Private 5G Network Market Size, Share, Trends, Growth & Forecast 2034

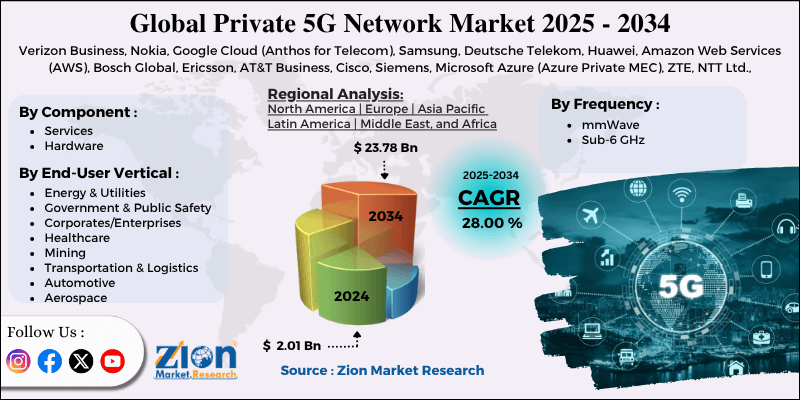

Private 5G Network Market By Component (Services and Hardware), By Frequency (mmWave and Sub-6 GHz), By End-User Vertical (Energy & Utilities, Government & Public Safety, Corporates/Enterprises, Healthcare, Mining, Transportation & Logistics, Automotive, Aerospace, Oil & Gas, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

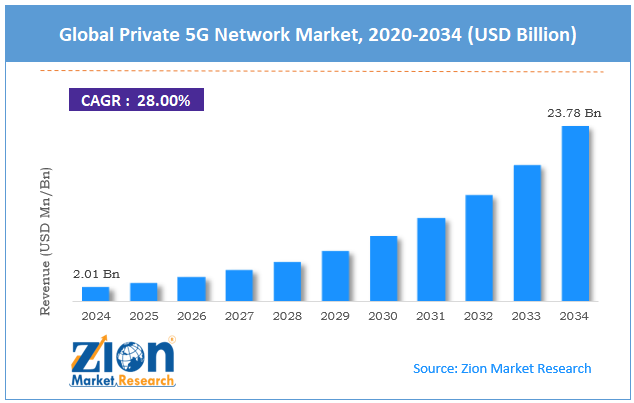

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.01 Billion | USD 23.78 Billion | 28.00% | 2024 |

Private 5G Network Industry Perspective:

The global private 5G network market size was worth around USD 2.01 billion in 2024 and is predicted to grow to around USD 23.78 billion by 2034, with a compound annual growth rate (CAGR) of roughly 28.00% between 2025 and 2034.

Private 5G Network Market: Overview

Private 5G networks are nonpublic networking solutions. They use unlicensed, licensed, or shared spectrum for operations. There are 4 main models of operating private 5G networks. It includes wholly owned & operated 5G networks, private 5G delivered using network slicing, hybrid private-public cloud 5G networks, and neutral host networks using signal sharing. According to market studies, private 5G networks are designed to introduce new possibilities and enhance existing solutions that other technologies or systems cannot support. Private 5G networks perform functions similar to public 5G infrastructure; however, access to the technology is limited by the owner. In most cases, private 5G solutions are deployed in enclosed spaces such as airports, manufacturing plants, business parks, ports, and campuses. Two major benefits of deploying private 5G networks include reduced latency and higher reliability as compared to public 5G solutions.

During the forecast period, demand for private 5G networks is expected to be driven by the growing applications of the technology in smart factories. Moreover, technological advancements across major transportation hubs such as airports and ports may further fuel market revenue. The industry growth will be limited due to the high cost of investment required to set up private 5G and maintenance expenses.

Key Insights:

- As per the analysis shared by our research analyst, the global private 5G network market is estimated to grow annually at a CAGR of around 28.00% over the forecast period (2025-2034)

- In terms of revenue, the global private 5G network market size was valued at around USD 2.01 billion in 2024 and is projected to reach USD 23.78 billion by 2034.

- The private 5G network market is projected to grow at a significant rate due to the rising applications of private 5G infrastructure across smart factories.

- Based on the component, the hardware segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user vertical, the automotive segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Private 5G Network Market: Growth Drivers

Rising applications of private 5G infrastructure across smart factories to deliver higher revenue

The global private 5G network market is expected to be driven by the rising applications of the technology in smart factories worldwide. According to industry analysis, modern and technologically sophisticated factories are equipped with cutting-edge sensors, wearables, and other Internet of Things (IoT) devices. Most smart factories are equipped with next-generation wireless technologies. However, powering such devices using traditional networking solutions can be difficult and can lead to reduced performance. In such cases, private 5G networks can deliver ideal solutions to companies investing in smart factories.

A major benefit of a private 5G network that end-users can leverage includes low-latency communication, as private networks can offer 5G speed and deliver latency as low as 1 millisecond. In February 2025, Hyundai Motors, one of the world’s most influential players in the automotive industry, announced a partnership with Samsung Electronics. The former will install a fifth-generation (5G) private network offered by Samsung at its advanced automobile manufacturing facility. The infrastructure will be deployed at Ulsan Plant owned by Hyundai Motor, which currently produces 6,000 vehicles per day.

How does ongoing integration of advanced technologies in the oil & gas sector promote growth of private 5G network market?

The global oil & gas industry is undergoing technological evolution at a steady pace. Oil & gas companies are aiming to improve business performance by enhancing their exploration and production procedures with the use of cutting-edge solutions. Moreover, the increasingly changing global demands and expectations from the oil sector have further encouraged market players to opt for technologies that can assist them in keeping up with the changing demands.

Extensive market study suggests that oil companies are at risk of losing USD 1.01 million every day due to network failures. The current solutions available in the global private 5G network market can help oil & gas companies mitigate these risks and ensure uninterrupted business performance in the long run.

Private 5G Network Market: Restraints

High cost of initial investment and maintenance expenses to limit market growth rate

The global private 5G network industry is expected to be restricted due to the high cost of investment required to set up the infrastructure. For instance, the average cost of setting up a private 5G network for a large factory can cost between USD 550,000 and over USD 6 million, depending on the technologies powered through the 5G network.

In addition to this, continuous maintenance expenses add to the overall cost associated with deploying private 5G networks. Smaller companies with limited budgets may find the solution unaffordable unless deployment costs are reduced significantly in the coming years.

Private 5G Network Market: Opportunities

Will introduction of more efficient and powerful private 5G networks open new doors for private 5G network industry growth?

The global private 5G network market is expected to generate growth opportunities due to the increasing launch of new and more powerful networks. Factors such as higher reliability and applications across environmental conditions can help industry players further propel the growing demand for private 5G solutions. In October 2024, NEC Corporation, a leading player in the integration of IT and network technologies, announced a partnership with Cisco. The companies have collaborated to build a new 5G network solution for the end customers. The offering is expected to be equipped with Cisco 5G SA Core and a Cloud Control Centre facilitated by NEC.

Moreover, the solution will also provide validated radio network and systems integration services. The increasing demand for private 5G networks as a service will further create expansion possibilities for industry players. In October 2024, Boldyn Networks (Boldyn) launched Private 5G as a Service. It is a novel service offering to deliver the full potential of 5G networks without requiring the end-users to invest in setting up the required infrastructure. The company is expected to invest EUR 300 million to expand the application of private networks globally.

Private 5G Network Market: Challenges

How do technical complexities associated with private network deployment challenge market growth?

The global private 5G network industry is expected to be challenged by the intense technical complexities associated with the solution. Integration of a private 5G network in existing systems can be technically challenging. It also requires skilled resources on board to ensure the smooth deployment of the network infrastructure. Limited number of skilled workforce currently available may further impede market expansion in the future.

Private 5G Network Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Private 5G Network Market |

| Market Size in 2024 | USD 2.01 Billion |

| Market Forecast in 2034 | USD 23.78 Billion |

| Growth Rate | CAGR of 28.00% |

| Number of Pages | 216 |

| Key Companies Covered | Verizon Business, Nokia, Google Cloud (Anthos for Telecom), Samsung, Deutsche Telekom, Huawei, Amazon Web Services (AWS), Bosch Global, Ericsson, AT&T Business, Cisco, Siemens, Microsoft Azure (Azure Private MEC), ZTE, NTT Ltd., and others. |

| Segments Covered | By Component, By Frequency, By End-User Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Private 5G Network Market: Segmentation

The global private 5G network market is segmented based on component, frequency, end-user vertical, and region.

Based on the components, the global market segments are services and hardware. In 2024, the hardware segment experienced the highest growth, driven by the increasing application of backhaul & g transport networks, as well as core networks, across the globe. The rising deployment of advanced equipment by major networking & technology companies such as Qualcomm, Nokia Corporation, and others is further propelling the segmental revenue. The hardware solution covers nearly 60% of the total revenue.

Based on frequency, the global private 5G network industry is divided into mmWave and sub-6 GHz.

Based on the end-user vertical, the global market divisions are energy & utilities, government & public safety, corporates/enterprises, healthcare, mining, transportation & logistics, automotive, aerospace, oil & gas, and others. In 2024, the highest growth was listed in the automotive section primarily due to the increasing use of private 5G networks during vehicle production. The segment held over 28% of the total revenue in 2024 and will continue to dominate the market in the coming years.

Private 5G Network Market: Regional Analysis

North America to lead the industry during the forecast period

The global private 5G network market will be led by North America during the forecast period. The presence of influential players operating in the private 5G network space will remain a crucial regional market growth driver. Furthermore, the increasing deployment of privately owned 5G networking solutions across major industries will propel regional market expansion to new heights.

In April 2025, regional player Verizon Business showcased a novel and first-of-its-kind portable Private 5G Network framework at the 2025 National Association of Broadcasters (NAB) Show. The network is designed to reduce challenges faced by live broadcasting channels in the media industry.

What factors will help Asia Pacific thrive in the private 5G network market?

Asia-Pacific is a thriving region in the private 5G network market, and it is anticipated to deliver a higher CAGR during the forecast period. China will emerge as a leading revenue generator due to the increasing experiments in the country related to private 5G network development and deployment.

The growing number of smart factories across the Asia-Pacific, especially in the automotive industry, will be essential for the Asia-Pacific’s continued growth momentum. In February 2025, Telstra and Ericsson launched the first programmable 5G network in the Asia Pacific. The launch was reported in Australia. The increasing rate of innovation in terms of private 5G networks as a service may further instill higher revenue in the Asia-Pacific.

Private 5G Network Market: Competitive Analysis

The global private 5G network market is led by players like:

- Verizon Business

- Nokia

- Google Cloud (Anthos for Telecom)

- Samsung

- Deutsche Telekom

- Huawei

- Amazon Web Services (AWS)

- Bosch Global

- Ericsson

- AT&T Business

- Cisco

- Siemens

- Microsoft Azure (Azure Private MEC)

- ZTE

- NTT Ltd.

The global private 5G network market is segmented as follows:

By Component

- Services

- Hardware

By Frequency

- mmWave

- Sub-6 GHz

By End-User Vertical

- Energy & Utilities

- Government & Public Safety

- Corporates/Enterprises

- Healthcare

- Mining

- Transportation & Logistics

- Automotive

- Aerospace

- Oil & Gas

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Private 5G networks are nonpublic networking solutions. They use unlicensed, licensed, or shared spectrum for operations.

The global private 5G network market is expected to be driven by the rising applications of the technology in smart factories worldwide.

According to study, the global private 5G network market size was worth around USD 2.01 billion in 2024 and is predicted to grow to around USD 23.78 billion by 2034.

The CAGR value of the private 5G network market is expected to be around 28.00% during 2025-2034.

The global private 5G network market will be led by North America during the forecast period.

The global private 5G network market is led by players like Verizon Business, Nokia, Google Cloud (Anthos for Telecom), Samsung, Deutsche Telekom, Huawei, Amazon Web Services (AWS), Bosch Global, Ericsson, AT&T Business, Cisco, Siemens, Microsoft Azure (Azure Private MEC), ZTE, and NTT Ltd.

The report explores crucial aspects of the private 5G network market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed