5G Mmwave Market Size, Share, Trends, Growth & Forecast 2034

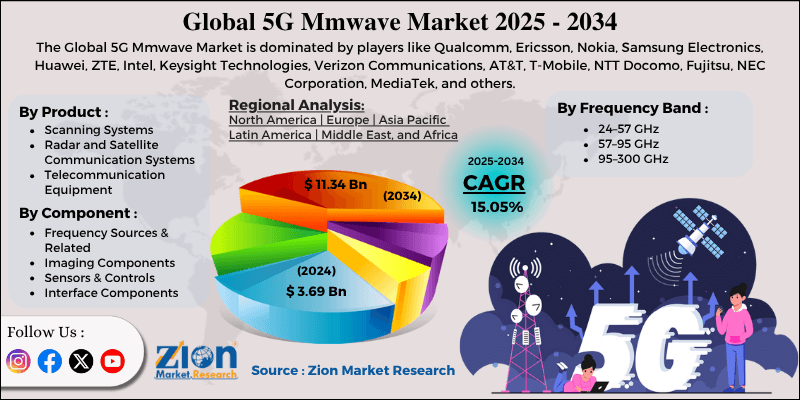

5G Mmwave Market By Product (Scanning Systems, Radar and Satellite Communication Systems, Telecommunication Equipment, and Other), By Component (Antennas & Transceiver Components, Frequency Sources & Related, Communication & Networking Components, Imaging Components, Sensors & Controls, Interface Components, and Other), By Frequency Band (24-57 GHz, 57-95 GHz, 95-300 GHz), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

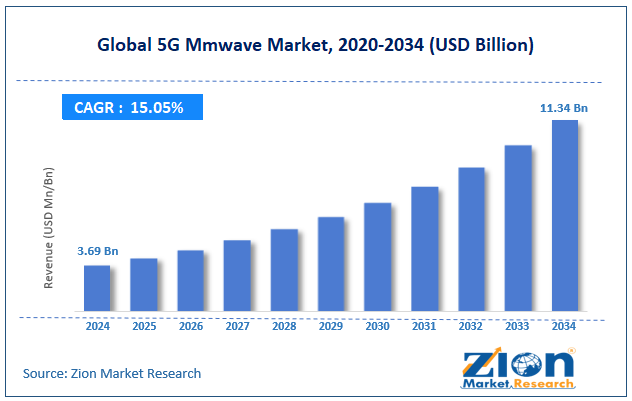

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.69 Billion | USD 11.34 Billion | 15.05% | 2024 |

5G Mmwave Industry Perspective:

The global 5G mmwave market size was around USD 3.69 billion in 2024 and is projected to reach USD 11.34 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.05% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global 5G mmwave market is estimated to grow annually at a CAGR of around 15.05% over the forecast period (2025-2034)

- In terms of revenue, the global 5G mmwave market was valued at approximately USD 3.69 billion in 2024 and is projected to reach USD 11.34 billion by 2034.

- The 5G mmwave market is projected to grow significantly owing to the rapid expansion of smart cities and IoT ecosystems, the growth of immersive XR applications and cloud gaming, and government initiatives and spectrum allocations for 5G.

- Based on product, the telecommunication equipment segment is expected to lead the market, while the radar and satellite communication systems segment is expected to grow considerably.

- By component, the antennas & transceiver segment is the dominant segment, while the communication & networking segment is projected to record sizeable revenue over the forecast period.

- Based on frequency band, the 24–57 GHz segment is expected to lead the market, followed by the 57–95 GHz segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

5G Mmwave Market: Overview

5G mmwave refers to the extremely high-frequency bands (usually 24-100 GHz) in 5G networks to deliver ultra-fast wireless connectivity. These bands provide multi-gigabit data rates, high capacity, and ultra-low latency, making them suitable for dense urban areas, stadiums, smart factories, and autonomous mobility applications. The global 5G mmwave market is likely to expand rapidly, fueled by rising mobile data traffic in urban clusters, the rollout of Industry 4.0 and enterprise digitalization, and the growth of immersive media. Speedy urbanization and the proliferation of IoT devices, smartphones, and high-definition video streaming have increased unprecedented mobile data growth in cities. Sub-6 GHz 5G networks fail to manage this high traffic effectively. mmwave offers ultra-high-capacity lanes to offload congestion and promise unbroken service.

Moreover, smart factories, logistics hubs, ports, and warehouses increasingly depend on automation, AI-driven monitoring, and robotics. mmwave networks offer ultra-low latency and deterministic connectivity, which are required for AGVs, predictive maintenance, and robotic arms. Enterprise private 5G deployments are fueling significant B2B investments. Furthermore, augmented, extended, and virtual reality applications require minimal latency and multi-gigabit throughput to maintain realistic experiences. mmwave allows real-time cloud rendering and high-class immersive streaming. Tech companies and media companies are heavily investing in monetizing these applications over 5G.

Despite growth, the global market is constrained by factors such as limited penetration & short propagation range, as well as high capital expenditure for dense deployments. mmwave signals have a low ability to penetrate walls, vegetation, windows, and other barriers. This significantly reduces coverage range compared to sub-6 GHz bands. Dense small-cell deployment is needed, increasing complexity and costs for operators. Similarly, mmwave networks may require several microcells, small antennas per square kilometer, and street poles. Infrastructure costs are significantly higher than conventional networks. Operators usually deploy until a clear ROI is established.

Nonetheless, the global 5G mmwave industry stands to gain from a few key opportunities, such as private 5G networks for enterprise & industrial sites and autonomous mobility & V2X data offload. Factories, logistics hubs, ports, and R&D campuses require specialized, low-latency, high-speed networks. mmwave enables reliable, secure connectivity that meets business SLAs. This denotes a high-margin revenue segment for system integrators and operators. Self-driving vehicles, smart intersections, and robo-taxis require multi-gigabit, real-time links for decision-making and sensor fusion. mmwave networks can manage dense urban traffic data. Mobility service providers and automotive OEMs fuel the adoption.

5G Mmwave Market Dynamics

Growth Drivers

How is the 5G mmwave market driven by the speedy expansion of smart cities and IoT ecosystems?

Smart city initiatives are a leading driver of 5G mmwave deployment, as these networks can support ample IoT device connectivity. In 2025, more than 30 smart city projects across the globe are integrating mmwave-enabled 5G to manage traffic, public safety systems, and energy more effectively. The growth of IoT devices is anticipated to reach 75 billion units worldwide by 2026, requiring high-bandwidth, high-frequency networks. Telecom companies are associating with municipalities to integrate mmwave into urban infrastructure, driving automation and data handling.

How is the growth of cloud gaming and immersive XR applications propelling the 5G mmwave market?

The growth of AR, cloud computing, and VR largely relies on 5G mmwave for ultra-high speeds and low latency. Newzoo (2025) anticipates that worldwide cloud gaming revenue will reach USD 12 billion by 2026, driven by mmwave networks for unified, real-time interactions. NVIDIA and Microsoft collaborated with Verizon to test mmwave 5G in urban areas, obtaining near-zero latency. Expanding XR applications in healthcare, education, and remote work further fuel mmwave network rollouts, amplifying the growth of the 5G mmwave market.

Restraints

Adoption challenges and device compatibility negatively impact the market progress

Not all IoT equipment and consumer devices support mmwave bands, restricting immediate industry potential. Counterpoint Research (2025) reports that only 28% of smartphones worldwide are mmwave-capable, with most relying on sub-6 GHz 5G. This slows consumer adoption and business acceptance for high-speed mmwave applications. Although Samsung and Apple are increasing support, penetration in mid-range and budget devices remains low, limiting industry growth.

Opportunities

How does collaboration with cloud and edge computing providers create promising avenues for 5G mmwave industry growth?

The growth of edge computing and cloud services is driving demand for high-speed mmwave networks to handle real-time data. IDC (2025) anticipates that worldwide edge computing adoption will reach USD 30 billion by 2027, with mmwave crucial for ultra-low-latency applications. Telecom operators are collaborating with cloud providers such as Microsoft Azure and AWS to deliver localized mmwave-powered edge solutions. This enables services such as AR-assisted maintenance, immersive media streaming, and real-time analytics, creating new revenue streams and driving growth in the 5G mmwave industry.

Challenges

Regulatory and spectrum allocation hurdles restrict the market growth

Regulatory delays and fragmented spectrum allocation remain key challenges. CEPT 2025 underscored that Eastern Europe experienced 18+ months of delays in the distribution of mmwave spectrum due to interference issues with radar and satellite systems. These delays slow network deployment and create uncertainty for investors. Different regulatory architectures in nations further complicate multinational rollouts. Harmonization of policies and expedited spectrum distribution are vital for speedy global adoption.

5G Mmwave Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 5G Mmwave Market |

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2034 | USD 11.34 Billion |

| Growth Rate | CAGR of 15.05% |

| Number of Pages | 214 |

| Key Companies Covered | Qualcomm, Ericsson, Nokia, Samsung Electronics, Huawei, ZTE, Intel, Keysight Technologies, Verizon Communications, AT&T, T-Mobile, NTT Docomo, Fujitsu, NEC Corporation, MediaTek, and others. |

| Segments Covered | By Product, By Component, By Frequency Band, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

5G Mmwave Market: Segmentation

The global 5G mmwave market is segmented by product, component, frequency band, and region.

Based on product, the global 5G mmwave industry is divided into scanning systems, radar and satellite communication systems, telecommunication equipment, and other products. The telecommunication equipment segment holds a dominating share of the market due to continuous upgrades and technology advancements. Telecommunication equipment, including base stations, 5G small cells, and customer premises equipment (CPE), is the foundation of mmwave network deployment. This segment benefits from significant urban densification and private-sector 5G rollouts. Operators are heavily investing in infrastructure to meet low-latency requirements and multi-gigabit demand.

Based on component, the global 5G mmwave market is segmented into antennas & transceiver components, frequency sources & related components, communication & networking components, imaging components, sensors & controls, interface components, and other components. The antennas and transceiver components segment holds a leading share due to continuous advancements in low-power, high-gain designs. Antennas and transceiver components, comprising RFICs, beamforming modules, and phased-array antennas, are crucial for mmwave reception and signal transmission. High-frequency performance and precise beam steering make these components vital for telecom infrastructure, satellite systems, and radar. The demand is fueled by dense urban 5G deployments and business private networks.

Based on frequency band, the global market is segmented into 24–57 GHz, 57–95 GHz, and 95–300 GHz. The 24–57 GHz segment leads due to broader adoption for 5G mmwave, driven by coverage, bandwidth, and device compatibility. Telecom operators favor this band for enterprise private 5G deployments and urban small-cell networks. It supports high data rates without compromising the manageable propagation characteristics of higher bands. The continuous spectrum distribution and regulatory support make this band the leading contributor to industry revenue.

5G Mmwave Market: Regional Analysis

What gives North America a competitive edge in the global 5G Mmwave Market?

North America is anticipated to retain its leading role in the global 5G mmwave market due to early spectrum allocation and government backing, substantial telecom operator investment, and high consumer demand for ultra-fast connectivity. The United States Federal Communications Commission (FCC) was among the first regulators to auction mmwave bands (28 GHz, 37 GHz, 39 GHz) for 5G, creating a clear route for commercial deployment.

By 2024, more than 80% of the licensed mmwave spectrum in North America had been allocated to major carriers. This early regulatory clarity accelerated network rollout in this region compared to the other areas. Moreover, leading regional operators such as AT&T, Verizon, and T-Mobile have invested heavily in mmwave infrastructure.

For instance, Verizon had deployed more than 35,000 small cells by 2024, encompassing major urban areas and stadiums. These large-scale CapEx investments provide dense network coverage and enable rapid adoption of 5G mmwave services. North American urban centers present high smartphone penetration and growing demand for cloud gaming, ultra-HD streaming, and AR/VR. The United States 5G user base for mmwave devices hit more than 25 million subscribers by 2024, propelling operator expansion. High willingness-to-pay backs premium 5G mmwave services.

Asia Pacific ranks as the second-largest region in the global 5G mmwave industry, driven by high urban population density and smartphone penetration, enterprise and industrial 5G adoption, and integration with advanced applications. Asia-Pacific cities such as Shanghai, Singapore, Seoul, and Tokyo have extremely high population density and high smartphone penetration. Urban demand for ultra-fast connectivity and immersive services fuels mmwave adoption. More than 30 million 5G mmwave subscriptions were reported in the Asia Pacific by 2024.

Additionally, manufacturing, smart factory initiatives, and logistics in the region are embracing mmwave for IoT applications and automation. For instance, South Korea’s smart factory program deployed more than 1200 private 5G networks using mmwave. Enterprise-based adoption majorly drives the industry. The region also leads in cloud gaming, AR/VR, and autonomous mobility trials needing ultra-low latency and high bandwidth. South Korea and Japan have introduced multiple pilot projects for digital twins, remote surgery, and autonomous transport using mmwave. These programs fuel early commercial adoption.

5G Mmwave Market: Competitive Analysis

The leading players in the global 5G mmwave market are:

- Qualcomm

- Ericsson

- Nokia

- Samsung Electronics

- Huawei

- ZTE

- Intel

- Keysight Technologies

- Verizon Communications

- AT&T

- T-Mobile

- NTT Docomo

- Fujitsu

- NEC Corporation

- MediaTek

5G Mmwave Market: Key Market Trends

Fixed Wireless Access (FWA) deployment in urban areas:

Operators are using mmwave FWA to offer gigabit broadband without the cost and delay of fiber rollout. High-density urban areas benefit substantially, allowing speedy last-mile connectivity. This trend augments revenue generation for telecom operators while reducing broadband gaps.

Technological innovations in RF components and beamforming:

Advancements in RFICs, smart beamforming, and phased-array antennas are decreasing the cost, size, and power consumption of mmwave equipment. This enhances device performance and reliability. Advancement is making mmwave solutions more commercially viable and scalable in regions.

The global 5G mmwave market is segmented as follows:

By Product

- Scanning Systems

- Radar and Satellite Communication Systems

- Telecommunication Equipment

- Other

By Component

- Antennas & Transceiver Components

- Frequency Sources & Related

- Communication & Networking Components

- Imaging Components

- Sensors & Controls

- Interface Components

- Other

By Frequency Band

- 24–57 GHz

- 57–95 GHz

- 95–300 GHz

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

5G mmwave refers to the extremely high-frequency bands (usually 24-100 GHz) in 5G networks to deliver ultra-fast wireless connectivity. These bands provide multi-gigabit data rates, high capacity, and ultra-low latency, making them suitable for dense urban areas, stadiums, smart factories, and autonomous mobility applications.

The global 5G mmwave market is projected to grow due to surging demand for ultra-low-latency connectivity, rising mobile data consumption and bandwidth needs, and the growing deployment of private 5G networks in enterprises.

According to a study, the global 5G mmwave market size was around USD 3.69 billion in 2024 and is expected to reach USD 11.34 billion by 2034.

The CAGR value of the 5G mmwave market is expected to be around 15.05% during 2025-2034.

Market trends and consumer preferences are shifting toward low-latency and ultra-fast connectivity for private networks, immersive applications, and high-capacity urban broadband.

Macroeconomic factors like interest rates, inflation, and operator CapEx constraints may slow large-scale deployments, but will not halt urban and enterprise 5G mmwave adoption.

North America is expected to lead the global 5G mmwave market during the forecast period.

The key players profiled in the global 5G mmwave market include Qualcomm, Ericsson, Nokia, Samsung Electronics, Huawei, ZTE, Intel, Keysight Technologies, Verizon Communications, AT&T, T-Mobile, NTT Docomo, Fujitsu, NEC Corporation, and MediaTek.

Stakeholders should focus on private 5G solutions, network densification, strategic partnerships, advanced RF innovation, and vertical-specific applications to remain competitive.

The report examines key aspects of the 5G mmwave market, including a detailed analysis of current growth drivers and constraints, as well as future growth opportunities and challenges.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed