Glufosinate Market Size, Share Report, Analysis, Trends, Growth, 2030

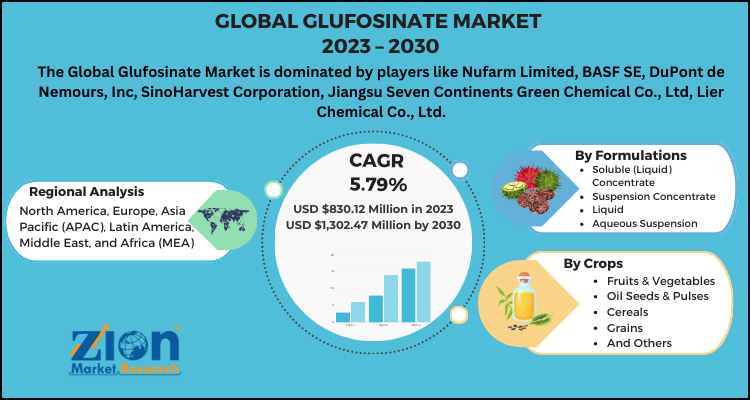

Glufosinate Market - By Formulations (Soluble (Liquid) Concentrate, Suspension Concentrate, Liquid, Aqueous Suspension, And Others), By Crops (Fruits & Vegetables, Oil Seeds & Pulses, Cereals, Grains, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2023 - 2030

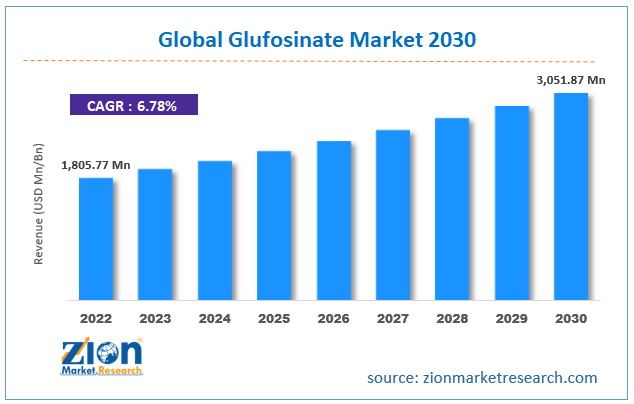

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,805.77 Million | USD 3,051.87 Million | 6.78% | 2022 |

Description

Glufosinate Industry Perspective:

The global glufosinate market size was worth around USD 1,805.77 Million in 2022 and is predicted to grow to around USD 3,051.87 Million by 2030 with a compound annual growth rate (CAGR) of roughly 6.78% between 2023 and 2030. The report analyzes the global glufosinate market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the glufosinate industry.

Key Insights:

- As per the analysis shared by our research analyst, the global glufosinate market is estimated to grow annually at a CAGR of around 6.78% over the forecast period (2023-2030)

- The global glufosinate market size was valued at around USD 1,805.77 Million in 2022 and is projected to reach USD 3,051.87 Million by 2030.

- The growth of the glufosinate market is being driven by increasing use as a non-selective herbicide in agriculture to control a wide range of weeds and grasses.

- Based on the formulations, the soluble liquid concentrate segment is expected to lead the market, while the wheat segment is expected to grow considerably.

- Based on crop, the fruits & vegetables, oil seeds & pulses, cereals, grains, and others segment, while the domestic consumers segment is projected to witness sizeable revenue over the forecast period.

- By region, North America is expected to dominate the global market during the forecast period.

Global Glufosinate Market: Overview

Glufosinate is an efficient herbicide utilized to control a wide range of weeds. It also helps prevent diseases on 100 crops. The farmer makes use of these herbicides as they offer more protection and work only on the applied portion of the plant. Glufosinate finds a large number of applications across the non-agriculture and agricultural sectors. This product is widely used in place of paraquat and glyphosate. However, it is also used in fungicides for crop protection against different diseases. The unique mode of action of glufosinate made it a suitable herbicide. Overall, glufosinate, also referred to as ammonium salt, offers numerous benefits, including a safe environment and nutritious food, and as an output, it reduces cost & increases high crop yield.

Global Glufosinate Market: Growth Factors

The global population is likely to reach 9 billion by 2050. Such a surge in the population will also increase food production by 70% on the given land. Weed poses a danger while harvesting, and in addition, leaving them untreated will also pose a negative impact on the average global yield causing a great loss. The global glufosinate market is likely to gain substantial traction during the forecast period, majorly due to the fast-growing agrochemical sector along with the surging requirement to prevent crops from diseases.

Furthermore, the growing demand for horticulture will further positively shape the trajectory of the global market during the forecast period. The market is witnessing an ever-expanding resistance application in the agriculture sector. Glufosinate is a United States Environmental Protection Agency-registered and California-registered chemical. However, India and China are among the top agriculture companies offering a huge opportunity for the global market. Covid-19 has significantly impacted the global glufosinate market, shutdowns and disruption in the supply chain downgraded the global market, but the emerging trends and ongoing initiatives by market leaders are likely to scale up the growth of the market again in the coming years. Frequent product launches are likely to foster healthy development in the global market.

Global Glufosinate Market: Segmentation

The global glufosinate market can be segmented into formulations, crops, and regions.

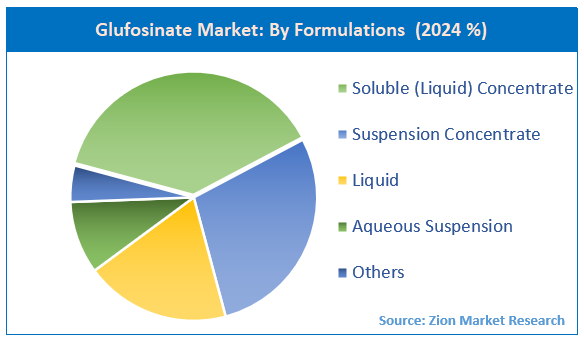

By Formulations, the market can be segmented into soluble (liquid) concentrate, suspension concentrate, liquid, aqueous suspension, and others. The soluble liquid concentrate accounts for the largest share of the global glufosinate market due to its ease of use, storage, and transport. Also, it is a non-abrasive and non-volatile material. In addition, it readily mixes with water.

By Crop, the market can be segmented into fruits & vegetables, oil seeds & pulses, cereals, grains, and others.

Recent Development

- In October 2024, BASF introduced Liberty Ultra, a next-generation glufosinate-based herbicide powered by Glu‑L Technology. Offering approximately 33% greater coverage and 20% better weed control than generic alternatives, it is EPA-approved for use on soybean, cotton, corn, and canola.

- In 2024, the EPA granted full registration to glufosinate‑P, a more efficient isomer of glufosinate. Designed for use on both conventional and glufosinate-resistant crops, it offers effective weed control with a lower environmental impact.

- In 2020, BASF acquired Glu‑L™ technology—a method for producing L-glufosinate ammonium—from AgriMetis. It remains significant for its role in driving downstream innovation.

Global Glufosinate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Glufosinate Market Research Report |

| Market Size in 2022 | USD 1,805.77 Million |

| Market Forecast in 2030 | USD 3,051.87 Million |

| Growth Rate | CAGR of 6.78% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Nufarm Limited, BASF SE, DuPont de Nemours, Inc, SinoHarvest Corporation, Jiangsu Seven Continents Green Chemical Co., Ltd, Lier Chemical Co., Ltd., UPL Limited, Zhejiang Yongnong Chem. Ind. Co., Ltd., Limin Chemical Co., Ltd, and Bayer AG., among others. |

| Segments Covered | By Formulations, By Crops, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Glufosinate Market dynamics:

Key Growth Drivers

The glufosinate market is experiencing robust growth driven by the rising issue of glyphosate resistance in weeds. As the effectiveness of glyphosate diminishes, farmers are increasingly turning to glufosinate as a crucial alternative for weed management. This demand is further fueled by the widespread adoption of genetically modified (GM) crops, particularly corn, soybeans, and canola, which have been engineered to be tolerant to glufosinate. The expanding global population and the subsequent need for higher agricultural productivity from limited arable land also contribute to the demand for effective herbicides like glufosinate to protect crop yields and ensure food security. Additionally, the phase-out and restriction of other herbicides, such as paraquat, have created a significant void in the market, which glufosinate is well-positioned to fill.

Restraints

Despite its strong market position, the glufosinate market faces several significant restraints. One of the most prominent is the increasing public and regulatory scrutiny regarding the environmental and health impacts of synthetic pesticides. Stringent government regulations and the potential for a ban in certain regions, such as the European Union, pose a considerable threat to market growth. Additionally, the development of glufosinate-resistant weeds, while not as widespread as glyphosate resistance, is a growing concern that could diminish the herbicide's long-term effectiveness. The market is also subject to price volatility, often influenced by oversupply from major producing countries like China, which can impact the profitability of manufacturers and make it difficult for them to maintain stable pricing.

Opportunities

The glufosinate market presents several key opportunities for future growth. The development of new, more efficient formulations, such as the L-glufosinate variant, can enhance efficacy and reduce the required application rate, making the product more competitive and environmentally friendly. There are also significant opportunities in emerging markets, particularly in the Asia-Pacific and Latin American regions, where agricultural modernization and the adoption of advanced farming practices are on the rise. Moreover, the integration of glufosinate with precision agriculture technologies, such as drone-based spraying and GPS-guided systems, can lead to more targeted application, minimize waste, and improve overall efficiency. The continuous development of new glufosinate-tolerant crop varieties by major seed companies further solidifies its position as a cornerstone of modern agriculture.

Challenges

The market for glufosinate faces several challenges that require strategic navigation. The primary challenge is the continuous pressure from regulatory bodies to restrict or ban the use of the herbicide due to its potential environmental and health risks. This necessitates significant investment in research and development to create safer, more sustainable alternatives or to prove the safety of existing products. The market also faces intense competition, not just from other chemical herbicides but also from the growing segment of bio-herbicides and non-chemical weed control methods. Furthermore, the reliance on a few key production regions, particularly China, creates supply chain vulnerabilities and exposes the market to geopolitical risks and price fluctuations, making it difficult to ensure a stable supply for a global market.

Global Glufosinate Market: Regional Analysis

North America accounts for the largest share of the global glufosinate market due to the presence of robust production facilities along with the largest customer base in the region.

Asia Pacific is also among the leading regions in the global glufosinate market due to the growing population in the region. In addition, growing economies like India and China are considered to be the agricultural hubs and thereby likely to contribute immensely towards the growth of the regional market..

Global Glufosinate Market: Competitive Players

Some of the significant players in the global glufosinate market include

- Nufarm Limited, BASF SE

- DuPont de Nemours. Inc

- SinoHarvest Corporation

- Jiangsu Seven Continents Green Chemical Co. Ltd

- Lier Chemical Co. Ltd.

- UPL Limited

- Zhejiang Yongnong Chem. Ind. Co. Ltd.

- Limin Chemical Co. Ltd

- Bayer AG.

- And Others

Many companies are undergoing mergers and acquisitions to expand their business geographically. For instance, Nufarm introduced a new Cheetah Pro Herbicide product. It is used to control broadleaf grassy weeds. Also, it is a non-selective herbicide in nature. However, the launch of this product has significantly strengthened the company’s portfolio, thereby offering future growth prospects.

The global Glufosinate Market is segmented as follows:

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the Glufosinate Market on a global and regional basis.

By Formulations

- Soluble (Liquid) Concentrate

- Suspension Concentrate

- Liquid

- Aqueous Suspension

- And Others

By Crops

- Fruits & Vegetables

- Oil Seeds & Pulses

- Cereals

- Grains

- And Others

Global Glufosinate Market: Regional Segment Analysis

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

What Reports Provide

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, ongoing, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

The herbicide glufosinate is a broad-spectrum herbicide that is frequently used in agriculture for weed management. For it to be effective, it inhibits an enzyme that is involved in the production of specific amino acids, which ultimately results in the death of plants.

According to the report, The global glufosinate market size was worth around USD 1,805.77 Million in 2022 and is predicted to grow to around USD 3,051.87 Million by 2030 with a compound annual growth rate (CAGR) of roughly 6.78% between 2023 and 2030.

The global population is likely to reach 9 billion by 2050. Such a surge in the population will also increase food production by 70% on the given land. Weed poses a danger while harvesting, and in addition, leaving them untreated will also pose a negative impact on the average global yield causing a great loss.

Some of the significant players in the global glufosinate market include Nufarm Limited, BASF SE, DuPont de Nemours, Inc, SinoHarvest Corporation, Jiangsu Seven Continents Green Chemical Co., Ltd, Lier Chemical Co., Ltd., UPL Limited, Zhejiang Yongnong Chem. Ind. Co., Ltd., and Limin Chemical Co.

North America accounts for the largest share of the global glufosinate market due to the presence of robust production facilities along with the largest customer base in the region. Asia Pacific is also among the leading regions in the global glufosinate market due to the growing population in the region.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed