Fetal Monitoring Systems Market Size, Share, Value & Forecast 2034

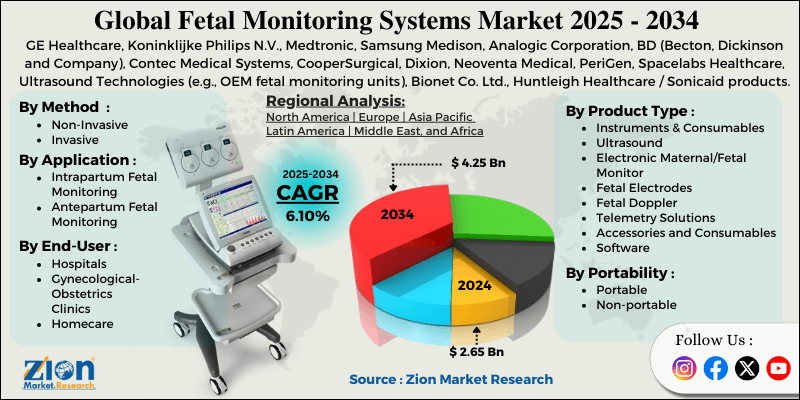

Fetal Monitoring Systems Market By Product Type (Instruments and Consumables, Ultrasound, Electronic Maternal/Fetal Monitor, Fetal Electrodes, Fetal Doppler, Telemetry Solutions, Accessories and Consumables, Software), By Portability (Portable, Non-portable), By Method (Non-Invasive, Invasive), By Application (Intrapartum Fetal Monitoring, Antepartum Fetal Monitoring), By End-User (Hospitals, Gynecological/Obstetrics Clinics, Homecare), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

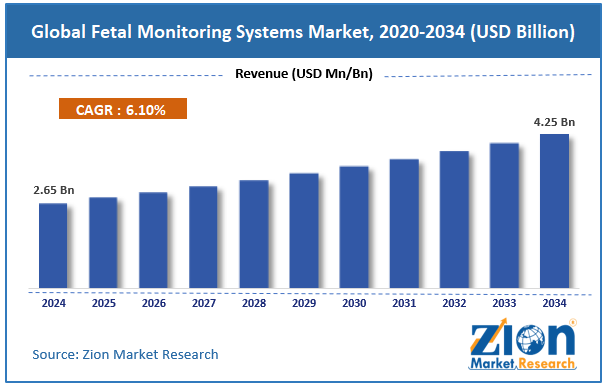

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.65 Billion | USD 4.25 Billion | 6.10% | 2024 |

Fetal Monitoring Systems Industry Perspective:

What will be the size of the global fetal monitoring systems market during the forecast period?

The global fetal monitoring systems market size was approximately USD 2.65 billion in 2024 and is projected to reach USD 4.25 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global fetal monitoring systems market is estimated to grow annually at a CAGR of around 6.10% over the forecast period (2025-2034)

- In terms of revenue, the global fetal monitoring systems market size was valued at around USD 2.65 billion in 2024 and is projected to reach USD 4.25 billion by 2034.

- The fetal monitoring systems market is projected to grow significantly owing to the increasing prevalence of high‑risk pregnancies, growing healthcare expenditure, and rising awareness of prenatal care.

- Based on product type, the ultrasound segment is expected to lead the market, while the electronic maternal/fetal monitor segment is expected to grow considerably.

- Based on portability, the non-portable segment is the dominating segment, while the portable segment is projected to witness sizeable revenue over the forecast period.

- Based on the method, the non-invasive segment is expected to lead the market, while the invasive segment is expected to grow considerably.

- Based on application, the antepartum fetal monitoring segment is the dominating segment, while the intrapartum fetal monitoring segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the hospitals segment is expected to lead the market, followed by the gynecological/obstetrics clinics segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Fetal Monitoring Systems Market: Overview

Fetal monitoring systems examine a fetus’s health during pregnancy and labor by tracking crucial signs like uterine contraction and heart rate. They help detect hypoxia, distress, or abnormal heart patterns early. Monitoring can be external, with sensors on the mother’s abdomen, or internal, with electrodes on the fetal scalp. The global fetal monitoring systems market is poised for notable growth, driven by rising maternal health awareness, rising numbers of high-risk pregnancies, and technological advancements. Worldwide, expectant mothers are increasingly aware of the significance of prenatal care and fetal health. This leads to elevated demand for monitoring technologies that can detect complications early. Clinics and hospitals are responding by adopting advanced fetal monitoring systems.

Moreover, medical conditions like hypertension, diabetes, and advanced maternal age are increasing the number of high-risk pregnancies. Fetal monitoring is crucial to guarantee the safety of the mother and child in such cases. Continuous monitoring enables clinicians to respond quickly to signs of distress. Furthermore, new advancements in wearable, wireless, and non-invasive fetal monitors enhance data accuracy and patient comfort. Smart algorithms and advanced sensors detect anomalies more effectively. These improvements make monitoring safer and highly convenient for healthcare providers and patients.

Nevertheless, the global market faces limitations, including limited reimbursement policies and a shortage of skilled personnel. In some nations, insurance coverage for fetal monitoring procedures is restricted or nonexistent. Patients may be unable to afford high-priced examinations. This financial barrier slows industry growth in some regions. Similarly, proper use and interpretation of monitoring systems need trained clinicians. Several regions experience a scarcity of skilled staff capable of operating compound devices. Lack of expertise reduce effectiveness and accuracy of monitoring.

Still, the global fetal monitoring systems industry benefits from several favorable factors, like wearable and mobile monitoring devices, data analytics, and AI integration. Wearable and portable devices allow home-based fetal monitoring and outpatient tracking. These solutions increase patient compliance and convenience. They also reduce hospital crowding and allow continuous monitoring without being intrusive. Additionally, AI can help forecast fetal distress and analyze large datasets in real time. This improves diagnostic accuracy and supports clinicians in making wise decisions. AI-based insights make monitoring systems more efficient and smarter.

Fetal Monitoring Systems Market: Dynamics

Growth Drivers

How is the growing emphasis on prenatal care awareness and education propelling the fetal monitoring systems market?

Elevated awareness of the significance of prenatal care has empowered expectant mothers to actively participate in monitoring their pregnancy health, leading to higher use of fetal monitoring services. Public health campaigns and education programs stress early detection of risk factors and continuous fetal examination as vital components of safe maternal care. This informed patient behavior motivates healthcare providers to adopt reliable monitoring solutions to meet expectations for safety and quality. Hence, fetal monitoring systems are increasingly integrated into maternal health protocols and routine prenatal checkups worldwide.

How are technological improvements in monitoring devices significantly fueling the growth of the fetal monitoring systems market?

Speedy innovation in fetal monitoring solutions, comprising wireless sensors, wearable multi-parameter devices, and AI-enabled analytics, is changing the way clinicians track fetal well-being. Newer systems offer improved accuracy, real-time analytics, and reduced setup complexity, helping identify subtle changes in fetal heart rate and maternal contractions. The integration of remote connectivity and cloud platforms enables clinicians to monitor patients from afar, extending hybrid care beyond conventional hospital confines. These improvements not only enhance clinical insights but also widen application scenarios, from labor packages to home-based prenatal tracking. These improvements ultimately fuel the fetal monitoring systems market.

Restraints

Regulatory and approval delays negatively impact the market progress.

Medical devices like fetal monitors should comply with strict regulatory standards across diverse nations, which may lead to lengthy approval schedules. Navigating different regulatory frameworks increases time-to-market for novel products, delaying the advancement of reach. Smaller manufacturers, especially, may lack resources to manage complex worldwide compliance requirements. These delays may discourage investment and slow the introduction of next-generation monitoring technologies.

Opportunities

How is integration with Predictive Analytics and AI opening lucrative opportunities for the development of the fetal monitoring systems market?

Artificial intelligence and advanced analytics have advanced as powerful tools for interpreting complex fetal health data and identifying patterns that may escape manual review. Predictive risk stratification may alert clinicians to early signs of distress, allowing proactive interventions. As machine learning models improve in interpretability and accuracy, they can enhance clinical decision-making and reduce false alarms. This blend of intelligence and monitoring offers fresh avenues for value-added services in the fetal monitoring systems industry.

Challenges

Balancing sensitivity and specificity restricts the market growth.

Fetal monitoring systems should strike a cautious balance between specificity to reduce false positives and sensitivity to detect early warning signs. Excessive false alarms may result in increased patient anxiety, unnecessary clinical interventions, and higher healthcare costs. On the other hand, low sensitive risks miss crucial signs of fetal compromise. Designing algorithms and hardware that deliver optimal performance across different patient populations remains a technical challenge.

Fetal Monitoring Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fetal Monitoring Systems Market |

| Market Size in 2024 | USD 2.65 Billion |

| Market Forecast in 2034 | USD 4.25 Billion |

| Growth Rate | CAGR of 6.10% |

| Number of Pages | 215 |

| Key Companies Covered | GE Healthcare, Koninklijke Philips N.V., Medtronic, Samsung Medison, Analogic Corporation, BD (Becton, Dickinson and Company), Contec Medical Systems, CooperSurgical, Dixion, Neoventa Medical, PeriGen, Spacelabs Healthcare, Ultrasound Technologies (e.g., OEM fetal monitoring units), Bionet Co. Ltd., Huntleigh Healthcare / Sonicaid products, and others. |

| Segments Covered | By Product Type, By Portability, By Method, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fetal Monitoring Systems Market: Segmentation

The global fetal monitoring systems market is segmented by product type, portability, method, application, end-user, and region.

Based on product type, the global fetal monitoring systems industry is divided into instruments and consumables, ultrasound, electronic maternal/fetal monitor, fetal electrodes, fetal Doppler, telemetry solutions, accessories and consumables, and software. The ultrasound segment registers nearly 52% of the global market. This growth is backed by its wide clinical use, its non-invasive nature for real-time fetal diagnostics and imaging, and its widespread adoption in prenatal care worldwide.

On the other hand, the electronic maternal/fetal monitor segment accounts for 31% of the market, as continuous monitoring of fetal, uterine, and heart activity is crucial in high-risk pregnancies and hospitals.

Based on portability, the global market is segmented into portable and non-portable. The non-portable segment leads with 72% share of the total market. This is backed by their comprehensiveness, high accuracy, and heavy use in clinics and hospitals for continuous monitoring of high-risk pregnancies and detailed maternal/fetal assessments.

Conversely, the portable systems segment grows with 38% market share owing to elevated demand for mobile, convenient, and home-use monitoring options that support outpatient care and telehealth.

Based on the method, the global fetal monitoring systems market is segmented into non-invasive and invasive. The non-invasive segment dominates with 76% market share because they offer comfortable, safer, and broadly accepted fetal examinations without penetrating the body. This makes them routine for most labor monitoring and prenatal care.

Nonetheless, the invasive methods segment accounts for 30% of the market, as they are used when direct, highly accurate monitoring is required. This is mainly used in complicated or high-risk labor situations despite elevated clinical risk.

Based on application, the global market is segmented into intrapartum fetal monitoring and antepartum fetal monitoring. The antepartum fetal monitoring segment accounts for 58% of the total market because monitoring fetal well-being before labor spans the longest period of pregnancy, supports early detection of complications, and is widely used in prenatal care protocols.

However, the intrapartum fetal monitoring segment holds 48% of the total market because of its crucial role in real-time tracking of fetal diseases during delivery and labor. This fuels consistent adoption in hospital labor wards.

Based on end-user, the global market is segmented into hospitals, gynecological/obstetrics clinics, and homecare. The hospitals segment captures 75% of the market, as they manage the majority of pregnancies, including high-risk cases, and use advanced continuous monitoring systems.

Still, the gynecological/obstetrics clinics segment continues to grow, with 30% market share, driven by routine prenatal care and the adoption of portable monitoring devices for outpatient settings.

Fetal Monitoring Systems Market: Regional Analysis

What enables North America strong foothold in the global Fetal Monitoring Systems Market?

North America is projected to maintain its dominant position in the global fetal monitoring systems market, with a 6.7% CAGR, owing to advanced healthcare infrastructure, high awareness and utilization of fetal care, and favorable reimbursement and healthcare policies. North America holds well-established hospitals and maternity centers equipped with advanced fetal monitoring technologies. High-class neonatal and labor care fuels consistent adoption of mature systems. This infrastructure backs the regional dominance.

Expectant mothers and healthcare professionals prioritize intrapartum and prenatal monitoring. Broader awareness is expected to lead to greater utilization of high-risk and routine fetal monitoring devices. This adds to stronger market demand. Insurance coverage and supportive healthcare policies reduce the cost of high-priced treatments for patients. Providers can more easily adopt advanced monitoring technologies. This motivates elevated system penetration in clinics and hospitals.

Europe maintains its position as the second-largest region, with a 5.6% CAGR in the global fetal monitoring systems industry, driven by high standards of neonatal and maternal care, favorable reimbursement and regulatory frameworks, and a surging focus on high-risk pregnancy management. European nations emphasize high standards in neonatal and maternal health outcomes. Routine intrapartum and antepartum monitoring is a crucial part of clinical protocols. This results in consistent use of fetal monitoring systems in the region. Several European health systems offer exhaustive reimbursement for labor and prenatal monitoring procedures. Supportive policies make advanced devices more affordable for patients and providers. This motivates investment in quality fetal monitoring solutions.

Additionally, Europe is increasingly focusing on managing high-risk pregnancies because of maternal age trends and lifestyle-associated disorders. Clinicians depend on detailed fetal surveillance to alleviate risks. This fuels demand for continuous and non-invasive monitoring technologies.

Fetal Monitoring Systems Market: Competitive Analysis

The leading players in the global fetal monitoring systems market are:

- GE Healthcare

- Koninklijke Philips N.V.

- Medtronic

- Samsung Medison

- Analogic Corporation

- BD (Becton

- Dickinson and Company)

- Contec Medical Systems

- CooperSurgical

- Dixion

- Neoventa Medical

- PeriGen

- Spacelabs Healthcare

- Ultrasound Technologies (e.g.

- OEM fetal monitoring units)

- Bionet Co. Ltd.

- Huntleigh Healthcare / Sonicaid products

What are the key trends in the global Fetal Monitoring Systems Market?

Wireless & wearable monitoring:

Wireless and wearable fetal monitors offer continuous tracking without restricting maternal movement. They enhance convenience and comfort for both clinicians and patients. Adoption is rising in home care and outpatient settings.

Patient-centric home solutions:

User-friendly and portable monitoring devices empower expectant parents to track fetal health at home. They offer promise between clinical visits. This trend fuels growth in the adoption of home-based fetal monitoring.

The global fetal monitoring systems market is segmented as follows:

By Product Type

- Instruments and Consumables

- Ultrasound

- Electronic Maternal/Fetal Monitor

- Fetal Electrodes

- Fetal Doppler

- Telemetry Solutions

- Accessories and Consumables

- Software

By Portability

- Portable

- Non-portable

By Method

- Non-Invasive

- Invasive

By Application

- Intrapartum Fetal Monitoring

- Antepartum Fetal Monitoring

By End-User

- Hospitals

- Gynecological/Obstetrics Clinics

- Homecare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed