Managed Equipment Service (MES) Market Size, Share, Trends, Growth 2034

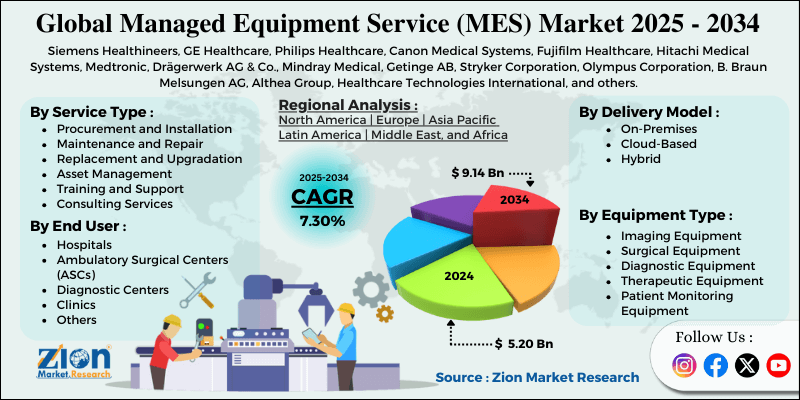

Managed Equipment Service (MES) Market By Service Type (Procurement and Installation, Maintenance and Repair, Replacement and Upgradation, Asset Management, Training and Support, Consulting Services), By Equipment Type (Imaging Equipment, Surgical Equipment, Diagnostic Equipment, Therapeutic Equipment, Patient Monitoring Equipment, and Others), By Delivery Model (On-Premises, Cloud-Based, Hybrid), By End-User (Hospitals, Ambulatory Surgical Centers [ASCs], Diagnostic Centers, Clinics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

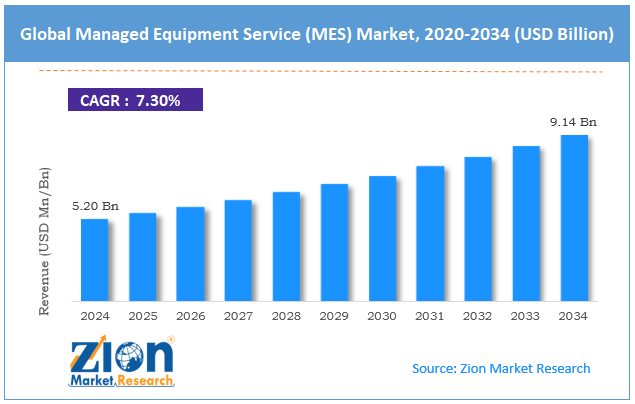

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.20 Billion | USD 9.14 Billion | 7.30% | 2024 |

Managed Equipment Service (MES) Industry Perspective:

The global managed equipment service (MES) market size was approximately USD 5.20 billion in 2024 and is projected to reach around USD 9.14 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global managed equipment service (MES) market is estimated to grow annually at a CAGR of around 7.30% over the forecast period (2025-2034)

- In terms of revenue, the global managed equipment service (MES) market size was valued at around USD 5.20 billion in 2024 and is projected to reach USD 9.14 billion by 2034.

- The managed equipment service (MES) market is projected to grow significantly due to rising global healthcare expenditure, a lack of skilled biomedical technicians and engineers, and increasing pressure to reduce hospital operational costs.

- Based on service type, the procurement and installation segment is expected to lead the market, while the maintenance and repair segment is expected to grow considerably.

- Based on equipment type, the imaging equipment segment is the largest, while the surgical equipment segment is projected to experience substantial revenue growth over the forecast period.

- Based on the delivery model, the on-premises segment holds a larger share, while the cloud-based segment holds a second-leading share.

- Based on end-user, the hospitals segment is expected to lead the market compared to the diagnostic centers segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Managed Equipment Service (MES) Market: Overview

Managed equipment service is a long-term performance-based partnership model where healthcare providers outsource the management, procurement, and maintenance of medical equipment to professional service providers. Instead of paying high upfront costs, clinics and hospitals pay a fixed price for guaranteed access to technical support, lifecycle management, and high-tech equipment. The global managed equipment service (MES) market is poised for significant growth, driven by increasing demand for advanced medical equipment, cost containment in healthcare, and a focus on core healthcare services. Healthcare providers continually choose the latest treatment technologies and diagnostics to enhance patient outcomes. MES helps them to access superior equipment without incurring heavy purchase costs. This fuels adoption, as hospitals strive to remain competitive with modern services and facilities.

Managing capital expenditure is a primary challenge for hospitals, and managed equipment services offer a long-term and predictable cost model. It decreases the cost pressure of buying, maintaining, and upgrading equipment. This helps institutions distribute resources more effectively towards patient care. Furthermore, hospitals focus on delivering high-quality healthcare rather than managing complex equipment cycles. MES providers take responsibility for procurement, upgrades, and servicing, freeing medical staff from administrative pressures. This helps professionals focus on achieving better patient outcomes.

Nevertheless, the global market faces limitations due to factors such as high initial contract commitments and complex contract structures. MES contracts typically span several years, requiring long-term financial commitments from providers. This may demotivate small institutions that are budget-conscious. Hence, adoption is mainly restricted to large hospitals. Negotiating MES contracts comprises comprehensive upgrade terms and service-level agreements. This difficulty may delay implementation and decision-making. Hospitals often hesitate due to concerns about long-term obligations. Still, the global managed equipment service (MES) industry benefits from several favorable factors, including the adoption of improved technologies and the integration of remote monitoring.

Artificial intelligence may help predict machinery failures and enhance servicing schedules. MES providers adopting AI may reduce downtime and improve performance guarantees. This offers opportunities for modernized service offerings. The growth of connected devices allows real-time monitoring of medical machinery. MES providers may avail IoT to deliver predictive maintenance and proactive servicing. This increases hospital trust in MES and decreases breakdowns.

Managed Equipment Service (MES) Market: Growth Drivers

Lifecycle documentation and regulatory compliance demands boost market growth

Stringent rules for industrial equipment and medical devices are surging the need for audit-ready documentation, validated service processes, and calibration logs. MES providers address these demands by centralizing compliance records, ensuring traceability, and reducing administrative workloads for customers. This capability is a decisive factor for businesses seeking to avoid inspection failures and penalties. With regulators across the globe tightening oversight, several manufacturers and hospitals are opting for managed-service contracts that promise compliance, as evidenced by recent enforcement trends, which are fueling the adoption of outsourced services.

How does technology enablement drive the global managed equipment service (MES) market?

Improvements in analytics, IoT sensors, and cloud solutions have transformed MES into a predictive service model that focuses on predictive maintenance. By detecting faults early and facilitating remote diagnostics, providers reduce unplanned downtime and enhance equipment performance. This digital shift reduces the total cost of ownership and facilitates premium pricing for service-based collaborations, illustrating how technology is a crucial driver of customer retention and adoption. Hence, this technological facilitation fuels the growth of the managed equipment service (MES) market.

Managed Equipment Service (MES) Market: Restraints

Resistance to outsourcing critical equipment management negatively impacts the managed equipment service (MES) market progress

Manufacturers and hospitals are sometimes hesitant to outsource the management of mission-critical machinery, citing concerns over vendor dependency and loss of control. Decision-makers often fear service delays, conflicts, or reduced autonomy in procurement when MES providers favor certain OEMs. This resistance slows the penetration of MES, mainly in markets where confidence in third-party service providers is still under development.

Managed Equipment Service (MES) Market: Opportunities

How does the rising adoption of value-based healthcare models create promising avenues for managed equipment service (MES) industry growth?

The transition towards value-based healthcare creates demand for MES providers who can ensure efficiency, uptime, and improved patient outcomes. Hospitals are under pressure to reduce costs without compromising quality care. This enhances equipment management and makes it a more appealing outsourced option. MES vendors offering outcome-based agreements that link service payments to performance will experience substantial growth. This trend ranks MES as a strategic facilitator of healthcare transformation worldwide.

Managed Equipment Service (MES) Market: Challenges

How do price pressure and intense competition challenge the global managed equipment service (MES) market?

The worldwide managed equipment service (MES) industry is becoming increasingly competitive, with third-party service firms, OEMs, and IT providers entering the domain. Intense competition often leads to aggressive pricing strategies that erode profit margins for providers. Customers, primarily in budget-conscious regions, request low prices despite the modernized features, such as predictive maintenance. This commoditization risk impends innovation incentives and long-term profitability.

Managed Equipment Service (MES) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Managed Equipment Service (MES) Market |

| Market Size in 2024 | USD 5.20 Billion |

| Market Forecast in 2034 | USD 9.14 Billion |

| Growth Rate | CAGR of 7.30% |

| Number of Pages | 212 |

| Key Companies Covered | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Healthcare, Hitachi Medical Systems, Medtronic, Drägerwerk AG & Co., Mindray Medical, Getinge AB, Stryker Corporation, Olympus Corporation, B. Braun Melsungen AG, Althea Group, Healthcare Technologies International, and others. |

| Segments Covered | By Service Type, By Equipment Type, By Delivery Model, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Managed Equipment Service (MES) Market: Segmentation

The global managed equipment service (MES) market is segmented based on service type, equipment type, delivery model, end-user, and region.

Based on service type, the global managed equipment service (MES) industry is divided into procurement and installation, maintenance and repair, replacement and upgradation, asset management, training and support, and consulting services. The procurement and installation segment accounts for a substantial share, as it enables hospitals to access superior medical equipment without incurring heavy capital expenditures.

On the other hand, the maintenance and repair segment held second place, as continuous services promise equipment reliability, compliance, and safety in accordance with healthcare standards.

Based on equipment type, the global market is segmented as imaging equipment, surgical equipment, diagnostic equipment, therapeutic equipment, patient monitoring equipment, and others. The imaging equipment segment held a dominant share, as hospitals rely on advanced imaging systems, such as CT, MRI, and X-ray, which require high investment and frequent upgrades.

Conversely, the surgical equipment held a second-leading share, as demand for robotic systems and modern tools is growing to aid precision-based and minimally invasive procedures.

Based on the delivery model, the global managed equipment service (MES) market is segmented into on-premises, cloud-based, and hybrid models. The on-premises segment has held a leading share, as a majority of hospitals prefer direct on-site security and control of their critical medical equipment systems.

However, the cloud-based segment holds second place, as the rise of remote monitoring and digitalization fuels the adoption of scalable and flexible service models.

Based on end-user, the global market is segmented as hospitals, ambulatory surgical centers (ASCs), diagnostic centers, clinics, and others. The hospitals segment holds leadership, as they require a broader range of advanced equipment and long-term service contracts to support large volumes of patient care.

Nonetheless, the diagnostic centers segment holds a second-leading position, as they are largely adopting MES to access high-priced testing and imaging solutions without incurring huge investments.

Managed Equipment Service (MES) Market: Regional Analysis

What gives Europe a competitive edge in the global Managed Equipment Service (MES) Market?

Europe is projected to maintain its dominant position in the global managed equipment service (MES) market, driven by the strong adoption of public-private partnerships, advanced healthcare infrastructure, and early market adoption. Europe leads in implementing PPP models in the medical sector, especially in Germany and the UK, where MES agreements are extensively used. This dependency on PPP majorly drives MES penetration in Europe.

Moreover, European nations are heavily investing in healthcare advancements. Hospitals in France, the Nordic countries, and Germany are upgrading their surgical and imaging equipment to maintain high-quality standards. MES enables these institutions to access advanced technology without incurring heavy upfront costs, thereby fueling industry dominance.

Additionally, Europe is an early adopter of MES, with long-established agreements in the UK dating back to the 1990s. This early adoption increases the region's sophistication and stability in the MES industry compared to developing countries. The proven track record and experience in the region enhance its dominance globally.

North America maintains its position as the second-largest region in the global managed equipment service (MES) industry, driven by high healthcare spending, a large number of advanced hospitals, and a focus on operational efficiency. North America, particularly the United States, accounts for the largest share of global healthcare expenditures. Hospitals experience pressure to manage costs without compromising access to advanced medical machinery. MES helps distribute expenses over time, increasing its appeal and aiding industry growth. Canada and the U.S. host numerous technologically improved specialty centers and hospitals.

Facilities are continuously upgrading surgical, imaging, and diagnostic equipment. MES offers these institutions a cost-effective way to maintain cutting-edge technology, driving adoption in the region. Additionally, healthcare providers in the region focus on enhancing operational efficiency because of value-based care models and competitive pressures. MES enables hospitals to outsource equipment management, provide predictable tools, and minimize downtime. This operational benefit fuels the second-leading adoption worldwide.

Managed Equipment Service (MES) Market: Competitive Analysis

The leading players in the global managed equipment service (MES) market are:

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems

- Fujifilm Healthcare

- Hitachi Medical Systems

- Medtronic

- Drägerwerk AG & Co.

- Mindray Medical

- Getinge AB

- Stryker Corporation

- Olympus Corporation

- B. Braun Melsungen AG

- Althea Group

- Healthcare Technologies International

Managed Equipment Service (MES) Market: Key Market Trends

Integration of Predictive Analytics and AI:

MES providers are primarily utilizing AI to predict equipment failures and optimize maintenance schedules. This reduces downtime and enhances operational efficiency for hospitals. Predictive analytics also allows improved cost management and resource planning in long-term contracts.

Adoption of Remote Monitoring and IoT:

IoT solutions and connected medical devices allow MES providers to monitor equipment performance in real-time. Hospitals benefit from proactive maintenance, data-driven decision-making, and remote troubleshooting. This trend enhances equipment uptime and quality care for patients.

The global managed equipment service (MES) market is segmented as follows:

By Service Type

- Procurement and Installation

- Maintenance and Repair

- Replacement and Upgradation

- Asset Management

- Training and Support

- Consulting Services

By Equipment Type

- Imaging Equipment

- Surgical Equipment

- Diagnostic Equipment

- Therapeutic Equipment

- Patient Monitoring Equipment

- Others

By Delivery Model

- On-Premises

- Cloud-Based

- Hybrid

By End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Clinics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Managed equipment service is a long-term performance-based partnership model where healthcare providers outsource the management, procurement, and maintenance of medical equipment to professional service providers. Instead of paying high upfront costs, clinics and hospitals pay a fixed price for guaranteed access to technical support, lifecycle management, and high-tech equipment.

The global managed equipment service (MES) market is projected to grow due to the increasing demand for advanced medical technologies, the surging prevalence of chronic diseases that require advanced equipment, and technological advancements in medical devices and imaging systems.

According to study, the global managed equipment service (MES) market size was worth around USD 5.20 billion in 2024 and is predicted to grow to around USD 9.14 billion by 2034.

The CAGR value of the managed equipment service (MES) market is expected to be approximately 7.30% from 2025 to 2034.

Macroeconomic factors, such as healthcare spending trends, inflation, and currency fluctuations, may impact the long-term adoption of MES contracts and their affordability by hospitals.

The MES market is witnessing a shift toward subscription-based, fixed-fee, and outcome-linked pricing models, offering cost predictability and support for value-based healthcare.

Europe is expected to lead the global managed equipment service (MES) market during the forecast period.

The key players profiled in the global managed equipment service (MES) market include Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Healthcare, Hitachi Medical Systems, Medtronic, Drägerwerk AG & Co., Mindray Medical, Getinge AB, Stryker Corporation, Olympus Corporation, B. Braun Melsungen AG, Althea Group, and Healthcare Technologies International.

Stakeholders should adopt strategies such as flexible service models, technological integration, value-based pricing, and strategic partnerships to remain competitive in the MES market.

The report examines key aspects of the managed equipment service (MES) market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed