Slack Wax Market Size, Share, Trends, Growth and Forecast 2034

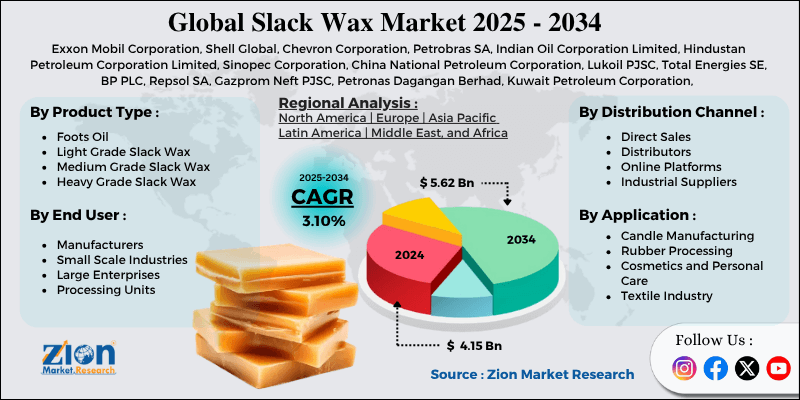

Slack Wax Market By Product Type (Foots Oil, Light Grade Slack Wax, Medium Grade Slack Wax, and Heavy Grade Slack Wax), By Application (Candle Manufacturing, Rubber Processing, Cosmetics and Personal Care, and Textile Industry), By Distribution Channel (Direct Sales, Distributors, Online Platforms, and Industrial Suppliers), By End-User (Manufacturers, Small Scale Industries, Large Enterprises, and Processing Units), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

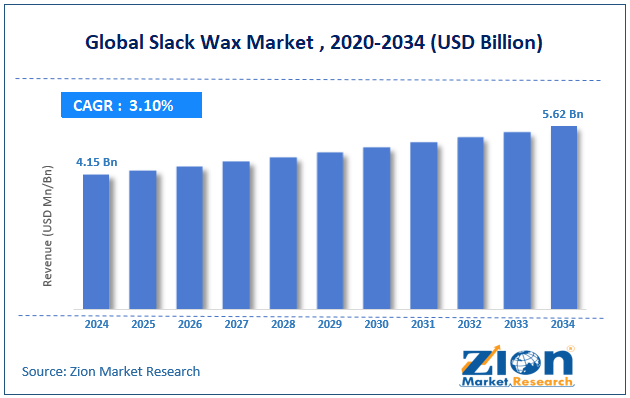

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.15 Billion | USD 5.62 Billion | 3.10% | 2024 |

Slack Wax Industry Perspective:

The global slack wax market was valued at approximately USD 4.15 billion in 2024 and is expected to reach around USD 5.62 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 3.10% between 2025 and 2034.

Slack Wax Market: Overview

Slack wax is a petroleum-derived product obtained during the dewaxing process of lubricating oil production, serving as a key raw material for various industries. This semi-refined petroleum product has a residual oil content and serves as an intermediate product between crude oil processing and fully refined paraffin wax production.

The slack wax market covers many industries, such as candle making, rubber processing, cosmetics, and textile applications, where it acts as a processing aid and ingredient modifier. Its versatility comes from its moldable properties, good binding properties, and ability to improve product flexibility and durability.

The market is for manufacturers seeking cost-effective alternatives to fully refined waxes that meet their quality standards for specific applications.

The increasing demand from emerging economies and growing applications in specialty chemical production are expected to drive substantial growth in the global slack wax industry throughout the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global Slack Wax market is estimated to grow annually at a CAGR of around 3.10% over the forecast period (2025-2034)

- In terms of revenue, the global slack wax market size was valued at around USD 4.15 billion in 2024 and is projected to reach USD 5.62 billion by 2034.

- The slack wax market is projected to grow significantly due to increasing demand from candle manufacturing industries, the expansion of rubber processing applications, and rising consumption in the cosmetics and personal care sectors.

- Based on product type, medium-grade slack wax leads the segment and is expected to continue dominating the global market.

- Based on the application, candle manufacturing is expected to lead the market.

- Based on the distribution channel, direct sales are expected to account for the largest market share.

- Based on end-users, manufacturers are expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Slack Wax Market: Growth Drivers

Cost-effectiveness and raw material availability for industrial applications

The slack wax market is growing as more industries see the cost benefits it offers compared to fully refined paraffin wax. Slack wax is usually 30–40% cheaper than refined wax, making it appealing to manufacturers with small budgets or high production needs.

Companies can save money on materials without compromising product quality when very high purity is not required. Since slack wax is a byproduct of making lubricating oils, it is widely available, which keeps the supply steady and prices stable. This cost-saving edge is encouraging its use in areas such as candle making, rubber processing, and chemical production, where maintaining low expenses is crucial.

Expanding applications in the specialty chemical and cosmetic industries

The slack wax industry is benefiting from the growing recognition of its multi-functional properties in specialty chemical formulations and cosmetic applications. Cosmetic companies use slack wax as an emollient, texture enhancer, and stability improver in creams, lotions, and hair care products.

Chemical processors add slack wax to formulations for adhesives, sealants, and protective coatings, where its binding properties and moisture resistance give valuable performance benefits. The textile industry uses slack wax in fabric treatment processes to make water-repellent and durable outdoor and technical textiles.

Pharmaceutical applications are emerging where slack wax is used as a tablet-coating agent and as a controlled-release mechanism for drug delivery systems.

Slack Wax Market: Restraints

Quality inconsistency and refining requirements

Despite the demand, the slack wax market has quality variations and needs additional processing to meet specific application requirements. The residual oil content in slack wax varies significantly from one batch to another and from one refinery to another, which creates consistency issues for manufacturers.

Some applications need further refining or purification steps, which add to the processing cost and complexity of the supply chain. Color and impurities can affect the final product's appearance and performance, especially in cosmetic and food-grade applications where strict quality standards apply. Storage and handling requirements for slack wax are more demanding than refined products due to its semi-processed nature.

Slack Wax Market: Opportunities

Growing demand from emerging markets and developing economies

The slack wax market presents opportunities as developing economies experience industrial growth and demand for cost-effective raw materials across various manufacturing sectors.

Countries in Asia, Africa, and Latin America are building new factories to produce candles, cosmetics, and rubber goods, where slack wax is a more cost-effective option compared to costly imported refined waxes.

As cities grow and new infrastructure is built, there is more demand for building products, glues, and coatings that use slack wax as a main ingredient. Government programs that support local manufacturing and reduce reliance on imports help boost the use of domestic slack wax.

Slack Wax Market: Challenges

Environmental regulations and sustainability concerns

The slack wax market faces increasing pressure from environmental regulations and sustainability initiatives that scrutinize petroleum-derived products and their production processes.

Stricter emissions rules for refineries and chemical plants can increase production costs and make it more difficult to obtain slack wax from some suppliers.

More consumers now care about the environment, so they prefer bio-based and renewable products instead of petroleum-based ones, which could lower future demand for slack wax.

Rules regarding waste disposal from slack wax processing also need more steps for proper handling and environmental safety. Global trade rules are starting to favor greener and eco-friendly products, which could harm export opportunities for slack wax manufacturers.

Slack Wax Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Slack Wax Market |

| Market Size in 2024 | USD 4.15 Billion |

| Market Forecast in 2034 | USD 5.62 Billion |

| Growth Rate | CAGR of 3.10% |

| Number of Pages | 213 |

| Key Companies Covered | Exxon Mobil Corporation, Shell Global, Chevron Corporation, Petrobras SA, Indian Oil Corporation Limited, Hindustan Petroleum Corporation Limited, Sinopec Corporation, China National Petroleum Corporation, Lukoil PJSC, Total Energies SE, BP PLC, Repsol SA, Gazprom Neft PJSC, Petronas Dagangan Berhad, Kuwait Petroleum Corporation, Abu Dhabi National Oil Company, Saudi Aramco, Reliance Industries Limited, Essar Oil Limited, Nayara Energy Limited, and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Slack Wax Market: Segmentation

The global slack wax market is segmented into product type, application, distribution channel, end-user, and region.

Based on product type, the market is segregated into foot oil, light-grade slack wax, medium-grade slack wax, and heavy-grade slack wax. Medium-grade slack wax leads the market due to its balanced properties, versatility across multiple applications, and optimal cost-performance ratio for most industrial uses.

Based on application, the slack wax industry is classified into candle manufacturing, rubber processing, cosmetics and personal care, and the textile industry. Candle manufacturing holds the largest market share due to the high volume consumption, cost-effectiveness for mass production, and suitable performance characteristics for various candle types and formulations.

Based on the distribution channel, the slack wax market is divided into direct sales, distributors, online platforms, and industrial suppliers. Direct sales are expected to lead the market during the forecast period due to bulk purchasing requirements, customized specifications, and established relationships between producers and large-scale industrial users.

Based on the end-user, the market is segmented into manufacturers, small-scale industries, large enterprises, and processing units. Manufacturers lead the market share due to high volume requirements, consistent demand patterns, and integration of slack wax into established production processes across multiple industrial sectors.

Slack Wax Market: Regional Analysis

Asia Pacific to lead the market

The Asia Pacific region leads the global slack wax market due to rapid industrialization, large refinery capacity, and strong demand from the manufacturing sectors of China, India, and Southeast Asian countries. The region accounts for around 40% of the global market share, and China is the largest producer and consumer of slack wax products.

Manufacturing hubs in the area use slack wax in various applications, from candle making to rubber processing, and hence, there is a sustained demand for cost-effective raw materials. The region has an extensive petroleum refining infrastructure, which provides a slack wax supply chain and competitive pricing.

Growing cosmetics and personal care industries in major Asian markets are driving demand for slack wax as an ingredient. Government support for local manufacturing and industrial development policies is further encouraging the consumption of slack wax across various applications.

North America is expected to show steady growth

North America is growing in the slack wax industry as established industries look for cost-effective alternatives and new applications emerge in specialty chemical segments.

The region’s mature refining industry provides a stable slack wax supply, and advanced manufacturing capabilities drive innovation in product applications and quality. Candle making is a big user of slack wax, with both traditional and specialty candle makers using different grades for different product lines.

Cosmetic and personal care companies are incorporating slack wax into their formulations for texture and product stability. Environmental regulations are driving cleaner processing methods and more sustainable slack wax production.

Recent Market Developments:

- In March 2025, Petro Wax Industries introduced a new line of premium-grade slack wax products specifically designed for cosmetic and personal care applications, featuring enhanced purity levels and consistent quality specifications.

- In January 2025, Asian Petroleum announced the expansion of its slack wax production capacity with a new processing facility in Southeast Asia, designed to meet the growing regional demand from manufacturing industries.

Slack Wax Market: Competitive Analysis

The global slack wax market is led by players like:

- Exxon Mobil Corporation

- Shell Global

- Chevron Corporation

- Petrobras SA

- Indian Oil Corporation Limited

- Hindustan Petroleum Corporation Limited

- Sinopec Corporation

- China National Petroleum Corporation

- Lukoil PJSC

- Total Energies SE

- BP PLC

- Repsol SA

- Gazprom Neft PJSC

- Petronas Dagangan Berhad

- Kuwait Petroleum Corporation

- Abu Dhabi National Oil Company

- Saudi Aramco

- Reliance Industries Limited

- Essar Oil Limited

- Nayara Energy Limited

The global slack wax market is segmented as follows:

By Product Type

- Foots Oil

- Light Grade Slack Wax

- Medium Grade Slack Wax

- Heavy Grade Slack Wax

By Application

- Candle Manufacturing

- Rubber Processing

- Cosmetics and Personal Care

- Textile Industry

By Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

- Industrial Suppliers

By End User

- Manufacturers

- Small Scale Industries

- Large Enterprises

- Processing Units

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Slack wax is a petroleum-derived product obtained during the dewaxing process of lubricating oil production and is a key raw material for many industries.

The slack wax market is expected to be driven by cost advantages over refined wax products, increasing demand from the candle manufacturing industry, expanding applications in the cosmetics and personal care sectors, growing industrial activities in emerging markets, and rising consumption in rubber processing applications.

According to our study, the global slack wax market was worth around USD 4.15 billion in 2024 and is predicted to grow to around USD 5.62 billion by 2034.

The CAGR value of the slack wax market is expected to be around 3.10% during 2025-2034.

The global slack wax market will register the highest revenue contribution from Asia Pacific during the forecast period.

Key players in the slack wax market include Exxon Mobil Corporation, Shell Global, Chevron Corporation, Petrobras SA, Indian Oil Corporation Limited, Hindustan Petroleum Corporation Limited, Sinopec Corporation, China National Petroleum Corporation, Lukoil PJSC, Total Energies SE, BP PLC, Repsol SA, Gazprom Neft PJSC, Petronas Dagangan Berhad, Kuwait Petroleum Corporation, Abu Dhabi National Oil Company, Saudi Aramco, Reliance Industries Limited, Essar Oil Limited, and Nayara Energy Limited.

The report provides a comprehensive analysis of the slack wax market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technological innovations, distribution strategies, and industrial applications that shape the ecosystem of the petroleum-derived products market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed