Spray Polyurethane Foam Market Size, Share, Growth & Forecast 2034

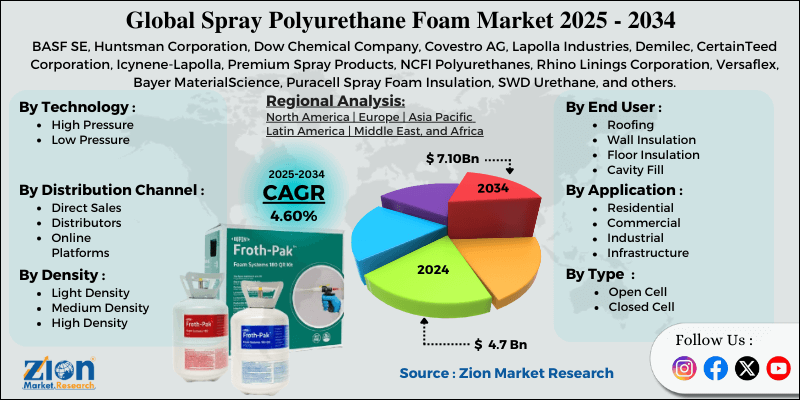

Spray Polyurethane Foam Market By Type (Open Cell and Closed Cell), By Application (Residential, Commercial, Industrial, and Infrastructure), By End-Use (Roofing, Wall Insulation, Floor Insulation, Cavity Fill, and Others), By Technology (High Pressure and Low Pressure), By Density (Light Density, Medium Density, and High Density), By Distribution Channel (Direct Sales, Distributors, and Online Platforms), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

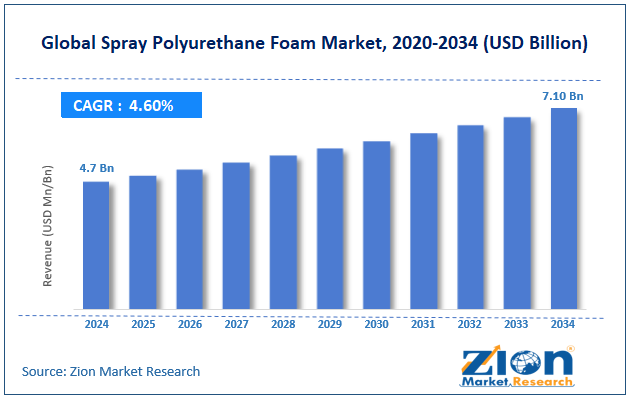

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.7 Billion | USD 7.10 Billion | 4.60% | 2024 |

Spray Polyurethane Foam Industry Perspective:

The global spray polyurethane foam market size was worth approximately USD 4.7 billion in 2024 and is projected to grow to around USD 7.10 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global spray polyurethane foam market is estimated to grow annually at a CAGR of around 4.60% over the forecast period (2025-2034).

- In terms of revenue, the global spray polyurethane foam market size was valued at approximately USD 4.7 billion in 2024 and is projected to reach USD 7.10 billion by 2034.

- The spray polyurethane foam market is projected to grow significantly due to rising energy efficiency requirements, increasing construction activities, growing awareness of sustainable building practices, expanding cold storage infrastructure, stringent building codes, and rising demand for retrofit insulation solutions.

- Based on type, the closed cell segment is expected to lead the spray polyurethane foam market, while the open cell segment is anticipated to experience significant growth.

- Based on application, the residential segment is expected to lead the market compared to the commercial segment.

- Based on end-use, the roofing segment is the dominating segment, while the wall insulation segment is projected to witness sizeable revenue over the forecast period.

- Based on technology, the high-pressure segment is expected to lead the market during the forecast period.

- Based on density, the medium density segment is expected to dominate compared to the light density segment.

- Based on the distribution channel, the distributors segment is expected to lead the market during the estimated period.

- Based on region, North America is projected to dominate the global spray polyurethane foam market during the estimated period, followed by Europe.

Spray Polyurethane Foam Market: Overview

Spray polyurethane foam is an insulation material formed when two liquid chemical components are mixed and sprayed onto surfaces, where they react and expand into a solid foam layer. This foam adheres firmly to walls, roofs, floors, and other building surfaces, creating a continuous barrier against heat transfer, air leakage, and moisture penetration. There are two primary types, namely open cell foam, which is lighter and softer with air-filled pockets that allow limited moisture movement, and closed cell foam, which is denser and more rigid with sealed cells that block moisture and offer higher insulation performance. Professional installers use specialized equipment that heats and pressurizes the liquid components before combining them at the spray gun nozzle. The material expands within seconds to many times its original liquid volume, filling gaps, cracks, and uneven spaces that other insulation materials are unable to cover effectively.

After curing, it forms a seamless layer without joints or seams, preventing air from escaping. Spray polyurethane foam provides strong thermal insulation, reduces energy use for heating and cooling, increases structural strength, controls condensation, and helps reduce sound transmission. It is used in residential buildings, commercial structures, industrial facilities, refrigerated storage spaces, and various infrastructure projects. The foam remains stable for many decades without settling or breaking down, preserving its insulating performance throughout the building’s life.

The increasing focus on energy efficiency in buildings and the growing construction industry are expected to drive growth in the spray polyurethane foam market throughout the forecast period.

Spray Polyurethane Foam Market Dynamics

Growth Drivers

How are energy efficiency mandates and building codes driving the spray polyurethane foam market expansion?

The spray polyurethane foam market is growing quickly as governments introduce stricter energy efficiency rules, requiring stronger insulation performance in modern buildings. Rising energy costs push homeowners and businesses to lower heating and cooling expenses by using better insulation materials. Spray foam offers a high R-value per inch, helping projects meet requirements without reducing usable interior areas. Energy rating systems, such as LEED, Energy Star, and Passive House, encourage continuous insulation systems, improving overall building efficiency. Utility companies provide rebates and incentives for high-performance insulation, lowering demand on electrical grids. Climate policies promote energy-efficient buildings as part of long-term carbon reduction plans worldwide.

Retrofit programs for older buildings increase demand for spray foam, which can be applied easily without major construction work. Net-zero energy goals require exceptional insulation performance from spray foam, which delivers effectively across many projects. Commercial property owners understand energy-efficient buildings attract higher rents and better long-term value. Industrial facilities lower operating costs by insulating equipment, pipes, and storage tanks using spray foam.

Growing construction activity and urbanization trends

The global spray polyurethane foam market is growing quickly as construction activity increases across developed and developing regions. Population growth and urbanization create strong demand for new residential housing across many segments. Commercial projects, including offices, retail centers, hotels, and healthcare facilities, generate significant insulation needs. Industrial expansion for factories, warehouses, and logistics facilities requires reliable insulation solutions using spray foam. Infrastructure development, including transport hubs, sports venues, and public buildings, uses advanced insulation materials for better performance. Renovation and remodeling projects in older buildings often include spray foam to improve overall energy efficiency. Prefabricated and modular construction benefits from spray foam because it seals and insulates factory-built components easily.

Rising living standards in emerging economies increase interest in comfortable and energy-efficient homes. Aging building stock in developed countries requires insulation upgrades to meet modern efficiency goals. Disaster recovery efforts after hurricanes, floods, and earthquakes create concentrated demand for spray foam. Multi-family buildings, including apartments and condominiums, rely on spray foam for effective sound control between units.

Restraints

How are health and safety concerns creating key restraints for the spray polyurethane foam market?

The spray polyurethane foam industry faces challenges because health and safety concerns remain important during installation and curing. The liquid chemicals contain isocyanates, which may cause respiratory irritation, skin sensitization, and asthma without careful handling. Occupational safety rules require strong protective equipment, proper ventilation systems, and thorough installer training on every project. Building occupants often vacate spaces during installation and curing periods, creating inconvenience and extra expenses. Some individuals develop chemical sensitivities or allergies, making them hesitant to use foam products in homes.

Media reports describing installation issues or health complaints create negative public perceptions among consumers. Professional liability concerns discourage certain contractors from offering spray foam services in many regions. Off-gassing during curing produces odors that some customers find unpleasant for several hours. Insufficient ventilation during installation may expose workers and nearby occupants to harmful chemical levels. Quality control issues, such as poor mixing ratios or incorrect application techniques, can sometimes lead to incomplete curing and ongoing emissions. Certification and licensing rules for installers reduce the available workforce in specific areas. Insurance costs for spray foam contractors remain high due to perceived risks associated with the use of chemicals.

Opportunities

Expanding cold chain and refrigeration infrastructure

The spray polyurethane foam industry is seeing strong opportunities in the fast-growing cold chain and refrigeration sectors, driven by food safety needs and shifting consumer habits. Online grocery delivery services require refrigerated fulfillment centers and temperature-controlled transport using reliable insulation. Pharmaceutical companies need cold storage for vaccines, biologics, and sensitive medications with strict regulatory conditions.

Fresh produce and meat distribution networks expand as consumers seek greater freshness and variety every day. Food processing facilities use spray foam to insulate walls, ceilings, and important refrigeration equipment. Cold storage warehouses benefit from seamless insulation without thermal bridges or air leaks. Refrigerated trucks and trailers rely on spray foam to maintain stable temperatures during long trips. Restaurant and grocery refrigeration systems perform better inside properly insulated spaces.

Data centers use spray foam in specialized cooling system installations for improved efficiency. Brewing and beverage industries depend on temperature-controlled areas for fermentation and storage. Ice rinks and frozen food plants need dependable insulation for consistent operation. Agricultural cold storage supports local farming and helps preserve seasonal crops effectively.

Challenges

How are raw material price volatility and supply chain issues challenging the spray polyurethane foam market?

The spray polyurethane foam market faces ongoing challenges due to the impact of raw material costs and supply chain issues on pricing stability and profit margins. Polyol and isocyanate components are derived from petroleum-based feedstocks, which are influenced by fluctuations in oil prices and refinery capacity limitations. Chemical production plants experience shutdowns for maintenance, accidents, or compliance work. Transportation costs for hazardous materials rise with fuel prices and ongoing driver shortages. Trade disputes and tariffs increase import expenses for chemicals and equipment in many regions. Environmental regulations limiting certain chemical processes reduce supply and raise market prices. Natural disasters, geopolitical conflicts, and pandemic disruptions interrupt supply chains unexpectedly.

Long lead times for raw material orders complicate inventory planning for many businesses. Currency fluctuations influence international purchases and competitive positions across global markets. Limited suppliers for specialized components create dependency risks for manufacturers. Quality differences between suppliers require testing and regular formulation adjustments. Minimum order requirements and shipping limits challenge smaller contractors and regional firms.

Spray Polyurethane Foam Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Spray Polyurethane Foam Market |

| Market Size in 2024 | USD 4.7 Billion |

| Market Forecast in 2034 | USD 7.10 Billion |

| Growth Rate | CAGR of 4.60% |

| Number of Pages | 216 |

| Key Companies Covered | BASF SE, Huntsman Corporation, Dow Chemical Company, Covestro AG, Lapolla Industries, Demilec, CertainTeed Corporation, Icynene-Lapolla, Premium Spray Products, NCFI Polyurethanes, Rhino Linings Corporation, Versaflex, Bayer MaterialScience, Puracell Spray Foam Insulation, SWD Urethane, and others. |

| Segments Covered | By Type, By Application, By End Use, By Technology, By Density, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Spray Polyurethane Foam Market: Segmentation

The global spray polyurethane foam market is segmented based on type, application, end-use, technology, density, distribution channel, and region.

Based on type, the global spray polyurethane foam industry is classified into open-cell and closed-cell. Closed cell leads the market due to its superior thermal resistance, moisture barrier properties, structural reinforcement benefits, and versatility across multiple applications, including demanding industrial and commercial environments.

Based on application, the industry is segregated into residential, commercial, industrial, and infrastructure. Residential applications hold the largest market share due to extensive new home construction, active renovation markets, homeowners’ focus on energy cost reduction, and increasing awareness of comfort and indoor air quality benefits.

Based on end use, the global spray polyurethane foam market is divided into roofing, wall insulation, floor insulation, cavity fill, and others. Roofing is expected to lead the market during the forecast period due to foam's ability to create seamless waterproof barriers, extend roof lifespan, provide superior insulation in limited spaces, and address complex roof geometries effectively.

Based on technology, the global market is segmented into high-pressure and low-pressure. High-pressure systems hold the largest market share due to their widespread adoption by professional contractors, superior mixing and application characteristics, faster installation speeds, and the ability to achieve specified foam properties consistently.

Based on density, the global market is segmented into light density, medium density, and high density. Medium-density foam is expected to lead the market as it balances performance characteristics, cost considerations, and application versatility, making it suitable for the majority of residential and commercial projects

Based on distribution channel, the global market is segmented into direct sales, distributors, and online platforms. Distributors hold the largest market share due to their established relationships with contractors, local inventory availability, technical support services, and equipment rental programs that lower barriers to contractor entry.

Spray Polyurethane Foam Market: Regional Analysis

North America leads due to its mature market and focus on energy efficiency.

North America holds a leading position in the spray polyurethane foam market because building codes that emphasize energy efficiency, widespread contractor expertise, and consumer awareness of insulation benefits remain strong across the region. The United States has the largest installed base of spray foam, with decades of development and technical improvement supporting reliable performance. Canadian building codes in cold climate regions strongly favor high-performance insulation solutions used across residential and commercial projects. Energy efficiency rebate programs from utilities and government agencies help reduce installation costs and increase adoption.

Building science education has created a solid knowledge base supporting proper material selection and installation practices. Extreme climate conditions in many areas demonstrate clear energy savings from superior insulation materials. Mature distribution networks ensure product availability and technical support across major population centers. Equipment manufacturers and chemical suppliers maintain significant operations across the region. Industry associations promote best practices and ongoing professional development for spray foam contractors. Green building movements and sustainability trends support foam’s long-term performance and energy efficiency advantages. Hurricane-prone regions value spray foam for structural strength and moisture resistance.

Retrofit activity in aging housing stock creates steady demand across urban and suburban markets. Commercial building owners strive to achieve efficiency in order to reduce operating costs and meet their sustainability goals. Cold storage and food processing industries across the region generate strong industrial demand. Building envelope specialists and energy auditors frequently recommend spray foam solutions for performance improvement.

What is driving Europe's steady growth in the market?

Europe is experiencing steady growth in the spray polyurethane foam market because of ambitious energy efficiency targets and carbon neutrality goals that continue to raise building performance requirements across the region. The European Union’s Energy Performance of Buildings Directive sets minimum standards favoring high-efficiency insulation across residential, commercial, and public buildings. Individual countries implement even stricter rules through national building codes designed to reduce long-term energy consumption.

Renovation wave programs focused on upgrading existing buildings create strong retrofit opportunities for spray foam installers. Northern European countries with cold climates maintain long traditions of high-performance building practices using advanced insulation methods. Passive House standards originating in Germany influence design strategies across many European markets.

Rising energy costs make insulation upgrades appealing for homeowners and businesses seeking lower utility expenses. Climate commitments across Europe support policies promoting energy-efficient construction. Heritage preservation efforts require insulation solutions that are suitable for historic buildings without altering their exterior appearances. District heating systems benefit from well-insulated buildings that minimize distribution losses.

Manufacturing facilities improve insulation to reduce carbon footprints and meet efficiency goals. Cold chain infrastructure expands to support agricultural exports and growing food distribution needs. Building renovation before sale or lease becomes common as owners aim to meet national energy rating requirements. Technical innovation in bio-based and low-GWP formulations strengthens market growth.

Recent Market Developments:

- In March 2025, BASF SE announced the introduction of biomass-balance flexible polyurethane foam systems for the North American furniture industry, claiming up to a 75% reduction in product carbon footprint compared to conventional systems.

Spray Polyurethane Foam Market: Competitive Analysis

The leading players in the global spray polyurethane foam market are:

- BASF SE

- Huntsman Corporation

- Dow Chemical Company

- Covestro AG

- Lapolla Industries

- Demilec

- CertainTeed Corporation

- Icynene-Lapolla

- Premium Spray Products

- NCFI Polyurethanes

- Rhino Linings Corporation

- Versaflex

- Bayer MaterialScience

- Puracell Spray Foam Insulation

- SWD Urethane

The global spray polyurethane foam market is segmented as follows:

By Type

- Open Cell

- Closed Cell

By Application

- Residential

- Commercial

- Industrial

- Infrastructure

By End Use

- Roofing

- Wall Insulation

- Floor Insulation

- Cavity Fill

- Others

By Technology

- High Pressure

- Low Pressure

By Density

- Light Density

- Medium Density

- High Density

By Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed