FinTech Blockchain Market Trend, Share, Growth, Size, Analysis and Forecast 2032

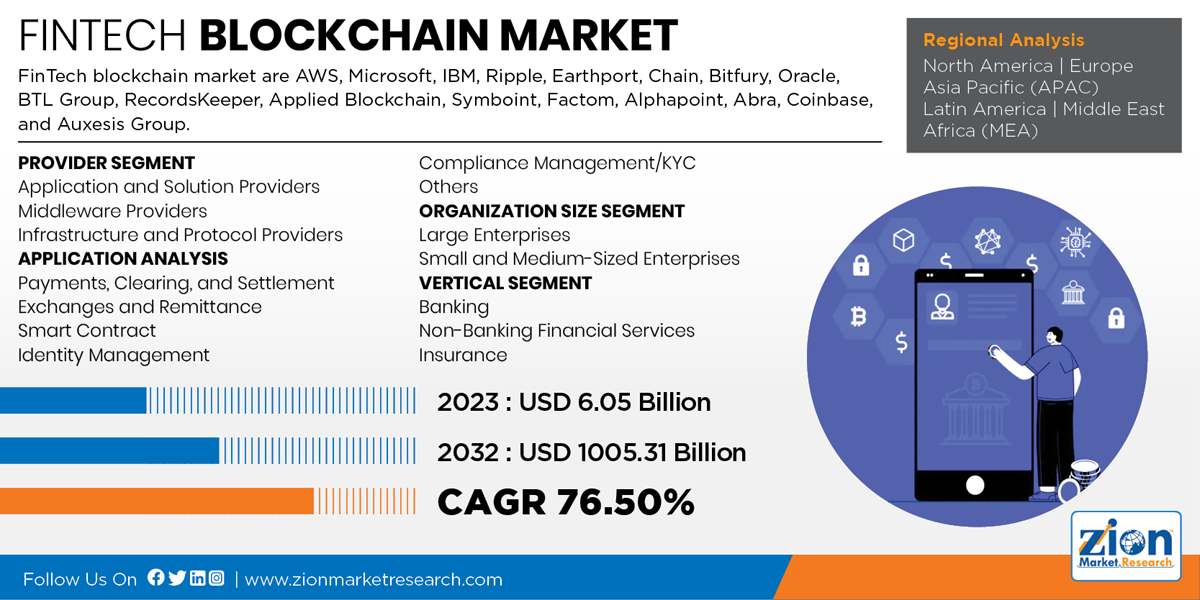

FinTech Blockchain Market by Provider (Middleware Providers, Application and Solution Providers, and Infrastructure and Protocol Providers), by Application (Exchanges and Remittance, Smart Contract, Payments, Clearing, and Settlement, Compliance Management/KYC, Identity Management, and Others), by Organization Size (Small- and Medium-Sized Enterprises and Large Enterprises), and by Vertical (Banking, Non-Banking Financial Services, and Insurance), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

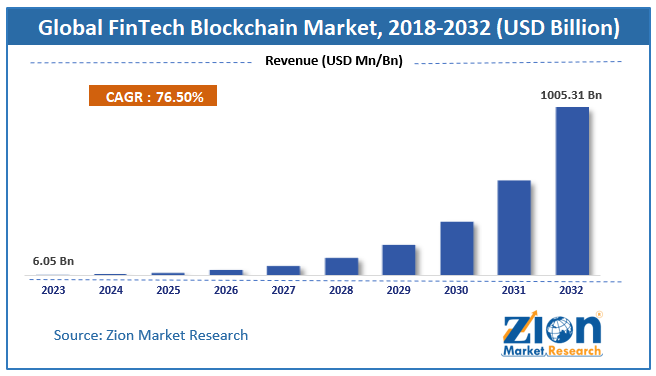

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.05 Billion | USD 1005.31 Billion | 76.50% | 2023 |

The global FinTech Blockchain market size accrued earnings worth approximately USD 6.05 Billion in 2023 and is predicted to gain revenue of about USD 1005.31 Billion by 2032, is set to record a CAGR of nearly 76.50% over the period from 2024 to 2032.

FinTech Blockchain Market Overview

Technology and digital transformation have changed people’s habits and firms’ activities. In the digital world, economic, financial, and social entities depend on technological inclusions. The financial institutions have always been an early adopter of advanced technologies. Fintech is known as technologically enabled innovation that results in advanced business models, applications, products with a material effect on financial institutions. It describes the application of digital technology to financial services. Due to the growth of digital payments in recent years, Fintech companies have started to adopt blockchain technology to expand their portfolio of insurance products to cross-border remittances. Blockchain helps to exchange value over the internet and has the ability to transform multiple industrial sectors and make the processes secure, transparent, and efficient. The main benefit of the blockchain technology is its ability to share information, which is secure and provides data integrity via distributed infrastructure. Here, technology plays an important tool in developing trust among consumers and businesses, where both can provide and access accurate data about transactions.

FinTech Blockchain Market Growth Dynamics

The factors that are likely to drive the FinTech blockchain market in the upcoming years is the adoption of technologically advanced blockchain solutions in investment banks, commercial banks, and insurance companies, the increase in the cryptocurrency market cap, the rise in the initial coin offerings, and the high demand for distributed ledger technology. In addition, due to the advanced blockchain technology solutions, the transactions have become faster and secure further fueling the FinTech blockchain market globally. It also eliminates the need for intermediaries and reduces the time for payers and providers and administration costs. However, the uncertain regulatory standards and frameworks and the lack of blockchain applications and use cases might limit this market. Nevertheless, the adoption of blockchain technology for smart contracts, payments, and digital identities are likely to create business opportunities in the market.

FinTech Blockchain Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | FinTech Blockchain Market |

| Market Size in 2023 | USD 6.05 Billion |

| Market Forecast in 2032 | USD 1005.31 Billion |

| Growth Rate | CAGR of 76.50% |

| Number of Pages | 220 |

| Key Companies Covered | FinTech blockchain market are AWS, Microsoft, IBM, Ripple, Earthport, Chain, Bitfury, Oracle, BTL Group, RecordsKeeper, Applied Blockchain, Symboint, Factom, Alphapoint, Abra, Coinbase, and Auxesis Group. |

| Segments Covered | By Provider, By Application, By Organization Size, By Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

FinTech Blockchain Market Segmentation Analysis

The study provides a decisive view of the FinTech blockchain market by segmenting the market based on provider, application, organization size, vertical, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By provider, the market is fragmented into middleware providers, application and solution providers, and infrastructure and protocol providers. By application, the market is fragmented into payments, clearing, and settlement, exchanges and remittance, identity management, smart contract, compliance management/KYC, and others. By organization size, the FinTech blockchain market is segmented into small- and medium-sized enterprises and large enterprises. By vertical, the FinTech blockchain market is segmented into banking, non-banking financial services, and insurance.

Geographically, this global market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds the largest market share, as it is among the most advanced regions in terms of technology adoption and infrastructure. The Asia Pacific is likely to witness the highest growth rate over the forecast time period, due to the rise in the investments in the blockchain technology solutions to make a change in the financial sector.

Some of the key players profiled in the global FinTech blockchain market are

- AWS

- Microsoft

- IBM

- Ripple

- Earthport

- Chain

- Bitfury

- Oracle

- BTL Group

- RecordsKeeper

- Applied Blockchain

- Symboint

- Factom

- Alphapoint

- Abra

- Coinbase

- and Auxesis Group.

Global FinTech blockchain market are as follows:

Global FinTech Blockchain Market: Provider Segment Analysis

- Application and Solution Providers

- Middleware Providers

- Infrastructure and Protocol Providers

Global FinTech Blockchain Market: Application Analysis

- Payments, Clearing, and Settlement

- Exchanges and Remittance

- Smart Contract

- Identity Management

- Compliance Management/KYC

- Others

Global FinTech Blockchain Market: Organization Size Segment Analysis

- Large Enterprises

- Small and Medium-Sized Enterprises

Global FinTech Blockchain Market: Vertical Segment Analysis

- Banking

- Non-Banking Financial Services

- Insurance

Global FinTech Blockchain Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed