HbA1c Testing Devices Market Size, Share, Trends, Growth 2034

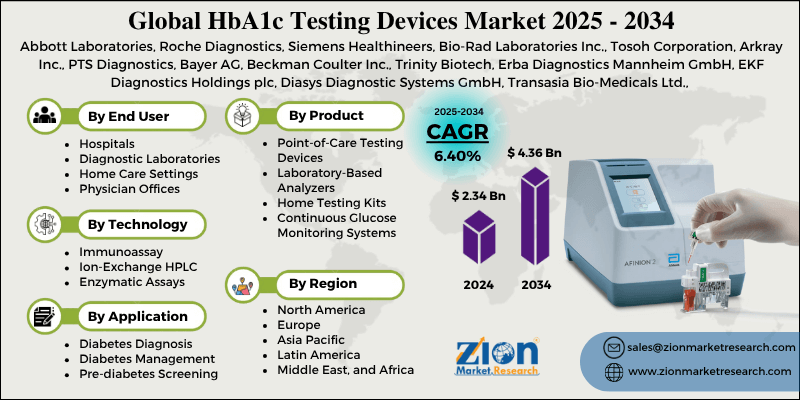

HbA1c Testing Devices Market By Product Type (Point-of-Care Testing Devices, Laboratory-Based Analyzers, Home Testing Kits, and Continuous Glucose Monitoring Systems), By Technology (Immunoassay, Ion-Exchange HPLC, Enzymatic Assays, and Boronate Affinity), By End-User (Hospitals, Diagnostic Laboratories, Home Care Settings, and Physician Offices), By Application (Diabetes Diagnosis, Diabetes Management, Pre-diabetes Screening, and Research Applications), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

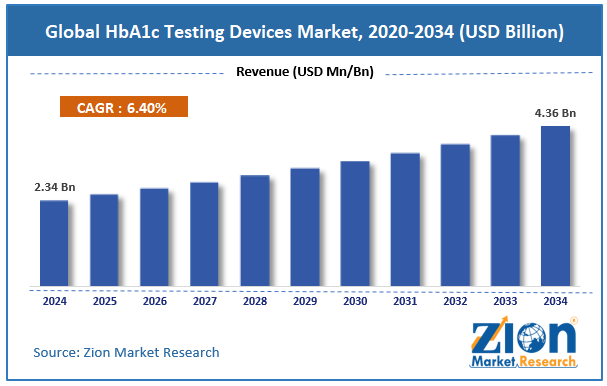

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.34 Billion | USD 4.36 Billion | 6.40% | 2024 |

HbA1c Testing Devices Industry Perspective:

The global HbA1c testing devices market was valued at approximately USD 2.34 billion in 2024 and is expected to reach around USD 4.36 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 6.40% between 2025 and 2034.

HbA1c Testing Devices Market: Overview

HbA1c testing devices are medical instruments that measure glycated hemoglobin levels in blood, providing healthcare professionals with critical information about average blood glucose control over the past two to three months. These diagnostic tools play a crucial role in diabetes management and monitoring, providing accurate assessments that enable physicians to make informed treatment decisions.

The HbA1c testing devices market encompasses various healthcare settings, including hospitals seeking reliable diagnostic solutions, clinical laboratories requiring high-throughput testing capabilities, and individual patients needing convenient home monitoring options. Their ability to provide long-term glucose control insights makes them indispensable for diabetes care management and early detection of pre-diabetic conditions.

The increasing prevalence of diabetes worldwide and growing awareness about preventive healthcare are expected to drive substantial growth in the global HbA1c testing devices industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global HbA1c testing devices market is estimated to grow annually at a CAGR of around 6.40% over the forecast period (2025-2034)

- In terms of revenue, the global HbA1c testing devices market size was valued at around USD 2.34 billion in 2024 and is projected to reach USD 4.36 billion by 2034.

- The HbA1c testing devices market is projected to grow significantly due to the increasing adoption of point-of-care testing and technological advancements in diagnostic accuracy and speed.

- Based on product type, point-of-care testing devices lead the segment and are expected to continue dominating the global market.

- Based on the technology, immunoassay is expected to lead the market.

- Based on the end user, hospitals are anticipated to command the largest market share.

- Based on application, diabetes management is expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

HbA1c Testing Devices Market: Growth Drivers

Rising global diabetes prevalence and healthcare awareness

The HbA1c testing devices market is growing as healthcare systems worldwide are recognizing the need for effective diabetes monitoring solutions, given the rising prevalence of diabetes. Diabetes affects over 500 million people globally, and numbers are increasing due to lifestyle changes, the aging population, and a shift toward processed foods.

Healthcare providers are implementing comprehensive diabetes management programs that rely heavily on regular HbA1c monitoring to track patient progress and adjust treatment accordingly.

The understanding of diabetes complications and the economic burden on healthcare systems has prompted governments and health organizations to invest in early detection and monitoring programs.

Technological advancement and point-of-care testing adoption

The HbA1c testing devices industry is growing rapidly as technology improves testing accuracy, speeds up the process, and makes it available across various healthcare settings. Modern point-of-care devices can deliver laboratory-quality results in minutes; no more waiting for laboratory results, and instant clinical decision-making.

Advanced sensor technology and miniaturization have made devices more portable and user-friendly. Integration with electronic health records and cloud-based data management systems has streamlined workflow and improved patient data tracking. Technology has simplified HbA1c testing while maintaining high accuracy.

HbA1c Testing Devices Market: Restraints

High device costs and reimbursement challenges

Despite rising demand, the HbA1c testing devices market faces several big challenges. High equipment costs and confusing reimbursement policies make it hard for many to adopt these devices, especially in low-budget healthcare settings.

Many advanced HbA1c devices need a significant upfront investment. This puts pressure on the budgets of small clinics, rural health centers, and healthcare systems in developing countries.

Furthermore, ongoing costs like maintenance, calibration, and consumables increase the overall expense. These added costs make it harder for providers to justify the investment. In many regions, insurance coverage and reimbursement rules vary a lot, making it unclear whether providers will recover their testing costs. These financial barriers create difficulties, especially in emerging markets.

HbA1c Testing Devices Market: Opportunities

Home healthcare and self-monitoring market expansion

The HbA1c testing devices industry is seeing opportunities as the shift to patient self-monitoring is creating demand for user-friendly, accurate testing solutions.

Aging populations and the management of chronic diseases are driving the need for home-based monitoring options that reduce hospital visits and healthcare costs. Telemedicine and remote patient monitoring programs require home testing devices that can transmit results to healthcare providers in real-time for monitoring and intervention.

Smartphone-compatible devices and mobile health applications are creating opportunities for integrated diabetes management solutions that combine testing, data tracking, and communication with healthcare providers in one platform.

HbA1c Testing Devices Market: Challenges

Regulatory compliance and standardization complexities

The HbA1c testing devices market faces challenges in navigating the complex regulatory landscape and standardization across different testing methods and geographies. Regulatory approvals vary significantly across countries and regions, necessitating substantial investments in documentation and clinical validation studies.

Standardization efforts to get consistent results across different platforms and laboratories are ongoing. Quality control requires strict testing protocols and thorough documentation, which can slow down product development and time to market.

Healthcare providers also need to comply with laboratory accreditation standards and participate in proficiency testing programs, adding operational complexity and cost.

HbA1c Testing Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | HbA1c Testing Devices Market |

| Market Size in 2024 | USD 2.34 Billion |

| Market Forecast in 2034 | USD 4.36 Billion |

| Growth Rate | CAGR of 6.40% |

| Number of Pages | 211 |

| Key Companies Covered | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories Inc., Tosoh Corporation, Arkray Inc., PTS Diagnostics, Bayer AG, Beckman Coulter Inc., Trinity Biotech, Erba Diagnostics Mannheim GmbH, EKF Diagnostics Holdings plc, Diasys Diagnostic Systems GmbH, Transasia Bio-Medicals Ltd., Mindray Medical International Limited, Danaher Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Ortho Clinical Diagnostics, Quidel Corporation, and others. |

| Segments Covered | By Product Type, By Technology, By End User, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

HbA1c Testing Devices Market: Segmentation

The global HbA1c testing devices market is segmented into product type, technology, end-user, application, and region.

Based on product type, the market is segregated into point-of-care testing devices, laboratory-based analyzers, home testing kits, and continuous glucose monitoring systems. Point-of-care testing devices lead the market due to their convenience, rapid result delivery, and ability to support immediate clinical decision-making in various healthcare settings.

Based on technology, the HbA1c testing devices industry is classified into immunoassay, ion-exchange HPLC, enzymatic assays, and boronate affinity. Immunoassay holds the largest market share due to its accuracy, reliability, and widespread adoption in both clinical and point-of-care testing applications.

Based on the end-user, the HbA1c testing devices market is divided into hospitals, diagnostic laboratories, home care settings, and physician offices. Hospitals are expected to lead the market during the forecast period due to high patient volumes, comprehensive diabetes care programs, and established testing infrastructure.

Based on the application, the market is segmented into diabetes diagnosis, diabetes management, pre-diabetes screening, and research applications. Diabetes management leads the market share due to the ongoing need for regular monitoring of diagnosed patients and the growing emphasis on proactive diabetes care management.

HbA1c Testing Devices Market: Regional Analysis

North America to lead the market

North America leads the global HbA1c testing devices market due to advanced healthcare infrastructure, high diabetes prevalence, and strong adoption of new technologies in clinical and home care settings. The region accounts for approximately 40% of the global market share, with the United States being the largest consumer of HbA1c testing devices.

Healthcare institutions in the region have implemented comprehensive diabetes management programs that rely heavily on regular HbA1c testing for patient care. The region has robust reimbursement systems that support widespread testing and allow healthcare providers to invest in advanced diagnostic equipment.

Strong partnerships between device manufacturers, healthcare providers, and research institutions have created an ecosystem for innovation and product development. Government initiatives for diabetes awareness and preventive care also support market growth through funding and policy development.

Europe is expected to show steady growth.

Europe is growing in the HbA1c testing devices industry as healthcare systems are focusing on diabetes management and preventive care. Europe’s emphasis on quality of care and patient safety aligns with advanced HbA1c testing technology, which provides accurate and reliable results.

Hospitals are adopting modern testing devices as part of their diabetes care programs and population health management initiatives. Government healthcare programs across European markets support HbA1c testing through coverage policies and diabetes management guidelines.

Regional medical device regulations and quality standards are driving the adoption of high-quality testing solutions. Personalized medicine and precision healthcare are further accelerating the adoption of advanced HbA1c testing devices in clinical and research applications.

Recent Market Developments:

- In April 2025, Abbott launched a new point-of-care HbA1c testing system with enhanced accuracy and faster result delivery, specifically designed for physician offices and small clinics.

- In February 2025, Roche Diagnostics introduced an innovative laboratory analyzer with improved throughput capacity and automated quality control features for high-volume testing environments.

HbA1c Testing Devices Market: Competitive Analysis

The global HbA1c testing devices market is led by players like:

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories Inc.

- Tosoh Corporation

- Arkray Inc.

- PTS Diagnostics

- Bayer AG

- Beckman Coulter Inc.

- Trinity Biotech

- Erba Diagnostics Mannheim GmbH

- EKF Diagnostics Holdings plc

- Diasys Diagnostic Systems GmbH

- Transasia Bio-Medicals Ltd.

- Mindray Medical International Limited

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Ortho Clinical Diagnostics

- Quidel Corporation

The global HbA1c testing devices market is segmented as follows:

By Product Type

- Point-of-Care Testing Devices

- Laboratory-Based Analyzers

- Home Testing Kits

- Continuous Glucose Monitoring Systems

By Technology

- Immunoassay

- Ion-Exchange HPLC

- Enzymatic Assays

- Boronate Affinity

By End User

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Physician Offices

By Application

- Diabetes Diagnosis

- Diabetes Management

- Pre-diabetes Screening

- Research Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HbA1c testing devices are medical instruments that measure glycated hemoglobin levels in blood, providing healthcare professionals with critical information about average blood glucose control over the past two to three months.

The HbA1c testing devices market is expected to be driven by the rising global prevalence of diabetes, increasing adoption of point-of-care testing, technological advancements in diagnostic accuracy, growing awareness of preventive healthcare, and the expansion of home healthcare services.

According to our study, the global HbA1c testing devices market was worth around USD 2.34 billion in 2024 and is predicted to grow to around USD 4.36 billion by 2034.

The CAGR value of the HbA1c testing devices market is expected to be around 6.40% during 2025-2034.

The global HbA1c testing devices market will register the highest revenue contribution from North America during the forecast period.

Key players in the HbA1c testing devices market include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories Inc., Tosoh Corporation, Arkray Inc., PTS Diagnostics, Bayer AG, Beckman Coulter Inc., Trinity Biotech, Erba Diagnostics Mannheim GmbH, EKF Diagnostics Holdings plc, Diasys Diagnostic Systems GmbH, Transasia Bio-Medicals Ltd., Mindray Medical International Limited, Danaher Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Ortho Clinical Diagnostics, and Quidel Corporation.

The report provides a comprehensive analysis of the HbA1c testing devices market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technological innovations, regulatory landscape, and healthcare adoption patterns that shape the diabetes diagnostic device market ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed