Smart Rings Market Size, Share, Trends, Growth and Forecast 2034

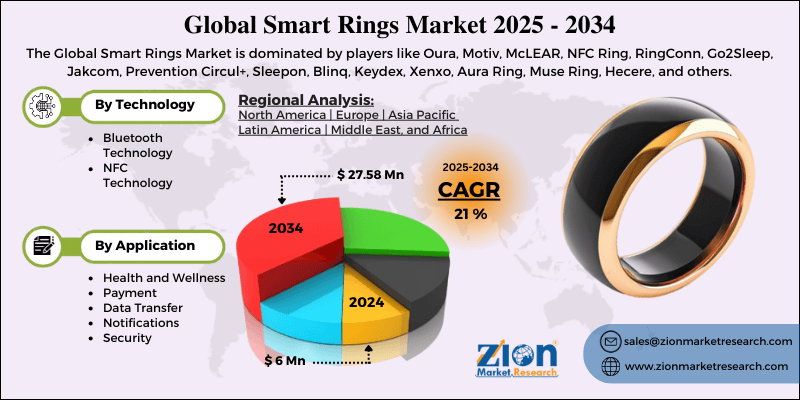

Smart Rings Market By Technology (Bluetooth Technology, NFC Technology), By Application (Health and Wellness, Payment, Data Transfer, Notifications, Security), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

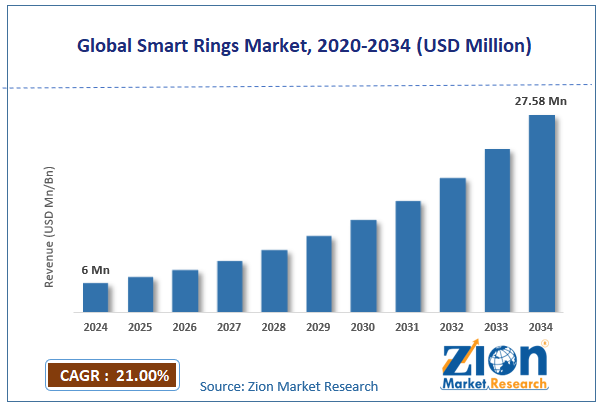

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6 Million | USD 27.58 Million | 21% | 2024 |

Smart Rings Industry Perspective:

The global smart rings market size was approximately USD 6 million in 2024 and is projected to reach around USD 27.58 million by 2034, with a compound annual growth rate (CAGR) of roughly 21% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global smart rings market is estimated to grow annually at a CAGR of around 21% over the forecast period (2025-2034)

- In terms of revenue, the global smart rings market size was valued at around USD 6 million in 2024 and is projected to reach USD 27.58 million by 2034.

- The smart rings market is projected to grow significantly due to the increasing demand for contactless payment solutions, rising smartphone penetration, and advancements in sensor technology.

- Based on technology, the Bluetooth technology segment is expected to lead the market, while the NFC technology segment is expected to grow considerably.

- Based on application, the health and wellness segment is the largest, while the payment segment is projected to experience substantial revenue growth over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Smart Rings Market: Overview

Smart rings are compact wearables that incorporate advanced technology into a finger ring shape, offering contactless payments, fitness tracking, notifications, and health monitoring. They can be linked to smartphones and other devices through Bluetooth, providing convenience without the bulk of traditional wearables. The global smart rings market is projected to witness substantial growth, driven by the growing demand for wearable technology, increasing health and fitness awareness, and the integration of NFC payments. The prominence of wearables continues to grow as users seek greater convenience and connectivity. Bright rings offer similar functions to smartwatches but in a more discreet and smaller form. This makes them highly appealing to tech-savvy consumers who value portability and convenience.

Consumers are actively adopting smart rings to track crucial health metrics, including sleep quality, oxygen levels, and heart rate. Post-pandemic awareness has made continuous health monitoring a necessity, rather than a luxury. This move is creating robust demand for health-focused wearables. Smart rings enable contactless transactions using NFC technology, providing a secure and convenient payment method. With the rising preference for cashless payments worldwide, this feature significantly drives adoption. It is particularly prominent among consumers seeking convenience and hygiene.

Although drivers exist, the global market is challenged by factors such as the high cost of premium smart rings and compatibility issues with devices. Advanced smart rings with health monitoring and NFC are priced at a premium. High prices limit their adoption among middle-class consumers, mainly in the developing markets. Price sensitivity remains a significant obstacle to widespread adoption. Moreover, not all smart rings work smoothly with all smartphones or operating systems. Compatibility restrictions can be frustrating for consumers who switch devices or use multiple platforms. This limits industry penetration in different user groups.

Even so, the global smart rings industry is well-positioned due to the rise in contactless payment adoption and incorporation with gaming and AR/VR. The growth of cashless economies worldwide creates demand for NFC-based devices. Smart rings offer a convenient and stylish alternative to smartphones and cards. This trend is expected to drive widespread adoption in the near future. Smart rings allow gesture control in AR/VR environments, improving user interaction. This creates thrilling possibilities in VR and gaming applications. It also supports the rise of metaverse infrastructure.

Smart Rings Market: Growth Drivers

How is miniaturization & sensor innovation driving the smart rings market?

Technical advances are making smart rings more comfortable, smaller, and more powerful. Innovations in optical sensors, low-power chips, and Bluetooth LE allow for more extended battery life and precise health monitoring. In 2024, manufacturers introduced compact designs with multi-layer battery capabilities and enhanced biometric features. The cost of components continues to drop, making mid-range models easily affordable without compromising on quality. These advancements improve the user experience, fueling the global smart rings market.

Sports performance, recovery & women’s health features considerably fuel the market growth

Fitness enthusiasts and athletes depend on smart rings for recovery tracking and advanced training analytics. Rings offer convenience during workouts and sleep, presenting continuous data. In 2024, novel models focused on women's health, comprising temperature-based insights and cycle tracking. Wellness programs and professional sports teams adopted smart rings for personalized coaching and performance optimization. This specialized functionality appeals to the niche segments and raises user engagement.

Smart Rings Market: Restraints

How is the smart rings market restricted by the lack of widespread contactless payment infrastructure?

Although smart rings support NFC payments, infrastructure readiness remains unstable in various markets. Developed regions, such as North America and Europe, have high contactless penetration, whereas developing regions still lag behind. In most parts of Latin America and India, NFC-based wearable transactions account for less than 3% of digital payments as of 2024, thereby restricting their practical utility. Without universal acceptance among transit systems and retailers, the payment feature is underutilized. This regional disparity highlights the adoption of new users seeking multi-functional advantages.

Smart Rings Market: Opportunities

How does integration with smart home and IoT ecosystems present favorable opportunities for the expansion of the smart rings market?

Smart rings are transforming beyond fitness to become universal control devices for IoT infrastructures. In 2024, many brands introduced gesture-based home automation, enabling consumers to control lighting, appliances, and locks using their hands. The smart home industry is anticipated to reach USD 231 billion by 2030, creating a harmonious prospect for the global smart rings industry. Rings with voice assistant integration and gesture recognition can become a key node for connected living. As users increasingly adopt IoT for security and convenience, this integration could significantly increase the value proposition of smart rings.

Smart Rings Market: Challenges

Ecosystem lock-in and interoperability restrict the market progress

Most smart rings operate within closed ecosystems, forcing users to stick with a single brand for a unified experience. For example, Galaxy Ring, introduced in 2024, offers deep integration only with Galaxy devices, estranging users of other platforms. The lack of third-party app compatibility and universal APIs creates friction for users who utilize mixed-brand devices. This fragmentation may slow the adoption among consumers who favor cross-platform functionality. Until the market adopts open standards, infrastructure silos will continue to be a significant challenge.

Smart Rings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Rings Market |

| Market Size in 2024 | USD 6 Million |

| Market Forecast in 2034 | USD 27.58 Million |

| Growth Rate | CAGR of 21% |

| Number of Pages | 213 |

| Key Companies Covered | Oura, Motiv, McLEAR, NFC Ring, RingConn, Go2Sleep, Jakcom, Prevention Circul+, Sleepon, Blinq, Keydex, Xenxo, Aura Ring, Muse Ring, Hecere, and others. |

| Segments Covered | By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Rings Market: Segmentation

The global smart ring market is segmented by technology, application, and region.

Based on technology, the global smart rings industry is divided into Bluetooth technology and NFC technology. Bluetooth technology holds a substantial market share, as it is the primary method for connecting rings to fitness apps, smartphones, and other devices. Its low power consumption and broad compatibility with iOS and Android platforms increase its preference among the majority of manufacturers. Bluetooth-based smart rings enable smooth data transfer for notifications, health monitoring, and fitness tracking. The reliability and convenience of Bluetooth promise that it will remain a broadly adopted technology in the industry.

On the other hand, NFC technology holds a second rank, primarily driven by the rapid adoption of secure authentication systems and contactless payments. NFC-based smart rings enable users to make touch-free and quick transactions, which gained huge attention post-pandemic due to their convenience and hygiene benefits. This technology is used for access control in smart homes and workplaces, which can introduce compatibility issues and regional payment limitations.

Based on application, the global smart rings market is segmented into health and wellness, payment, data transfer, notifications, and security. The health and wellness segment dominates the market due to growing consumer demand for continuous health monitoring. Smart rings embedded with sensors track health rate, oxygen saturation, sleep patterns, and activity levels, increasing their appeal for health-conscious and fitness enthusiasts. The post-pandemic emphasis has driven this trend majorly. Therefore, a majority of manufacturers prefer health-related features to meet the rising demands and expectations of consumers.

Conversely, payment holds a second-leading share, driven by the rise in contactless transactions worldwide. NFC-based smart rings enable users to make secure and quick payments without the need for smartphones or cards, which have gained immense prominence in transportation and retail. This shift towards hygienic solutions and cashless economies post-pandemic further supports regional growth.

Smart Rings Market: Regional Analysis

What factors help North America hold a dominant position in the global Smart Rings Market?

North America is likely to sustain its leadership in the smart rings market due to the adoption of high wearable technology, strong awareness of health and fitness, and advanced payment infrastructure. North America holds the highest wearable adoption rate, with more than 60% of adults using wearable devices in at least one form. The region's users are early adopters of smart technologies, comprising rings, due to their familiarity with fitness trackers and smartwatches. This strong acceptance of wearables ranks the region as the leader in the global market.

Moreover, the United States fitness market is estimated to be worth more than $35 billion, and consumers are increasingly focused on health monitoring. Following the pandemic, there has been a surge in demand for continuous health tracking solutions, such as smart rings. This health-conscious culture fuels the growth of smart rings for wellness.

Furthermore, North America dominates in contactless payment adoption, with more than 85% of in-person transactions in Canada and the United States now contactless-ready. NFC-based smart rings benefit from this ecosystem, making payments secure and seamless. The strong presence of financial technology companies boosts the adoption.

Europe continues to hold the second-highest share in the smart rings industry, driven by the strong adoption of wearable technology, widespread adoption of contactless payments, and high consumer spending on premium technologies. Europe boasts a rapidly growing wearable tech industry, projected to surpass $18 billion by 2026. Users are actively adopting smart rings as alternatives to smartwatches for connectivity and health. High demand and awareness for advanced wearables keep Europe among the leading markets worldwide.

Europe is also a forerunner in contactless payments, with more than 70% of all card transactions being contactless in nations like Poland and the UK. NFC-based smart rings benefit from this payment ecosystem, making them an appealing solution for quick and secure transactions. This trend majorly drives the payment application segment in the region. European users have high purchasing power, with average disposable income surpassing EUR 30,000 in Western Europe. This creates strong demand for stylish, smart, and premium wearables, such as smart rings. Hence, the region ranks as a significant industry for high-end technology items.

Smart Rings Market: Competitive Analysis

The leading players in the global smart rings market are:

- Oura

- Motiv

- McLEAR

- NFC Ring

- RingConn

- Go2Sleep

- Jakcom

- Prevention Circul+

- Sleepon

- Blinq

- Keydex

- Xenxo

- Aura Ring

- Muse Ring

- Hecere

Smart Rings Market: Key Market Trends

Fashion-tech collaborations for stylish designs:

Smart rings are evolving beyond their functional purpose to become fashion accessories through collaborations between luxury fashion houses and tech brands. Users are increasingly opting for wearables that seamlessly blend aesthetics with technology, leading to the launch of premium products. Designers are emphasizing the use of customizable materials, such as precious metals, ceramics, and titanium. This trend is appealing to high-income buyers who seek stylish and functional gadgets.

Integration of advanced health monitoring features:

Smart rings are primarily equipped with advanced health sensors to monitor blood oxygen levels, heart rate, sleep patterns, and body temperature. The growing trend towards preventive healthcare is driving this advancement in wearable technology. Brands like Ultrahuman and Oura are leading this move, offering medical-grade precision in compact devices. This trend supports the growing demand for continuous health tracking daily.

The global smart rings market is segmented as follows:

By Technology

- Bluetooth Technology

- NFC Technology

By Application

- Health and Wellness

- Payment

- Data Transfer

- Notifications

- Security

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Smart rings are compact wearables that incorporate advanced technology into a finger ring shape, offering contactless payments, fitness tracking, notifications, and health monitoring. They can be linked to smartphones and other devices through Bluetooth, providing convenience without the bulk of traditional wearables.

The global smart rings market is projected to grow due to the increasing adoption of wearable technology, rising health and fitness awareness, and integration with automation and smart home systems.

According to study, the global smart rings market size was worth around USD 6 million in 2024 and is predicted to grow to around USD 27.58 million by 2034.

The CAGR value of the smart rings market is expected to be around 21% from 2025 to 2034.

Technological advancements in sensors, miniaturization, AI, and NFC are enhancing efficiency, functionality, and user experience, fueling the speedy adoption of smart rings globally.

Regulatory compliance for NFC payments, data privacy laws such as GDPR, and sustainability requirements for eco-friendly materials are significantly impacting the growth of the smart rings market.

North America is expected to lead the global smart rings market during the forecast period.

The United States is a key contributor to the global smart ring market, thanks to its advanced payment infrastructure, high adoption rates of wearable devices, and a strong presence of leading manufacturers.

The key players profiled in the global smart rings market include Oura, Motiv, McLEAR, NFC Ring, RingConn, Go2Sleep, Jakcom, Prevention Circul+, Sleepon, Blinq, Keydex, Xenxo, Aura Ring, Muse Ring, and Hecere.

The report examines key aspects of the smart rings market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed