywell International Inc

- Comba Telecom

- Intel Corporation

- Cobham Antenna Systems

- COMMSCOPE

- Ericsson

- Leica Geosystems AG

- Laird Technologies

- LOCOSYS Technology Inc

- Linx Technologies

- Qualcomm Incorporated

- MediaTek Inc

- Motorola Solutions Inc

- NEC Corporation

- Nokia Corporation

- NXP Semiconductors

- PCTEL Inc

- Samsung Electronics Co Ltd

- Sierra Wireless (Accel Networks)

The global 5G Smart Antenna market is segmented as follows:

By Type

- Adaptive Array

- Switched Multi-beam

By Product

- Single Input Single Output

- Multiple Input Multiple Output

- Multiple Input Single Output

- Single Input Multiple Output

By Application

- Infrastructure

- Automotive

- RADAR

- Satellite Communications

- Cellular Communications

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed