Rubber Processing Chemicals Market Size, Share, Growth Report 2032

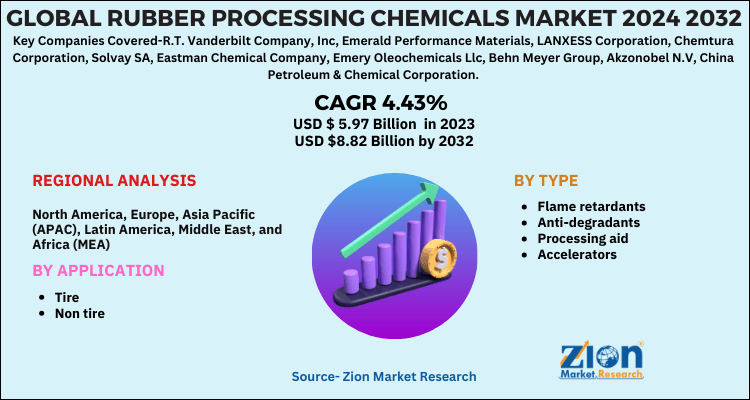

Rubber Processing Chemicals Market: By Application (Tire, Non Tire), By Type (Flame Retardants, Anti-Degradants, Processing Aid, Accelerators), and By Region: Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

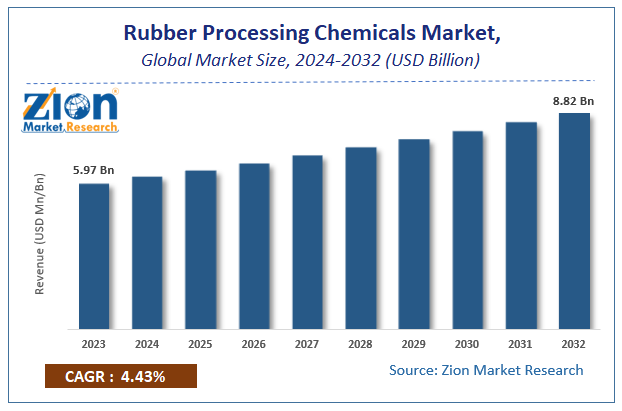

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.97 Billion | USD 8.82 Billion | 4.43% | 2023 |

Rubber Processing Chemicals Market Insights

Zion Market Research has published a report on the global Rubber Processing Chemicals Market, estimating its value at USD 5.97 Billion in 2023, with projections indicating that it will reach USD 8.82 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.43% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Rubber Processing Chemicals Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

The worldwide rubber processing chemicals market is expanding progressively all across the globe as a result of the rising stipulation across the tires industry and from other different end-use industries. Key firms are involved in constant R&D activities and product innovation on account of strict environmental guidelines. The market is distinguished by new product expansions and launches, as companies are attempting to enlarge their customer base. For example, Chemtura, in April 2016, declared the capacity extension of Adiprene LF MDI polyurethane elastomers production unit in Latina, Italy. This project will provide enhanced processing over MbOCA-free alternatives in the urethane applications.

Rubbers also known as elastomers are the polymers with elastic and deformation properties. Rubber processing is the technique of processing the rubber to finished products by using various steps such as compounding, mixing, vulcanizing and shaping. About 70% of the rubber products present in the market utilizes synthetic rubber.

Rubber processing chemicals enhance the rubber properties in terms of heat resistance, water, and mechanical stress resistance. Therefore, rubber processing chemicals find applications in various industries such as in rubber and automobile industries which are expected to drive the market growth of rubber processing chemicals in the coming years. Rubber based products such as tire, mats, hoses, floor, gloves and belts are highly consumed across the globe. This has led to the high growth of rubber industry in turn exhibiting growth of rubber processing chemicals market in the coming years. Stringent regulations imposed by the governing bodies on harmful emissions exhaled out during rubber processing may hinder the rubber processing chemical market growth in the forecast period. Nevertheless, increasing demand for bio-based rubber along with growing demand for rubber processing chemicals from the emerging countries is likely to open the new avenue for rubber processing chemicals market in the coming years.

Growth Factors

Rubber is used to manufacture a variety of products such as gloves, tires, mats, flooring, pipes, and belts. Its improved resistance against the effects of heat, sunlight, oxygen, mechanical stress, and ozone is leading the global market growth. Owing to growing domestic demand for automobiles and an extensive network of automotive manufacturers, the rubber processing chemical market in the U.S. is witnessing a surge.

Rubber Processing Chemicals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rubber Processing Chemicals Market |

| Market Size in 2023 | USD 5.97 Billion |

| Market Forecast in 2032 | USD 8.82 Billion |

| Growth Rate | CAGR of 4.43% |

| Number of Pages | 120 |

| Key Companies Covered | R.T. Vanderbilt Company, Inc, Emerald Performance Materials, LANXESS Corporation, Chemtura Corporation, Solvay SA, Eastman Chemical Company, Emery Oleochemicals Llc, Behn Meyer Group, Akzonobel N.V, China Petroleum & Chemical Corporation |

| Segments Covered | By Application, By Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

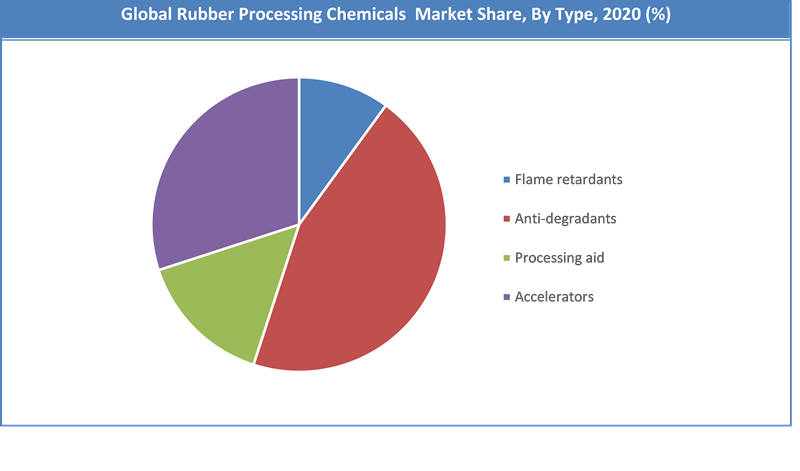

The rubber processing chemicals market can be segmented based on type and application. On the basis of types, the rubber processing chemicals market can be segmented as flame retardants, anti-degradants, processing aid and accelerators. Some of the wide spread applications of rubber processing chemicals are non tire and tire.

On the basis of types, the rubber processing chemicals market can be segmented as flame retardants, anti-degradants, processing aid and accelerators. Anti- degradants emerged as the potent segment among all in 2015 owing to its extensive properties when mixed with accelerators for obtaining high tensile strength, better finishing. Anti- degradants are generally blended with accelerators during vulcanization process. Numerous applications of rubber processing chemicals are non tire and tire. The tire was the major segment with the highest percentage of market share in 2015. Mostly tire is used in automobile industry. This factor has led to the increase in demand for the tire which in turn is expected to drive the demand for rubber processing chemicals market in the near future.

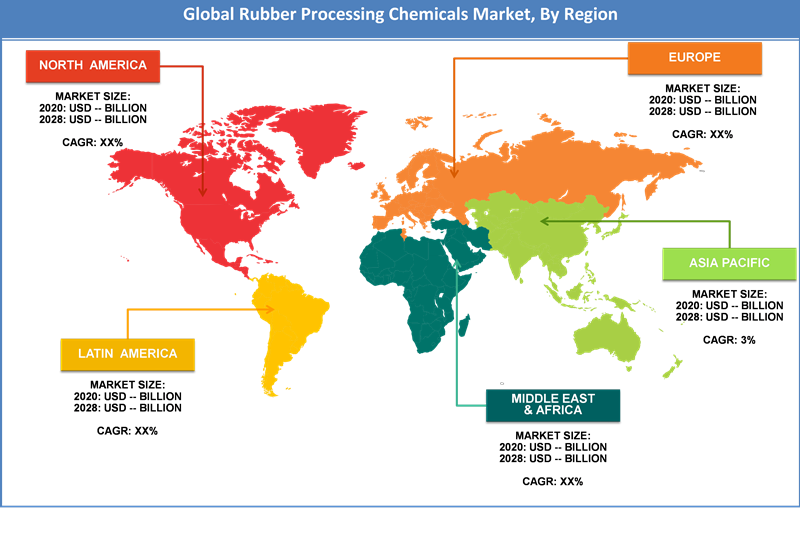

Asia-Pacific is expected to witness predominant growth for the rubber processing chemicals within the forecast period. China accounted for the largest share of the rubber processing chemical market due to the presence of huge consumers for rubber processing chemicals in this region. Also, growing rubber industry in China is likely to trigger the demand for rubber processing chemical market owing to the high use of rubber processing chemicals in the rubber industry. Europe was the second largest market for rubber processing chemicals followed by North America in 2015. This was mainly due to high demand for rubber processing chemicals from the automobile industry. However, various stringent rules led by the governing bodies are likely to impact the growth of rubber processing chemicals market in North America. Latin America is anticipated to show decent growth over the coming years owing to growing rubber industry in Brazil. The Middle East and Africa are likely to exhibit lucrative growth in the forecast period.

Regional Analysis Preview

North America and Europe were the primary markets in 2018 for the rubber processing chemicals market and Europe is projected to observe considerable expansion over the near future. Nevertheless, strict regulations passed by North America’s government on the rubber processing may hamper the rubber processing chemicals market growth in this region.

The rising requirement for rubber processing chemicals in Germany as a result of its numerous end-user applications like automobile industry might propel the growth of the rubber processing chemicals market in Europe. The mounting R&D spending for rubber processing chemicals owing to laws implemented by the government and strong friendship owing to the existence of several substitute products and vendors is anticipated to drive the rubber processing chemical market.

Key Market Players & Competitive Landscape

Key participants profiled in the report include:

- R.T. Vanderbilt Company, Inc

- Emerald Performance Materials

- LANXESS Corporation

- Chemtura Corporation

- Solvay SA

- Eastman Chemical Company

- Emery Oleochemicals Llc

- Behn Meyer Group

- Akzonobel N.V

- China Petroleum & Chemical Corporation

are some of the major players in the rubber processing chemical market.

The global Rubber Processing Chemicals Market are segmented as follows:

By Application

- Tire

- Non tire

By Type

- Flame retardants

- Anti-degradants

- Processing aid

- Accelerators

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Rubber Processing Chemicals Market was valued at US$ 5.97 Billion in 2023.

The global Rubber Processing Chemicals Market is expected to reach US$ 8.82 B by 2032 at a CAGR of about 4.43% from 2024 to 2032.

Rubber is used to manufacture a variety of products such as gloves, tires, mats, flooring, pipes, and belts. Its improved resistance against the effects of heat, sunlight, oxygen, mechanical stress, and ozone is leading the global market growth.

North America in 2023 ruled the Rubber Processing Chemicals Market and was believed to be the highest income-generating area all over the globe.

Key participants profiled in the report include R.T. Vanderbilt Company, Inc, Emerald Performance Materials, LANXESS Corporation, Chemtura Corporation, Solvay SA, Eastman Chemical Company, Emery Oleochemicals Llc, Behn Meyer Group, Akzonobel N.V, China Petroleum & Chemical Corporation are some of the major players in the rubber processing chemical market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed