High Resolution Industrial Camera Market Size, Share, Trends, Growth 2034

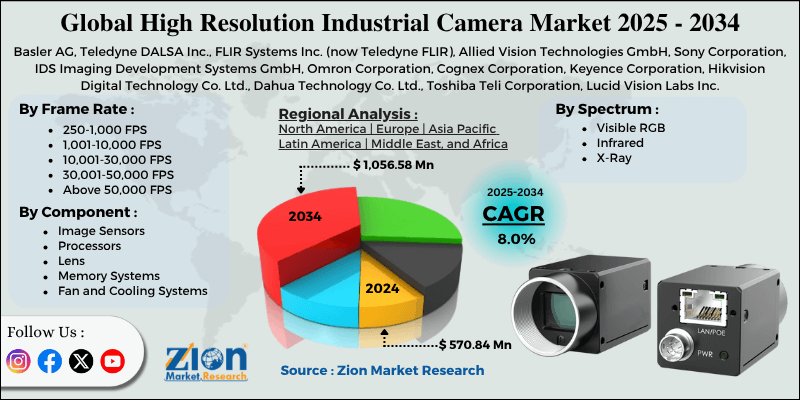

High Resolution Industrial Camera Market By Component (Image Sensors, Processors, Lens, Memory Systems, Fan and Cooling Systems, and Others), By Spectrum (Visible RGB, Infrared, X-Ray), By Frame Rate (250-1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, Above 50,000 FPS), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

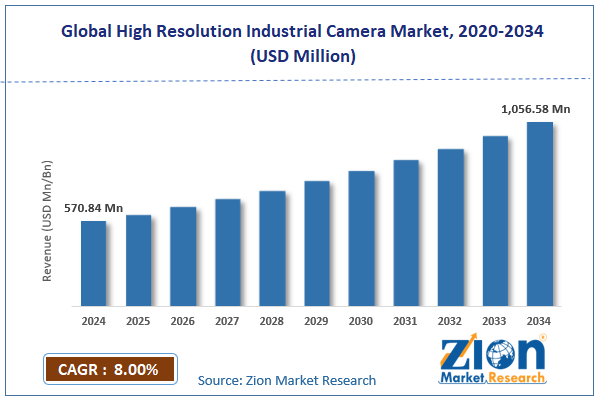

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 570.84 Million | USD 1,056.58 Million | 8% | 2024 |

High Resolution Industrial Camera Industry Perspective:

The global high resolution industrial camera market size was around USD 570.84 million in 2024 and is projected to reach USD 1056.58 million by 2034, with a compound annual growth rate (CAGR) of roughly 8% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global high resolution industrial camera market is estimated to grow annually at a CAGR of around 8% over the forecast period (2025-2034)

- In terms of revenue, the global high-resolution industrial camera market was valued at approximately USD 570.84 million in 2024 and is projected to reach USD 1056.58 million by 2034.

- The high resolution industrial camera market is projected to grow significantly owing to the rising adoption of machine vision systems across industries, the increasing need for precision measurement and defect detection, and technological advancements in CMOS and CCD sensor technologies.

- Based on the component, the image sensors segment is expected to lead the market, while the lens segment is expected to grow considerably.

- Based on the spectrum, the visible RGB segment is the dominating segment, while the infrared segment is projected to witness sizeable revenue over the forecast period.

- Based on frame rate, the 1,001-10,000 FPS segment is expected to lead the market compared to the 250-1,000 FPS segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

High Resolution Industrial Camera Market: Overview

High-resolution industrial cameras are advanced imaging devices designed to measure, precisely inspect, and monitor in industrial environments. They capture high-quality, detailed images with superior clarity, enabling accurate analysis across various applications, including robotics, manufacturing, scientific research, and quality control. The global high resolution industrial camera market is likely to expand rapidly, driven by the growing adoption of industrial robotics and automation, the rise of quality inspection, and advancements in image sensors. Automation is transforming manufacturing operations, and high-resolution cameras are paramount for precision control and robotic vision. They enable accurate detection, inspection, and alignment, thereby reducing human error in production lines. The growing use of automated systems worldwide is driving the need for these advanced imaging solutions.

Moreover, manufacturers are prioritizing immaculate production, making high-resolution cameras vital for detecting microscopic defects. These cameras provide real-time visual feedback, minimizing waste and ensuring quality. Their application is growing speedily in the automotive, electronics, and semiconductor industries to maintain stringent quality and safety standards.

Furthermore, recent advancements in CC and CMOS sensors have driven camera performance, allowing for higher resolution and faster frame rates. These advancements enhance low-light imaging and power efficiency, improving usability in complex environments. As sensor technology improves, cameras are becoming more efficient and capable for industrial deployment.

Despite the growth, the global market is constrained by factors such as high initial investment, integration costs, and data storage and bandwidth restrictions. Installing high-resolution camera systems requires significant investment in software and hardware integration. Medium and small businesses usually find these costs challenging to manage. This financial constraint restricts broader adoption, mainly in the developing markets.

Likewise, high-resolution imaging generates vast quantities of data, requiring advanced storage and network infrastructure. Low bandwidth can lead to latency issues in real-time image processing and analysis. These technical challenges reduce system efficiency and raise operational costs.

Nonetheless, the global high resolution industrial camera industry stands to benefit from several key opportunities, such as the growth of autonomous vehicles and the rising demand from developing nations. High-resolution cameras are vital for vision systems in autonomous cars and industrial drones. They allow precise navigation, data collection, and obstacle detection for remote monitoring.

With growing investments in autonomous technology, the advanced industrial camera industry is expanding rapidly. The rapid industrialization in nations such as China, Brazil, and India is creating new opportunities for camera manufacturers. Local industries are adopting automation to enhance production efficiency and export quality. As digital ecosystems and infrastructure strengthen, camera adoption will boost further.

High Resolution Industrial Camera Market Dynamics

Growth Drivers

How is the automotive industry's increasing demand for quality control fueling the high resolution industrial camera market?

The automotive market’s move toward autonomous vehicles and electrification has augmented the demand for advanced visual inspection systems. high-resolution industrial cameras are largely used for surface inspection, robotic guidance, and dimensional measurement in modern assembly lines. Companies like Omron Corporation have introduced 5G-enabled vision cameras to deliver real-time, high-speed inspections, enhancing efficiency and precision in EV production.

How are technological improvements in imaging technology and sensor development driving the high resolution industrial camera market?

Improvements in image sensor technologies, such as CCD and CMOS, have significantly enhanced the performance of industrial cameras. Innovations in BSI (backside-illuminated) sensors have increased light sensitivity by nearly 25%, enhancing imaging in low-light conditions and enabling frame rates over 200 fps for industrial vision tasks. These advancements are enabling faster, sharper image capture, while efficient processing chips and miniaturization are expanding the use of cameras in pharmaceuticals, aerospace, and electronics, thus propelling the high resolution industrial camera market.

Restraints

Lack of skilled professionals for system integration hampers the market progress

Implementing high-resolution camera systems requires expertise in AI, optics, and industrial automation; however, a worldwide shortage of skilled labor is hindering their adoption. The World Economic Forum's 2024 report highlighted a 27% talent gap in industrial automation and AI-based imaging fields. Manufacturing in Europe and Asia is experiencing project delays due to limited training and integration skills. This workforce scarcity increases project costs and dependency on external system integrators, eventually affecting long-term ROI and operational flexibility.

Opportunities

How does the growth of e-commerce and logistics automation open lucrative opportunities for the development of the high-resolution industrial camera market?

The rapid expansion of global logistics and e-commerce is driving demand for vision-guided automation systems. Automated warehouses are dependent on high-resolution cameras for package identification, robotic navigation, and sorting. According to McKinsey, investments in e-commerce logistics automation reached $42 billion in 2024, up 19% from 2023. Prominent companies like Keyence and Cognex are launching smart cameras for shape recognition and barcode scanning, creating strong growth opportunities for suppliers in the supply chain and in retail automation. Such automation is fueling the growth of the high resolution industrial camera industry.

Challenges

Rapid technological obsolescence restricts the market growth

Rapid technological advancements in the imaging industry render high-resolution camera systems quickly obsolete. According to reports, the product life cycle in industrial imaging has decreased by 25% over the past decade. With AI-integrated sensors emerging every 12-18 months and novel CMOS technologies, constant upgrades increase operational costs and risk of obsolescence for manufacturers unable to keep pace.

High Resolution Industrial Camera Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Resolution Industrial Camera Market |

| Market Size in 2024 | USD 570.84 Million |

| Market Forecast in 2034 | USD 1,056.58 Million |

| Growth Rate | CAGR of 8.0% |

| Number of Pages | 214 |

| Key Companies Covered | Basler AG, Teledyne DALSA Inc., FLIR Systems Inc. (now Teledyne FLIR), Allied Vision Technologies GmbH, Sony Corporation, IDS Imaging Development Systems GmbH, Omron Corporation, Cognex Corporation, Keyence Corporation, Hikvision Digital Technology Co. Ltd., Dahua Technology Co. Ltd., Toshiba Teli Corporation, Lucid Vision Labs Inc., The Imaging Source Europe GmbH, Nikon Corporation, and others. |

| Segments Covered | By Component, By Spectrum, By Frame Rate, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High Resolution Industrial Camera Market: Segmentation

The global high resolution industrial camera market is segmented based on component, spectrum, frame rate, and region.

Based on component, the global high resolution industrial camera industry is divided into image sensors, processors, lenses, memory systems, fan and cooling systems, and others. The image sensors segment held a dominant market share, as they are vital components for capturing precise visual data. The move from CCD to advanced CMOS technology has enhanced image clarity, energy efficiency, and speed, strengthening their dominance. Constant advancements by companies such as Onsemi, Samsung, and Sony enable higher resolutions and faster frame rates, reinforcing their indispensability in industrial imaging.

Based on spectrum, the global high resolution industrial camera market is segmented into visible RGB, infrared, and X-ray. The visible RGB segment dominates the market due to its widespread use in inspection and manufacturing. These cameras offer accurate color imaging, high clarity, and versatility. Their AI compatibility and cost-effectiveness make them the most preferred choice for industrial applications.

Based on frame rate, the global market is segmented into 250-1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, and above 50,000 FPS. The 1,001-10,000 FPS segment holds a leading market share due to its balance of speed, cost, and resolution. It is extensively used in robotics, inspection, and motion analysis. Its capability to capture fast-moving objects without distortion makes it the highly preferred choice in electronics and manufacturing.

High Resolution Industrial Camera Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global High Resolution Industrial Camera Market?

Asia Pacific is anticipated to retain its leading role in the global high resolution industrial camera market, driven by the strong presence of the semiconductor and electronics industries, rising investments in Industry 4.0 and smart factories, and technological advancements. The region's dominance in electronics and semiconductor manufacturing further strengthens its market position. High-resolution cameras are broadly used for wafer inspection, defect analysis, and PCB assembly in these industries.

Moreover, Asia Pacific corporations and governments are actively investing in smart manufacturing infrastructure and Industry 4.0 programs. Economies like Japan and China are adopting AI-based vision systems and IoT-integrated automation to drive productivity. Furthermore, the presence of leading sensor and camera manufacturers in the region, such as Toshiba, Sony, and Hikvision, fuels ongoing advancements in imaging technology. Local production capabilities enhance accessibility and reduce the costs of advanced imaging systems. The availability of cost-effective, high-quality camera components has made the region a leader in both consumption and production.

Europe ranks as the second-largest region in the global high resolution industrial camera industry, driven by a strong foundation in robotics and industrial automation, leadership in aerospace and automotive manufacturing, and the growth of smart manufacturing and Industry 4.0 initiatives. Europe ranks second in the market due to its advanced industrial automation ecosystem. Nations such as Italy, Germany, and France have deeply integrated robotics and vision solutions into their manufacturing processes.

Moreover, Europe's leadership in the aerospace and automotive industries fuels strong demand for inspection solutions and precision imaging. Major manufacturers such as Volkswagen, BMW, and Airbus use high-resolution cameras for defect detection, process optimization, and component alignment.

Additionally, European nations are leaders in implementing Industry 4.0 strategies focused on AI-driven automation, IoT integration, and data analytics. Nations like the UK and Germany are heavily investing in smart factory projects, driving the adoption of smart vision systems.

High Resolution Industrial Camera Market: Competitive Analysis

The leading players in the global high resolution industrial camera market are:

- Basler AG

- Teledyne DALSA Inc.

- FLIR Systems Inc. (now Teledyne FLIR)

- Allied Vision Technologies GmbH

- Sony Corporation

- IDS Imaging Development Systems GmbH

- Omron Corporation

- Cognex Corporation

- Keyence Corporation

- Hikvision Digital Technology Co. Ltd.

- Dahua Technology Co. Ltd.

- Toshiba Teli Corporation

- Lucid Vision Labs Inc.

- The Imaging Source Europe GmbH

- Nikon Corporation

High Resolution Industrial Camera Market: Key Market Trends

Rising adoption of 3D and hyperspectral imaging technologies:

Hyperspectral and 3D cameras are transforming inspection and analysis in manufacturing, healthcare, and agriculture. They deliver precise data on material composition, depth, and surface texture, improving accuracy. The growing demand for multidimensional inspection and non-destructive testing is fueling broader adoption of these advanced imaging solutions.

Expansion of edge computing and smart factory applications:

Edge computing is a significant trend that facilitates data processing on devices or cameras rather than on centralized servers. This reduces latency and enhances real-time decision-making in industrial environments. With the worldwide rise in IoT and Industry 4.0, edge-enabled high-resolution cameras are broadly adopted for process optimization and autonomous inspections.

The global high resolution industrial camera market is segmented as follows:

By Component

- Image Sensors

- Processors

- Lens

- Memory Systems

- Fan and Cooling Systems

- Others

By Spectrum

- Visible RGB

- Infrared

- X-Ray

By Frame Rate

- 250-1,000 FPS

- 1,001-10,000 FPS

- 10,001-30,000 FPS

- 30,001-50,000 FPS

- Above 50,000 FPS

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

High-resolution industrial cameras are advanced imaging devices designed to measure, precisely inspect, and monitor in industrial environments. They capture high-quality, detailed images with superior clarity, enabling accurate analysis across applications such as robotics, manufacturing, scientific research, and quality control.

The global high-resolution industrial camera market is projected to grow due to rising demand for automation and quality inspection in manufacturing, increasing adoption in semiconductor and electronics inspection, and growing use in medical and life science imaging applications.

According to a study, the global high-resolution industrial camera market size was around USD 570.84 million in 2024 and is expected to grow to around USD 1056.58 million by 2034.

The CAGR of the high-resolution industrial camera market is expected to be around 8% during 2025-2034.

The Visible RGB spectrum segment holds the largest share in the global High Resolution Industrial Camera Market due to its use in inspection, manufacturing, and automation applications.

Asia Pacific is expected to lead the global high resolution industrial camera market during the forecast period.

China is a key contributor to the global High Resolution Industrial Camera Market, driven by its rapid adoption of automation technologies and strong manufacturing base.

The key players profiled in the global high resolution industrial camera market include Basler AG, Teledyne DALSA Inc., FLIR Systems Inc. (now Teledyne FLIR), Allied Vision Technologies GmbH, Sony Corporation, IDS Imaging Development Systems GmbH, Omron Corporation, Cognex Corporation, Keyence Corporation, Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Toshiba Teli Corporation, Lucid Vision Labs Inc., The Imaging Source Europe GmbH, and Nikon Corporation.

Leading players are adopting product innovation, strategic partnerships, AI integration, and global expansion initiatives to strengthen their market presence.

The report examines key aspects of the high resolution industrial camera market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed