Gastroenterology Products Market Size, Share & Forecast 2034

Gastroenterology Products Market By Product Type (Endoscopy Devices, Laparoscopy Devices, GI Stents, Enteral Feeding Devices, Biopsy Devices, Hemostasis Devices, GI Imaging & Monitoring Systems, Pharmaceuticals & Biologics), By Disease Indication (Gastroesophageal Reflux Disease [GERD], Colorectal Cancer [CRC], Inflammatory Bowel Diseases [IBD] - Crohn’s disease, ulcerative colitis, Irritable Bowel Syndrome [IBS], Liver Disorders, Pancreatic Disorders, Biliary Diseases, Gastric & Peptic Ulcers, Others), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers [ASCs], Diagnostic Centers, Research & Academic Institutes, and Home Healthcare), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034-

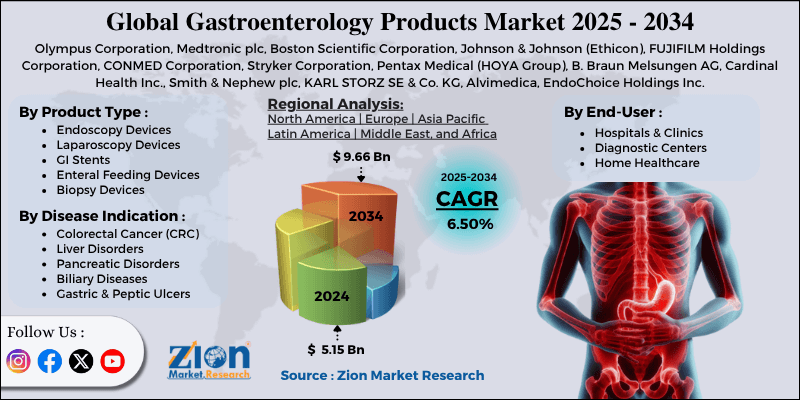

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.15 Billion | USD 9.66 Billion | 6.50% | 2024 |

Gastroenterology Products Industry Perspective:

The global gastroenterology products market size was approximately USD 5.15 billion in 2024 and is projected to reach around USD 9.66 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global gastroenterology products market is estimated to grow annually at a CAGR of around 6.50% over the forecast period (2025-2034)

- In terms of revenue, the global gastroenterology products market size was valued at around USD 5.15 billion in 2024 and is projected to reach USD 9.66 billion by 2034.

- The gastroenterology products market is projected to grow significantly due to the growing aging population worldwide, improvements in endoscopic technologies, and the expansion of healthcare infrastructure in developing regions.

- Based on product type, the endoscopy devices segment is expected to lead the market, while the pharmaceuticals & biologics segment is expected to grow considerably.

- Based on disease indication, the Gastroesophageal Reflux Disease (GERD) segment is the largest segment. In contrast, the Colorectal Cancer (CRC) segment is projected to witness substantial revenue growth over the forecast period.

- Based on end-user, the hospitals & clinics segment is expected to lead the market compared to the ambulatory surgical centers (ASCs) segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Gastroenterology Products Market: Overview

Gastroenterology products encompass a broad range of medical devices, pharmaceuticals, and instruments specifically designed for the treatment, diagnosis, and management of digestive system diseases. These products encompass areas such as capsule endoscopes, endoscopy equipment, stents, biopsy devices, and medications for conditions like ulcers, acid reflux, irritable bowel syndrome, and Crohn's disease. The global gastroenterology products market is poised for significant growth, driven by the increasing adoption of minimally invasive procedures, advancements in endoscopy devices, and rising healthcare expenditures worldwide. Endoscopic procedures, robotic-assisted surgeries, and capsule endoscopies are highly preferred due to their reduced pain, fewer complications, and shorter recovery times. The prominence of such fuels the demand for innovative gastroenterology products, mainly in specialty clinics and hospitals.

Moreover, high-definition imaging, 3D visualization, and AI-based diagnostic tools in endoscopic systems are enhancing the efficacy and accuracy of these systems. Companies are investing in digital solutions that support early detection of cancers and polyps, making technology a significant propeller. Furthermore, emerging and developed economies are driving healthcare budgets to improve accessibility and infrastructure. With the World Bank reporting growing healthcare spending as a % of GDP, the demand for advanced gastroenterology drugs and devices continues to rise.

Nevertheless, the global market faces limitations due to factors such as a limited number of skilled professionals and regulatory challenges, including approval delays. The efficient use of advanced gastroenterology equipment needs trained technicians and gastroenterologists. The lack of a skilled workforce, particularly in emerging and rural regions, hampers adoption despite the availability of products. Likewise, gastroenterology products, particularly novel endoscopic solutions, undergo rigorous regulatory approval processes. Delays in EMA, FDA, or regional approvals typically slow down product introduction and launches, hindering industry penetration.

Still, the global gastroenterology products industry benefits from several favorable factors, including the integration of AI in diagnostics and the increasing adoption of non-invasive solutions and capsule endoscopy. AI-based endoscopic platforms may detect polyps, abnormalities, and early cancer lesions with better accuracy. This advancement enhances clinical outcomes and offers lucrative opportunities for device manufacturers. Additionally, capsule endoscopy offers a patient-friendly and painless alternative to conventional techniques. The growing research, development, and adoption of these non-invasive diagnostic tools offer strong industry opportunities.

Gastroenterology Products Market Dynamics

Growth Drivers

How do elevated awareness and early screening programs fuel the gastroenterology products market?

Growing awareness of gastrointestinal health and the advantages of early diagnosis is fueling the gastroenterology products market. Healthcare organizations and governments in regions such as Europe and North America are implementing national screening programs for gastric and colorectal cancers.

Digital health initiatives and awareness campaigns have educated patients on recognizing early GI symptoms, resulting in high demand for diagnostic solutions and outpatient procedures. Early detection not only enhances survival rates but also augments industry consumption of biopsy, endoscopy, and imaging equipment.

How do improvements in gastroenterology devices drive the gastroenterology products market?

Technological advancements are driving the adoption of gastroenterology products remarkably. The development of AI-assisted endoscopes, advanced imaging systems, and capsule endoscopes has enhanced diagnostic accuracy while reducing procedural invasiveness. Recent news spotlights companies like Medtronic and Olympus presenting next-gen endoscopes equipped with real-time lesion detection. These innovations not only improve patient outcomes but also fuel clinical preference for technologically mature solutions.

Restraints

Lack of skilled healthcare professionals hinders the market progress

The scarcity of trained gastroenterologists and a skilled workforce offers a significant challenge to industry growth. Scarcities are reported in developing regions, such as Southeast Asia and India, where training infrastructure is limited. Recent news spotlights that hospitals in Europe are outsourcing gastroenterology procedures to dedicated centers due to a lack of local expertise. Without sufficient or proper professional knowledge, the adoption of modernized gastroenterology products remains constrained, mainly in complex diagnostic and therapeutic procedures.

Opportunities

How do strategic collaborations and mergers create lucrative opportunities for growth in the gastroenterology products market?

Partnerships, collaborations, and mergers between device manufacturers, healthcare providers, and pharmaceutical companies create opportunities for market growth and advancements. In 2025, Siemens Healthineers and Medtronic announced a partnership to develop AI-assisted tools, integrate care systems, and precision surgery solutions. By leveraging strategic alliances, companies can augment product introductions, expand their global footprint, and enhance R&D, contributing to the growth of the gastroenterology products industry.

Challenges

Disturbances in the supply chain limit the market growth

Global supply chain disruptions, particularly for high-tech components such as endoscopic materials and imaging sensors, hinder the timely availability of products. According to a 2025 Deloitte report, supply chain delays impacted 18% of medical device deliveries worldwide, comprising gastroenterology equipment.

Recent news has underscored delays in Olympus's endoscope shipments due to semiconductor shortages. These disturbances raise lead times, inflate costs, and can adversely affect hospital operations. Companies should boost local sourcing and logistics to alleviate this challenge.

Gastroenterology Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gastroenterology Products Market |

| Market Size in 2024 | USD 5.15 Billion |

| Market Forecast in 2034 | USD 9.66 Billion |

| Growth Rate | CAGR of 6.50% |

| Number of Pages | 215 |

| Key Companies Covered | Olympus Corporation, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Ethicon), FUJIFILM Holdings Corporation, CONMED Corporation, Stryker Corporation, Pentax Medical (HOYA Group), B. Braun Melsungen AG, Cardinal Health Inc., Smith & Nephew plc, KARL STORZ SE & Co. KG, Alvimedica, EndoChoice Holdings Inc., ERBE Elektromedizin GmbH, and others. |

| Segments Covered | By Product Type, By Disease Indication, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gastroenterology Products Market: Segmentation

The global gastroenterology products market is segmented based on product type, disease indication, end-user, and region.

Based on product type, the global gastroenterology products industry is divided into endoscopy devices, laparoscopy devices, GI stents, enteral feeding devices, biopsy devices, hemostasis devices, GI imaging & monitoring systems, and pharmaceuticals & biologics. The endoscopy devices segment holds a dominating share of the market because of extensive use in treating and diagnosing GI diseases. Innovations such as AI-assisted detection, high-definition imaging, and minimally invasive techniques have enhanced their clinical efficiency. Preventive screening programs and growing awareness further fuel adoption in specialty clinics and hospitals, impacting the segmental dominance.

Based on disease indication, the global gastroenterology products market is segmented into gastroesophageal reflux disease (GERD), colorectal cancer (CRC), inflammatory bowel diseases (IBD) – Crohn’s disease, ulcerative colitis, irritable bowel syndrome (IBS), liver disorders, pancreatic disorders, biliary diseases, gastric & peptic ulcers, and others. The gastroesophageal reflux disease (GERD) segment holds a leadership position in the market, affecting millions of individuals across all age groups. Its high prevalence fuels the demand for diagnostic tools, pharmacological treatments like proton pump inhibitors, and endoscopic interventions. The chronic nature of GERD necessitates ongoing management, driving sustained growth in the industry. Elevated awareness and screening programs also strengthen GERD as the dominating indication segment.

Based on end-user, the global market is segmented into hospitals & clinics, ambulatory surgical centers (ASCs), diagnostic centers, research & academic institutes, and home healthcare. The hospitals & clinics segment is leading, as they offer comprehensive therapeutic and diagnostic services for GI disorders. They heavily invest in advanced endoscopy systems, treatment solutions, and imaging devices to cater to massive patient volumes. The availability of an expert workforce and infrastructure makes the segment significant for both drug-based and device-based products in gastroenterology. A constant patient inflow and the adoption of less invasive procedures strengthen their dominant rank.

Gastroenterology Products Market: Regional Analysis

Why is North America outperforming other regions in the global Gastroenterology Products Market?

North America is projected to maintain its dominant position in the global gastroenterology products market due to the high prevalence of gastrointestinal disorders, advanced healthcare infrastructure, and an aging population. North America holds a substantial volume of GI disorders, comprising colorectal cancer, GERD, and IBD. This high disease incidence fuels the demand for gastroenterology products.

Moreover, the region boasts well-developed hospitals, diagnostic centers, and specialty clinics, equipped with modernized and advanced gastroenterology devices. The high adoption of high-definition endoscopy systems, AI-assisted diagnostics, and capsule endoscopes promises early detection and efficient treatment. Strong infrastructure supports the region's dominant rank.

Additionally, the region's ageing population raises the incidence of chronic GI conditions like colorectal cancer, diverticulosis, and ulcers. The United States Census Bureau anticipates that 23% of the U.S. population will be aged 65 and older by 2060, which is expected to increase the demand for therapeutic and diagnostic gastroenterology products.

Europe maintains its position as the second-leading region in the global gastroenterology products industry, driven by the high prevalence of gastrointestinal diseases, sophisticated healthcare infrastructure, and a chronic disease burden. Europe holds a significant weight of GI diseases, especially inflammatory bowel diseases and colorectal cancer.

According to the European Cancer Information System, CRC accounts for more than 12% of all novel cancer rules in the region, fueling the demand for therapeutic and diagnostic gastroenterology products. European nations, such as the UK, Germany, and France, have specialty clinics and advanced hospitals equipped with superior imaging and endoscopic systems. The broader availability of high-definition endoscopes and less invasive equipment supports effective treatment and diagnosis, contributing to robust industry growth.

Moreover, Europe has the largest older population, with more than 20% of the population aged 65 and above in 2023. Older individuals are more prone to GI diseases like GERD, ulcers, and colorectal cancers, raising the need for pharmaceuticals and devices in the gastroenterology domain.

Gastroenterology Products Market: Competitive Analysis

The leading players in the global gastroenterology products market are:

- Olympus Corporation

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson (Ethicon)

- FUJIFILM Holdings Corporation

- CONMED Corporation

- Stryker Corporation

- Pentax Medical (HOYA Group)

- B. Braun Melsungen AG

- Cardinal Health Inc.

- Smith & Nephew plc

- KARL STORZ SE & Co. KG

- Alvimedica

- EndoChoice Holdings Inc.

- ERBE Elektromedizin GmbH

Gastroenterology Products Market: Key Market Trends

Growing emphasis on preventive screening programs:

Healthcare organizations and governments are increasing colorectal cancer and digestive health screening programs. Elevated awareness of the benefits of early detection is driving demand for endoscopy devices, imaging systems, and biopsy tools.

Development of targeted therapies and biologics:

Pharmaceutical advancements in targeted drugs and biologics for Crohn’s disease, IBD, and ulcerative colitis are hastening. Personalized medicine approaches are gaining prominence, complementing device-based interventions and growing treatment options for chronic GI disorders.

The global gastroenterology products market is segmented as follows:

By Product Type

- Endoscopy Devices

- Laparoscopy Devices

- GI Stents

- Enteral Feeding Devices

- Biopsy Devices

- Hemostasis Devices

- GI Imaging & Monitoring Systems

- Pharmaceuticals & Biologics

By Disease Indication

- Gastroesophageal Reflux Disease (GERD)

- Colorectal Cancer (CRC)

- Inflammatory Bowel Diseases (IBD) – Crohn’s disease, ulcerative colitis

- Irritable Bowel Syndrome (IBS)

- Liver Disorders

- Pancreatic Disorders

- Biliary Diseases

- Gastric & Peptic Ulcers

- Others

By End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Research & Academic Institutes

- Home Healthcare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Gastroenterology products encompass a broad range of medical devices, pharmaceuticals, and instruments specifically designed for the treatment, diagnosis, and management of digestive system diseases. These products encompass areas such as capsule endoscopes, endoscopy equipment, stents, biopsy devices, and medications for conditions like ulcers, acid reflux, irritable bowel syndrome, and Crohn's disease.

The global gastroenterology products market is projected to grow due to the rising prevalence of gastrointestinal disorders, the increasing adoption of minimally invasive procedures, and rising global healthcare expenditure.

According to study, the global gastroenterology products market size was worth around USD 5.15 billion in 2024 and is predicted to grow to around USD 9.66 billion by 2034.

The CAGR value of the gastroenterology products market is expected to be approximately 6.50% during the period 2025-2034.

Emerging trends include minimally invasive procedures, AI-assisted diagnostics, biologics and targeted therapies, capsule endoscopy, and digital health integration.

Key opportunities include the adoption of minimally invasive procedures, the rising prevalence of GI disorders, the expansion in emerging markets, AI and digital health integration, and the development of biologics and targeted therapies.

North America is expected to lead the global gastroenterology products market during the forecast period.

The key players profiled in the global gastroenterology products market include Olympus Corporation, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Ethicon), FUJIFILM Holdings Corporation, CONMED Corporation, Stryker Corporation, Pentax Medical (HOYA Group), B. Braun Melsungen AG, Cardinal Health, Inc., Smith & Nephew plc, KARL STORZ SE & Co. KG, Alvimedica, EndoChoice Holdings, Inc., and ERBE Elektromedizin GmbH.

The competitive landscape is highly fragmented, dominated by strategic partnerships, global players investing in R&D, and mergers & acquisitions to expand product portfolios, drive innovation in devices, diagnostics, and pharmaceuticals, and enter new markets.

The report examines key aspects of the gastroenterology products market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed