Isononyl Acrylate Market Size, Growth, Global Trends, Forecast 2034

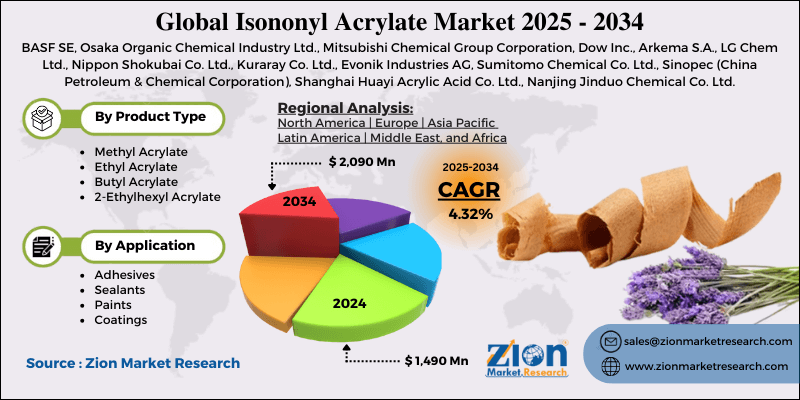

Isononyl Acrylate Market By Product Type (Methyl Acrylate, Ethyl Acrylate, Butyl Acrylate, 2-Ethylhexyl Acrylate), By Application (Adhesives, Sealants, Paints, Coatings), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

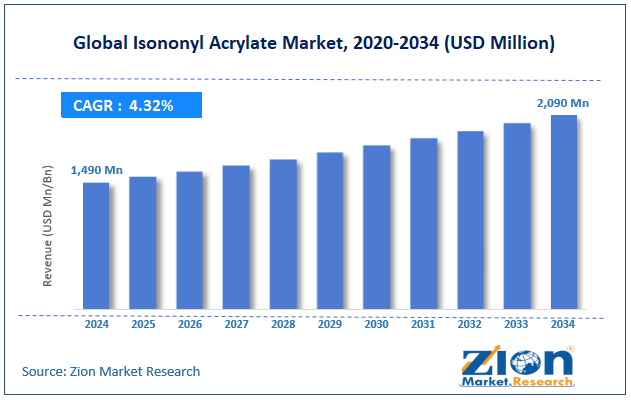

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,490 Million | USD 2,090 Million | 4.32% | 2024 |

Isononyl Acrylate Industry Perspective:

The global isononyl acrylate market size was approximately USD 1,490 million in 2024 and is projected to reach around USD 2,090 million by 2034, with a compound annual growth rate (CAGR) of approximately 4.32% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global isononyl acrylate market is estimated to grow annually at a CAGR of around 4.32% over the forecast period (2025-2034)

- In terms of revenue, the global isononyl acrylate market size was valued at around USD 1,490 million in 2024 and is projected to reach USD 2,090 million by 2034.

- The isononyl acrylate market is projected to grow significantly due to the increasing use in the transportation and automotive industries, growing use in coatings formulations and paints, and advancements in resin and polymer technologies.

- Based on product type, the 2-ethylhexyl acrylate segment is expected to lead the market, while the butyl acrylate segment is expected to grow considerably.

- Based on application, the adhesives segment is the largest, while the coatings segment is projected to experience substantial revenue growth over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Isononyl Acrylate Market: Overview

Isononyl acrylate is a specialty acrylate monomer used mainly in the making of pressure-sensitive adhesives, sealants, and coatings because of its optimal flexibility, strong adhesion properties, and low glass transition temperature. It enhances UV resistance, durability, and weatherability in final products, thereby increasing its suitability across various industries. The global isononyl acrylate market is projected to witness substantial growth, driven by increasing demand for pressure-sensitive adhesives, the expansion of the automotive sector, and the rise in infrastructure and construction projects. Isononyl acrylate’s exceptional properties make it vital in PSAs for labels, tapes, and films. With the speedy growth of logistics, e-commerce, and packaging, the demand for reliable adhesives is increasing. This is the key growth propeller for the consumption of INAC worldwide. The automotive sector uses INAC-based adhesives for lightweight structures, bonding applications, and interior trims.

As automobile manufacturers prioritize fuel efficiency and weight reduction, high-performance adhesives are replacing mechanical fasteners. INAC-based adhesives and sealants are necessary because of their durability and weatherability. The rise in smart city projects and urbanization is fueling the demand for advanced construction materials.

Although drivers exist, the global market is challenged by factors like volatile prices of raw materials and health and safety concerns. INAC is obtained from petroleum-based feedstock, which is subject to variations in crude oil prices. This volatility disturbs profit margins and cost structures for producers. Prolonged exposure to acrylates may lead to skin irritation and respiratory issues. These health risks deter the adoption of specific applications, thereby reducing industry penetration.

Even so, the global isononyl acrylate industry is well-positioned due to the growing adoption of bio-based acrylates, rising use in medical applications, and integration in wearables. The inclination towards renewable and bio-based chemicals offers opportunities for the ecological production of INAC. Companies are heavily investing in green acrylic to capture eco-conscious users.

Moreover, medical tapes, transdermal patches, and wound dressings depend on PSAs. With the growing healthcare expenditure, the demand for medical-grade INAC adhesives is set to expand remarkably. Furthermore, the wearable sector needs ultra-flexible and durable adhesives. INAC's transparency and low-temperature flexibility are suitable for next-generation electronic applications.

Isononyl Acrylate Market: Growth Drivers

Supply chain dynamics and feedstock price volatility boost market growth

Since INAC is obtained from petrochemical feedstock, variations in C9 fractions and crude oil majorly impact its market price. Sudden plant outages, supply concentration, and regional logistics among a few producers may create unexpected industry tightness. These disturbances typically result in a double-digit increase in spot costs, affecting procurement prices for downstream users.

Conversely, capacity growth and long-term supply contracts help balance the industry and pricing trends. Monitoring feedstock indices and producer declarations is hence vital for understanding INAC's short-term industry dynamics, positively fueling the isononyl acrylate market.

How is the growing use of electronics and automotive adhesives considerably fueling the isononyl acrylate market growth?

Trends in lightweighting for the automotive industry and miniaturization of electronic devices are significant factors driving the demand for INAC-based adhesives. In consumer electronics and electric vehicles, producers need adhesives that offer robust bonding for delicate components and composites. INAC delivers flexibility and toughness, which enhance its suitability for bonding various substrates in high-performance applications. According to the reports, adhesives in EVs are projected to account for more than 8% yearly, opening prospects for acrylate-based formulations. The rising number of collaborations between OEMs and chemical suppliers highlights the role of INAC in these sectors.

Isononyl Acrylate Market: Restraints

How do limited scale and high production costs adversely impact the isononyl acrylate market progress?

INAC is a specialty acrylate, and unlike commodity monomers, it is produced on a comparatively small scale, which keeps prices high. Low economies of scale result in higher unit product costs compared to other acrylates, such as ethyl or butyl acrylate. Mid-scale and small adhesive producers in developing economies often switch to low-priced substitutes due to cost pressures. Recent financial reports from chemical giants focus on margin restrictions in specialty acrylates, which restrict the rigorous adoption.

Isononyl Acrylate Market: Opportunities

How does the development of sustainable and bio-based acrylates create promising avenues for the growth of the isononyl acrylate industry?

Sustainability pressures are driving R&D investment in bio-based acrylates, providing INAC producers with an opportunity to differentiate in the isononyl acrylate industry through eco-friendly solutions. Pilot projects are underway to produce bio-obtained isononyl alcohol, the precursor to INAC, decreasing reliance on petrochemicals. Worldwide investment in bio-based and green chemicals exceeded $120 billion in 2023, offering fertile ground for advancements in INAC. The successful scaling of bio-based products may open up new markets in consumer goods and packaging, where eco-label compliance is a key purchasing factor. Recent R&D collaborations and patent filings denote a steady pipeline of ecological acrylate solutions in development.

Isononyl Acrylate Market: Challenges

Regional disruptions and supply chain concentration restrict the market growth

The worldwide market is concentrated among a few producers, increasing its exposure to supply disturbances. Regional logistic restrictions or plant shutdowns may lead to sharp hikes and temporary scarcity for buyers. For instance, logistics barriers in East Asia in 2023 caused downstream disturbances in North America and Europe. This dependence on restricted suppliers forces buyers to differentiate towards other acrylates, decreasing the demand stability of INAC. Recent supply chain news in 2024 focused on the urgency of adding regional capacity to alleviate these barriers.

Isononyl Acrylate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Isononyl Acrylate Market |

| Market Size in 2024 | USD 1,490 Million |

| Market Forecast in 2034 | USD 2,090 Million |

| Growth Rate | CAGR of 4.32% |

| Number of Pages | 215 |

| Key Companies Covered | BASF SE, Osaka Organic Chemical Industry Ltd., Mitsubishi Chemical Group Corporation, Dow Inc., Arkema S.A., LG Chem Ltd., Nippon Shokubai Co. Ltd., Kuraray Co. Ltd., Evonik Industries AG, Sumitomo Chemical Co. Ltd., Sinopec (China Petroleum & Chemical Corporation), Shanghai Huayi Acrylic Acid Co. Ltd., Nanjing Jinduo Chemical Co. Ltd., Jilin Petrochemical Company, KH Neochem Co. Ltd., and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Isononyl Acrylate Market: Segmentation

The global isononyl acrylate market is segmented based on product type, application, and region.

Based on product type, the global isononyl acrylate industry is divided into methyl acrylate, ethyl acrylate, butyl acrylate, and 2-ethylhexyl acrylate. The 2-ethylhexyl acrylate segment holds a substantial market share due to its low glass transition temperature, excellent adhesion, and exceptional flexibility. It is broadly used in pressure-sensitive adhesives, coatings, and sealants, increasing its preference in various applications. The rise in e-commerce packaging, electronics manufacturing, and automotive light weighting surges the demand for 2-ethylhexyl acrylate-based adhesives. Its robust balance of cost-effectiveness and performance assures its prominence in industries.

On the other hand, the butyl acrylate segment holds a secondary rank, driven by its role in adhesives, coatings, and construction materials. Its resistance to water and weathering makes it ideal for architectural and industrial coatings. With the growth of smart infrastructure and urbanization projects, butyl acrylate is primarily used in protective and paint finishes. Though less versatile than 2-EHA, it is a key segment in the industry.

Based on application, the global isononyl acrylate market is segmented into adhesives, sealants, paints, and coatings. The adhesives segment holds a dominating share, mainly because isononyl acrylate is a core element in PSAs. Its strong bonding, flexibility, and UV resistance make it suitable for labels, packaging, and tapes. The rise in worldwide logistics, e-commerce, and consumer goods is constantly fueling the demand. Moreover, sectors like electronics and automotive are continuously dependent on INAC-based adhesives for high-performance and lightweight bonding solutions.

Conversely, the coatings segment holds a second-leading share, benefiting from INAC's durability, low glass transition temperature, and weather resistance. Construction projects, industrial applications, and automotive refinishing are key drivers of demand. The ability of INAV-based coatings to withstand harsh temperatures and UV exposure enhances their adoption. With the rapid development of smart cities and infrastructure worldwide, coatings are projected to remain a robust contributor to growth.

Isononyl Acrylate Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Isononyl Acrylate Market?

Asia Pacific is likely to sustain its leadership in the isononyl acrylate market due to its strong industrial and manufacturing base, growing automotive industry, and speedy infrastructure growth and urbanization. APAC dominates due to its extensive manufacturing and industrial hubs, particularly in South Korea, China, Japan, and India. These economies account for more than 45% of the worldwide sealant and adhesive demand, directly driving the consumption of INAC.

The concentration of the automotive, construction, and electronics industries is the reason for regional dominance. The region is home to the world's largest automotive producers, led by India (5.5 million units in 2023) and China (30 million units in 2023). INAC-based adhesives replace mechanical fasteners for increased efficiency and lightweighting. This growing vehicle production promises steady demand for high-performing acrylates.

Furthermore, the Asia Pacific is a forerunner in urban growth, with China investing $1.3 trillion in infrastructure by 2030 and India aiming for 100 smart cities. INAC-based coatings and sealants are vital for durability and weather resistance in these projects. APAC's construction expansion majorly fuels the consumption of isononyl acrylate.

Europe continues to secure the second-highest share in the isononyl acrylate industry owing to the established aerospace and automotive industries, rising demand for sustainable packaging, and the adoption of advanced renewable energy. Europe is home to leading automakers such as Mercedes-Benz, BMW, and Volkswagen, which collectively produced more than 12 million passenger vehicles in 2023. INAC-based coatings and adhesives are broadly used in advanced bonding, light-weighting, and interior applications. The aerospace industry, led by Airbus, further drives demand for high-performance acrylates.

Moreover, Europe leads in sustainable packaging, with the EU aiming to make all packaging reusable or recyclable by 2030. INAC-based adhesives play a vital role in eco-friendly and flexible packaging solutions. The growing e-commerce and FMCG activities promise steady adhesive demand in France, Germany, and the United Kingdom.

Additionally, Europe's electronics sector, being smaller than APAC's, is heavily investing in high-tech manufacturing, especially in France and Germany. INAC's adhesives are used in display films and semiconductor components. The region also installed 16 GW of fresh wind power capacity in 2023, driving the demand for durable INAC-based adhesives in renewable energy application areas.

Isononyl Acrylate Market: Competitive Analysis

The leading players in the global isononyl acrylate market are:

- BASF SE

- Osaka Organic Chemical Industry Ltd.

- Mitsubishi Chemical Group Corporation

- Dow Inc.

- Arkema S.A.

- LG Chem Ltd.

- Nippon Shokubai Co. Ltd.

- Kuraray Co. Ltd.

- Evonik Industries AG

- Sumitomo Chemical Co. Ltd.

- Sinopec (China Petroleum & Chemical Corporation)

- Shanghai Huayi Acrylic Acid Co. Ltd.

- Nanjing Jinduo Chemical Co. Ltd.

- Jilin Petrochemical Company

- KH Neochem Co. Ltd.

Isononyl Acrylate Market: Key Market Trends

Shift toward low-VOC and eco-friendly adhesives:

Sustainability is a vital trend, with sectors demanding water-based and low-VOC formulations. INAC is primarily integrated into eco-friendly adhesive systems to support stringent environmental standards. This inclination backs the growth in construction, packaging, and automotive applications.

Integration in high-performance electronics:

INAC is gaining significant prominence for its displays, touchscreens, and protective films due to their UV resistance and flexibility. The growth of consumer electronics, IoT devices, and wearable devices drives demand. This trend is particularly strong in the APAC region, which generates more than 70% of the world's electronics.

The global isononyl acrylate market is segmented as follows:

By Product Type

- Methyl Acrylate

- Ethyl Acrylate

- Butyl Acrylate

- 2-Ethylhexyl Acrylate

By Application

- Adhesives

- Sealants

- Paints

- Coatings

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Isononyl acrylate is a specialty acrylate monomer used mainly in the making of pressure-sensitive adhesives, sealants, and coatings because of its optimal flexibility, strong adhesion properties, and low glass transition temperature. It enhances UV resistance, durability, and weatherability in final products, thereby increasing its suitability across various industries.

The global isononyl acrylate market is projected to grow due to the growing consumer goods and electronics sector, the rising trend toward durable and lightweight materials, and speedy industrialization in developing economies.

According to study, the global isononyl acrylate market size was worth around USD 1,490 million in 2024 and is predicted to grow to around USD 2,090 million by 2034.

The CAGR value of the isononyl acrylate market is expected to be around 4.32% from 2025 to 2034.

Emerging trends and innovations in the isononyl acrylate market include low-VOC adhesive formulations, the development of bio-based acrylates, integration into renewable energy systems, advanced applications in electronics, and sustainable packaging solutions.

Asia Pacific is expected to lead the global isononyl acrylate market during the forecast period.

China is a significant contributor to the global isononyl acrylate market, driven by high demand from the construction, automotive, and electronics sectors, as well as its large manufacturing base.

The key players profiled in the global isononyl acrylate market include BASF SE, Osaka Organic Chemical Industry Ltd., Mitsubishi Chemical Group Corporation, Dow Inc., Arkema S.A., LG Chem Ltd., Nippon Shokubai Co., Ltd., Kuraray Co., Ltd., Evonik Industries AG, Sumitomo Chemical Co., Ltd., Sinopec (China Petroleum & Chemical Corporation), Shanghai Huayi Acrylic Acid Co., Ltd., Nanjing Jinduo Chemical Co., Ltd., Jilin Petrochemical Company, and KH Neochem Co., Ltd.

The isononyl acrylate market is highly competitive, dominated by key global chemical manufacturers that focus on strategic partnerships, product innovation, and regional expansion.

The report examines key aspects of the isononyl acrylate market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed