Wires And Cables Market Size, Share, Trends & Forecast 2034

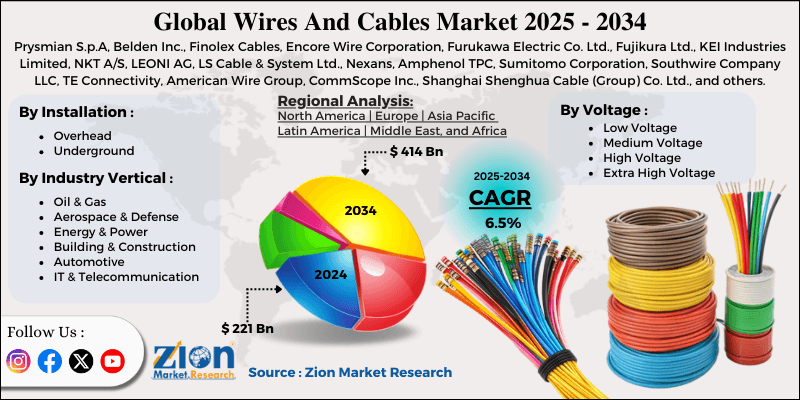

Wires And Cables Market By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra High Voltage), By Installation (Overhead and Underground), By Industry Vertical (Oil & Gas, Aerospace & Defense, Energy & Power, Building & Construction, Automotive, IT & Telecommunication, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

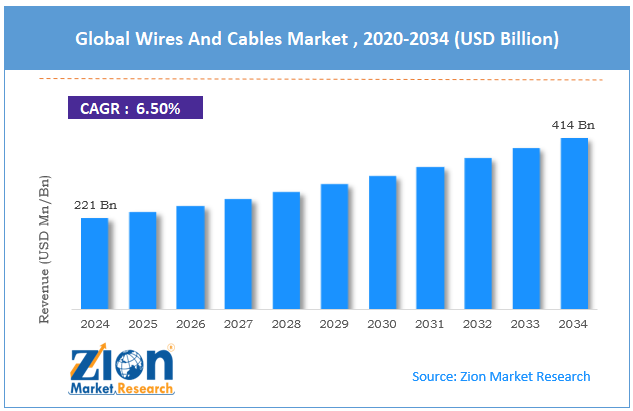

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 221 Billion | USD 414 Billion | 6.5% | 2024 |

Wires And Cables Industry Perspective:

The global wires and cables market size was worth around USD 221 billion in 2024 and is predicted to grow to around USD 414 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global wires and cables market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034).

- In terms of revenue, the global wires and cables market size was valued at around USD 221 billion in 2024 and is projected to reach USD 414 billion by 2034.

- Increasing renewable energy across the globe is expected to drive the wires and cables market over the forecast period.

- Based on the voltage, the low voltage segment is expected to capture the largest market share over the projected period.

- Based on the installation, the overhead segment is expected to capture the largest market share over the projected period.

- Based on the industry vertical, the energy & power segment is expected to capture the largest market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Wires And Cables Market: Overview

A wire is a single, flexible strand or rod made of conductive material, such as copper or aluminum, that carries electricity. For fixed installations, it can be solid (a single thick strand) to keep it stable, or stranded (many thin filaments twisted together) to make it more flexible for use in automobiles or appliances. People often wrap wires in materials like PVC or rubber to prevent short circuits and protect them from the elements. They use AWG (American Wire Gauge) and other gauges to measure their diameter. Wires with smaller numbers are thicker and can carry more current. A cable is a single piece with two or more insulated wires twisted, braided, or bundled together and covered by a sheath. This speeds up the communications. This design extends component lifespans, reduces interference, and allows many circuits to fit in a single unit. This includes power lines (hot, neutral, and ground) and Ethernet data lines. Wires are insulated for usage in telecommunications and industry to stop electromagnetic interference. There are many types, such as twisted-pair for reducing noise and coaxial for high-frequency transmission.

Wires And Cables Market Dynamics

Growth Drivers

How does the growth in residential projects and commercial structures propel the wires and cables industry growth?

There are electrical standards that must be followed on construction sites, but some electrical companies offer services that don't comply with these regulations. Most demand in this field comes from homes, followed by stores and offices. To power contemporary infrastructure, long-lasting tools, and machines used in construction, a solid electrical system is required. Even if the installation is temporary, the electrician in charge of the construction must ensure everyone's safety. No matter how important it is, cable manufacturing should always meet high standards. This includes building construction, demolition, electrical panels, sheds, and lighting operations.

For instance, the United States Census Bureau, construction spending during August 2025 was estimated at a seasonally adjusted annual rate of $2,169.5 billion, 0.2 percent (±0.7 percent) above the revised July estimate of $2,165.0 billion.

Restraints

Volatility in the price of raw materials is hampering the industry’s growth

The wires and cables industry is struggling to grow due to unpredictable raw material costs. This makes production more expensive and lowers profit margins. The major reasons prices for copper, aluminum, and plastic go up and down include global supply and demand imbalances, geopolitical tensions, and supply-chain disruptions, such as trade wars and natural disasters.

For instance, the price of copper fluctuates depending on how much mining is allowed and how much energy is required. On the other hand, changes in petrochemicals do alter insulation materials. In places like the Gulf Cooperation Council and India, where infrastructure projects have low budgets, this uncertainty makes it harder for them to move forward. This makes them less competitive with cheaper imported goods. According to Trading Economics, the price of copper went up 0.68% from the day before to 5.28 USD/Lb on December 10, 2025. Over the past month, the price of copper has risen 4.56%, and over the past year, it has risen 25.43%.

Opportunities

Does the growing number of companies in the wire and cables business offer a potential opportunity for industry growth?

The increasing number of companies in the wire and cables business offers a potential opportunity for the growth of the wires and cables market. For instance, in August 2025, Surya Roshni is one of India's most trusted names in lighting, fans, home appliances, steel, and PVC pipes. With the launch of its new Turbo Flex range, which is a powerful combination of safety, durability, and versatility designed for modern households and commercial establishments, the company has expanded into the wires and cables segment. This strengthens its position in the electrical solutions market.

The new wires are available in two types: Turbo Flex FR (Flame Retardant) and Turbo Flex Green FRLSH (Flame Retardant, Low Smoke, and Halogen). They are RoHS (Restriction of Hazardous Substances) compliant and eco-friendly, with additional safety features and a robust standard offering designed to be reliable every day.

Challenges

Why does the high upfront cost and complexity for certain installations pose a major challenge to the wires and cables market expansion?

High initial costs and complex installation make it harder for the market to grow, as they slow adoption, limit project pipelines, and make customers feel they are taking on more risk. For complex wire and cable projects, such as underground high-voltage lines, fiber backbones, smart grid, or data center cabling, significant capital is required for materials, civil works, engineering, and specialist labor before any money is made. This lengthens payback periods and makes it harder to justify investments when public budgets or corporate capital expenditures are limited. As a result, some projects are cut back, delayed, or canceled, which directly affects demand growth.

Wires And Cables Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wires And Cables Market |

| Market Size in 2024 | USD 221 Billion |

| Market Forecast in 2034 | USD 414 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 216 |

| Key Companies Covered | Prysmian S.p.A, Belden Inc., Finolex Cables, Encore Wire Corporation, Furukawa Electric Co. Ltd., Fujikura Ltd., KEI Industries Limited, NKT A/S, LEONI AG, LS Cable & System Ltd., Nexans, Amphenol TPC, Sumitomo Corporation, Southwire Company LLC, TE Connectivity, American Wire Group, CommScope Inc., Shanghai Shenghua Cable (Group) Co. Ltd., and others. |

| Segments Covered | By Voltage, By Installation, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wires And Cables Market: Segmentation

Voltage Insights

The low voltage segment dominates the market, capturing over 40% of market share. This increase is due to the widespread use of low-voltage cables in building wiring, LAN cables, appliance wiring, distribution networks, and other applications. These wires and cables enable smart grids to deliver additional electric power and improve service for end users. The energy and power sectors worldwide are rapidly changing. Most developing and developed countries are experiencing high electricity demand and are moving toward large-scale renewable energy sources.

Installation Insights

The overhead segment is expected to account for the largest share of revenue over the projected period. The overhead installation technique is the most extensively used approach worldwide. The overhead approach using wires and cables is the simplest and least expensive method of installation. Overhead installation techniques are most commonly used in countries with fewer populations. However, countries with a high risk of natural disasters, such as earthquakes and floods, are more likely to deploy overhead wires.

Industry Vertical Insights

The energy & power segment dominates the market over the projected period. There are many significant developments in the technology that underpins the energy T&D ecosystem. For example, they're switching from old transmission lines to high- and extra-high-voltage lines to reduce transmission losses. These adjustments are intended to make ecosystems more stable; however, this is not the case because renewable energy sources evolve over time. The adoption of new technologies, such as synchronized charging for electric cars and net metering for solar households, has also had a big effect on the utilities sector.

But as more and more countries use renewable energy and generate power, it has become even more vital for them to connect their transmission systems. As per the Institute for Energy Economics and Financial Analysis, in FY2025, only 8,830 ckm of new transmission lines were commissioned in India.

Regional Insights

The Asia-Pacific region is expected to account for 38% of the wires and cables market revenue in 2024. The growth in the region is owing to the growing urbanization and industrialization. Furthermore, the rising infrastructure development in countries like India and China is a major catalyst for the growth of the market. For instance, according to the Press Information Bureau, India’s total infrastructure spending has grown exponentially, with budget allocations rising to ₹10 lakh crore in 2023-24.

How does the renewable energy integration in India drive the wires and cables market?

The use of renewable energy in India is driving rapid growth in the wires and cables market by creating strong demand for infrastructure to transmit and distribute power efficiently. As the country quickly increases its solar and wind power capacity, it needs new transmission lines, substations, and grid-connectivity networks to move renewable energy from places where it is generated, which are often in remote areas like deserts, coastal areas, and high-wind corridors, to cities and industries where it is used. As this change occurs, there is a growing need for high-voltage and extra-high-voltage cables, underground cables, and specialized products such as solar DC cables, XLPE-insulated cables, and fiber-embedded smart cables that monitor the health of the grid.

In addition, renewable energy projects that receive funding from programs such as the Solar Park Program, Green Energy Corridors, PM-KUSUM, and offshore wind projects require extensive wiring for interconnection, inverter linkage, substations, and evacuation systems. The government's search for a modern, adaptable, and intelligent grid, necessary for managing renewable energy that isn't always available, underscores the importance of better cables that can withstand higher loads, offer greater insulation, and last longer.

As more renewable energy systems are built, more money is going into energy storage and hybrid systems, both of which depend on good wiring. India's use of renewable energy not only makes the wires and cables market larger, but also drives it toward higher-value, more technologically advanced products. This is a big long-term growth driver for the business.

Wires And Cables Market: Competitive Analysis

The global wires and cables market is dominated by players like:

- Prysmian S.p.A

- Belden Inc.

- Finolex Cables

- Encore Wire Corporation

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- KEI Industries Limited

- NKT A/S

- LEONI AG

- LS Cable & System Ltd.

- Nexans

- Amphenol TPC

- Sumitomo Corporation

- Southwire Company LLC

- TE Connectivity

- American Wire Group

- CommScope Inc.

- Shanghai Shenghua Cable (Group) Co. Ltd.

The global wires and cables market is segmented as follows:

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Installation

- Overhead

- Underground

By Industry Vertical

- Oil & Gas

- Aerospace & Defense

- Energy & Power

- Building & Construction

- Automotive

- IT & Telecommunication

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed