Defence Antenna Systems Market Size, Share, Trends, Growth & Forecast 2034

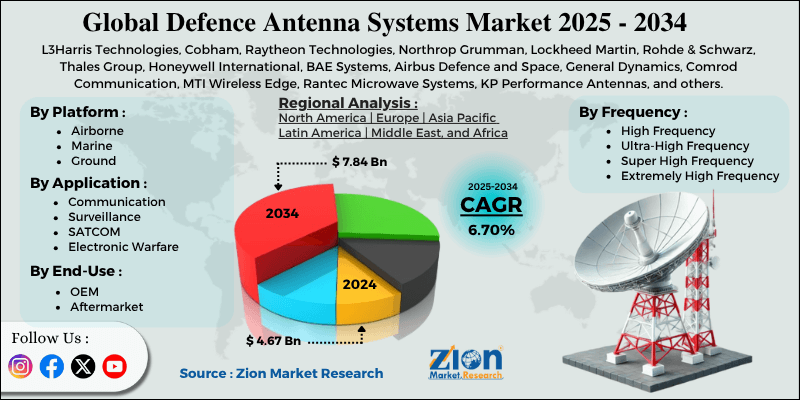

Defence Antenna Systems Market By Platform (Airborne, Marine, Ground), By Frequency (High Frequency, Ultra-High Frequency, Super High Frequency, Extremely High Frequency), By Application (Communication, Surveillance, SATCOM, Electronic Warfare, Telemetry), By End-Use (OEM, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

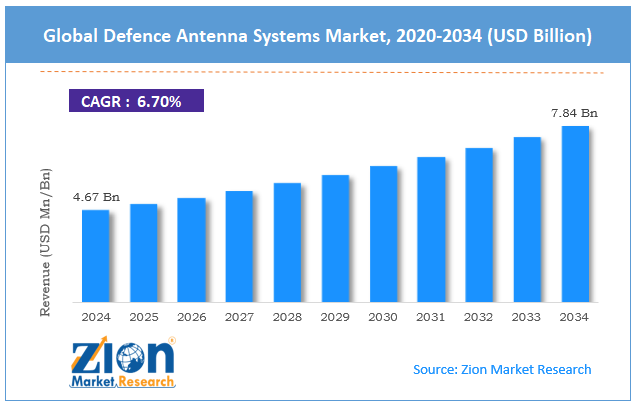

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.67 Billion | USD 7.84 Billion | 6.70% | 2024 |

Defence Antenna Systems Industry Perspective:

The global defence antenna systems market size was worth around USD 4.67 billion in 2024 and is predicted to grow to around USD 7.84 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global defence antenna systems market is estimated to grow annually at a CAGR of around 6.70% over the forecast period (2025-2034)

- In terms of revenue, the global defence antenna systems market size was valued at around USD 4.67 billion in 2024 and is projected to reach USD 7.84 billion by 2034.

- The defence antenna systems market is projected to grow significantly due to the increasing demand for secure military communication networks, the growth in electronic warfare and ISR operations, and advancements in phased-array and innovative antenna technologies.

- Based on the platform, the airborne segment is expected to lead the market, while the ground segment is expected to grow considerably.

- Based on frequency, the super high frequency segment is the dominating segment, while the extremely high frequency segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the communication segment leads the market, while the surveillance segment is projected to grow steadily over the coming years.

- Based on end-use, the OEM segment is expected to lead the market compared to the aftermarket segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Defence Antenna Systems Market: Overview

Defense antenna systems sector forms a crucial segment of the defense and security industry, offering high-performance antenna solutions for military communication, electronic warfare, navigation, surveillance, and intelligence applications. These systems allow long-range, secure, and unbroken connectivity across air, sea, land, and space defense platforms. The global defence antenna systems market is projected to witness substantial growth driven by the growing defense modernization programs, increasing geopolitical stresses and conflicts, and improvements in electronic warfare and radar technologies. Governments across the globe are upgrading military infrastructure with improved communication and radar systems. Defense antenna systems are a crucial component of these upgrades, improving battlefield connectivity, electronic warfare capabilities, and surveillance, which drives the industry expansion.

Moreover, the growth in regional conflicts and worldwide security concerns has elevated the demand for intense surveillance and military communication systems. Economies are actively investing in advanced antenna systems to provide situational awareness and guard communication networks during wars. Furthermore, emerging electronic warfare threats require well-developed antennas that can withstand jamming, detect signals over long distances, and operate across multiple band frequencies. Technological advancements in phased-array and smart antennas are driving the industry growth.

Although drivers exist, the global market is challenged by factors like the high cost of advanced antenna systems, technical complexity, and integration challenges with legacy systems. Cutting-edge defense antennas, particularly multi-band systems or phased arrays, involve significant R&D and manufacturing costs, which limit their adoption for smaller defense budgets. Integrating and designing advanced antenna systems needs dedicated expertise and infrastructure. Complex maintenance and installation processes may hamper procurement, especially for developing economies.

Likewise, several armed forces still operate legacy platforms. Integrating modern antenna systems with older hardware may be expensive, time-consuming, and complex. Even so, the global defence antenna systems industry is well-positioned due to the development of lightweight and compact antennas, integration with ML and AI, and the growth of autonomous and unmanned defense systems. Miniaturized antennas for UAVs, armored vehicles, and portable communication systems offer opportunities to cater to the changing battlefield needs. AI-based antennas can detect jamming, enhance signal processing, and dynamically adjust beam patterns, offering improved performance and opening new revenue streams. Increasing deployment of UGVs, UAVs, and autonomous naval platforms fuels the demand for dedicated antennas for communication, navigation, and remote operations.

Defence Antenna Systems Market Dynamics

Growth Drivers

How is the defence antenna systems market driven by the rising threats of cyber and electronic warfare?

The intensification of electronic warfare activities and cyber threats has forced military organizations to invest in modernized antenna systems that can withstand jamming, electronic attacks, and interception. According to the reports, defense electronics and EW equipment spending in North America and Europe is anticipated to surpass USD 45 billion by 2030.

Modern antennas are now designed with stealth communication, low-probability-of-intercept, and anti-jamming capabilities, which are essential in contested environments. Recent news highlights the United States Navy deploying modernized radar antennas capable of operating in hostile electronic environments, illustrating how increasing EW threats are driving the market.

How are technological improvements in antenna systems considerably fueling the defence antenna systems market?

Innovations in antenna technology, like miniaturized high-frequency antennas, phased array antennas, and electronically steerable antennas are fueling the growth of the defence antenna systems market. These solutions offer improved beamforming, compact design, and multi-band operation, meeting advanced defense requirements.

According to the reports by Defense IQ 2025, the adoption of advanced phased array systems is projected to surge by a 7.2% CAGR worldwide because of elevated deployment in communication and radar platforms. Recent contracts awarded to companies like Raytheon for next-generation communication and radar antennas underscore the current demand for superior solutions. These technological improvements make defense operations more efficient, precise, and reliable.

Restraints

Regulatory and export control challenges negatively impact the market progress

Defense antennas, primarily advanced communication and high-frequency systems, are subject to stringent international regulations, including ITAR and other export controls. These norms limit sales, cross-border collaborations, and technology transfer, restricting industry penetration. In 2025, there were 18% fewer cross-border defense electronics contracts due to tighter export restrictions, according to SIPRI. For instance, the United StatesStates' restrictions onon selling AESA antennas to some Middle Eastern nations delayed multiple contracts, illustrating how regulatory barriers hamper worldwide industry growth.

Opportunities

How does the rising deployment of unmanned and autonomous platforms offer advantageous conditions for the defence antenna systems market?

The proliferation of unmanned aerial vehicles, autonomous land and naval platforms, and drones is driving the demand for lightweight, compact, and high-performance antennas. Studies predict that the military UAV industry will progress at a 9.5% CAGR by 2030. Recent news specifies that Northrop Grumman and Leonardo have launched specialized antennas for UAVs capable of multi-brand operations. This rise in autonomous platform deployment offers lucrative opportunities in the global defence antenna systems industry for antenna manufacturers aiming for high-precision and lightweight designs.

Challenges

Rapid technological obsolescence restricts the market growth

Defense antennas experience constant innovation cycles, with improved technologies rendering older ones obsolete within a short period. According to the reports, nearly 20% of communication antennas and radars are replaced within 5-7 years because of upgrades. Recent news highlights the phasing out of older AESA radar systems in NATO aircraft programs. Manufacturers should continuously invest in research and development to stay competitive, increasing the challenge of obsolescence.

Defence Antenna Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Defence Antenna Systems Market |

| Market Size in 2024 | USD 4.67 Billion |

| Market Forecast in 2034 | USD 7.84 Billion |

| Growth Rate | CAGR of 6.70% |

| Number of Pages | 213 |

| Key Companies Covered | L3Harris Technologies, Cobham, Raytheon Technologies, Northrop Grumman, Lockheed Martin, Rohde & Schwarz, Thales Group, Honeywell International, BAE Systems, Airbus Defence and Space, General Dynamics, Comrod Communication, MTI Wireless Edge, Rantec Microwave Systems, KP Performance Antennas, and others. |

| Segments Covered | By Platform, By Frequency, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Defence Antenna Systems Market: Segmentation

The global defence antenna systems market is segmented based on platform, frequency, application, end-use, and region.

Based on the platform, the global defence antenna systems industry is divided into airborne, marine, and ground. The airborne segment registers a leading share of the market due to higher demand for aircraft communication, surveillance, and radar systems.

On the other hand, the ground segment holds a second-leading share, driven by land-based military communication networks, electronic warfare applications, and radar systems.

Based on frequency, the global market is segmented into high frequency, ultra-high frequency, super high frequency, and extremely high frequency. The super high frequency segment leads the market because of its extensive use in satellite communication, missile guidance systems, and radar.

Conversely, the exceptionally high frequency segment holds a second rank, fueled by advanced military applications needing high data rates, anti-jamming capabilities, and secure communication.

Based on application, the global defence antenna systems market is segmented into communication, surveillance, SATCOM, electronic warfare, and telemetry. The communication segment dominates the market due to the critical need for reliable and secure military communication networks.

Nevertheless, the surveillance segment holds a second-leading position, fueled by the rising demand for real-time battlefield monitoring, situational awareness, and threat detection.

Based on end-use, the global market is segmented into OEM and aftermarket. The OEM segment holds leadership in the market, fueled by the demand for novel defense platforms embedded with integrated antenna systems.

However, the aftermarket segment is expected to grow considerably, driven by retrofitting, maintenance, and upgrade requirements for existing military equipment.

Defence Antenna Systems Market: Regional Analysis

What gives North America a competitive edge in the global Defence Antenna Systems Market?

North America is likely to sustain its leadership in the defence antenna systems market due to high defense spending, technological improvements, R&D capabilities, and the presence of leading defense contractors. North America, particularly the United States, accounts for the largest share of global defense expenditure, with the U.S. budget expected to surpass USD 900 billion in 2025. A significant share of this budget is allocated to advanced communication, electronic warfare, and radar systems, which fuels robust demand for defense antenna systems. This continuous investment promises continuous improvements and procurement of next-generation antennas.

Moreover, the region houses the leading defense technology companies and research institutions with robust R&D capabilities. Advancements in phased-array, smart antennas, and multi-band originate mainly from the region, helping it gain a competitive advantage in high-performing defense antenna solutions. This technological dominance appeals to the allied and domestic military procurement contracts.

Furthermore, North America houses key defense antenna manufacturers like Northrop Grumman, L3Harris, Lockheed Martin, and Raytheon Technologies, which dominate the market. These companies supply integrated antenna systems in airborne, ground, and naval platforms, strengthening the region’s leadership.

Europe continues to secure the second-highest share in the defence antenna systems industry due to significant defense budgets in major economies, improvements in air and naval forces, and NATO membership and collaborative programs. European economies, especially France, Germany, and the UK, collectively spend more than Euro 250 billion every year on defense, emphasizing modernization programs and improved military platforms. A significant share of these budgets is distributed to communication, radar, and electronic warfare systems, which fuels the demand for defense antenna systems. This continuous funding backs persistent upgrades and procurement.

European countries are upgrading their fleets with stealth ships, unmanned aerial vehicles, and advanced fighter jets, all of which require well-developed antennas for communication, SATCOM, and radar. This fleet advancement is a significant factor contributing to the region's robust industry position. Europe's integration with NATO fuels the demand for interoperable defense communication and radar systems. Collaborative programs like the Eurodrone initiative and the European MALE RPAS project require advanced antennas to ensure high-speed and secure data sharing among member countries.

Defence Antenna Systems Market: Competitive Analysis

The leading players in the global defence antenna systems market are:

- L3Harris Technologies

- Cobham

- Raytheon Technologies

- Northrop Grumman

- Lockheed Martin

- Rohde & Schwarz

- Thales Group

- Honeywell International

- BAE Systems

- Airbus Defence and Space

- General Dynamics

- Comrod Communication

- MTI Wireless Edge

- Rantec Microwave Systems

- KP Performance Antennas

Defence Antenna Systems Market: Key Market Trends

Integration with unmanned and autonomous platforms:

The rising use of UGVs, UAVs, and autonomous naval systems has elevated the demand for lightweight, compact, and high-performance antennas. Real-time data transmission, surveillance capabilities, and navigation are becoming crucial for unmanned operations.

Advancements in smart and AI-enabled antennas:

Machine learning and artificial intelligence are actively integrated into antenna systems for dynamic beamforming, signal optimization, and threat detection. These smart antennas improve battlefield awareness, reduce human intervention in complex operations, and improve communication reliability.

The global defence antenna systems market is segmented as follows:

By Platform

- Airborne

- Marine

- Ground

By Frequency

- High Frequency

- Ultra-High Frequency

- Super High Frequency

- Extremely High Frequency

By Application

- Communication

- Surveillance

- SATCOM

- Electronic Warfare

- Telemetry

By End-Use

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Defense antenna systems sector forms a crucial segment of the defense and security industry, offering high-performance antenna solutions for military communication, electronic warfare, navigation, surveillance, and intelligence applications. These systems allow long-range, secure, and unbroken connectivity across air, sea, land, and space defense platforms.

The global defence antenna systems market is projected to grow due to the expansion of naval and airborne C4ISR applications, increased joint military exercises and coalition communication needs, and rising defense modernization programs.

According to study, the global defence antenna systems market size was worth around USD 4.67 billion in 2024 and is predicted to grow to around USD 7.84 billion by 2034.

The CAGR value of the defence antenna systems market is expected to be around 6.70% during 2025-2034.

Emerging trends include multi-band and phased-array systems, AI-enabled smart antennas, network-centric warfare integration, compact designs for unmanned platforms, and cyber-resilient communication technologies.

Pricing trends in the defence antenna systems market show a gradual increase due to high R&D costs, advanced technology integration, and demand for multi-functional and secure systems.

North America is expected to lead the global defence antenna systems market during the forecast period.

The key players profiled in the global defence antenna systems market include L3Harris Technologies, Cobham, Raytheon Technologies, Northrop Grumman, Lockheed Martin, Rohde & Schwarz, Thales Group, Honeywell International, BAE Systems, Airbus Defence and Space, General Dynamics, Comrod Communication, MTI Wireless Edge, Rantec Microwave Systems, and KP Performance Antennas.

What strategies should stakeholders adopt to stay competitive in the defence antenna systems market?

Stakeholders should focus on strategic partnerships, technological innovation, expanding into emerging regional markets, and product diversification to stay competitive.

The report examines key aspects of the defense antenna systems market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed