Home Entertainment Product Market Size, Share, Trends, Growth 2034

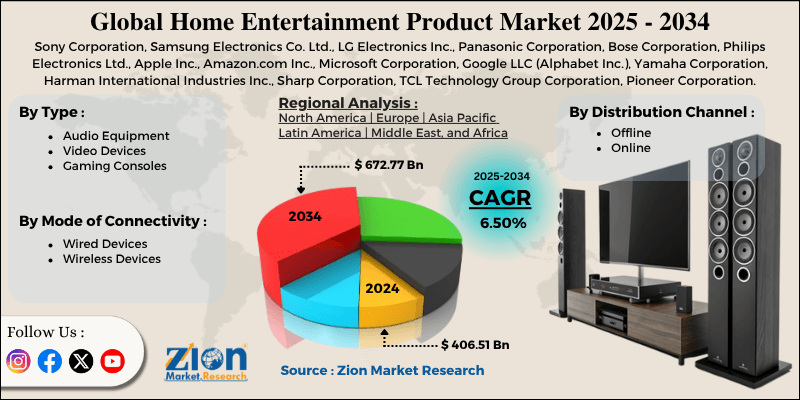

Home Entertainment Product Market By Type (Audio Equipment, Video Devices, Gaming Consoles), By Mode of Connectivity (Wired Devices, Wireless Devices), By Distribution Channel (Offline, Online), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

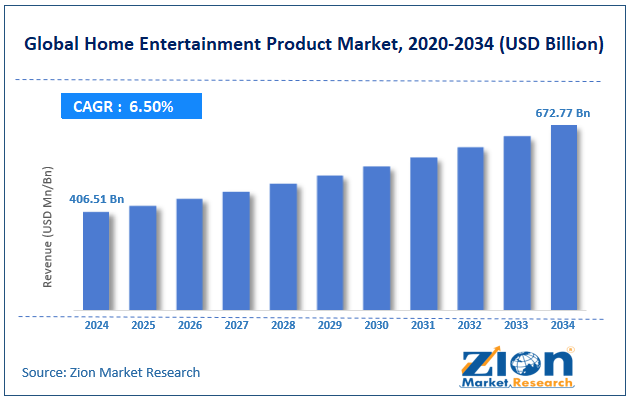

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 406.51 Billion | USD 672.77 Billion | 6.50% | 2024 |

Home Entertainment Product Industry Perspective:

The global home entertainment product market size was approximately USD 406.51 billion in 2024 and is projected to reach around USD 672.77 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global home entertainment product market is estimated to grow annually at a CAGR of around 6.50% over the forecast period (2025-2034)

- In terms of revenue, the global home entertainment product market size was valued at around USD 406.51 billion in 2024 and is projected to reach USD 672.77 billion by 2034.

- The home entertainment product market is projected to grow significantly due to rapid technological advancements in smart TVs and audio systems, the growing adoption of home automation and connected devices, and the rising popularity of gaming consoles and VR entertainment.

- Based on type, the video devices segment is expected to lead the market, while the audio equipment segment is expected to grow considerably.

- Based on mode of connectivity, the wireless devices segment is the dominant segment, while the wired devices segment is projected to witness sizable revenue growth over the forecast period.

- Based on the distribution channel, the offline segment is expected to lead the market compared to the online segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Home Entertainment Product Market: Overview

Home entertainment products encompass a diverse range of systems and devices designed to provide visual, audio, and interactive entertainment experiences within households. These encompass home theatre systems, streaming devices, soundbars, televisions, gaming consoles, and smart speakers that integrate with smart home technologies and digital platforms. The global home entertainment product market is projected to experience substantial growth, driven by increasing demand for connected devices and smart TVs, the expansion of streaming and OTT platforms, and the deployment of high-speed internet and 5 G. The rising adoption of smart TVs incorporated with streaming apps and voice assistants is fueling the market. Consumers prefer all-in-one entertainment systems offering convenience and connectivity. This move is compelling manufacturers to innovate products with IoT and AI capabilities.

Moreover, the increasing availability of affordable streaming services, such as Disney+, Netflix, and Amazon Prime, is transforming content consumption patterns. Consumers are actively replacing traditional TV with on-demand viewing options. This trend directly raises the demand for smart entertainment devices. Furthermore, the rollout of enhanced broadband connectivity and 5G networks allows faster streaming and gaming experiences. High-speed internet supports 8K and 4K video formats, appealing to consumers to upgrade their devices. This technological leap improves accessibility and quality of home entertainment.

Although drivers exist, the global market is challenged by factors such as high product costs and replacement expenses, as well as short product life cycles and rapid technological obsolescence. Advanced home entertainment systems, such as surround sound setups and OLED TVs, are usually high-priced. High initial costs restrict adoption among price-sensitive consumers. Frequent product upgrades further add to consumer hesitation in the developing markets. Similarly, fast-paced innovation makes existing devices quickly outmoded, impacting long-term consumer investment. Manufacturers frequently release upgraded models, which decreases resale value. This demotivates potential buyers from purchasing premium systems.

Even so, the global home entertainment product industry is well-positioned due to the expansion of AI integration, the rise of smart homes, and the emergence of streaming services and cloud gaming. The incorporation of AI-driven entertainment systems offers automation and personalized content. Voice assistants, synchronized lighting, and smart displays improve user experience. This creates ample opportunities for companies in the smart home ecosystem. Additionally, cloud gaming eliminates the need for costly hardware, making it more appealing to a broader audience. Companies like NVIDIA and Microsoft are capitalizing on this trend. The growing prominence of cloud-based entertainment presents new revenue opportunities.

Home Entertainment Product Market Dynamics

Growth Drivers

How are rising disposable income and home renovation trends surging the home entertainment product market growth?

Rising global disposable income and the surging trend of home renovation are propelling investments in premium home entertainment systems. Post-pandemic lifestyle changes have encouraged people to improve their living spaces for recreation and comfort. For example, the United States home renovation sector reached $540 billion in 2024, with a remarkable share distributed to entertainment room upgrades. The desire for convenience and luxury has led to a growing demand for integrated smart home entertainment solutions that feature centralized controls.

How are technological improvements in gaming consoles and Virtual Reality (VR) fueling the home entertainment product market?

The home entertainment product market is rapidly evolving, driven by advancements in immersive technologies and the emergence of gaming consoles. In 2024, the gaming console industry surpassed $60 billion, driven by introductions such as Microsoft's Xbox Series X refresh and Sony's PS5 Pro. At the same time, the growth of Apple Vision Pro and Meta Quest 3 has elevated the adoption of AR and VR experiences. This rising fusion of streaming, gaming, and virtual environments is transforming home entertainment into a multi-sensory and interactive ecosystem.

Restraints

Environmental and E-Waste concerns restrict the market progress

The growing accumulation of e-waste from outdated entertainment devices has become a significant concern. Governments are enforcing more stringent sustainability and recycling regulations, increasing compliance costs for manufacturers. The EU's 2025 Circular Electronics Initiative does not mandate the use of recyclable materials and reparability in novel products. While these measures support environmental goals, they also increase design complexity and production expenses, which can impact short-term profitability.

Opportunities

How does rising demand for sustainable and energy-efficient devices present favorable prospects for the home entertainment product market growth?

Sustainability has progressed as a key opportunity, with energy-efficient and eco-friendly materials becoming major consumer priorities. The EU's 2024 Ecodesign Directive, as well as similar policies in Japan and the US, are encouraging companies to innovate towards greener product lines. For example, Samsung introduced SolarCell Remote Controls and recycled plastic TV casing in 2024 to decrease environmental impact. This move towards sustainability not only supports regulatory compliance but also brand loyalty among environmentally conscious consumers, impacting the growth of the home entertainment product industry.

Challenges

Rapid shifts in consumer preferences and content habits limit the market growth

The pace at which consumer viewing habits change offers a continuous challenge. Younger audiences are increasingly preferring mobile-based entertainment over traditional home setups, affecting hardware sales. A 2025 Nielsen study revealed that nearly 58% of Gen Z users primarily watch entertainment on tablets and smartphones, compared to only 28% on televisions. This behavioral move forces brands to rethink form factor and develop multi-screen synchronization capabilities. Failure to adapt quickly to these trends risks making products undesirable and declining relevance among younger demographics.

Home Entertainment Product Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Entertainment Product Market |

| Market Size in 2024 | USD 406.51 Billion |

| Market Forecast in 2034 | USD 672.77 Billion |

| Growth Rate | CAGR of 6.50% |

| Number of Pages | 215 |

| Key Companies Covered | Sony Corporation, Samsung Electronics Co. Ltd., LG Electronics Inc., Panasonic Corporation, Bose Corporation, Philips Electronics Ltd., Apple Inc., Amazon.com Inc., Microsoft Corporation, Google LLC (Alphabet Inc.), Yamaha Corporation, Harman International Industries Inc., Sharp Corporation, TCL Technology Group Corporation, Pioneer Corporation, and others. |

| Segments Covered | By Type, By Mode of Connectivity, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Home Entertainment Product Market: Segmentation

The global home entertainment product market is segmented based on type, mode of connectivity, distribution channel, and region.

Based on type, the global home entertainment product industry is divided into audio equipment, video devices, and gaming consoles. The video devices segment held a leading share of the market, comprising projectors, streaming media players, and smart TVs. This segmental dominance is fueled by the broader adoption of connected and smart TVs, continuous advancements in display technologies such as 8K, QLED, and OLED, as well as the growing prominence of OTT platforms. Consumers are progressively prioritizing large-screen and high-definition visual experiences, making this segment the revenue-generating class.

Based on mode of connectivity, the global home entertainment product market is segmented into wired devices and wireless devices. The wireless devices segment held a dominating share in the market. This segmental prominence is driven by the growing popularity of Bluetooth and Wi-Fi-enabled products, including smart speakers, streaming devices, and smart TVs. Consumers prefer wireless solutions for their flexibility, convenience, and seamless integration into a smart home ecosystem, eliminating the clutter of cables.

Based on the distribution channel, the global market is segmented into offline and online. The offline distribution channel captures a maximum share of the market. Consumers continue to prefer physical retail stores, such as specialty outlets and electronics showrooms, for the opportunity to experience products firsthand before making a purchase. The availability of expert guidance, after-sales services, and immediate product testing makes offline channels the foremost choice, particularly for high-value items such as home theatre systems and televisions.

Home Entertainment Product Market: Regional Analysis

What enables North America to have a strong foothold in the global Home Entertainment Product Market?

North America is likely to maintain its leadership in the home entertainment product market due to the high adoption of connected and smart devices, a strong presence of major market players, high consumer spending, and a preference for premium products. North America holds the leading penetration rates of smart TVs and connected entertainment systems worldwide. In 2025, more than 82% of the US households own at least one smart TV, backed by broad access to 5G networks and broadband. This technological maturity propels continuous demand for high-performing and upgraded entertainment devices.

Moreover, the region is home to prominent innovators and manufacturers such as Bose, Apple, LG Electronics (US divisions), and Sony, which continually introduce superior home entertainment technologies. Their strategic distribution and marketing networks assure wide consumer access. This concentration of industry leaders boosts regional dominance and fuels early adoption trends.

Furthermore, regional consumers have high disposable incomes, allowing them to invest in premium home entertainment systems. The average US household spends more than $2,500 every year on consumer electronics, indicating a robust culture of home-based entertainment. This economic capacity directly surges the sales of high-end TVs, gaming consoles, and sound systems.

The Asia Pacific continues to hold the second-highest share in the home entertainment product industry, driven by rapid urbanization, rising disposable income, increased consumer spending on electronics, and expanding internet penetration. In 2025, APAC experienced massive urbanization, with more than 55% of its population now residing in urban areas. Economies such as Indonesia, India, and China are experiencing a rise in the number of middle-income households. This rising consumer segment progressively invests in modern home entertainment systems as a part of an upgraded lifestyle.

Likewise, the region's growing disposable income is driving the demand for smart and premium entertainment products. Consumers are prioritizing products such as soundbars, smart TVs, and projectors to enhance their home leisure experiences. Additionally, APAC is a leader in internet growth, with more than 2.7 million active internet users and strong deployment of 5G networks. This enhanced connectivity allows smooth streaming, smart home integration, and online gaming. Hence, the demand for wireless entertainment products and streaming devices continues to surge.

Home Entertainment Product Market: Competitive Analysis

The leading players in the global home entertainment product market are:

- Sony Corporation

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Bose Corporation

- Philips Electronics Ltd.

- Apple Inc.

- Amazon.com Inc.

- Microsoft Corporation

- Google LLC (Alphabet Inc.)

- Yamaha Corporation

- Harman International Industries Inc.

- Sharp Corporation

- TCL Technology Group Corporation

- Pioneer Corporation

Home Entertainment Product Market: Key Market Trends

Rising demand for wireless and multi-room audio systems:

Consumers are shifting towards wireless entertainment setups, which include Bluetooth-enabled soundbars, Wi-Fi-based home theater systems, and earbuds. Multi-room audio solutions that synchronize music in different spaces have gained remarkable popularity. This trend is driven by the desire for flexible and clutter-free setups that deliver immersive sound experiences without the need for complex wiring.

Increasing adoption of immersive and advanced display technologies:

There is a growing consumer preference for high-end visual experiences, leading to the rapid adoption of 8K, 4K, QLED, and OLED technologies. Manufacturers are focusing on ultra-thin, curved displays and energy-efficient models to improve viewing immersion. Furthermore, the incorporation of AR/VR technologies and 3D sound systems is transforming the next generation of home entertainment experiences.

The global home entertainment product market is segmented as follows:

By Type

- Audio Equipment

- Video Devices

- Gaming Consoles

By Mode of Connectivity

- Wired Devices

- Wireless Devices

By Distribution Channel

- Offline

- Online

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Home entertainment products encompass a diverse range of systems and devices designed to provide visual, audio, and interactive entertainment experiences within households. These encompass home theatre systems, streaming devices, soundbars, televisions, gaming consoles, and smart speakers that integrate with smart home technologies and digital platforms.

The global home entertainment product market is projected to grow due to rising disposable income and improved living standards, as well as the expansion of high-speed internet and 5G connectivity, and the increasing adoption of smart home integration and IoT-enabled entertainment products.

According to study, the global home entertainment product market size was worth around USD 406.51 billion in 2024 and is predicted to grow to around USD 672.77 billion by 2034.

The CAGR value of the home entertainment product market is expected to be approximately 6.50% from 2025 to 2034.

Macroeconomic factors, including disposable income growth, inflation, global supply chain stability, and currency fluctuations, will significantly influence consumer spending and product affordability in the home entertainment product market.

The home entertainment product market is experiencing a dual pricing trend, with 4K and premium smart devices gaining traction alongside feature-rich and affordable models that target budget-conscious consumers.

North America is expected to lead the global home entertainment product market during the forecast period.

The key players profiled in the global home entertainment product market include Sony Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., Panasonic Corporation, Bose Corporation, Philips Electronics Ltd., Apple Inc., Amazon.com, Inc., Microsoft Corporation, Google LLC (Alphabet Inc.), Yamaha Corporation, Harman International Industries, Inc., Sharp Corporation, TCL Technology Group Corporation, and Pioneer Corporation.

The competitive landscape of the home entertainment product market is highly fragmented, featuring global leaders such as Sony, Samsung, and LG, alongside emerging regional brands that compete through pricing, innovation, and smart technology integration.

The report examines key aspects of the home entertainment product market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed