Smart Containers Market Size, Growth, Global Trends, Forecast 2034

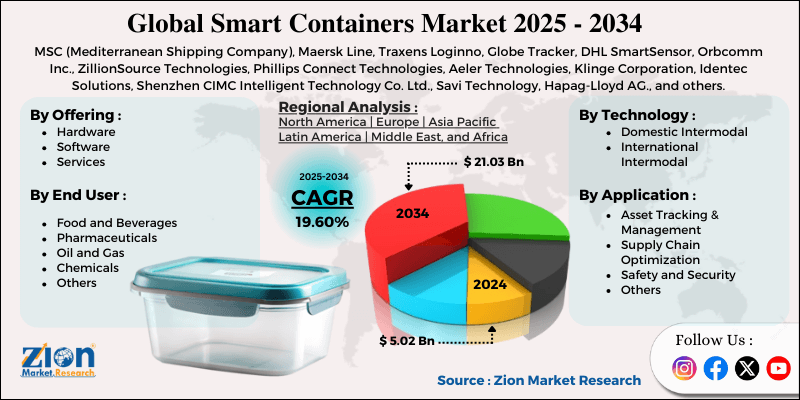

Smart Containers Market By Offering (Hardware, Software, Services), By Technology (Domestic Intermodal, International Intermodal), By Application (Asset Tracking & Management, Supply Chain Optimization, Safety and Security, and Others), By End-Use (Food and Beverages, Pharmaceuticals, Oil and Gas, Chemicals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

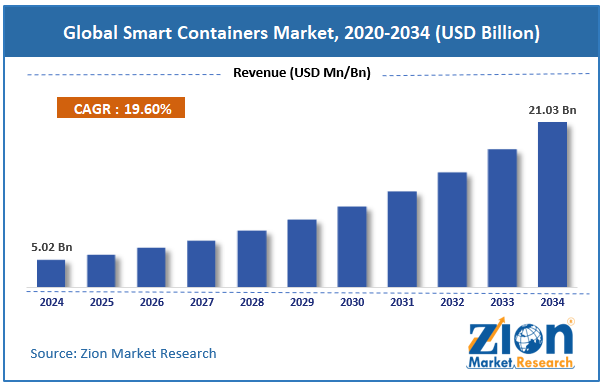

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.02 Billion | USD 21.03 Billion | 19.60% | 2024 |

Smart Containers Industry Perspective:

The global smart containers market size was approximately USD 5.02 billion in 2024 and is projected to reach around USD 21.03 billion by 2034, with a compound annual growth rate (CAGR) of roughly 19.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global smart containers market is estimated to grow annually at a CAGR of around 19.60% over the forecast period (2025-2034)

- In terms of revenue, the global smart containers market size was valued at around USD 5.02 billion in 2024 and is projected to reach USD 21.03 billion by 2034.

- The smart containers market is projected to grow significantly due to the increasing adoption of connected and IoT technologies, the growth of cross-border and e-commerce trade, and a heightened focus on reducing cargo theft and loss.

- Based on offering, the hardware segment is expected to lead the market, while the software segment is expected to grow considerably.

- Based on technology, the international intermodal segment is the dominant segment, while the domestic intermodal segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the asset tracking & management segment is expected to lead the market compared to the supply chain optimization segment.

- Based on end-use, the food and beverages segment holds the leading share, while the pharmaceuticals segment is expected to experience considerable growth.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Smart Containers Market: Overview

Smart containers are advanced shipping containers equipped with technologies such as GPS tracking, IoT sensors, and real-time monitoring systems, enhancing supply chain visibility and efficiency. They enable businesses to track location, humidity, temperature, and security status during transit, thereby decreasing the risk of theft, damage, and delays. The global smart containers market is poised for notable growth, driven by the increasing demand for real-time supply chain visibility, the expansion of worldwide e-commerce and trade, and a heightened focus on cold chain logistics. Businesses are actively needing real-time tracking of goods to prevent delays and losses. Smart containers offer accurate data on condition and location, decreasing operational risks. This visibility improves customer satisfaction and enhances decision-making.

Moreover, the growing international trade and the advancement of e-commerce are driving the demand for effective logistics. Smart containers simplify shipping operations, decreasing delivery costs and times. With cross-border transactions on the rise, the need for advanced tracking solutions is growing. Also, the food and pharmaceutical industries heavily depend on cold chain logistics to maintain product integrity. Smart containers embedded with humidity and temperature sensors promise safety standards and compliance. This is vital for transporting sensitive and perishable goods.

Nevertheless, the global market faces limitations due to factors such as high initial deployment costs and low network connectivity in remote regions. Smart containers need higher investment in software, hardware, and connectivity infrastructure. This high upfront cost discourages medium and small logistics companies from adopting. It plays a key role in the developing economies. Furthermore, smart containers depend on cellular and IoT networks for real-time tracking. In underdeveloped and remote regions, connectivity issues hamper unified monitoring. This decreases the efficiency of smart container solutions in global shipping routes.

Still, the global smart containers industry benefits from several favorable factors, including the rising adoption of digital supply chains and growth in cold chain transportation. With digitalization and Industry 4.0 trends, businesses are inclining towards smart logistics solutions. Smart containers fit perfectly in automated supply chains, offering growth potential. This move will boost the industry adoption worldwide. The demand for temperature-controlled shipments in the food and pharmaceutical industries is on the rise. Smart containers with modernized temperature monitoring can hold leadership in this niche domain. This offers major revenue streams for manufacturers.

Smart Containers Market: Growth Drivers

How do stringent regulatory requirements for cargo safety drive the global smart containers market?

Regulatory bodies and governments are mandating stringent norms for cargo handling, especially for chemicals, pharmaceuticals, and food products. The Drug Supply Chain Security Act, in conjunction with FDA and IMO regulations, requires enhanced security and transparency in the transportation of sensitive goods. Smart containers comply with these requirements by offering data on tamper-proof security, humidity, and temperature. Recent news reports show Pfizer is adopting smart containers for COVID-19 vaccine shipments to comply with universal regulations.

Surge in perishable goods shipments and e-commerce propel the market

The rapid growth of cross-border trade and e-commerce for perishable goods is driving the adoption of smart containers, influencing the global smart containers market. Consumers demand real-time shipment tracking and faster deliveries, making smart containers appealing to the logistics providers.

Furthermore, the growth in global exports of perishables, such as fresh produce, dairy, and seafood, requires temperature-controlled smart containers. Companies like Hapag-Lloyd announced the expansion of their smart reefer container fleet in 2024, catering to the growing demand for perishable shipments.

Smart Containers Market: Restraints

Lack of standardization and interoperability is hampering the market progress

The absence of global standards for communication protocols, IoT devices, and data integration creates interoperability issues among different platforms and vendors. This lack of compatibility compels logistics companies to invest in custom integrations or multiple systems, raising complexity and costs. Recent reports from the Digital Container Shipping Association (DCSA) emphasize the urgent need for standardization to facilitate unified data exchange. Without this, worldwide scalability will be restricted.

Smart Containers Market: Opportunities

How does growth in reusable and shared container ecosystems (container-as-a-service) offer advantageous conditions for the development of the smart containers market?

The transition from one-way packaging to reusable containers requires smart containers that can effectively track condition, location, and utilization throughout reuse cycles. Pooling platforms and fleet owners can use smart telemetry to decrease losses, enhance turn times, and automate billing for late returns, thus raising ROI on reusable assets.

Pooling models allow economies of scale and recurring revenue. Telemetry enables operators to optimize fleet size and decrease deadheading. Investment dollars flowing into circular logistics pilots mean early movers can secure anchor consumers. Offering modular sensor packages and serviceable, durable units for multi-year life cycles is a clear product strategy in the domain, thereby benefiting the smart containers industry.

Smart Containers Market: Challenges

How do price sensitivity and procurement cycles in conservative industries limit the growth of the smart containers market?

Large shippers and 3PLs typically operate on long procurement cycles and thin margins, requiring lengthy deployment pilots and clear ROI before they commit; this hinders speedy scaling for novel smart-container entrants. Several buyers expect hardware to amortize over the coming years; they avoid recurring fees and demand low device cost, which conflicts with vendors' SaaS revenue objectives.

Presenting quantifiable benefits (lower detention, reduced spoilage, and faster turns) requires long pilots and access to claims data. This data is hard to secure and increase cross-partner relationships. Shifts in freight demand or economic downturns can also lead to the deprioritization of capital investments in visibility technology. Successful vendor strategies, hence, comprise flexible commercial pilots, strong case studies with verifiable KPIs, and usage-based pricing.

Smart Containers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Containers Market |

| Market Size in 2024 | USD 5.02 Billion |

| Market Forecast in 2034 | USD 21.03 Billion |

| Growth Rate | CAGR of 19.60% |

| Number of Pages | 212 |

| Key Companies Covered | MSC (Mediterranean Shipping Company), Maersk Line, Traxens Loginno, Globe Tracker, DHL SmartSensor, Orbcomm Inc., ZillionSource Technologies, Phillips Connect Technologies, Aeler Technologies, Klinge Corporation, Identec Solutions, Shenzhen CIMC Intelligent Technology Co. Ltd., Savi Technology, Hapag-Lloyd AG., and others. |

| Segments Covered | By Offering, By Technology, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Containers Market: Segmentation

The global smart containers market is segmented by offering, technology, application, end-use, and region.

Based on offering, the global smart containers industry is divided into hardware, software, and services. The hardware segment holds a substantial market share due to the increasing demand for real-time visibility and condition monitoring.

On the other hand, the software segment holds a second-leading share, as it enables data analytics, integration with logistics platforms, and the delivery of real-time alerts.

Based on technology, the global market is segmented into domestic intermodal and international intermodal. The international intermodal sector holds the largest share of the market because smart containers are widely used for cross-border shipping and global trade.

Conversely, the domestic intermodal segment ranks second, primarily due to its use for inland transportation within economies. Its adoption is attributed to the demand for pharmaceuticals, perishable goods, and high-value domestic cargo.

Based on application, the global smart containers market is segmented into asset tracking & management, supply chain optimization, safety and security, and others. The asset tracking & management segment accounts for the largest share of the market due to the core function of smart containers to offer real-time visibility of container and goods location.

However, the supply chain optimization segment also progresses steadily, as smart containers play a vital role in minimizing delays, enhancing route efficiency, and reducing fuel costs.

Based on end-use, the global market is segmented into food and beverages, pharmaceuticals, oil and gas, chemicals, and others. The food & beverages segment dominates the market due to high demand for humidity-monitored and temperature-controlled shipments.

Nevertheless, the pharmaceuticals segment holds a second-leading share in the market, driven by the growing need for condition monitoring and precise temperature control.

Smart Containers Market: Regional Analysis

What gives North America a competitive edge in the global Smart Containers Market?

North America is projected to maintain its dominant position in the global smart containers market, owing to its strong presence of advanced logistics infrastructure, high adoption of digital supply chain solutions, and growing cross-border and e-commerce trade with Mexico and Canada. North America holds well-established transportation and logistics networks worldwide. The United States alone manages freight worth more than $19 trillion yearly. This robust infrastructure supports the large-scale adoption of smart container solutions, enhancing efficiency and visibility.

The region leads in IoT integration for logistics, with the United States' IoT industry anticipated to reach USD 390 billion by 2030. Smart containers benefit from this infrastructure by leveraging automation, predictive analytics, and real-time tracking. This trend is aligned with substantial investment from tech-based logistics companies. The growth in e-commerce and USMCA has driven cross-border trade flows. In 2022, U.S. e-commerce sales surpassed USD 1 trillion, driving demand for efficient logistics solutions, including smart containers. This expansion propels the adoption of enhanced delivery accuracy and asset tracking.

Europe maintains its position as the second-largest region in the global smart containers industry, thanks to its strong logistics and shipping infrastructure, high regulatory standards for supply chain transparency, and rapid digitalization. Europe boasts the most advanced logistics networks worldwide, supported by major ports such as Hamburg, Rotterdam, and Antwerp. The European logistics industry was estimated to be worth Euro 1.1 trillion in 2022, making it a key hub for smart container adoption. This ecosystem enables the unified implementation of an IoT-based container solution.

The European Union mandates stringent regulations on cold chain compliance, cargo tracking, and environmental sustainability. Smart containers help businesses comply with regulations like EU GDP (Good Distribution Practice) for pharmaceuticals. These regulatory needs majorly boost the demand for real-time monitoring solutions. European logistics are rigorously adopting AI, IoT, and blockchain for supply chain visibility. The EU's Digital Transport and Logistics Forum (DTLF) programs further encourage digital integration in shipping. This technology-based approach enhances the use of smart containers for route optimization and predictive analytics.

Smart Containers Market: Competitive Analysis

The leading players in the global smart containers market are:

- MSC (Mediterranean Shipping Company)

- Maersk Line

- Traxens Loginno

- Globe Tracker

- DHL SmartSensor

- Orbcomm Inc.

- ZillionSource Technologies

- Phillips Connect Technologies

- Aeler Technologies

- Klinge Corporation

- Identec Solutions

- Shenzhen CIMC Intelligent Technology Co. Ltd.

- Savi Technology

- Hapag-Lloyd AG.

Smart Containers Market: Key Market Trends

Growing adoption of blockchain for transparency:

Blockchain technology is being assimilated into smart container systems to ensure secure and tamper-proof transactions. It improves trust among stakeholders by maintaining an undisputable record of shipment location and conditions. This trend is primarily observed in regulated and high-value industries, such as the pharmaceutical sector.

Implementation of 5G for real-time data transfer:

The launch of 5G networks is enhancing connectivity for smart containers, allowing more reliable and faster data transmission. This enables constant monitoring, even in remote locations, thereby improving global tracking capabilities. With the increase in 5G adoption, the efficiency and functionality of smart containers are expected to rise remarkably.

The global smart containers market is segmented as follows:

By Offering

- Hardware

- Software

- Services

By Technology

- Domestic Intermodal

- International Intermodal

By Application

- Asset Tracking & Management

- Supply Chain Optimization

- Safety and Security

- Others

By End Use

- Food and Beverages

- Pharmaceuticals

- Oil and Gas

- Chemicals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Smart containers are advanced shipping containers equipped with technologies such as GPS tracking, IoT sensors, and real-time monitoring systems, enhancing supply chain visibility and efficiency. They enable businesses to track location, humidity, temperature, and security status during transit, thereby decreasing the risk of theft, damage, and delays.

The global smart containers market is projected to grow due to increasing demand for international logistics and trade, stringent regulations for cargo security and safety, and advancements in sensors and wireless communication technologies.

According to study, the global smart containers market size was worth around USD 5.02 billion in 2024 and is predicted to grow to around USD 21.03 billion by 2034.

The CAGR value of the smart containers market is expected to be approximately 19.60% from 2025 to 2034.

The food and beverages segment holds the largest share in the smart containers market, driven by the real-time monitoring of shipments and high demand for temperature-controlled products.

Emerging trends include the integration of AI and IoT, 5G-enabled real-time tracking, blockchain-based transparency, and advanced cold chain monitoring for perishable goods.

North America is expected to lead the global smart containers market during the forecast period.

The key players profiled in the global smart containers market include MSC (Mediterranean Shipping Company), Maersk Line, Traxens Loginno, Globe Tracker, DHL SmartSensor, Orbcomm Inc., ZillionSource Technologies, Phillips Connect Technologies, Aeler Technologies, Klinge Corporation, Identec Solutions, Shenzhen CIMC Intelligent Technology Co., Ltd., Savi Technology, and Hapag-Lloyd AG.

Stakeholders should invest in AI-driven and IoT solutions, adopt blockchain for transparency, form strategic partnerships, and focus on cost-efficient, sustainable logistics innovations.

The report examines key aspects of the smart containers market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed