Private and Hybrid Cloud Enabled IT Infrastructure Market Size 2025 - 2034

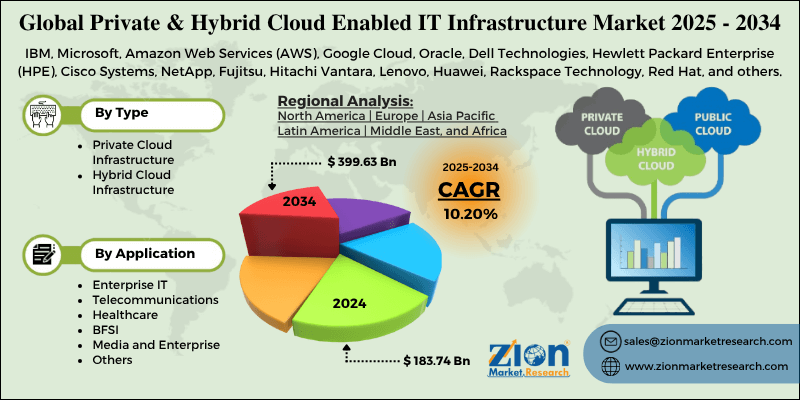

Private and Hybrid Cloud Enabled IT Infrastructure Market By Type (Private Cloud Infrastructure, Hybrid Cloud Infrastructure), By Application (Enterprise IT, Telecommunications, Healthcare, BFSI, Media and Enterprise, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

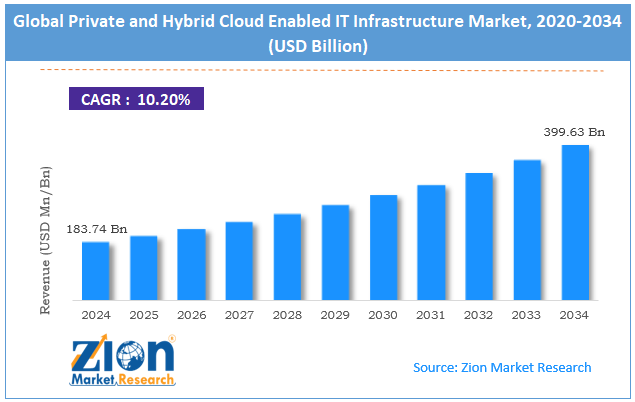

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 183.74 Billion | USD 399.63 Billion | 10.2% | 2024 |

Private and Hybrid Cloud Enabled IT Infrastructure Industry Perspective:

The global private and hybrid cloud enabled IT infrastructure market size was worth around USD 183.74 billion in 2024 and is predicted to grow to around USD 399.63 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global private and hybrid cloud enabled IT infrastructure market is estimated to grow annually at a CAGR of around 10.20% over the forecast period (2025-2034)

- In terms of revenue, the global private and hybrid cloud enabled IT infrastructure market size was valued at around USD 183.74 billion in 2024 and is projected to reach USD 399.63 billion by 2034.

- The private and hybrid cloud-enabled IT infrastructure market is projected to grow significantly due to the rising adoption of cloud-based services by enterprises, the need for scalable and flexible IT infrastructure, and the growth of digital transformation initiatives across industries.

- Based on type, the hybrid cloud infrastructure segment is expected to lead the market, while the private cloud infrastructure segment is expected to grow considerably.

- Based on application, the enterprise IT segment is the dominating segment, while the BFSI segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Private and Hybrid Cloud Enabled IT Infrastructure Market: Overview

The private and hybrid cloud enabled IT infrastructure industry focuses on IT environments that integrate private and on-premise cloud resources with public cloud services to deliver scalable, flexible, and secure computing solutions. Businesses adopt this infrastructure to enhance workloads, improve data security, and enhance operational efficiency while maintaining better control over sensitive information. The global private and hybrid cloud enabled IT infrastructure market is likely to expand rapidly, fueled by the growing demand for digital transformation, enhanced security and compliance requirements, and operational efficiency and cost optimization. Businesses are progressively shifting workloads to cloud-enabled infrastructure to advance operations, improve IT efficiency, and automate processes. Hybrid and private cloud solutions allow smooth integration of legacy systems with cloud environments, backing organizational agility.

Moreover, with stringent data privacy norms like CCPA and GDPR, businesses prefer hybrid and private cloud for secure storage and processing of sensitive data while still leveraging public cloud scalability for non-critical workloads. Additionally, hybrid cloud infrastructure enables businesses to manage resources effectively, reducing capital expenditure on on-premise servers and scaling workloads as required, thereby decreasing the overall cost of ownership.

Despite the growth, the global market is impeded by factors such as complexity in management and integration, as well as data privacy and security concerns. Integrating hybrid cloud systems with current on-premise IT environments could be technically complex, demanding advanced tools and specialization to manage workloads smoothly. Similarly, despite enhanced security measures, businesses remain cautious about possible data breaches, especially when sensitive information is partially hosted on public cloud platforms.

Nonetheless, the global private and hybrid cloud-enabled IT infrastructure industry stands to gain from a few key opportunities, such as the growing demand for multi-cloud solutions and strategic collaborations. Businesses are adopting multi-cloud strategies to enhance performance, reduce costs, and improve redundancy, which augments the demand for hybrid cloud-enabled IT infrastructure. Collaborations between IT service companies, cloud providers, and hardware vendors create opportunities for innovative solutions and expanded industry reach.

Private and Hybrid Cloud Enabled IT Infrastructure Market Dynamics

Growth Drivers

How is the private and hybrid cloud enabled IT infrastructure market driven by the demand for scalable and flexible IT infrastructure?

Modern businesses need IT environments that can quickly adapt to changing workloads and business requirements. Hybrid cloud infrastructure offers dynamic scalability, enabling companies to contract or increase resources without significant capital expenditure. The demand for scalable IT infrastructure is projected to rise at a 21% CAGR worldwide by 2030, according to the Statista report. Recent initiatives by Google Cloud, like Anthos, demonstrate the drive for flexible deployment and multi-cloud management. This demand promises continuous growth of the private and hybrid cloud enabled IT infrastructure market, mainly among SMEs and tech-driven businesses.

Increasing integration of AI and advanced analytics

The incorporation of machine learning, advanced analytics, and AI needs high-performance computing environments, which private and hybrid infrastructures can provide. Recent declarations by IBM and Oracle focus on AI-ready hybrid cloud solutions for predictive analytics, real-time decision-making, and business intelligence. This trend increases the appeal of private and hybrid cloud systems, as companies seek to leverage AI while controlling sensitive data and promising compliance.

Restraints

Shortage of skilled IT professionals hampers the market progress

The lack of skilled cloud architects, hybrid cloud engineers, and security specialists is a key industry challenge. According to the reports, worldwide demand for cloud professionals surged by 32% YoY, yet supply continues to be low. Businesses struggle to deploy, optimize, and manage hybrid cloud solutions without a trained workforce. Amazon Web Services and Microsoft Azure have lately introduced specialized training and certification programs to address this talent gap. Until skilled labor availability is enhanced, broader adoption will be limited.

Opportunities

How does the rising demand for multi-cloud and interoperable solutions present favorable prospects for the private and hybrid cloud enabled IT infrastructure industry expansion?

Businesses are progressively seeking multi-cloud environments to avoid vendor lock-in and improve resilience. According to the Flexera (2025) report, 92% of companies have a multi-cloud strategy, with hybrid cloud as the backbone. Recent associations between Google Cloud, IBM, and VMware emphasize providing smooth hybrid cloud interoperability. Vendors offering multi-cloud and flexible management solutions can capitalize on this trend. This fuels the growth of the private and hybrid cloud enabled IT infrastructure industry as businesses prioritize scalability and agility in cloud platforms.

Challenges

How are network latency and connectivity issues limiting the private and hybrid cloud enabled IT infrastructure market growth?

Hybrid cloud systems depend heavily on reliable and high-speed connectivity. Network latency, inconsistent internet infrastructure, and bandwidth limitations in a few regions hamper performance. According to the 2024 Cisco report, network-related delays impact up to 35% of hybrid deployments in rural or remote areas. Recent initiatives in fiber and 5G deployment aim to resolve these problems, but connectivity continues to be a hindrance in some geographies. Enterprises should invest in network optimization to completely leverage hybrid cloud benefits.

Private and Hybrid Cloud Enabled IT Infrastructure Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Private and Hybrid Cloud Enabled IT Infrastructure Market |

| Market Size in 2024 | USD 183.74 Billion |

| Market Forecast in 2034 | USD 399.63 Billion |

| Growth Rate | CAGR of 10.20% |

| Number of Pages | 214 |

| Key Companies Covered | IBM, Microsoft, Amazon Web Services (AWS), Google Cloud, Oracle, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, NetApp, Fujitsu, Hitachi Vantara, Lenovo, Huawei, Rackspace Technology, Red Hat, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Private and Hybrid Cloud Enabled IT Infrastructure Market: Segmentation

The global private and hybrid cloud enabled IT infrastructure market is segmented based on type, application, and region.

Based on type, the global private and hybrid cloud enabled IT infrastructure industry is divided into private cloud infrastructure and hybrid cloud infrastructure. The hybrid cloud infrastructure segment registered a dominating share of the market because of its ability to blend the best features of private and public clouds. It enables businesses to scale workloads dynamically while maintaining the security of sensitive data on private servers. Businesses benefit from cost optimization, faster deployment, and operational flexibility of applications. Its versatility in sectors like healthcare, IT, and finance fuels broader adoption.

On the other hand, the private cloud infrastructure segment holds a second-leading share since it offers specialized resources and improved security for sensitive data. Businesses with stringent compliance needs prefer private clouds to maintain complete control over their IT environment. Despite being costlier and less flexible than hybrid clouds, it offers reduced exposure to cyber risks and predictable performance. Its adoption is robust among government institutions and large enterprises.

Based on application, the global private and hybrid cloud enabled IT infrastructure market is segmented into enterprise IT, telecommunications, healthcare, BFSI, media, and enterprise, and others. The enterprise IT segment registers a leading share of the market since businesses primarily migrate core business applications to hybrid and private cloud infrastructures. It backs critical workloads like CRM, ERP, and collaboration tools, promising high scalability and availability. Businesses benefit from improved security, reduced IT management costs, and operational efficiency. The rising focus on digital transformation in industries further propels the demand in this category.

Conversely, the BFSI segment holds a second position due to its compliance requirements and stringent data security. Financial institutions adopt hybrid and private cloud solutions to manage sensitive customer data, support digital banking platforms, and run analytics. Hybrid models help BFSI companies to scale workloads effectively while maintaining strong security. The rising trend of fintech innovations and online banking remains a driver for adoption in this sector.

Private and Hybrid Cloud Enabled IT Infrastructure Market: Regional Analysis

Why is North America outperforming other regions in the global Private and Hybrid Cloud Enabled IT Infrastructure Market?

North America is anticipated to retain its leading role in the global private and hybrid cloud enabled IT infrastructure market as a result of high cloud adoption among businesses, presence of major cloud service providers, and strong telecom and IT infrastructure. North America holds the leading cloud adoption rates worldwide, with more than 80% of businesses leveraging cloud-based solutions for core operations. SMEs and large corporations alike are progressively implementing private and hybrid cloud infrastructure to improve scalability and efficiency. This strong adoption fuels the demand for advanced IT infrastructure solutions in the region.

The region houses worldwide cloud leaders like Microsoft Azure, Amazon Web Services, and Google Cloud, which constantly invest in private and hybrid cloud infrastructure. Their presence promises advanced technology availability, innovative service offerings, and competitive pricing. This infrastructure motivates businesses to adopt cloud-enabled IT solutions at a speedy pace.

Moreover, North America holds a well-developed telecommunications and IT backbone, adding high-speed connectivity and reliable data centers. This infrastructure allows businesses to implement a hybrid cloud solution smoothly with minimal latency. The region's strong network facilities appeal to multinational and local companies to deploy cloud-enabled IT infrastructure.

Europe ranks as the second-leading region in the global private and hybrid cloud enabled IT infrastructure industry as a result of growing cloud adoption in enterprises, strong presence of data protection norms, and advanced IT and network infrastructure. Europe has experienced speedy adoption of cloud solutions, with approximately 70% of businesses using some form of hybrid or private cloud infrastructure by 2040.

Businesses in industries like healthcare, BFSI, and manufacturing are mitigating workloads to cloud-enabled environments. This broad adoption fuels steady growth in Europe’s IT infrastructure industry. Stringent norms like GDPR force European businesses to prioritize data compliance and security. Hybrid and cloud solutions offer controlled environments essential to meet these requirements. Businesses are hence heavily investing in secure cloud infrastructure, propelling the growth of the industry.

Furthermore, Europe holds well-established IT infrastructure, comprising high-speed internet connectivity and modern data centers, which support hybrid and private cloud deployments. Economies like the UK, France, and Germany result in data center capacity and cloud readiness. This infrastructure allows businesses to implement cloud strategies reliably and efficiently.

Private and Hybrid Cloud Enabled IT Infrastructure Market: Competitive Analysis

The leading players in the global private and hybrid cloud enabled IT infrastructure market are:

- IBM

- Microsoft

- Amazon Web Services (AWS)

- Google Cloud

- Oracle

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems

- NetApp

- Fujitsu

- Hitachi Vantara

- Lenovo

- Huawei

- Rackspace Technology

- Red Hat

Private and Hybrid Cloud Enabled IT Infrastructure Market: Key Market Trends

Multi-cloud and hybrid strategies:

Businesses are progressively adopting multi-cloud strategies that blend public, private, and hybrid cloud environments. This approach enables enterprises to improve cost efficiency, reduce redundancy, and enhance performance while avoiding vendor lock-in. The need for flexibility in workload deployment and disaster recovery planning fuels this trend. Enterprises are leveraging hybrid architectures to balance control with scalability.

Increased focus on cybersecurity and compliance:

With the rising cyber threats, businesses are investing in hybrid and private cloud infrastructures. Advanced security features like identity access management, encryption, and threat detection are now standard. Compliance with regulations like HIPAA, GDPR, and CCPA is fueling businesses to adopt cloud solutions that promise data protection without sacrificing flexibility.

The global private and hybrid cloud enabled IT infrastructure market is segmented as follows:

By Type

- Private Cloud Infrastructure

- Hybrid Cloud Infrastructure

By Application

- Enterprise IT

- Telecommunications

- Healthcare

- BFSI

- Media and Enterprise

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The private and hybrid cloud enabled IT infrastructure industry focuses on IT environments that integrate private and on-premise cloud resources with public cloud services to deliver scalable, flexible, and secure computing solutions. Businesses adopt this infrastructure to enhance workloads, improve data security, and enhance operational efficiency while maintaining better control over sensitive information.

The global private and hybrid cloud enabled IT infrastructure market is projected to grow due to increasing demand for data security and privacy, growth of remote work and virtual collaboration, and regulatory compliance and data sovereignty concerns.

According to the study, the global private and hybrid cloud-enabled IT infrastructure market size was worth around USD 183.74 billion in 2024 and is predicted to grow to around USD 399.63 billion by 2034.

The CAGR value of the private and hybrid cloud enabled IT infrastructure market is expected to be around 10.20% during 2025-2034.

Market trends and consumer preferences are evolving toward secure, flexible, and scalable multi-cloud and hybrid solutions integrated with edge computing, AI, and compliance-driven features.

Technological advancement is driving the market by enabling secure, more efficient, and scalable hybrid and private cloud solutions. Innovations in automation, AI, edge computing, and virtualization are enhancing management and performance.

Macroeconomic factors will impact the market by influencing IT spending, adoption rates, and investment in cloud infrastructure. Economic growth, inflation, and currency fluctuations shape technology investments and enterprise budgets.

North America is expected to lead the global private and hybrid cloud enabled IT infrastructure market during the forecast period.

The key players profiled in the global private and hybrid cloud enabled IT infrastructure market include IBM, Microsoft, Amazon Web Services (AWS), Google Cloud, Oracle, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, NetApp, Fujitsu, Hitachi Vantara, Lenovo, Huawei, Rackspace Technology, and Red Hat.

The report examines key aspects of the private and hybrid cloud enabled IT infrastructure market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

InfrastructureIndustry Perspective:Key Insights: Infrastructure Overview Infrastructure Market Dynamics Infrastructure Report Scope Infrastructure Segmentation Infrastructure Regional Analysis Infrastructure Competitive Analysis Infrastructure Key Market TrendsThe global private and hybrid cloud enabled IT infrastructure market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed