Functional Drinks Market Size, Growth, Global Trends, Forecast 2034

Functional Drinks Market By Product (Energy Beverages, Functional Fruit and Vegetable Juices, Sports Beverages, Prebiotic and Probiotic Drinks, and Others), By Application (Health and Wellness, Weight Loss), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Gyms & Fitness Centers, Food Service), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

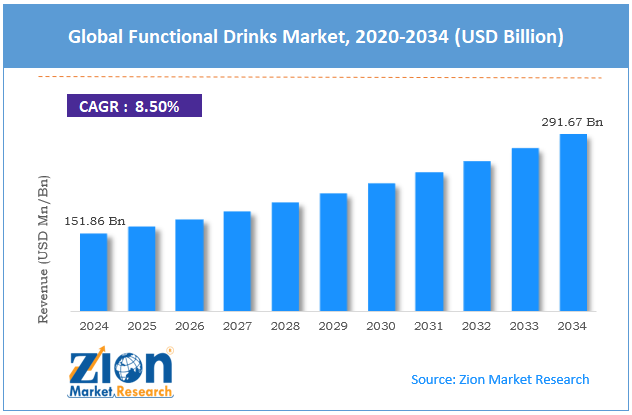

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 151.86 Billion | USD 291.67 Billion | 8.5% | 2024 |

Functional Drinks Industry Perspective:

What will be the size of the global functional drinks market during the forecast period?

The global functional drinks market size was around USD 151.86 billion in 2024 and is projected to reach USD 291.67 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global functional drinks market is estimated to grow annually at a CAGR of around 8.50% over the forecast period (2025-2034)

- In terms of revenue, the global functional drinks market size was valued at around USD 151.86 billion in 2024 and is projected to reach USD 291.67 billion by 2034.

- The functional drinks market is projected to grow significantly owing to increasing demand for immunity-boosting beverages post-COVID-19 pandemic, expansion of plant-based and natural ingredient trends, and innovation in nutraceuticals and fortified beverages.

- Based on product, the energy beverages segment is expected to lead the market, while the sports beverages segment is expected to grow considerably.

- Based on application, the health and wellness segment is the largest, while the weight loss segment is projected to record sizeable revenue over the forecast period.

- Based on the distribution channel, the supermarkets & hypermarkets segment is expected to lead the market, followed by the convenience stores segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by the Asia Pacific.

Functional Drinks Market: Overview

Functional drinks are beverages formulated to offer health benefits besides basic hydration, usually containing added minerals, vitamins, adaptogens, probiotics, or plant extracts. The common categories include energy drinks, sports drinks, protein shakes, kombucha, and fortified waters, dedicated to better digestion, immunity, recovery, and energy. The global functional drinks market is poised to expand rapidly, driven by growing health awareness, busy lifestyles, convenience, and sports and fitness culture. Consumers are increasingly concerned about their preventive health and wellness, driving demand for drinks with functional benefits. Functional drinks are believed to be easy ways to supplement nutrition and support specific fitness goals. This trend increases the preference for products with clean-label, natural ingredients.

Moreover, modern consumers juggle family, work, and social commitments, creating a demand for convenient nutrition. Functional beverages fit into on-the-go routines as quick energy sources, hydration, or immune support. This convenience factor drives stronger adoption than with traditional supplements. Furthermore, surging participation in fitness activities has boosted demand for performance-enhancing drinks. Active consumers and athletes seek drinks that support hydration, recovery, and endurance. This trend drives demand for protein beverages, sports drinks, and electrolyte formulations.

Despite growth, the global market is constrained by factors such as high product prices and regulatory and labeling complexity. Premium functional ingredients and specialized processing raise production costs. Higher retail prices may prompt hesitation among price-sensitive consumers, particularly in emerging markets. This limits mass adoption more than conventional drinks. Likewise, diverse global regulations govern health claims, ingredients approvals, and fortification limits. Compliance requires extensive documentation and testing, increasing costs and time-to-market. Labeling errors may expose brands to reputational and legal risks.

Nonetheless, the global functional drinks industry stands to benefit from several key opportunities, such as personalization, nutrition, customization, and clean-label and natural innovations. Improvements in health data and consumer profiling allow tailored beverage formulations. Personalized functional drink solutions can address individual needs such as stress management, energy, and gut health. This customization trend offers loyalty potential and premium pricing. Additionally, demand for clean-label products and transparent ingredient lists continues to grow. There is an opportunity to develop beverages with recognizable and minimally processed ingredients. Such offerings attract discerning consumers who prefer authentic health solutions.

Functional Drinks Market: Growth Drivers

How are strategic investments and major brand participation driving progress in the functional drinks market?

Large beverage companies are fueling growth in functional drinks through new product launches and acquisitions, underscoring the category’s strategic significance. PepsiCo’s acquisition of a prebiotic soda brand signals a shift from traditional soft drinks to health-focused alternatives. Coca-Cola has also launched prebiotic soda products to meet demand for low-sugar and gut-health options. These initiatives validate the industry’s growth potential and entice health-conscious users. They also offer brands with greater scaling power and broader distribution networks.

How is the functional drinks market growth augmented by product innovation & functional ingredient diversification?

Continuous advancements in functional drink formulations, including plant-based proteins, prebiotics, botanical extracts, and nootropics, are driving growth in the functional drinks market. Brands are now offering targeted benefits beyond basic nutrition, attracting professionals, athletes, and wellness-focused consumers. New flavors and benefit-specific products, such as energy, gut health, and focus, are expanding the market. Leading energy drinks brands have launched several variants to stay competitive. This diversification appeals to new consumers and encourages repeat purchases in categories.

Restraints

Consumer skepticism on efficacy slows down the market progress

Despite growing interest, a large segment of consumers remains unsure whether functional drinks deliver meaningful health advantages. A majority of the claims are perceived as vague or driven by marketing rather than by strong clinical science, leading to distrust. This skepticism slows purchase frequency, particularly among non-early adopters. Brands spend heavily on education campaigns to prove advantages, which increases marketing costs. The challenge is strong among health-knowledgeable and older consumers who prefer evidence over buzzwords.

Opportunities

How do personalized nutrition & tailored functionalization present favorable prospects for the functional drinks market?

Improvements in personalized health, backed by data from wearables, genetic testing, and health applications, are allowing tailored drink solutions. Brands can now group consumers by specific needs like stress relief, sleep support, or metabolic health and deliver customized formulations. Direct-to-consumer channels accelerate this trend by offering subscription services tailored to individual profiles. Personalization enhances engagement and fosters brand loyalty. It also justifies a high price because of perceived added value. These improvements offer present favorable prospects in the global functional drinks industry.

Challenges

Distribution & cold‑chain limitations limit the market growth

Some functional beverages require controlled-temperature storage to preserve sensitive nutrients or live cultures. In regions with underdeveloped transportation infrastructure, maintaining cold chains is infeasible or expensive. Retailers may avoid stocking products with special storage requirements due to limited refrigerator or freezer space. This limits industry penetration beyond urban centers and raises logistics costs. Distribution inefficiencies slow overall adoption in several growth markets.

Functional Drinks Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Functional Drinks Market |

| Market Size in 2024 | USD 151.86 Billion |

| Market Forecast in 2034 | USD 291.67 Bllion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 220 |

| Key Companies Covered | The Coca-Cola Company, PepsiCo Inc., Nestlé S.A., Danone S.A., Red Bull GmbH, Monster Beverage Corporation, Keurig Dr Pepper Inc., Unilever PLC, Amway Corporation, Herbalife Nutrition Ltd., The Kraft Heinz Company, Archer Daniels Midland Company, Campbell Soup Company, General Mills Inc., Celsius Holdings Inc., and others. |

| Segments Covered | By Product, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Functional Drinks Market: Segmentation

The global functional drinks market is segmented based on product, application, distribution channel, and region.

Why is the Energy Beverages segment projected to dominate the functional drinks market?

Based on product, the global functional drinks industry is divided into energy beverages, functional fruit and vegetable juices, sports beverages, prebiotic and probiotic drinks, and others. The energy beverages segment dominates with 42% of the total market share. This dominance is backed by strong consumer demand for mental focus, quick energy boosts, and support for an active lifestyle. The segmental prominence reflects wide appeal among professionals, youth, and fitness enthusiasts worldwide.

Conversely, the sports beverages segment ranks second, accounting for 31% of the total market. This is supported by rising participation in recreational and fitness activities and by demand for electrolyte replacement and hydration solutions. The segment’s dominance highlights the growing focus on recovery and performance in everyday wellness.

What factors help the Health and Wellness segment lead the functional drinks market?

Based on application, the global functional drinks market is segmented into health and wellness and weight loss. The health and wellness segment holds leadership with 81% of the overall market. The segmental prominence reflects wide consumer preference for drinks that support general well-being, daily nutrition, immunity, and overall quality of life. This is driven by growing health consciousness and preventive lifestyle choices.

Nevertheless, the weight-loss segment is the fastest-growing, accounting for 20% of the total market share. It comprises fat-metabolism support, products formulated for calorie control and metabolic health, and meal replacements, attracting consumers focused on structured weight-management programs and composition goals.

What are the key reasons for the leadership of the Supermarkets & Hypermarkets segment in the functional drinks market?

Based on distribution channel, the global market is segmented into supermarkets & hypermarkets, convenience stores, online retail, gyms & fitness centers, and food service. The supermarkets & hypermarkets capture a leading position with 46% of the total market share. This leadership is backed by their wider product collections, broad retail footprint, and one-stop mainstream buyers, and supports planned and impulse purchases with dedicated health-focused shelf space.

However, the convenience stores segment ranks second, accounting for nearly 20% of the overall market. This is fueled by quick access to ready-to-drink functional beverages and on-the-go consumption patterns. Strategically located in high-traffic areas, convenience stores capture impulse buys, especially among urban and younger consumers who prioritize ease and speed.

Functional Drinks Market: Regional Analysis

Why is North America outperforming other regions in the global Functional Drinks market?

North America is anticipated to retain its leading role in the global functional drinks market, with a 10.2% CAGR, driven by high health and wellness awareness, strong fitness and sports culture, and advanced retail and distribution infrastructure. Consumers in the region are highly conscious of preventive health, nutritional supplementation, and fitness. This awareness fuels strong demand for functional drinks that support energy, immunity, and overall well-being. The region’s culture of proactive health management promotes regular consumption.

Moreover, broader participation in sports, gyms, and active lifestyles drives demand for sports, energy, and protein beverages. Functional drinks are integrated into workout routines for recovery, hydration, and performance enhancement. This trend sustains growth in numerous product categories. Furthermore, North America benefits from supermarket chains, online retail platforms, and convenience stores. A strong marketing presence and easy accessibility allow functional drinks to reach a wider audience effectively. Wide distribution promises high market visibility and penetration.

Why does Asia Pacific rank second in the global Functional Drinks Market?

Asia Pacific ranks as the second-largest region in the global functional drinks industry, with a 11.7% CAGR, driven by speedy urbanization and changing lifestyles, growing health awareness, and expanding middle-class and disposable income. The region’s growing urban population is adopting fast-paced, modern lifestyles that prioritize convenience. Functional beverages offer ready-to-drink, quick nutrition, and energy solutions for busy consumers, fueling strong demand in cities.

Awareness of immunity, preventive healthcare, and wellness is surging among middle-class consumers. People are seeking drinks enriched with minerals, vitamins, herbal ingredients, and probiotics to maintain overall health. Additionally, rising disposable incomes in India and China enable consumers to purchase premium functional drinks. Affordability, combined with lifestyle aspirations, motivates the uptake of health-focused drinks

Functional Drinks Market: Competitive Analysis

The leading players in the global functional drinks market are:

- The Coca-Cola Company

- PepsiCo Inc.

- Nestlé S.A.

- Danone S.A.

- Red Bull GmbH

- Monster Beverage Corporation

- Keurig Dr Pepper Inc.

- Unilever PLC

- Amway Corporation

- Herbalife Nutrition Ltd.

- The Kraft Heinz Company

- Archer Daniels Midland Company

- Campbell Soup Company

- General Mills Inc.

- Celsius Holdings Inc.

What are the key trends in the global Functional Drinks Market?

Functional sparkling & innovative formats:

New formats like enhanced teas, ready-to-drink wellness shots, functional sparkling waters, and adaptogenic tonics are increasing the category's appeal. These formats blend enjoyment with health benefits, appealing to lifestyle-oriented and young consumers. The variety increases occasions for consumption beyond energy and sports drinks.

Sustainable packaging & ethical branding:

Environmental consciousness is influencing purchase decisions, with demand for biodegradable, recyclable, or reusable packaging growing. Brands are highlighting sustainability commitments and ethical sourcing to differentiate themselves. This trend aligns with wider ESG expectations and strengthens consumer loyalty.

The global functional drinks market is segmented as follows:

By Product

- Energy Beverages

- Functional Fruit and Vegetable Juices

- Sports Beverages

- Prebiotic and Probiotic Drinks

- Others

By Application

- Health and Wellness

- Weight Loss

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Gyms & Fitness Centers

- Food Service

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed