Prosthetic Arm Market Size, Share, Trends, Growth and Forecast 2034

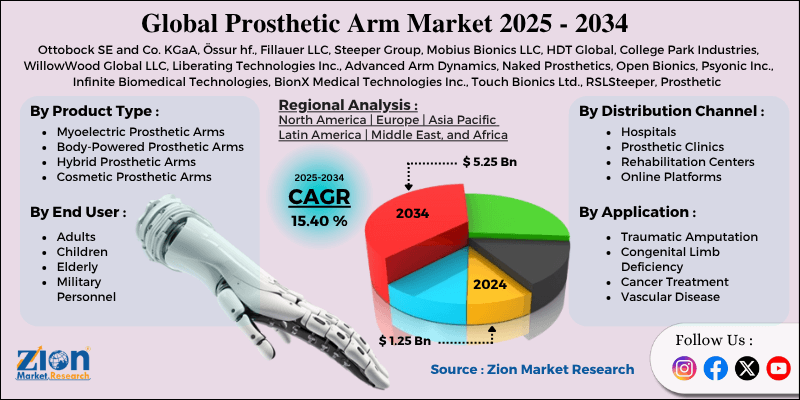

Prosthetic Arm Market By Product Type (Myoelectric Prosthetic Arms, Body-Powered Prosthetic Arms, Hybrid Prosthetic Arms, and Cosmetic Prosthetic Arms), By Application (Traumatic Amputation, Congenital Limb Deficiency, Cancer Treatment, and Vascular Disease), By Distribution Channel (Hospitals, Prosthetic Clinics, Rehabilitation Centers, and Online Platforms), By End-User (Adults, Children, Elderly, and Military Personnel), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

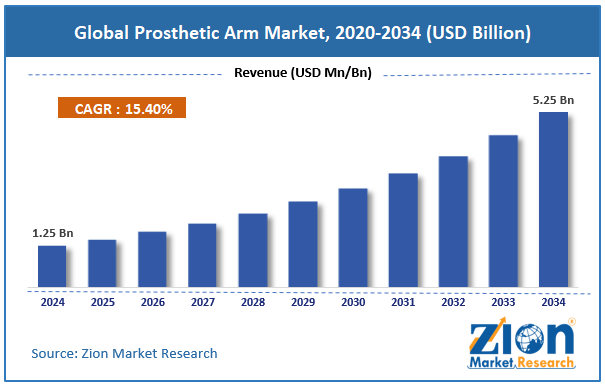

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.25 Billion | USD 5.25 Billion | 15.40% | 2024 |

Prosthetic Arm Industry Perspective:

The global prosthetic arm market was valued at approximately USD 1.25 billion in 2024 and is expected to reach around USD 5.25 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 15.40% between 2025 and 2034.

Prosthetic Arm Market: Overview

Prosthetic arms are artificial limb devices used to replace missing upper limbs for people who have had an amputation or were born with a limb difference. These range from simple mechanical arms to advanced bionic ones with neural control. The market includes myoelectric devices that respond to muscle signals, body-powered types with cables and harnesses, and hybrid models combining different control methods.

Modern prosthetic arms offer a stronger grip, multi-joint movement, and better sensory feedback, helping users perform daily tasks more independently. The market serves trauma patients, cancer survivors, people with congenital conditions, and military personnel needing upper limb restoration.

The increasing prevalence of diabetes-related amputations, advancements in prosthetic technologies, and growing awareness of rehabilitation options are expected to drive substantial growth in the global prosthetic arm industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global prosthetic arm market is estimated to grow annually at a CAGR of around 15.40% over the forecast period (2025-2034)

- In terms of revenue, the global prosthetic arm market size was valued at around USD 1.25 billion in 2024 and is projected to reach USD 5.25 billion by 2034.

- The prosthetic arm market is projected to grow significantly due to the rising incidence of traumatic injuries, technological advancements in neural interfaces, and increased healthcare spending on rehabilitation services.

- Based on product type, myoelectric prosthetic arms lead the segment and are expected to continue dominating the global market.

- Based on the application, traumatic amputation is expected to lead the market.

- Based on the distribution channel, hospitals are anticipated to command the largest market share.

- Based on end-users, adults are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Prosthetic Arm Market: Growth Drivers

Advanced technology integration and neural control systems

The prosthetic arm market is growing as technology turns artificial limbs into biomechanical tools that respond to neural signals and provide feedback. Modern myoelectric prosthetics read muscle contractions and turn them into precise movements, allowing control of multiple joints and complex tasks.

Brain-computer interfaces now enable direct neural control, where implanted sensors and machine learning convert thoughts into prosthetic movements. Carbon fiber and titanium alloys have made prosthetic arms lighter and stronger, reducing fatigue while improving durability. Smart sensors in prosthetic fingers provide feedback on grip pressure and the texture of objects.

Growing prevalence of diabetes and vascular diseases is leading to amputations

The prosthetic arm industry is growing fast due to rising diabetes-related complications and peripheral vascular diseases that often lead to upper limb amputations. Diabetic patients can develop severe circulation issues and infections, which may result in arm removal when other treatments fail.

The global diabetes epidemic affects millions and is increasing the demand for prosthetic rehabilitation. Vascular diseases like peripheral artery disease and thrombosis reduce blood flow, causing tissue death and the need for surgical amputation.

Cancer treatments, especially for bone and soft tissue sarcomas, may also require limb removal to stop the spread of disease. Traumatic amputations from industrial accidents, car crashes, and military injuries add to the need for prosthetic care.

Prosthetic Arm Market: Restraints

High costs and limited accessibility to insurance coverage

Despite all the technology, the prosthetic arm market still faces major challenges due to the high cost of advanced devices and limited insurance coverage, which restricts access to care.

High-end myoelectric prosthetic arms can cost tens of thousands of dollars, making them unaffordable for many individuals who could greatly benefit from them. Insurance coverage differs greatly across countries and providers, with many plans either excluding or limiting prosthetic benefits.

Users also face ongoing expenses for maintenance, replacement parts, and adjustments. Training and rehabilitation, which are essential for proper use, often come with extra costs that may not be covered by insurance. Fitting and customizing prosthetics is a complex process that requires skilled professionals, thereby increasing overall care costs.

Prosthetic Arm Market: Opportunities

Emerging markets and healthcare infrastructure development

The prosthetic arm industry is expanding as developing countries invest in healthcare infrastructure and gain access to advanced medical technologies. Emerging economies are building specialized rehabilitation centers and training prosthetic technicians to meet rising patient needs. International aid groups and government programs are funding prosthetic care in areas hit by conflict, natural disasters, and industrial accidents.

Telemedicine is helping deliver remote consultations and follow-up care, making specialized services available in underserved regions. Mobile prosthetic clinics are reaching rural areas with limited healthcare facilities. Awareness campaigns and education programs are reducing the stigma around prosthetic use and encouraging early rehabilitation.

Prosthetic Arm Market: Challenges

Complex fitting procedures and user adaptation requirements

The prosthetic arm market faces major challenges in fitting, training, and long-term adaptation, which require both clinical expertise and strong patient commitment. Successful prosthetic use begins with a full evaluation of the residual limb, including muscle strength, range of motion, and daily lifestyle needs. The fitting process involves several appointments, with adjustments and modifications to ensure a proper fit.

Users must undergo intensive training to learn control techniques, build muscle memory, and adapt the device to daily routines. Psychological adjustment is also difficult and often needs counseling and support to address body image and expectations. Common physical issues, such as skin irritation, pressure sores, and mechanical failures, require regular clinical attention.

Prosthetic Arm Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Prosthetic Arm Market |

| Market Size in 2024 | USD 1.25 Billion |

| Market Forecast in 2034 | USD 5.25 Billion |

| Growth Rate | CAGR of 15.40% |

| Number of Pages | 212 |

| Key Companies Covered | Ottobock SE and Co. KGaA, Össur hf., Fillauer LLC, Steeper Group, Mobius Bionics LLC, HDT Global, College Park Industries, WillowWood Global LLC, Liberating Technologies Inc., Advanced Arm Dynamics, Naked Prosthetics, Open Bionics, Psyonic Inc., Infinite Biomedical Technologies, BionX Medical Technologies Inc., Touch Bionics Ltd., RSLSteeper, Prosthetic and Orthotic Associates, Hanger Inc., Proteor USA, and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Prosthetic Arm Market: Segmentation

The global prosthetic arm market is segmented into product type, application, distribution channel, end-user, and region.

Based on product type, the market is segregated into myoelectric prosthetic arms, body-powered prosthetic arms, hybrid prosthetic arms, and cosmetic prosthetic arms. Myoelectric prosthetic arms lead the market due to their advanced functionality, intuitive control mechanisms, and superior grip strength capabilities that enable complex manipulation tasks.

Based on application, the prosthetic arm industry is classified into traumatic amputation, congenital limb deficiency, cancer treatment, and vascular disease. Traumatic amputation holds the largest market share due to the high incidence of industrial accidents, motor vehicle collisions, and combat-related injuries requiring immediate prosthetic intervention.

Based on the distribution channel, the prosthetic arm market is divided into hospitals, prosthetic clinics, rehabilitation centers, and online platforms. Hospitals are expected to lead the market during the forecast period due to comprehensive patient care capabilities, specialized clinical teams, and integrated rehabilitation services.

Based on the end-user, the market is segmented into adults, children, the elderly, and military personnel. Adults lead the market share due to higher amputation rates from workplace injuries, medical conditions, and the largest population demographic requiring prosthetic services worldwide.

Prosthetic Arm Market: Regional Analysis

North America to lead the market

North America leads the global prosthetic arm market due to its advanced healthcare system, broad insurance coverage, and strong investment in prosthetic research and development.

The region accounts for approximately 40% of the global market, with the U.S. being the largest user of prosthetic arm devices. Hospitals and clinics in the area have well-established rehabilitation programs that drive ongoing demand for high-tech prosthetics.

Strict medical device regulations support high standards and foster innovation in prosthetic technology. Collaboration among manufacturers, research institutes, and healthcare providers has built a strong development and supply network.

Government support for veteran and military prosthetic programs further boosts market growth. Advanced manufacturing capabilities and a skilled clinical workforce help the region quickly adopt new technologies.

Europe is expected to show steady growth.

Europe is growing steadily in the prosthetic arm market as healthcare systems focus more on rehabilitation and improving quality of life through advanced prosthetic technology.

Universal healthcare and strong social support systems make prosthetics accessible to many eligible patients. Hospitals and rehabilitation centers are now using advanced prosthetic arms as part of standard care for amputees. Partnerships between universities and medical device companies are helping develop new designs and better control systems.

Government policies and disability programs are expanding coverage for prosthetics and rehabilitation services. Strict regional regulations ensure safety and encourage ongoing innovation. Rising diabetes cases and an aging population are creating a steady demand for prosthetics. Training programs for prosthetic technicians and rehabilitation specialists are expanding to meet the growing needs of patient care.

Recent Market Developments:

- In March 2025, Ottobock announced the launch of their next-generation myoelectric prosthetic arm with integrated artificial intelligence and enhanced sensory feedback capabilities for improved user experience.

- In January 2025, Mobius Bionics received regulatory approval for its advanced neural-controlled prosthetic arm system, featuring multiple grip patterns and intuitive control mechanisms.

Prosthetic Arm Market: Competitive Analysis

The global prosthetic arm market is led by players like:

- Ottobock SE and Co. KGaA

- Össur hf.

- Fillauer LLC

- Steeper Group

- Mobius Bionics LLC

- HDT Global

- College Park Industries

- WillowWood Global LLC

- Liberating Technologies Inc.

- Advanced Arm Dynamics

- Naked Prosthetics

- Open Bionics

- Psyonic Inc.

- Infinite Biomedical Technologies

- BionX Medical Technologies Inc.

- Touch Bionics Ltd.

- RSLSteeper

- Prosthetic and Orthotic Associates

- Hanger Inc.

The global prosthetic arm market is segmented as follows:

By Product Type

- Myoelectric Prosthetic Arms

- Body-Powered Prosthetic Arms

- Hybrid Prosthetic Arms

- Cosmetic Prosthetic Arms

By Application

- Traumatic Amputation

- Congenital Limb Deficiency

- Cancer Treatment

- Vascular Disease

By Distribution Channel

- Hospitals

- Prosthetic Clinics

- Rehabilitation Centers

- Online Platforms

By End User

- Adults

- Children

- Elderly

- Military Personnel

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Prosthetic arms are artificial limb devices used to replace missing upper limbs for people who have had an amputation or were born with a limb difference.

The prosthetic arm market is expected to be driven by advancements in neural interface technologies, the increasing prevalence of diabetes-related amputations, growing awareness of rehabilitation benefits, expanding healthcare infrastructure, and improved insurance coverage for prosthetic services.

According to our study, the global prosthetic arm market was worth around USD 1.25 billion in 2024 and is predicted to grow to around USD 5.25 billion by 2034.

The CAGR value of the prosthetic arm market is expected to be around 15.40% during 2025-2034.

The global prosthetic arm market will register the highest revenue contribution from North America during the forecast period.

Key players in the prosthetic arm market include Ottobock SE and Co. KGaA, Össur hf., Fillauer LLC, Steeper Group, Mobius Bionics LLC, HDT Global, College Park Industries, WillowWood Global LLC, Liberating Technologies Inc., Advanced Arm Dynamics, Naked Prosthetics, Open Bionics, Psyonic Inc., Infinite Biomedical Technologies, BionX Medical Technologies Inc., Touch Bionics Ltd., RSLSteeper, Prosthetic and Orthotic Associates, Hanger Inc., and Proteor USA.

The report provides a comprehensive analysis of the prosthetic arm market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technological innovations, distribution strategies, and rehabilitation preferences that shape the advanced prosthetic device market ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed