Home Automatic Appliance Market Size, Share, Trends, Growth 2034

Home Automatic Appliance Market By Product Type (Smart Refrigerators, Robotic Vacuum Cleaners, Smart Washing Machines, Intelligent Air Conditioners, Automated Coffee Makers, and Others), By Technology (Internet of Things Connectivity, Voice Recognition Systems, Artificial Intelligence Integration, Motion Sensors, Remote Control Capabilities, and Others), By Application (Kitchen Automation, Cleaning Automation, Climate Control, Laundry Management, Entertainment Systems, Security and Monitoring), By End-User (Residential Households, Luxury Apartments, Smart Homes, Rental Properties, Senior Living Facilities, Vacation Homes), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

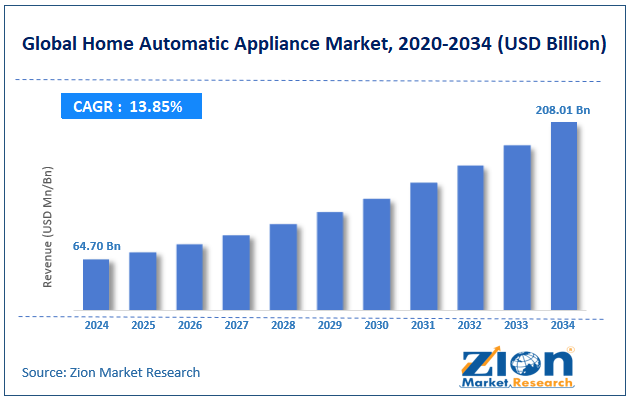

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 64.70 Billion | USD 208.01 Billion | 13.85% | 2024 |

Home Automatic Appliance Industry Perspective:

The global home automatic appliance market size was worth approximately USD 64.70 billion in 2024 and is projected to grow to around USD 208.01 billion by 2034, with a compound annual growth rate (CAGR) of roughly 13.85% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global home automatic appliance market is estimated to grow annually at a CAGR of around 13.85% over the forecast period (2025-2034).

- In terms of revenue, the global home automatic appliance market size was valued at approximately USD 64.70 billion in 2024 and is projected to reach USD 208.01 billion by 2034.

- The home automatic appliance market is projected to grow significantly due to the increasing adoption of smart home technologies and rising consumer demand for convenience-oriented household solutions.

- Based on product type, the robotic vacuum cleaners segment is expected to lead the home automatic appliance market, while the smart washing machines segment is anticipated to experience significant growth.

- Based on technology, the Internet of Things connectivity segment is expected to lead the home automatic appliance market, while the artificial intelligence integration segment is anticipated to witness notable growth.

- Based on application, the kitchen automation segment is the dominating segment, while the cleaning automation segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the residential households segment is expected to lead the market compared to the vacation homes segment.

- Based on region, North America is projected to dominate the global home automatic appliance market during the estimated period, followed by Europe.

Home Automatic Appliance Market: Overview

Home automatic appliances are smart household devices that perform daily tasks automatically with little or no human effort using advanced technology and connectivity. They make daily chores easier, save time, use less energy, and increase comfort through intelligent automation. These devices work through wireless networks, voice commands, mobile applications, and smart sensors to offer convenience and personalized use. Companies are enhancing features, improving energy efficiency, and refining designs while ensuring they integrate seamlessly with various smart home systems. They are changing how people manage their homes and promoting sustainable living by reducing waste and saving resources.

With constant innovation, home automatic appliances have become an important part of modern living. They are shaping the future of smarter, greener, and more comfortable homes. As technology continues to advance, these appliances will play an even greater role in creating connected and energy-efficient lifestyles.

The increasing consumer preference for convenience, energy efficiency, and connected living experiences is expected to drive growth in the home automatic appliance market throughout the forecast period.

Home Automatic Appliance Market Dynamics

Growth Drivers

Rising demand for convenience and time-saving household solutions

The home automatic appliance market is growing as consumers across the world look for products that save time on daily household work and improve the quality of life. Busy families depend on automated devices to handle tasks such as cleaning, cooking, and home care without supervision. These appliances give people more free time by automating repetitive chores, allowing them to focus on work, family, and hobbies. Rising urbanization and smaller homes are increasing the need for compact, multifunctional devices that offer maximum efficiency. Working professionals prefer appliances they can control through smartphones to manage household tasks from anywhere.

Dual-income families need automated solutions that keep homes clean and comfortable with little effort. With fast and demanding lifestyles, consumers choose products offering real convenience and easy fit into everyday routines. This change in consumer habits is transforming the home appliance industry and supporting steady market growth.

How are increasing energy costs and environmental awareness driving home automatic appliance market growth?

The global home automatic appliance market is growing as consumers pay more attention to electricity costs and the environmental impact of household energy use. Rising utility bills are prompting homeowners to invest in smart appliances that track energy usage and adjust consumption according to actual needs. These devices use sensors and learning systems to run during off-peak hours and cut overall electricity expenses.

Modern automatic appliances come with energy-saving certifications and eco-modes that appeal to environmentally aware buyers. Smart refrigerators reduce food waste through temperature control and effective inventory tracking, while intelligent washing machines use the right amount of water for each wash. Government incentives and rebate offers for energy-efficient products are motivating people to replace old appliances. Climate change concerns are driving manufacturers to create products with lower carbon footprints and sustainable materials. Smart thermostats and air conditioners learn user habits and change settings automatically to save power.

Restraints

How are high initial costs and affordability concerns creating restraints for the home automatic appliance market?

A major challenge for the home automatic appliance market is the large price gap between regular appliances and smart automated ones, making them less affordable for cost-conscious consumers. Features like connectivity, sensors, and smart controls increase production costs, leading to higher retail prices that many households find hard to afford. Middle-income families face difficulty in managing the upfront cost of fully automated home systems, even with the promise of long-term savings. Economic uncertainty and inflation make people cautious about buying premium appliances when basic models meet daily needs.

Many still see automatic appliances as luxury products instead of everyday essentials, reducing their appeal in price-sensitive regions. Limited financing and payment options make it tough for buyers to pay gradually over time. Worries about value for money and unclear savings discourage purchases. Income differences across regions create uneven growth, keeping automatic appliances out of reach for many families in developing areas.

Opportunities

Aging populations and accessibility needs

The home automatic appliance industry is seeing strong growth by meeting the needs of elderly people and those with mobility challenges who rely on assistive technologies. Seniors benefit from voice-controlled appliances that remove the need for buttons or manual effort. Robotic vacuum cleaners and automated cleaning systems help them keep homes clean without strain. Smart refrigerators with large screens and reminders support seniors in managing medicines and meal times. Automated lighting and climate control systems offer comfort without frequent movement or adjustments.

Healthcare experts suggest automatic appliances for patients recovering from injuries or surgeries who need short-term help with daily routines. Caregivers value remote monitoring features that let them check on elderly family members and ensure appliances work safely. Product designers are using universal design principles to make appliances easier for users with physical limitations. These growing applications are opening new market opportunities and pushing manufacturers to create inclusive products for people with different needs.

Challenges

How are technical complexity and connectivity issues limiting the market growth?

The home automatic appliance industry faces major challenges with device compatibility, network stability, and overall user experience across different technologies. Unstable wireless connections can interrupt performance and frustrate users expecting smooth operation from their smart devices. Manufacturers often use separate communication systems, stopping appliances from working together in one smart home setup. Software errors and updates can cause sudden malfunctions or loss of saved settings.

Users with limited technical skills find it hard to install and fix connected appliances without expert help. Internet failures can disable some features, increasing dependence on reliable network access. Security flaws in connected devices raise worries about privacy and hacking risks. Complicated interfaces and mobile applications confuse non-technical users who prefer simple controls. Customer support often fails to solve technical problems quickly, leading to user frustration and increased returns. High repair costs and a shortage of skilled technicians make maintenance difficult for many households.

Home Automatic Appliance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Automatic Appliance Market |

| Market Size in 2024 | USD 64.70 Billion |

| Market Forecast in 2034 | USD 208.01 Billion |

| Growth Rate | CAGR of 13.85% |

| Number of Pages | 214 |

| Key Companies Covered | Samsung Electronics Co. Ltd., LG Electronics Inc., Whirlpool Corporation, Haier Group Corporation, Bosch Home Appliances, Panasonic Corporation, Electrolux AB, Midea Group Co. Ltd., iRobot Corporation, Dyson Limited, Miele and Cie. KG, BSH Hausgeräte GmbH, GE Appliances (Haier), Hitachi Ltd., Xiaomi Corporation, and others. |

| Segments Covered | By Product Type, By Technology, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Home Automatic Appliance Market: Segmentation

The global home automatic appliance market is segmented based on product type, technology, application, end-user, and region.

Based on product type, the global home automatic appliance industry is classified into smart refrigerators, robotic vacuum cleaners, smart washing machines, intelligent air conditioners, automated coffee makers, and others. Robotic vacuum cleaners lead the market due to their widespread consumer acceptance, proven effectiveness in maintaining floor cleanliness, and continuous improvements in navigation technology and battery performance.

Based on technology, the industry is segregated into Internet of Things connectivity, voice recognition systems, artificial intelligence integration, motion sensors, remote control capabilities, and others. Internet of Things connectivity leads the market due to its fundamental role in enabling device communication, widespread industry adoption, and compatibility with existing smart home infrastructure.

Based on application, the global home automatic appliance market is divided into kitchen automation, cleaning automation, climate control, laundry management, entertainment systems, and security and monitoring. Kitchen automation is expected to lead the market during the forecast period due to the high frequency of kitchen activities, diverse product offerings, and strong consumer interest in cooking convenience.

Based on end-user, the global market is segmented into residential households, luxury apartments, smart homes, rental properties, senior living facilities, and vacation homes. Residential households hold the largest market share due to their vast numbers, diverse product needs, and continuous replacement cycles.

Home Automatic Appliance Market: Regional Analysis

North America leads the global market

North America leads the home automatic appliance market due to high income levels, strong technology use, and well-developed smart home systems. The United States is the biggest market, supported by technology-aware consumers, reliable internet access, and major retailers offering a wide range of products. The region benefits from top appliance brands, new startups, and strong investment in home automation companies. American consumers are open to purchasing products that offer comfort, energy savings, and ease of use with voice assistants. The presence of major technology companies and smart home platforms speeds up product development and consumer awareness. High homeownership and large living spaces make it easier to install multiple automatic appliances.

Both online and physical retail networks give customers convenient access to products and support. Strong promotions and demonstrations help people understand features and build trust in new technology. Rising interest in sustainable living and green homes is increasing demand for energy-efficient appliances. Cooperation among appliance makers, technology firms, and utility providers is strengthening the market and keeping North America in the lead. Expanding 5G networks and better connectivity support advanced features and real-time performance. The growing use of voice-controlled systems and AI assistants is further boosting acceptance of fully automated homes.

How is Europe making steady growth in the global home automatic appliance market?

Europe is experiencing steady growth in the home automatic appliance market as countries promote energy efficiency and consumers focus on sustainability when buying products. European Union nations are setting strict carbon reduction goals that support the use of smart appliances with lower environmental impact. The region’s commitment to a circular economy and long-lasting products is encouraging manufacturers to design durable and repairable automatic appliances.

European consumers are highly eco-conscious and prefer products with clear energy ratings and proven efficiency. Different housing styles, ranging from historic buildings to modern apartments, create a demand for flexible appliances that fit various spaces. Growing city populations in London, Paris, and Berlin are increasing the need for compact and space-saving devices. Cooperation among EU members helps align standards and certifications, making product comparisons easier. Research centers are collaborating with manufacturers to develop next-generation appliances that comply with Europe’s stringent safety and environmental standards.

Expanding high-speed internet in both cities and rural areas improves connectivity for smart appliances. Strong government support for innovation and clean technology is speeding up product development and market growth. Partnerships between energy companies and appliance makers are promoting smart grid connections and energy-saving programs.

Recent Market Developments:

- In January 2025, GE Appliances was named “Smart Appliance Company of the Year” in the 2025 IoT Breakthrough Awards Program, recognizing its integration of generative AI, connected-home solutions, and energy-optimization systems.

- In September 2025, Midea Group showcased its latest home-automation solutions at the IFA Berlin 2025 trade show, under the theme “Master Your Home,” focusing on comfort, energy efficiency, and space-saving design for European households.

Home Automatic Appliance Market: Competitive Analysis

The leading players in the global home automatic appliance market are:

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Whirlpool Corporation

- Haier Group Corporation

- Bosch Home Appliances

- Panasonic Corporation

- Electrolux AB

- Midea Group Co. Ltd.

- iRobot Corporation

- Dyson Limited

- Miele and Cie. KG

- BSH Hausgeräte GmbH

- GE Appliances (Haier)

- Hitachi Ltd.

- Xiaomi Corporation

The global home automatic appliance market is segmented as follows:

By Product Type

- Smart Refrigerators

- Robotic Vacuum Cleaners

- Smart Washing Machines

- Intelligent Air Conditioners

- Automated Coffee Makers

- Others

By Technology

- Internet of Things Connectivity

- Voice Recognition Systems

- Artificial Intelligence Integration

- Motion Sensors

- Remote Control Capabilities

- Others

By Application

- Kitchen Automation

- Cleaning Automation

- Climate Control

- Laundry Management

- Entertainment Systems

- Security and Monitoring

By End User

- Residential Households

- Luxury Apartments

- Smart Homes

- Rental Properties

- Senior Living Facilities

- Vacation Homes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Home automatic appliances are smart household devices that perform daily tasks automatically with little or no human effort using advanced technology and connectivity.

The global home automatic appliance market is projected to grow due to increasing consumer demand for convenience, rising adoption of Internet of Things technologies, and growing emphasis on energy efficiency and sustainable living practices.

According to a study, the global home automatic appliance market size was worth around USD 64.70 billion in 2024 and is predicted to grow to around USD 208.01 billion by 2034.

The CAGR value of the home automatic appliance market is expected to be around 13.85% during 2025-2034.

North America is expected to lead the global home automatic appliance market during the forecast period.

The major players profiled in the global home automatic appliance market include Samsung Electronics Co. Ltd., LG Electronics Inc., Whirlpool Corporation, Haier Group Corporation, Bosch Home Appliances, Panasonic Corporation, Electrolux AB, Midea Group Co. Ltd., iRobot Corporation, Dyson Limited, Miele and Cie. KG, BSH Hausgeräte GmbH, GE Appliances (Haier), Hitachi Ltd., and Xiaomi Corporation.

The report examines key aspects of the home automatic appliance market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

In the home automatic appliance market, advancements such as machine learning algorithms, improved sensor technologies, edge computing, and enhanced connectivity protocols are improving device intelligence, responsiveness, and reliability, making automatic appliances more effective and user-friendly across applications.

In the home automatic appliance market, consumers are increasingly seeking voice-controlled, energy-efficient, and interconnected devices. Manufacturers are responding by developing products with enhanced artificial intelligence capabilities, intuitive interfaces, and seamless integration with popular smart home platforms.

In the home automatic appliance market, major players like Samsung, LG, and Whirlpool are expanding through product innovation, strategic partnerships, and ecosystem development while focusing on artificial intelligence integration, energy efficiency improvements, and user experience enhancements to strengthen global market positions.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed