Smart Hydraulics Fluid Market Size & Share, Growth, Trends Report 2034

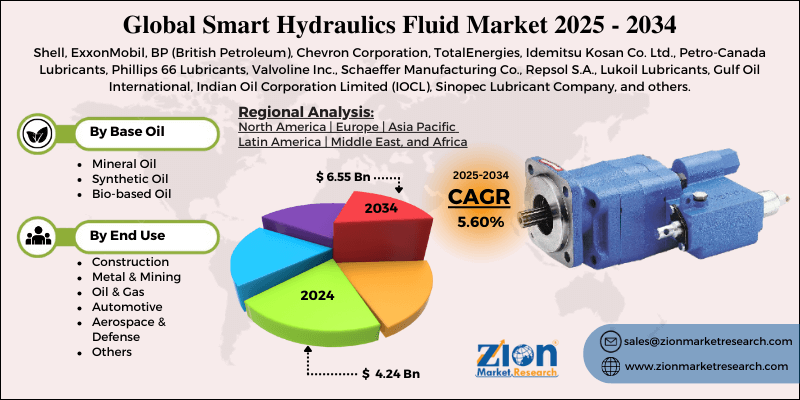

Smart Hydraulics Fluid Market By Base Oil (Mineral Oil, Synthetic Oil, Bio-based Oil), By End Use (Construction, Metal & Mining, Oil & Gas, Automotive, Aerospace & Defense, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

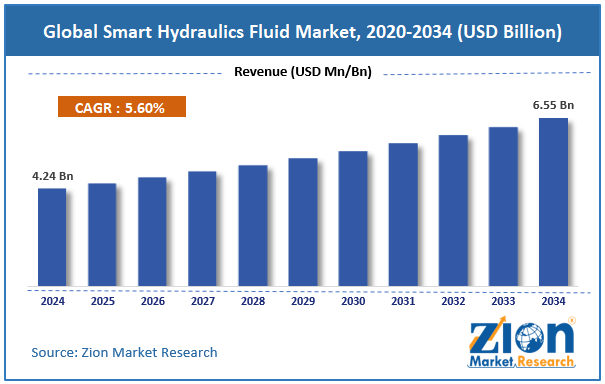

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.24 Billion | USD 6.55 Billion | 5.60% | 2024 |

Smart Hydraulics Fluid Industry Perspective:

The global smart hydraulics fluid market size was worth around USD 4.24 billion in 2024 and is predicted to grow to around USD 6.55 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global smart hydraulics fluid market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2025-2034)

- In terms of revenue, the global smart hydraulics fluid market size was valued at around USD 4.24 billion in 2024 and is projected to reach USD 6.55 billion by 2034.

- The smart hydraulics fluid market is projected to grow significantly due to the increasing demand for energy-efficient hydraulic fluids, the rising adoption of predictive maintenance in hydraulic systems, and the growing trend of smart manufacturing and Industry 4.0.

- Based on base oil, the synthetic oil segment is expected to lead the market, while the mineral oil segment is expected to grow considerably.

- Based on end use, the construction segment is expected to lead the market compared to the metal & mining segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Smart Hydraulics Fluid Market: Overview

Smart hydraulic fluids are the advanced hydraulic fluids engineered with innovative technologies and additives to improve system efficacy, performance, and reliability. These fluids are specially designed to adapt to diverse operating conditions, offering advantages like reduced wear, enhanced viscosity control, and better thermal stability. The global smart hydraulics fluid market is likely to expand rapidly, driven by a focus on sustainability, energy efficiency, growing construction and mining activities, and the increasing adoption of predictive maintenance. Smart hydraulic fluids optimize energy transfer, reducing energy consumption in hydraulic systems. Industries are being forced to comply with carbon reduction goals, which in turn increases the appeal of energy-efficient fluids. Their ability to reduce system friction also lowers operating costs and emissions. Rapid infrastructure development and urbanization in Latin America and the Asia Pacific are driving up demand for heavy-duty hydraulic systems. Smart fluids assure enhanced performance under harsh conditions in construction and mining equipment. This industry alone registers for a substantial revenue share worldwide.

Furthermore, predictive maintenance is a vital trend in industrial operations to avoid unexpected failures. Smart fluids allow real-time health tracking of machinery, preventing costly breakdowns. This trend is assertive in the automotive and aerospace sectors.

Despite the growth, the global market is impeded by factors such as the high initial cost of smart fluids and compatibility issues with legacy machines. Smart hydraulic fluids are more expensive than conventional fluids due to the use of additive technologies and advanced formulations. This cost difference may hamper medium and small-scale industries from adopting. Price sensitivity in developing economies adds to the limitation. Several legacy hydraulic systems are not dedicated to advanced smart fluids. System upgrades and retrofitting to accommodate novel fluids could be time-consuming and costly. This hampers penetration in many industries with outdated machinery.

Nonetheless, the global smart hydraulics fluid industry stands to gain from a few key opportunities, like rising adoption in autonomous machinery and the growth of biodegradable and green fluid solutions. Semi-autonomous and autonomous mining and construction equipment need high-reliability fluids. Smart hydraulic fluids improve operational efficacy and safety in these advanced machines. This segment offers significant growth potential in the near future.

Also, with sustainability goals rising worldwide, the demand for bio-based smart hydraulic fluids is rising. These fluids assimilate environmental safety with innovative features, gaining traction in eco-conscious industries. Companies capitalizing on green smart fluids are poised to gain a competitive advantage.

Smart Hydraulics Fluid Market: Growth Drivers

Focus on service monetization and predictive maintenance drives the market growth

Predictive maintenance programs highly depend on fluid-condition monitoring to optimize service timelines. Smart fluids offer remote health scoring that alerts operators to potential failures before they occur. This allows condition-based maintenance, decreasing unplanned downtime and spare parts inventory. OEMs can monetize data through diagnostic services or subscription dashboards. The shift from reactive to predictive maintenance models drives the adoption of smart hydraulic fluids, thereby impacting the global smart hydraulic fluid market.

How are formulation innovation and material-science improvements fueling the smart hydraulics fluid market?

Improvements in base oils, embedded sensors, and additives have permitted fluids with longer service life and enhanced oxidative and thermal stability. Some formulations offer measurable changes in electrical or optical properties as they worsen, streamlining monitoring. These enhancements reduce maintenance frequency and increase component longevity in demanding environments. Operators and OEMs are largely willing to pay a premium for such high-performing fluids. Constant advancements in formulations fuel competitiveness in the industry.

Smart Hydraulics Fluid Market: Restraints

Standardization and compatibility challenges negatively impact market progress

Smart hydraulic fluids typically require specific hydraulic systems, materials, and seals to function correctly. Blending these fluids with conventional oils may degrade performance and give inaccurate sensor readings. The absence of globally standardized protocols and formulations in equipment types restricts their broader adoption. OEMs should ensure both system and fluid compatibility to avoid operational problems. This lack of standardization presents a consistent challenge for the development of the smart hydraulic fluid industry.

Smart Hydraulics Fluid Market: Opportunities

How do connected construction fleets and emerging-market infrastructure create advantageous conditions for the development of the smart hydraulics fluid market?

Large-scale public works in the Middle East, Asia, and parts of Africa are adding millions of operating hours to loader, crane, concrete, and excavator machines, fertile ground for the adoption of smart fluid. Telematics penetration in construction fleets has grown steadily, allowing fluid-condition data flow into centralized maintenance systems for better warranty compliance and utilization. Contractors are actively favoring extended-drain fluids that reduce downtime on remote sites, where service logistics are expensive. Suppliers offering site-level oil study, training, and contamination audits can distinguish and lock in multi-project contracts.

Smart Hydraulics Fluid Market: Challenges

How does dependence on connectivity and digital infrastructure hinder the growth of the smart hydraulics fluid industry?

Smart hydraulics fluids depend on IoT networks, analytics platforms, and sensors to deliver predictive insights. Facilities without reliable network connectivity cannot completely utilize the technology’s benefits. Industrial sites in the developing market usually lack the required infrastructure for continual monitoring. This dependency on advanced digital systems remains a vital challenge for industry growth.

Smart Hydraulics Fluid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Hydraulics Fluid Market |

| Market Size in 2024 | USD 4.24 Billion |

| Market Forecast in 2034 | USD 6.55 Billion |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 214 |

| Key Companies Covered | Shell, ExxonMobil, BP (British Petroleum), Chevron Corporation, TotalEnergies, Idemitsu Kosan Co. Ltd., Petro-Canada Lubricants, Phillips 66 Lubricants, Valvoline Inc., Schaeffer Manufacturing Co., Repsol S.A., Lukoil Lubricants, Gulf Oil International, Indian Oil Corporation Limited (IOCL), Sinopec Lubricant Company, and others. |

| Segments Covered | By Base Oil, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Hydraulics Fluid Market: Segmentation

The global smart hydraulics fluid market is segmented based on base oil, end use, and region.

Based on base oil, the global smart hydraulics fluid industry is divided into mineral oil, synthetic oil, and bio-based oil. The synthetic oil segment registers a substantial share of the market because of its superior performance features like enhanced thermal stability, ability to manage harsh conditions, and oxidation resistance. They are broadly used in automotive, aerospace, and industrial applications where reliability and efficiency are paramount.

Conversely, the mineral oil segment ranks second in the global market due to its availability and low cost, which increases its preference in cost-sensitive applications, mainly in emerging regions. Nonetheless, they lack advanced features compared to synthetic oils.

Based on end use, the global smart hydraulics fluid market is segmented as construction, metal & mining, oil & gas, automotive, aerospace & defense, and others. The construction segment holds a dominating share in the market, followed by the metal & mining segment. The construction industry uses a vast number of hydraulic systems in loaders, excavators, cranes, and other heavy machinery. The need for reduced downtime, high reliability, and predictive maintenance in large-scale infrastructure projects fuels the demand for smart hydraulic fluids in the domain.

On the other hand, the metal & mining segment holds a second-leading share since these industries highly depend on hydraulics for crushing, drilling, and material handling. Extreme operating environments and the need for fluids that can tolerate high temperature and pressure make smart fluids vital here, ranking the segment second.

Smart Hydraulics Fluid Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Smart Hydraulics Fluid Market?

Asia Pacific is anticipated to retain its leading role in the global smart hydraulics fluid market as a result of speedy industrialization and infrastructure development, expansion of mining and construction activities, and growing adoption of advanced technologies. Asia Pacific is experiencing amplified industrialization, mainly in nations like India, China, and Southeast Asia. Large-scale infrastructure projects, transportation developments, and smart cities are fueling the demand for hydraulic systems in construction machinery. Infrastructure investments in Asia are anticipated to hit USD 26 trillion by 2030, driving the consumption of hydraulic fluid, according to the Asian Development Bank.

Moreover, the region is a forerunner in worldwide construction and mining equipment, with economies like Indonesia and India surging in mining output. According to the World Mining Data, the region accounts for more than 60% of global mineral production, necessitating advanced hydraulic systems for continuous operations. Smart fluids assure longer equipment life and predictive maintenance, making them vital for these industries.

Furthermore, Asian economies are speedily integrating manufacturing practices under programs like India's 'Digital India' and China's 'Made in China 2025' initiatives. These initiatives focus on IoT-based monitoring and automation, where smart hydraulics play a vital role. The APAC industrial automation industry is anticipated to progress at an 8.2% CAGR by 2032, aiding this trend.

Europe ranks as the second-leading region in the global smart hydraulics fluid industry as a result of sophisticated manufacturing and industrial base, higher adoption of advanced solutions, and a strong heavy equipment and construction industry. Europe houses well-developed industrial hubs in Italy, Germany, France, and the UK, with significant demand for advanced hydraulic systems. The European manufacturing industry accounts for more than 15% of the regional GDP, necessitating effective fluid solutions for operational reliability, according to Eurostat. Smart hydraulic fluids are preferred to maintain high productivity and decrease equipment downtime in these developed regions.

Additionally, European industries have been early adopters of Industry 4.0, IoT-based systems, and automation, mainly in Germany’s ‘Industrie 4.0' program. These initiatives fuel the need for mart hydraulic fluids with real-time monitoring and predictive maintenance competencies. The European industrial automation industry is expected to reach USD 65 billion by 2030, driving the adoption of fluid in smart machinery. The regional mining and construction activities, especially in France, Germany, and the Nordic countries, depend on advanced hydraulic systems. The European construction machinery industry is estimated at approximately USD 22 billion in 2024, creating significant demand for smart fluids. These fluids improve performance in heavy-duty operations under varied climatic conditions.

Smart Hydraulics Fluid Market: Competitive Analysis

The leading players in the global smart hydraulics fluid market are:

- Shell

- ExxonMobil

- BP (British Petroleum)

- Chevron Corporation

- TotalEnergies

- Idemitsu Kosan Co. Ltd.

- Petro-Canada Lubricants

- Phillips 66 Lubricants

- Valvoline Inc.

- Schaeffer Manufacturing Co.

- Repsol S.A.

- Lukoil Lubricants

- Gulf Oil International

- Indian Oil Corporation Limited (IOCL)

- Sinopec Lubricant Company

Smart Hydraulics Fluid Market: Key Market Trends

Move towards eco-friendly and bio-based fluids:

Environmental regulations and sustainability concerns are driving manufacturers towards the development of low-toxicity and biodegradable smart hydraulic fluids. Bio-based fluids are gaining prominence in APAC and Europe, where reduced carbon footprint and eco-compliance are highly favored. This move also supports corporate sustainability goals in industrial, automotive, and construction sectors.

Integration with digital twin technologies and predictive maintenance:

Smart hydraulic fluids are being widely used in conjunction with digital twin models and predictive maintenance software. This allows companies to imitate system behavior, optimize operational efficacy, and detect early signs of wear. This trend is gaining popularity in aerospace, automotive manufacturing, and heavy industries.

The global smart hydraulics fluid market is segmented as follows:

By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By End Use

- Construction

- Metal & Mining

- Oil & Gas

- Automotive

- Aerospace & Defense

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Smart hydraulic fluids are the advanced hydraulic fluids engineered with innovative technologies and additives to improve system efficacy, performance, and reliability. These fluids are specially designed to adapt to diverse operating conditions, offering advantages like reduced wear, enhanced viscosity control, and better thermal stability.

The global smart hydraulics fluid market is projected to grow due to the rising adoption of smart hydraulic systems in industrial automation, improvements in sensor-based monitoring and IoT technologies, and the growing need for high-performance fluids with extended lifespan.

According to study, the global smart hydraulics fluid market size was worth around USD 4.24 billion in 2024 and is predicted to grow to around USD 6.55 billion by 2034.

The CAGR value of the smart hydraulics fluid market is expected to be around 5.60% during 2025-2034.

The construction segment is projected to lead the smart hydraulics fluid market by 2034. Growing infrastructure projects and high demand for advanced hydraulic systems in heavy machinery drive this dominance.

The value chain of the global smart hydraulics fluid industry comprises fluid formulation, raw material sourcing, distribution, manufacturing, and aftermarket services.

Asia Pacific is expected to lead the global smart hydraulics fluid market during the forecast period.

The key players profiled in the global smart hydraulics fluid market include Shell, ExxonMobil, BP (British Petroleum), Chevron Corporation, TotalEnergies, Idemitsu Kosan Co., Ltd., Petro-Canada Lubricants, Phillips 66 Lubricants, Valvoline Inc., Schaeffer Manufacturing Co., Repsol S.A., Lukoil Lubricants, Gulf Oil International, Indian Oil Corporation Limited (IOCL), and Sinopec Lubricant Company.

Leading players are adopting partnerships, mergers & acquisitions, regional expansion, and product innovation to boost their market presence.

The report examines key aspects of the smart hydraulics fluid market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed