Wearable Payment Devices Market Size, Share, Trends, Growth 2034

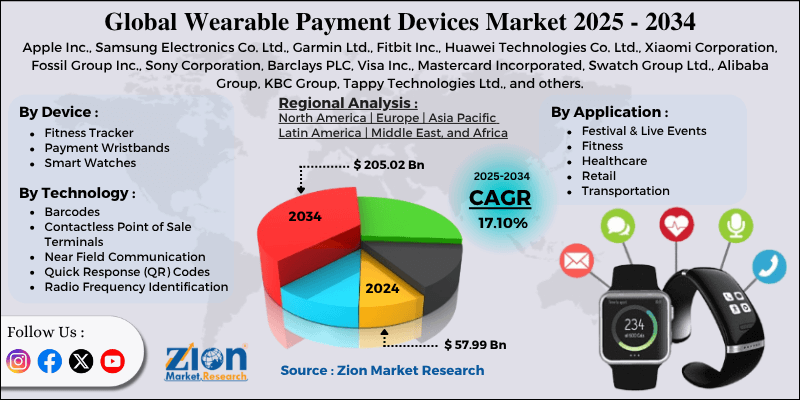

Wearable Payment Devices Market By Device (Fitness Tracker, Payment Wristbands, Smart Watches), By Technology (Barcodes, Contactless Point of Sale [POS] Terminals, Near Field Communication [NFC], Quick Response [QR] Codes, Radio Frequency Identification [RFID]), By Application (Festival & Live Events, Fitness, Healthcare, Retail, Transportation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

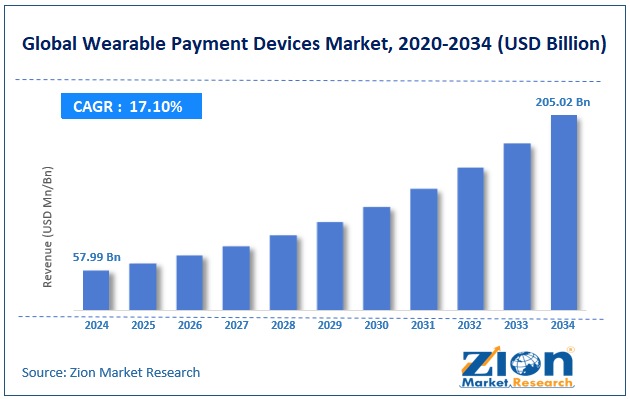

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 57.99 Billion | USD 205.02 Billion | 17.10% | 2024 |

Wearable Payment Devices Industry Perspective:

The global wearable payment devices market size was approximately USD 57.99 billion in 2024 and is projected to reach around USD 205.02 billion by 2034, with a compound annual growth rate (CAGR) of roughly 17.10% between 2025 and 2034.

Wearable Payment Devices Market: Overview

Wearable payment devices are smart tools or devices, such as fitness trackers, smartwatches, and payment-permitted wristbands or rings, that facilitate contactless payments using near-field communication, radio-frequency identification technology, or QR codes. These devices blend security, speed, and convenience, facilitating unified transactions without the need for physical cards or cash. The global wearable payment devices market is projected to witness substantial growth, driven by increasing demand for contactless payments, the rising proliferation of smart devices, and higher penetration of digital wallets. Contactless payments have increased as consumers seek hygienic and safer transaction methods, particularly following the COVID-19 pandemic. Nearly 74% of consumers worldwide use contactless payments, driving the adoption of wearables, according to Mastercard.

Moreover, the growing use of fitness bands and smartwatches globally, particularly among the tech-savvy and younger population, has increased the scope for integrated payment features. The growth of mobile wallets, such as Samsung Pay, Google Pay, and Apple Pay, has been crucial. These platforms majorly support wearable integration, creating a unified user experience.

Despite the growth, the global market is hindered by factors such as high-priced advanced devices, limited battery life and performance issues, and a lack of interoperability among platforms. Premium wearable devices with payment features are costly, which restricts their adoption among budget-conscious consumers, particularly in emerging economies.

Additionally, frequent charging and low power capacity can reduce the usability of some wearables for continuous payment usage, particularly in high-traffic environments such as public transportation. Likewise, incompatibility between different devices, financial service providers, and operating systems restricts the use, particularly in multi-bank use cases or cross-border scenarios.

Nonetheless, the global wearable payment devices industry stands to gain from several key opportunities, including integration with banking and health insurance services, as well as retail loyalty integration. Linking payment wearables with loyalty programs or infrastructure benefits may improve consumer trust and confidence.

For instance, insurers offering discounts to active users who wear wearables. Furthermore, wearable devices facilitate integrated loyalty systems, cashback programs, and digital coupons. Retailers leverage real-time consumer data, thus driving engagement.

Key Insights:

- As per the analysis shared by our research analyst, the global wearable payment devices market is estimated to grow annually at a CAGR of around 17.10% over the forecast period (2025-2034)

- In terms of revenue, the global wearable payment devices market size was valued at around USD 57.99 billion in 2024 and is projected to reach USD 205.02 billion by 2034.

- The wearable payment devices market is projected to grow significantly due to the growth in contactless payments, advancements in RFID and NFC technology, and a surge in adoption in the transportation and retail sectors.

- Based on device, the smartwatches segment is expected to lead the market, while the fitness tracker segment is expected to grow considerably.

- Based on technology, the Near Field Communication (NFC) is the dominant segment. In contrast, the Contactless Point of Sale (POS) Terminals segment is projected to witness substantial revenue growth over the forecast period.

- Based on application, the retail segment is expected to lead the market, followed by the transportation segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Wearable Payment Devices Market: Growth Drivers

Smart city initiatives and supportive government policies boost market growth

Governments worldwide are aiming to digitalize financial transactions through regulatory support and smart city initiatives. Cities like London, Singapore, and Dubai are key examples where retail outlets, public transportation systems, and event venues widely accept wearable payments. The Land Transport Authority of Singapore reported that more than 80% of travelers used contactless payments in 2024, with the majority using wearable devices.

The EU's Digital Finance Strategy enforces regulations for innovative and secure payment systems. Such architectures are forcing payment processors and wearable OEMs to obey PSD2 directives and open banking APIs.

Tokenization technology and security enhancements contribute to the market growth

Security has been a key concern for payment solutions, but the latest improvements in biometric verification, tokenization, and eSE (embedded secure elements) have notably enhanced trust in wearable payments. Tokenization ensures that actual card details are not shared during transactions, thereby decreasing the risk of fraud. Mastercard and Visa now require all wearable devices to support tokenization regulations for payment certification.

In addition, wearables are increasingly following PCI DSS and EMVCo standards, which promise compliance and consistency in global markets. The adoption of blockchain-based encryption models in some modern wearable devices is also progressing, although it is still in its early stages. These advancements promise regulatory bodies and users that wearable payments are secure than traditional card transactions, thus impacting the progress of the wearable payment devices market.

Wearable Payment Devices Market: Restraints

Infrastructure gaps and low merchant acceptance negatively impact market progress

Although contactless payments are increasing, not all vendors, particularly in semi-urban and rural areas, support NFC-based POS terminals that facilitate wearable payments. A few medium-sized or small businesses find it challenging and expensive to manage, particularly in regions with poor internet connectivity and unreliable power supplies.

Also, in some advanced areas, wearable payment compatibility is not yet standardized. This is a key concern when trying to pay with devices like NFC rings or fitness bands, since they may not easily communicate with all types of terminals. Therefore, this hampers the growth of the wearable payment devices market.

Wearable Payment Devices Market: Opportunities

Insurance and healthcare sector collaborations positively impact market growth

The convergence of payment functionalities and health monitoring presents a key opportunity, particularly in hospital-based services, fitness memberships, and health insurance, driving the wearable payment devices industry. Wearables can now manage blood oxygen monitoring, step tracking, and heart rate logging, and allow unified experiences in pharmacies, health centers, and wellness facilities.

This infrastructure offers wearable devices that serve not only as transactional tools but also as wellness financial instruments, merging Fintech and personal health into one device.

Wearable Payment Devices Market: Challenges

Growing feature demands vs. limited battery capacity restrict the market growth

Wearable payment devices are equipped with complex features, including real-time health tracking, biometric sensors, LTE, GPS, and NFC chips, all of which require power. Nonetheless, battery capacity and size remain restricted due to the compact form factor of wearables. Several devices last only 3 days on a single charge, with payment features significantly contributing to battery drain.

Although brands are experimenting with novel battery materials, power-efficient chips, and solar charging, these advancements are still in development or prohibitively expensive. Until a breakthrough occurs, the power-performance trade-off will remain a persistent challenge that hinders and reduces the broader adoption of wearable payment devices.

Wearable Payment Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wearable Payment Devices Market |

| Market Size in 2024 | USD 57.99 Billion |

| Market Forecast in 2034 | USD 205.02 Billion |

| Growth Rate | CAGR of 17.10% |

| Number of Pages | 211 |

| Key Companies Covered | Apple Inc., Samsung Electronics Co. Ltd., Garmin Ltd., Fitbit Inc., Huawei Technologies Co. Ltd., Xiaomi Corporation, Fossil Group Inc., Sony Corporation, Barclays PLC, Visa Inc., Mastercard Incorporated, Swatch Group Ltd., Alibaba Group, KBC Group, Tappy Technologies Ltd., and others. |

| Segments Covered | By Device, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wearable Payment Devices Market: Segmentation

The global wearable payment devices market is segmented based on device, technology, application, and region.

Based on device, the global wearable payment devices industry is divided into fitness trackers, payment wristbands, and smart watches. The smart watch segment held a dominant share of the market due to its advanced capabilities, strong global penetration, and growing brand infrastructure. The multifunctionality of smartwatches, like communication, payment features, and fitness tracking, makes them a highly adopted device type. Brands like Samsung Galaxy Watch, Garmin, and Apple Watch have incorporated unified NFC-based payment systems, resulting in high consumer adoption.

Based on technology, the global wearable payment devices market is segmented into barcodes, contactless point of sale (POS) terminals, near field communication (NFC), quick response (QR) codes, and radio frequency identification (RFID). Near Field Communication (NFC) is the leading technology in the global market owing to its global POS compatibility, reliability, and security features like biometric authentication and tokenization. NFC promises fast, secure, and contactless transactions with a simple tap, increasing ease of use for fitness trackers and smartwatches. Leading ecosystems, such as Google Pay, Apple Pay, Garmin, and Samsung Pay, are all designed around NFC, fueling broader adoption.

Based on application, the global market is segmented as festival & live events, fitness, healthcare, retail, transportation, and others. The retail segment held a leading position backed by global consumer adoption of digital wallets via wearables and high-frequency transactions. Consumers are highly preferring the use of fitness trackers and smartwatches for in-store payments at fashion outlets, supermarkets, and convenience stores. The broader availability of NFC-based POS systems, along with their ease of use and integration with loyalty programs, has driven their adoption.

Wearable Payment Devices Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is likely to maintain its leadership in the wearable payment devices market due to the high penetration of digital wallets and smart devices, a strong contactless payment ecosystem, and high consumer awareness and technology adoption. North America boasts the highest ownership rates of fitness trackers and smartwatches.

With the broader integration of Google Pay, Samsung Pay, and Apple Pay, users are increasingly using these devices for everyday purchases. As of 2024, more than 88 percent of POS terminals in Canada and the United States support contactless payments, allowing for unified transactions through wearables. This robust infrastructure readiness is a central propeller of wearable payment adoption.

Additionally, North American consumers are highly tech-savvy and quick to adopt new payment technologies. A Mastercard survey (2024) found that more than 65% of U.S. consumers are comfortable using wearables for payments. This consumer openness has fueled the transition towards wearable-based transactions.

Europe continues to hold the second-highest share in the wearable payment devices industry, driven by the rising penetration of wearable devices, a supportive Fintech and digital banking ecosystem, and strong adoption of transit and urban infrastructure. Europe holds a speedily expanding consumer base for fitness bands and smartwatches. The increasing demand for multifunctional devices has enabled consumers to adopt wearable devices that support contactless payments and health tracking.

In addition, the European Fintech scenario is flourishing, with major neobanks and banks, such as Monzo, Revolut, and N26, actively promoting wearable-supported payment platforms. These banks offer unified integration with Google Pay, Garmin Pay, and Apple Pay. The region's proactive approach to digital financial services drives the adoption of wearable devices.

Similarly, cities like Paris, Berlin, and London have incorporated NFC transit systems that facilitate wearable payments, for example, Transport for London (TfL), which aids payments via the Underground, buses, and trains. These systems fuel daily use and normalize wearable devices as a part of routine commuting.

Wearable Payment Devices Market: Competitive Analysis

The major operating players in the global wearable payment devices market are:

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Garmin Ltd.

- Fitbit Inc.

- Huawei Technologies Co. Ltd.

- Xiaomi Corporation

- Fossil Group Inc.

- Sony Corporation

- Barclays PLC

- Visa Inc.

- Mastercard Incorporated

- Swatch Group Ltd.

- Alibaba Group

- KBC Group

- Tappy Technologies Ltd.

Wearable Payment Devices Market: Key Market Trends

Growth of fashion-tech collaborations:

Brands are merging fashion with Fintech by designing customizable and stylish payment wearables. Companies like Michael Kors, Fossil, and Visa have introduced smart accessories, such as designer straps, bracelets, and rings, that serve as both fashion items and payment solutions. These collaborations aim to attract fashion-conscious and younger consumers.

Escalating use in public transportation systems:

Global urban transit systems are rapidly adopting wearable payment support. Cities like Singapore, London, and New York allow commuters to use fitness bands or smartwatches. This daily-use application is fueling the mass-market attraction and increasing the adoption of wearable payment devices.

The global wearable payment devices market is segmented as follows:

By Device

- Fitness Tracker

- Payment Wristbands

- Smart Watches

By Technology

- Barcodes

- Contactless Point of Sale (POS) Terminals

- Near Field Communication (NFC)

- Quick Response (QR) Codes

- Radio Frequency Identification (RFID)

By Application

- Festival & Live Events

- Fitness

- Healthcare

- Retail

- Transportation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wearable payment devices are smart tools or devices, such as fitness trackers, smartwatches, and payment-permitted wristbands or rings, that facilitate contactless payments using near-field communication, radio-frequency identification technology, or QR codes. These devices blend security, speed, and convenience, facilitating unified transactions without the need for physical cards or cash.

What key factors will influence the growth of the wearable payment devices market from 2025 to 2034?

The global wearable payment devices market is projected to grow due to the broader adoption of smart bands and smartwatches, government-led digital payment initiatives, and the increasing adoption of health and fitness wearable devices.

According to study, the global wearable payment devices market size was worth around USD 57.99 billion in 2024 and is predicted to grow to around USD 205.02 billion by 2034.

The CAGR value of the wearable payment devices market is expected to be approximately 17.10% from 2025 to 2034.

North America is expected to lead the global wearable payment devices market during the forecast period.

The key players profiled in the global wearable payment devices market include Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit Inc., Huawei Technologies Co., Ltd., Xiaomi Corporation, Fossil Group, Inc., Sony Corporation, Barclays PLC, Visa Inc., Mastercard Incorporated, Swatch Group Ltd., Alibaba Group, KBC Group, and Tappy Technologies Ltd.

The report examines key aspects of the wearable payment devices market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed