Wireless Sensors Market Size, Share, And Growth Report 2032

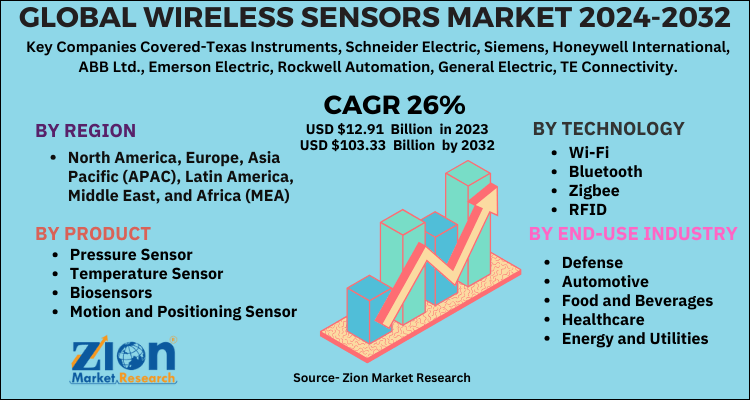

Wireless Sensors Market by Product (Pressure Sensor, Temperature Sensor, Biosensors, Motion & Positioning Sensor, Humidity Sensors, Level Sensors, Gas Sensors, and Others), by Technology (Wi-Fi, Bluetooth, Zigbee, RFID, and Others), by End-Use Industry (Defense, Automotive, Food & Beverages, Healthcare, Energy & Utilities, and Others), and By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.91 Billion | USD 103.33 Billion | 26% | 2023 |

Wireless Sensors Market: Size

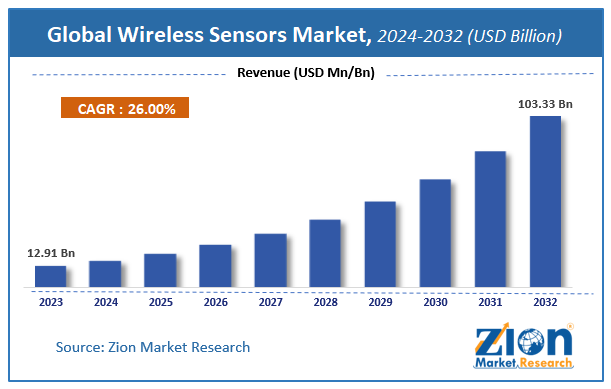

The global Wireless Sensors Market size was worth around USD 12.91 billion in 2023 and is predicted to grow to around USD 103.33 billion by 2032 with a compound annual growth rate (CAGR) of roughly 26% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Wireless Sensors Market on a global and regional level.

Wireless Sensors Market: Overview

The wireless sensors market is anticipated to grow considerably in the future, owing to the increasing product demand by the energy and utility sector. Numerous oil and gas organizations have to monitor, control, secure, and maintain industrial assets efficiently. Wireless sensors are effective in resolving various problems, such as corrosion, gas leak detection, etc. Oil and gas companies are investing in the latest technologies to meet their security standards and have a technical advantage. Thus, the global wireless sensors market is expected to witness notable growth over the forecast time period.

The rising demand for wireless sensors by the food and beverage industry is also fueling the market growth. Wireless sensors help to maintain the ideal temperature and humidity levels in plants for the manufacturing of various food items, such as bread. In the bakery sector, the ambient humidity and temperature have a huge impact on the food quality, specifically in the mixing, forming, and packaging stages of production. However, the limited bandwidth of wireless sensors may have an adverse effect on the wireless sensors market development. Alternatively, increasing wireless technology usage is expected to open new growth avenues for the wireless sensors market over the forecast timeline.

Wireless Sensors Market: Segmentation

The study provides a crucial view of the wireless sensors market by segmenting the market based on the product, technology, end-use industry, and region. All the segments of the wireless sensors market have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on product, the global wireless sensors market is fragmented into pressure sensor, temperature sensor, biosensors, motion and positioning sensor, humidity sensors, level sensors, gas sensors, and others. The motion and positioning sensor segment is projected to grow notably over the forecast timeframe, due to the rising product demand in the developing economies of the Asia Pacific region.

On the basis of technology, the global wireless sensors market includes Wi-Fi, Bluetooth, Zigbee, RFID, and others. The Wi-Fi segment is expected to hold a significant market share in the future, owing to the rising wireless technology demand in numerous sectors.

By end-use industry, the market includes defense, automotive, food and beverages, healthcare, energy and utilities, and others.

Wireless Sensors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wireless Sensors Market |

| Market Size in 2023 | USD 12.91 Billion |

| Market Forecast in 2032 | USD 103.33 Billion |

| Growth Rate | CAGR of 26% |

| Number of Pages | 188 |

| Key Companies Covered | Texas Instruments, Schneider Electric, Siemens, Honeywell International, ABB Ltd., Emerson Electric, Rockwell Automation, General Electric, TE Connectivity, and Endress+Hauser |

| Segments Covered | By product, By technology, By end-use industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wireless Sensors Market: Regional Analysis

The regional segmentation comprises the current and forecast demand for the Middle East and Africa, North America, Asia Pacific, Latin America, and Europe.

Latin America is expected to grow notably in the global wireless sensors market over the forecast time span, owing to the increasing investments made in the Brazilian automotive sector. The European wireless sensors market is anticipated to make notable contributions to the global market for wireless sensors, due to the increasing product demand in the healthcare sector. Most of the healthcare organizations in Europe are focusing on investing in the latest technologies to provide better healthcare services to the patients. The aim of using wireless sensors in healthcare is to ensure uninterrupted patient monitoring.

Wireless Sensors Market: Competitive Players

Some major players of the global wireless sensors market are:

- Texas Instruments

- Schneider Electric

- Siemens

- Honeywell International

- ABB Ltd.

- Emerson Electric

- Rockwell Automation

- General Electric

- TE Connectivity

- Endress+Hauser

The Global Wireless Sensors Market is segmented as follows:

Global Wireless Sensors Market: Product Analysis

- Pressure Sensor

- Temperature Sensor

- Biosensors

- Motion and Positioning Sensor

- Humidity Sensors

- Level Sensors

- Gas Sensors

- Others

Global Wireless Sensors Market: Technology Analysis

- Wi-Fi

- Bluetooth

- Zigbee

- RFID

- Others

Global Wireless Sensors market: End-Use Industry Analysis

- Defense

- Automotive

- Food and Beverages

- Healthcare

- Energy and Utilities

- Others

Global Wireless Sensors market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wireless sensors are devices that detect and measure physical or environmental conditions, such as temperature, humidity, pressure, motion, or light, and transmit the data wirelessly to a central system or network.

According to study, the Wireless Sensors Market size was worth around USD 12.91 billion in 2023 and is predicted to grow to around USD 103.33 billion by 2032.

The CAGR value of Wireless Sensors Market is expected to be around 26% during 2024-2032.

Latin America has been leading the Wireless Sensors Market and is anticipated to continue on the dominant position in the years to come.

The Wireless Sensors Market is led by players like Texas Instruments, Schneider Electric, Siemens, Honeywell International, ABB Ltd., Emerson Electric, Rockwell Automation, General Electric, TE Connectivity, and Endress+Hauser.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed