Pyrolytic Boron Nitride (PBN) Market Size, Share, Trends, Growth 203

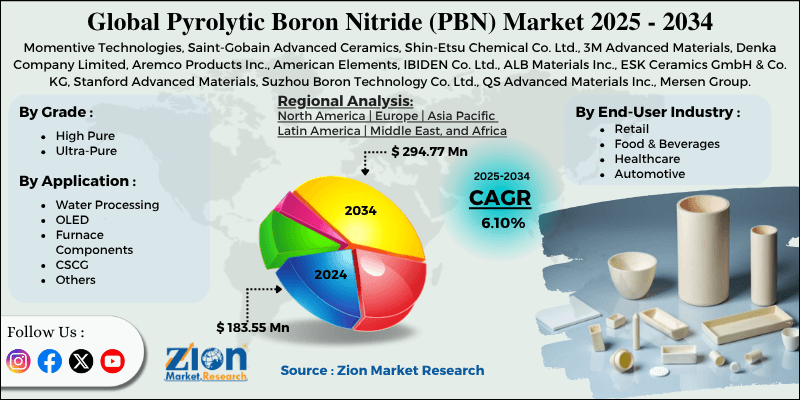

Pyrolytic Boron Nitride (PBN) Market By Grade (High Pure, Ultra-Pure), By Application (Water Processing, OLED, Furnace Components, CSCG, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

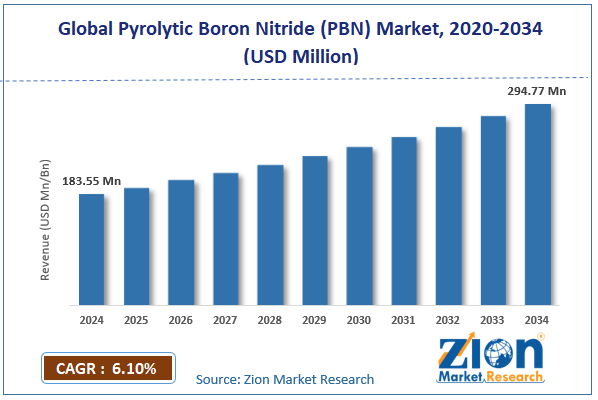

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 183.55 Million | USD 294.77 Million | 6.10% | 2024 |

Pyrolytic Boron Nitride (PBN) Industry Perspective:

The global pyrolytic boron nitride (PBN) market size was approximately USD 183.55 million in 2024 and is projected to reach around USD 294.77 million by 2034, with a compound annual growth rate (CAGR) of approximately 6.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global pyrolytic boron nitride (PBN) market is estimated to grow annually at a CAGR of around 6.10% over the forecast period (2025-2034)

- In terms of revenue, the global pyrolytic boron nitride (PBN) market size was valued at around USD 183.55 million in 2024 and is projected to reach USD 294.77 million by 2034.

- The pyrolytic boron nitride (PBN) market is projected to grow significantly owing to the rise in LED manufacturing applications, the growth of the aerospace and defense sector, and increasing adoption in thin-film deposition equipment.

- Based on grade, the high-purity segment is expected to lead the market, while the ultra-pure segment is anticipated to experience significant growth.

- Based on application, the furnace components segment is the largest, while the CSCG segment is projected to experience substantial revenue growth over the forecast period.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Pyrolytic Boron Nitride (PBN) Market: Overview

Pyrolytic boron nitrate is a high-performing ceramic material produced through (CVD) chemical vapor deposition of nitrogen and boron at higher temperatures. It is non-porous, highly pure, and offers exceptional chemical inertness, thermal stability, and electrical insulation properties. The global pyrolytic boron nitride (PBN) market is poised for significant growth due to the expansion of the semiconductor manufacturing industry, the rise of optoelectronics and the LED industry, and the increasing use in high-temperature furnaces. The increase in semiconductor chip fabrication is driving the use of PBN heaters and crucibles. Its high-class thermal stability and chemical inertness make it essential for processes such as epitaxy and MOCVD. As global semiconductor capacity increases, demand for PBN continues to rise.

Moreover, PBN's purity and smooth surface make it suitable for the crystal growth of GaN, GaAs, and other LED substrates. With the worldwide LED industry exceeding $100 billion, PBN components are essential for effective growth chambers. This fuels the adoption in the automotive, display, and lighting industries.

Furthermore, research-grade and industrial high-temperature furnaces need materials that resist thermal shock. PBN's high melting point and oxidation resistance make it suitable for heaters, crucibles, and insulation. The growth of material science research and aerospace increases its demand.

Nevertheless, the global market faces limitations due to factors such as low availability of raw materials and a complex manufacturing process. The production of boron nitrate depends on high-purity boron and nitrogen sources. Supply chain disturbances or price volatility in boron compounds can hamper the industry's growth. The geographic concentration of suppliers further increases reliance risks.

Likewise, CVD-based fabrication needs precise temperature and gas flow control. Any deviation that impacts product consistency results in high rejection rates. This challenge offers obstacles for small manufacturers and new entrants. Still, the global pyrolytic boron nitride (PBN) industry benefits from several favorable factors, like the expanding semiconductor foundry infrastructure and growing demand in quantum computing. With global semiconductor fabs established in India, China, the United States, and Europe, PBN's role as a vital material for MOCVD systems is being reinforced. Government-based semiconductor missions improve future demand. Suppliers can capitalize on localized manufacturing hubs.

Additionally, quantum computing hardware requires thermally stable and ultra-clean environments. PBN's insulation and purity make it suitable for qubit fabrication and cryogenic setups. With the growing research, PBN discovers new high-tech applications.

Pyrolytic Boron Nitride (PBN) Market Dynamics

Growth Drivers

How is the pyrolytic boron nitride (PBN) market driven by the growth of the LED and photonics sector?

The proliferation of LED lighting, photonics, and laser diodes is the leading propelling factor of the pyrolytic boron nitride (PBN) market. PBN’s optimal thermal conductivity (up to 60 W/mK) and dielectric strength make it crucial in GaN-on-sapphire and GaAs-based LED manufacturing. Recent investments in micro-LED fabs, particularly in South Korea and China, are increasing the demand for PBN crucibles and substrate carriers. Additionally, advancements in IR photonics and UV have enabled new applications where material stability under harsh temperatures is crucial.

How is the pyrolytic boron nitride (PBN) market propelled by the advancements in plasma systems and vacuum?

PBN's stability in ultra-high vacuum (UHV) and plasma processing environments resulted in its growing use in ion implantation, sputtering systems, and PECVD. PBN's ability to resist plasma erosion and its low dielectric loss make it vital for precision-controlled environments. In 2024, Tokuyama and Kyocera introduced novel variants modified for vacuum coating chambers and magnetron sputtering components. As demand for plasma-enhanced thin-film solutions increases in the fields of optics and electronics, PBN continues to gain dominance as a performance-critical material.

Restraints

Difficulties in large-scale fabrication hamper the market progress

Despite its superior properties, PBN is challenging to machine, shape, and scale for large or complex geometries due to its intricate CVD growth and brittle nature. Fabrication of large crucibles or uniform films requires high-precision vacuum chambers and controlled deposition kinetics, which restrict throughput. These technical intricacies limit PBN's use to niche and high-value applications, rather than mass production. Continuous advancements in CVD reactor design and plasma-assisted deposition have been made, but commercial scalability remains a persistent barrier.

Opportunities

How does the growth in defense, aerospace, and satellite applications open lucrative opportunities for the pyrolytic boron nitride (PBN) sector advancement?

PBN's chemical, thermal, and dielectric stability increases suitability for satellite electronics, nozzles, and aerospace insulation. The global aerospace ceramics industry is projected to reach $28 billion by 2026, driven by increasing demand in space and hypersonic missions. NASA's 2024 CubeSat projects, along with ESA satellite programs, underscore the dependency on advanced ceramics. Defense sector investments in high-temperature propulsion and guidance systems also need PBN components. Collaborations between aerospace manufacturers and PBN producers are generating new revenue streams in high-performance applications, influencing the pyrolytic boron nitride (PBN) industry.

Challenges

Environmental and regulatory compliance limit the market growth

CVD-based PBN production releases chlorinated and ammonia by-products, which are subject to stringent environmental regulations. Compliance with U.S. EPA Clean Air standards and EU REACH 2024 raises operational costs. Producers should invest in waste management systems and advanced scrubbers, which will increase production overheads. Regulatory pressure may restrict growth in some regions. Sustainability demands are prompting some end-users to prefer eco-friendlier substitutes, which is limiting industry growth.

Pyrolytic Boron Nitride (PBN) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pyrolytic Boron Nitride (PBN) Market |

| Market Size in 2024 | USD 183.55 Million |

| Market Forecast in 2034 | USD 294.77 Million |

| Growth Rate | CAGR of 6.10% |

| Number of Pages | 216 |

| Key Companies Covered | Momentive Technologies, Saint-Gobain Advanced Ceramics, Shin-Etsu Chemical Co. Ltd., 3M Advanced Materials, Denka Company Limited, Aremco Products Inc., American Elements, IBIDEN Co. Ltd., ALB Materials Inc., ESK Ceramics GmbH & Co. KG, Stanford Advanced Materials, Suzhou Boron Technology Co. Ltd., QS Advanced Materials Inc., Mersen Group, ZYP Coatings Inc., and others. |

| Segments Covered | By Grade, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pyrolytic Boron Nitride (PBN) Market: Segmentation

The global pyrolytic boron nitride (PBN) market is segmented based on grade, application, and region.

Based on grade, the global pyrolytic boron nitride (PBN) industry is divided into high-purity and ultra-pure. The high-purity segment holds a leading market share due to its extensive use in semiconductors, high-temperature furnaces, and LEDs. It offers an optimal balance of performance, purity, and cost, increasing its suitability for crystal growth crucibles, insulation components, and evaporation sources. Its chemical resistance and superior thermal conductivity support industrial-scale manufacturing. Strong demand from the optoelectronics and electronics device fabrication sectors strengthens the segment's prominence.

On the other hand, the ultra-pure segment holds a secondary position, driven by its significant role in research applications and advanced semiconductor fabrication, which requires extreme purity. It reduces contamination, vital for thin-film deposition, MOCVD systems, and epitaxial growth. Despite its high costs, its superior performance in ultra-high vacuum conditions makes it suitable for applications in aerospace, quantum computing, and nanotechnology. Growing research and development in next-generation electronics continues to drive the segmental dominance.

Based on application, the global pyrolytic boron nitride (PBN) market is segmented into water processing, OLED, furnace components, CSCG, and others. The furnace components segment led due to its high-temperature research and industrial furnaces. PBN's thermal stability, electrical insulation, and chemical inertness make it ideal for crucibles, heaters, and liners. Key industries comprise semiconductor, material research, and LEDs. Growing demand for energy-efficient and high-performance furnaces strengthens the segment's dominance.

Conversely, the CSCG segment holds a second-leading share, fueled by the demand for high-purity crucibles in silicon, sapphire crystal growth, and GaN. PBN crucibles offer contamination and uniform thermal distribution. Despite high costs, their ability to generate defect-free crystals makes them significant for the optoelectronics and semiconductor industries. Rising investments in LED and semiconductor technologies continue to drive the segment.

Pyrolytic Boron Nitride (PBN) Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Pyrolytic Boron Nitride (PBN) Market?

The Asia Pacific is projected to maintain its dominant position in the global pyrolytic boron nitride (PBN) market, driven by its strong semiconductor manufacturing base, the growth of the optoelectronics and LED industries, and high investment in research and development. The APAC region, particularly Japan, South Korea, and China, houses the leading semiconductor production capacity, fueling high demand for PBN liners, crucibles, and furnace components. The region's dominance in chip fabrication promises constant growth for suppliers. The region is a leader in LED production, with the APAC region accounting for 70% of the global LED manufacturing output. PBN's role in crystal growth for LED substrates and epitaxial processes makes it a significant material. The demand for energy efficiency and rapid urbanization augments industry consumption.

Moreover, governments in the Asia Pacific are actively investing in electronics and advanced materials R&D. Economies such as South Korea and Japan spend more than 3% of their GDP on R&D, with a focus on next-generation semiconductor and quantum devices. This propels the demand for high-purity and ultra-pure PBN in precision and experimental applications.

North America maintains its position as the second-largest region in the global pyrolytic boron nitride (PBN) industry, driven by strong electronics and semiconductor manufacturing, advanced R&D, and high-tech applications, as well as demand from the defense and aerospace industries. North America, led by the United States, boasts a sophisticated electronics and semiconductor industry, accounting for more than 20% of global semiconductor revenue. PBN is extensively used in furnace components, crystal growth equipment, and MOCVD systems. The presence of leading chip manufacturers, such as Micron, Intel, and Texas Instruments, promises steady demand for PBN products.

Additionally, the region heavily invests in R&D for next-generation electronics, aerospace technologies, and quantum computing. The U.S. spends over USD 600 billion annually on advanced materials, encouraging the use of ultra-pure PBN in precision labs. This focus on advancement fuels the adoption of high-performing PBN materials.

Furthermore, North America is home to the world's leading defense and aerospace industries, accounting for approximately 40% of global aerospace spending. PBN's thermal stability, electrical insulation, and chemical resistance make it ideal for high-temperature, vacuum, and insulation applications in defense and spacecraft equipment.

Pyrolytic Boron Nitride (PBN) Market: Competitive Analysis

The leading players in the global pyrolytic boron nitride (PBN) market are:

- Momentive Technologies

- Saint-Gobain Advanced Ceramics

- Shin-Etsu Chemical Co. Ltd.

- 3M Advanced Materials

- Denka Company Limited

- Aremco Products Inc.

- American Elements

- IBIDEN Co. Ltd.

- ALB Materials Inc.

- ESK Ceramics GmbH & Co. KG

- Stanford Advanced Materials

- Suzhou Boron Technology Co. Ltd.

- QS Advanced Materials Inc.

- Mersen Group

- ZYP Coatings Inc.

Pyrolytic Boron Nitride (PBN) Market: Key Market Trends

Shift towards ultra-pure PBN for high-tech applications:

Ultra-pure PBN is gaining prominence in nanotechnology, quantum computing, and aerospace research due to its minimal contamination and superior performance under extreme conditions. Companies are primarily investing in ultra-pure variants, despite the high costs associated with them. This trend highlights the growing significance of high-value and precision applications.

Integration with coating technologies & advanced furnace:

PBN is primarily used in conjunction with advanced high-temperature furnace systems, MOCVD, and CVD processes to enhance equipment lifespan and thermal efficiency. Composite and coating innovations improve material durability and decrease contamination risks. This technological integration fuels adoption in high-end optoelectronic and semiconductor manufacturing.

The global pyrolytic boron nitride (PBN) market is segmented as follows:

By Grade

- High Pure

- Ultra-Pure

By Application

- Water Processing

- OLED

- Furnace Components

- CSCG

- Others

By End-User Industry

- Retail

- Food & Beverages

- Healthcare

- Automotive

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pyrolytic boron nitrate is a high-performing ceramic material produced through (CVD) chemical vapor deposition of nitrogen and boron at higher temperatures. It is non-porous, highly pure, and offers exceptional chemical inertness, thermal stability, and electrical insulation properties.

The global pyrolytic boron nitride (PBN) market is projected to grow due to increasing demand from the semiconductor industry, advancements in crystal growth technologies, and the expansion of optoelectronics and electronics markets.

According to study, the global pyrolytic boron nitride (PBN) market size was worth around USD 183.55 million in 2024 and is predicted to grow to around USD 294.77 million by 2034.

The CAGR value of the pyrolytic boron nitride (PBN) market is expected to be around 6.10% during 2025-2034.

The emerging trends in the PBN market include advanced coating technologies, development of ultra-pure grades, integration with next-gen semiconductor and LED manufacturing, and expansion in Asia-Pacific high-tech hubs.

Asia Pacific is expected to lead the global pyrolytic boron nitride (PBN) market during the forecast period.

China is the leading contributor to the global Pyrolytic Boron Nitride (PBN) market.

The key players profiled in the global pyrolytic boron nitride (PBN) market include Momentive Technologies, Saint-Gobain Advanced Ceramics, Shin-Etsu Chemical Co., Ltd., 3M Advanced Materials, Denka Company Limited, Aremco Products, Inc., American Elements, IBIDEN Co., Ltd., ALB Materials Inc., ESK Ceramics GmbH & Co. KG, Stanford Advanced Materials, Suzhou Boron Technology Co., Ltd., QS Advanced Materials Inc., Mersen Group, and ZYP Coatings, Inc.

Leading players are adopting strategic initiatives such as partnerships with semiconductor and LED manufacturers, mergers and acquisitions, expansion of regional production and distribution networks, and product innovation to strengthen their market presence.

The report examines key aspects of the pyrolytic boron nitride (PBN) market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed