Global Nutraceuticals Market Size, Share, Growth Analysis Report - Forecast 2034

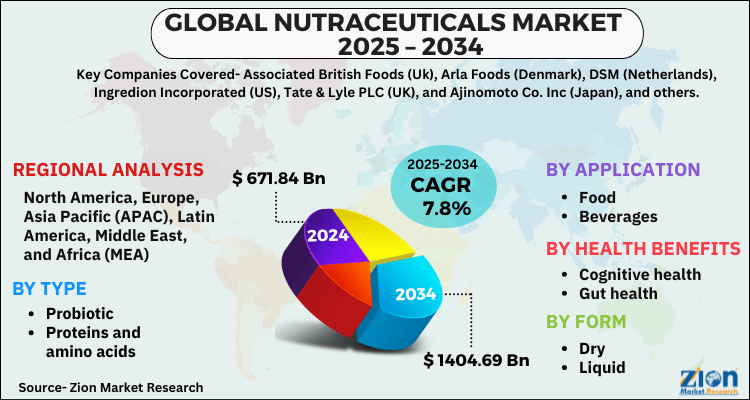

Nutraceuticals Market By Type (Probiotic, Proteins and amino acids, Phytochemical & plant extracts, Fibers & specialty carbohydrates, Omega 3 fatty acids, Vitamins, Prebiotic, Carotenoids, Minerals, and Others), By Application (Food, Beverages, Personal care, Animal nutrition, and Dietary supplements), Health Benefits (Cognitive health, Gut health, Heart health, Bone health, Immunity, Nutrition, Weight management, and others), Form (Dry, and Liquid), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

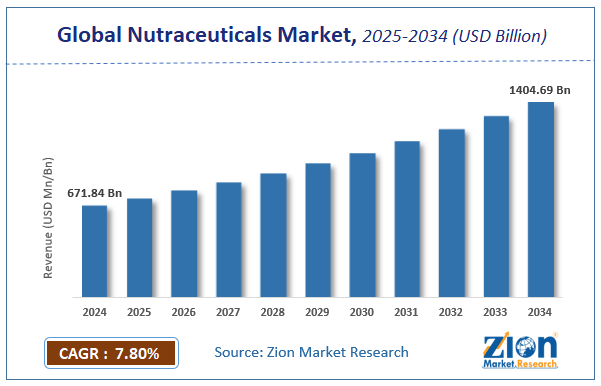

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 671.84 Billion | USD 1404.69 Billion | 7.8% | 2024 |

Nutraceuticals Market: Industry Perspective

The global nutraceuticals market size was worth around USD 671.84 Billion in 2024 and is predicted to grow to around USD 1404.69 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.8% between 2025 and 2034. The report analyzes the global nutraceuticals market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the nutraceuticals industry.

Nutraceuticals Market: Overview

The rising demand for dietary supplements and functional foods is expected to be a major driving force in the market over the forecast period. In addition, a positive outlook toward medical nutrition, given its growing use in the treatment of cardiovascular disorders and malnutrition, is likely to boost the growth of the Nutraceuticals market in the coming years. The rising geriatric population, rising healthcare costs, changing lifestyles, food innovation, and expectations regarding higher prices will propel the growth of the market in the upcoming years. Consumers have a very positive attitude toward functional foods, owing to the additional health and wellness benefits that these products provide, driving the market’s growth. During the pandemic period, demand for nutraceutical goods expanded globally because of the flexibility of storage choices, the need for combination formulations with various benefits, increasing consumer education levels, educated consumers, and the growth in health concerns among connected consumers. Moreover, rising healthcare costs, combined with an aging global population, are expected to support the global Nutraceuticals industry's growth over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global nutraceuticals market is estimated to grow annually at a CAGR of around 7.8% over the forecast period (2025-2034).

- Regarding revenue, the global nutraceuticals market size was valued at around USD 671.84 Billion in 2024 and is projected to reach USD 1404.69 Billion by 2034.

- The nutraceuticals market is projected to grow at a significant rate due to growing health consciousness, increasing disposable incomes, and rising demand for dietary supplements and functional foods.

- Based on Type, the Probiotic segment is expected to lead the global market.

- On the basis of Application, the Food segment is growing at a high rate and will continue to dominate the global market.

- Based on the Health Benefits, the Cognitive health segment is projected to swipe the largest market share.

- By Form, the Dry segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Nutraceuticals Market: Drivers

Increasing incidences of chronic diseases

The global burden of chronic diseases is rapidly rising. Obesity, diabetes, high blood pressure, and cardiovascular disease are all on the rise in the world's population. As a result, people are becoming more aware of their eating habits. People are choosing healthier foods because there is a strong link between diet and health. Consumers are also on the lookout for products that offer the right balance of nutrition and flavor. This pressing need is met by fortified food ingredients, which provide food formulators with ingredients that provide specific functionalities and healthier alternatives. As a result, the demand for nutraceutical ingredients is bolstered by the entire health and wellness movement.

Nutraceuticals Market: Restraints

Higher fortified product costs deter widespread use and adoption.

Functional foods and beverages, animal nutrition, pharmaceuticals, and personal care products are just a few of the applications for nutraceutical ingredients. However, the incorporation of nutraceutical components into food and beverage goods, feed products, medicines, and personal care items boosts the pricing of these end products. As a result, lower adoption of such products occurs, stifling market growth. Despite the fact that probiotic-infused bottled water products provide important health benefits such as improved digestive and immune health, most consumers are unlikely to switch from their traditional bottled water consumption. As a result, premium pricing of fortified goods would impede market growth for nutraceutical ingredients throughout the projection period.

Nutraceuticals Market: Opportunities

In the nutraceutical ingredients industry, there have been both product-based and technological innovations.

Nutraceutical ingredient producers are fast adopting personalized healthcare technology in order to offer better-suited and tailored end products for customers. Consumer goods companies are increasingly collecting data to enable a proper analysis of purchasing behavior and lifestyle in order to provide customers with tailored options based on their preferences. This information not only helps consumer companies develop personalized dietary advice, but it also helps pharmaceutical companies form significant partnerships to help personalize over-the-counter supplements. Apart from studying consumer purchasing patterns, genomics also helps to personalize nutraceutical products by enabling treatments that are closely linked to a person's genetic profile. This opens up a huge market for nutraceutical end-product manufacturers, as linking a diet to a genome not only improves health but also reduces the risk of developing negative health conditions like cardiovascular disease, obesity, diabetes, and inflammatory bowel disease. Such validated use of technology in conjunction with a dietary plan is expected to open up previously untapped market growth opportunities for nutraceutical ingredient manufacturers.

Nutraceuticals Market: Challenges

Nutraceutical products are associated with consumer skepticism.

Along with growing consumer awareness of better dietary choices and increased health awareness, there is still a level of consumer skepticism about the use of nutraceutical products. Although there are several factors preventing consumer adoption of nutraceutical products, synthetic sourcing and unsubstantiated health claims are the two most significant. Most nutraceutical ingredient manufacturers use health claims as a major marketing and selling point; however, when these claims do not pan out, consumer skepticism about these products rises. The formulation of synthetic sourcing of nutraceutical products is another factor impeding market growth. The majority of consumers dislike products that have been genetically modified to improve their performance. These factors act as major roadblocks to the growth of the nutraceutical ingredient market.

Nutraceuticals Market: Segmentation

The global nutraceuticals market is segmented based on Type, Application, Health Benefits, Form, and region.

By type, the market is segmented into Probiotics, Proteins and amino acids, Phytochemical & plant extracts, Fibers & specialty carbohydrates, Omega 3 fatty acids, Vitamins, Prebiotic, Carotenoids, Minerals, and Others. The probiotic category is predicted to be the largest over the projection period. Because of their positive effects on overall human health, probiotic ingredients are quickly becoming one of the most important ingredients in a variety of health and nutritional products. As a result, probiotic ingredients are widely used in a variety of industries, including functional foods, beverages, dietary supplements, and animal nutrition.

By application, the market is classified into Food, Beverages, Personal care, Animal nutrition, and Dietary supplements. During the forecast period, the dietary supplement segment is expected to be the fastest-growing by application. Dietary supplements are growing in popularity because they provide a variety of health benefits, including improved gut microflora balance, improved intestinal functions such as bulking and regularity, increased calcium absorption & improved bone density, improved immune function, reduced toxins that can cause fatty liver and other diseases, reduced risk of cardiovascular diseases, blood sugar control, and possibly reduced risk of cancer.

By form, the market is classified into Dry, and liquid. Dry extracts of these ingredients are obtained from a variety of sources. Vitamin C, for example, comes from the acerola plant, while protein powder, fiber, and amino acids come from the hemp plant. Dry ingredients preserve the flavor and color of food and beverage products while also allowing for easier handling and storage, which is difficult with liquid ingredients. Dietary supplements in the dry form of nutraceuticals are available as tablets or capsules.

Nutraceuticals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Nutraceuticals Market |

| Market Size in 2024 | USD 671.84 Billion |

| Market Forecast in 2034 | USD 1404.69 Billion |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 150 |

| Key Companies Covered | Associated British Foods (Uk), Arla Foods (Denmark), DSM (Netherlands), Ingredion Incorporated (US), Tate & Lyle PLC (UK), and Ajinomoto Co. Inc (Japan), and others. |

| Segments Covered | By Type, By Application, By Health Benefits, By Form, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Nutraceuticals Market: Regional Landscape

Europe is becoming one of the most important markets for nutraceuticals. Anti-aging concerns among the elderly drive the nutraceuticals market in Europe, which is primarily concentrated in France, Italy, Germany, the United Kingdom, and Spain. As a consequence of increased consumer and governmental pressure in Europe, demand for nutraceutical goods is expanding. Western Europe continues to be a leader in nutraceutical sales, primarily through pharmacy-based distribution. In the forecast period, rising obesity, cardiovascular disease, and obesity disease are expected to lead the nutraceutical industry. In addition, functional bottled water is becoming more popular in European countries.

During the projection period, Asia Pacific is likely to dominate the market. This is due to the region's growing population, rising disposable income, and rising living standards. Growing public awareness of health-improving foods is also expected to be a major driver of market expansion. The rising popularity of functional foods and beverages in several Asian Pacific countries has aided regional market expansion. As a result, probiotics are becoming increasingly popular among consumers as a way to improve gut health, which can help to prevent a variety of chronic diseases.

Recent Developments

- In 2021, General Mills developed a new snack brand called Good Measure that is designed specifically to not spike the blood sugar of the person snacking. There are currently two products under the Good Measure brand: creamy nut butter bars and crunchy almond crisps. Blueberry & Almond, Peanut & Dark Chocolate, and Almond & Dark Chocolate are just a few of the flavors available.

- In 2021, Alpine Start Inc., a premium instant coffee maker, announced the launch of its functional beverages, With Benefits, with the help of Kickstarter, an American public benefit organization. The new fortified beverages are packed in vitamins, minerals, and MCTs and prepared with all-natural, clean-label ingredients to boost immunity and focus.

Nutraceuticals Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the nutraceuticals market on a global and regional basis.

The global nutraceuticals market is dominated by players like:

- Associated British Foods (Uk)

- Arla Foods (Denmark)

- DSM (Netherlands)

- Ingredion Incorporated (US)

- Tate & Lyle PLC (UK)

- Ajinomoto Co.(Japan).

The nutraceuticals market is segmented as follows:

By type

- Probiotic

- Proteins and amino acids

- Phytochemical & plant extracts

- Fibers & specialty carbohydrates

- Omega 3 fatty acids

- Vitamins

- Prebiotic

- Carotenoids

- Minerals

- Others

By application

- Food

- Beverages

- Personal care

- Animal nutrition

- Dietary supplements

By health benefits

- Cognitive health

- Gut health

- Heart health

- Bone health

- Immunity

- Nutrition

- Weigh management

- Others

By form

- Dry

- Liquid

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The rising demand for dietary supplements and functional foods is expected to be a major driving force in the market over the forecast period.

The global nutraceuticals market is expected to grow due to rising consumer focus on health and wellness, increasing demand for functional foods and dietary supplements, and growing aging population.

According to a study, the global nutraceuticals market size was worth around USD 671.84 Billion in 2024 and is expected to reach USD 1404.69 Billion by 2034.

The global nutraceuticals market is expected to grow at a CAGR of 7.8% during the forecast period.

North America is expected to dominate the nutraceuticals market over the forecast period.

Leading players in the global nutraceuticals market include Associated British Foods (Uk), Arla Foods (Denmark), DSM (Netherlands), Ingredion Incorporated (US), Tate & Lyle PLC (UK), and Ajinomoto Co. Inc (Japan), among others.

The report explores crucial aspects of the nutraceuticals market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed