Military Land Vehicle Market Size, Share, Growth, Forecast 2032

Military Land Vehicle Market - By Type (Main Battle Tank, Infantry Battle Tank, Armored Personnel Carriers, Armored Combat Support Vehicles, Mine Protected Vehicles, Light Armored Vehicles, Light Utility Vehicles, Anti-Aircraft, Unmanned Vehicles, And Others.), And By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

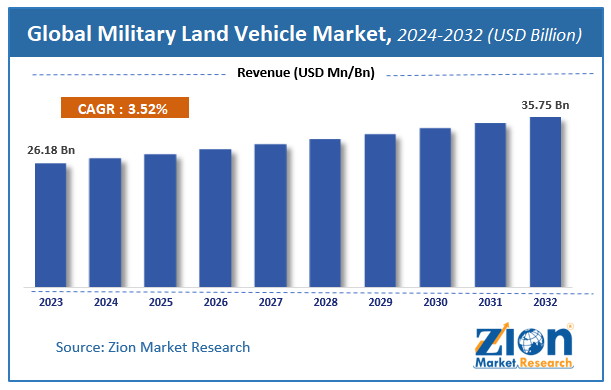

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

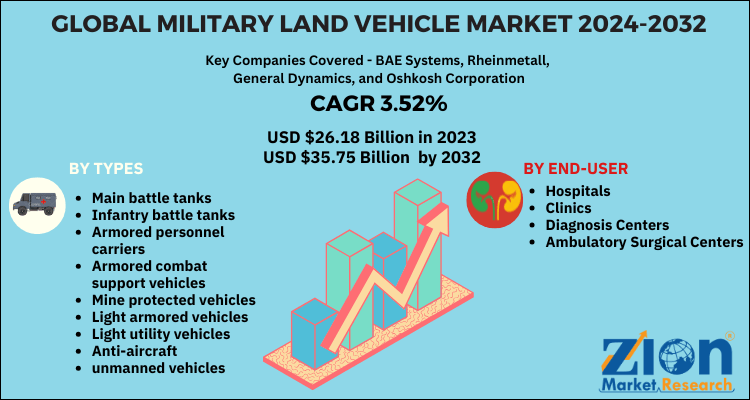

| USD 26.18 Billion | USD 35.75 Billion | 3.52% | 2023 |

Military Land Vehicle Industry Perspective

According to a report from Zion Market Research, the global Military Land Vehicle Market was valued at USD 26.18 Billion in 2023 and is projected to hit USD 35.75 Billion by 2032, with a compound annual growth rate (CAGR) of 3.52% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Military Land Vehicle industry over the next decade.

The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global market space. The military land vehicle industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the military land vehicle market report explores the investor and stakeholder space to help companies make data-driven decisions.

Global Military Land Vehicle Market: Overview

Defense is an integral part of every nation. Protecting the country’s land and its people is one of the first and foremost responsibilities of every national government. Land security is one of the areas of defense strategy apart from navy and air security. A nation’s land has to be protected and defended to secure its boundaries and protect the people living on the land. Military land vehicles are of use in every defense planning. Protecting own land is as important as maintaining a strong economy in the country.

A Military Land Vehicle is any type of ground-based transportation used by military forces for various operational purposes. These vehicles are designed to perform a wide range of military functions, including combat, logistics, reconnaissance, and transport of personnel and equipment. They are typically equipped with advanced technology, armor, and weaponry to withstand harsh combat environments and provide protection to soldiers.

Military land vehicles include several categories, such as:

-

Armored Fighting Vehicles (AFVs): These include tanks, armored personnel carriers (APCs), and infantry fighting vehicles (IFVs), which are designed for frontline combat, providing protection, mobility, and firepower.

-

Tanks: Heavy armored vehicles with large-caliber guns, designed primarily for direct combat and to engage enemy forces.

-

Utility Vehicles: These are versatile, often unarmored vehicles used for transporting troops, supplies, and equipment, such as the Humvee.

-

Logistics and Transport Vehicles: These include trucks and transporters used for moving personnel, weapons, ammunition, and other supplies to the battlefield.

-

Reconnaissance Vehicles: Lightly armored and highly mobile, these vehicles are designed for scouting and gathering intelligence in hostile environments.

-

Mine-Resistant Ambush Protected (MRAP) Vehicles: Built specifically to withstand roadside bombs and IEDs, these are heavily armored to protect occupants from explosions.

Military land vehicles are essential components of a nation’s defense infrastructure, supporting various operations ranging from combat to peacekeeping and humanitarian missions.

Global Military Land Vehicle Market: Growth Factors

Emerging nations with developing economies are showing more interest in the purchase of military land vehicles. These economies with growing populations need more advanced defense mechanisms with comparatively more numbers of land protection machines or equipment to protect civilians and secure the national border. In addition, the overall global security scenario is getting more complicated and hence increasing the pressure on nations to have more modern and accurate defense mechanisms than ever before. With every new invention in this industry, the growth of the global military vehicle market is growing.

The Military Land Vehicle Market is driven by several key growth factors. First, increasing defense budgets across many nations, driven by rising geopolitical tensions and security concerns, have spurred the demand for advanced military vehicles. Governments are prioritizing the modernization of their defense systems, focusing on the acquisition of technologically advanced vehicles that offer improved mobility, firepower, and protection.

Second, the growing need for vehicles that can operate in diverse and challenging environments, such as urban warfare, deserts, and rugged terrains, is encouraging the development of adaptable and highly maneuverable vehicles. The rise of asymmetric warfare and counterterrorism operations has further emphasized the need for enhanced vehicle survivability, leading to investments in armored vehicles with advanced protective features, including mine-resistant and improvised explosive device (IED)-resistant designs.

Third, technological advancements are playing a critical role in market growth. The integration of autonomous systems, artificial intelligence (AI), and unmanned ground vehicles (UGVs) into military land vehicles is driving innovation. These technologies improve operational efficiency, reduce human risk, and enable greater situational awareness in combat scenarios.

Additionally, the growing emphasis on reducing vehicle weight without compromising performance and protection is leading to the use of lightweight, high-strength materials, further boosting market growth. The expansion of defense initiatives, modernization programs, and international collaborations in developing military infrastructure are also contributing to the market's upward trajectory.

Finally, the demand for multi-role vehicles that can serve in a variety of missions, from troop transport and reconnaissance to logistics and combat support, is encouraging the development of more versatile platforms, further fueling the growth of the military land vehicle market.

Military Land Vehicle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Military Land Vehicle Market |

| Market Size in 2023 | USD 26.18 Billion |

| Market Forecast in 2032 | USD 35.75 Billion |

| Growth Rate | CAGR of 3.52% |

| Number of Pages | 110 |

| Key Companies Covered | BAE Systems, Rheinmetall, General Dynamics, and Oshkosh Corporation |

| Segments Covered | By Types And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

However, due to a few nations with weaker economic conditions, the defense expenditures of those countries are decreasing and hence badly affecting the overall global military land vehicles market. The new trend in developed countries to produce their own defense equipment is also restricting the import of vehicles from other countries, which in turn adversely impacts the global market

Global Military Land Vehicle Market: Segmentation

The world military land vehicle market is segmented on the basis of types and regions.

On the basis of types, the global military land vehicles market is segmented as main battle tanks, infantry battle tanks, armored personnel carriers, armored combat support vehicles, mine protected vehicles, light armored vehicles, light utility vehicles, anti-aircraft, unmanned vehicles, and others.

On the basis of regions, the global military land vehicles market is classified into the United States, Latin America, Africa, Asia Pacific, the Middle East, and Europe.

Global Military Land Vehicle Market: Competitive Players

Some of the key players dominating the global military land vehicles market include BAE Systems, Rheinmetall, General Dynamics, and Oshkosh Corporation. The global military land vehicles market is very dynamic as every nation and scientists around the globe are putting efforts to have more powerful and effective military vehicles with greater efficiency and minimal collateral damages.

Global Military Land Vehicle Market: Regional Analysis

Developed countries such as the United States and the United Kingdom are more engaged in world politics owing to their geopolitical interest; hence, they require more defense equipment and stronger mechanisms as compared to other countries. They are cutting the number of soldiers in the services and focusing more on the use of machines.

Apart from these nations, few Asian and African countries are frequently facing security issues, leading to the increase in demand for security and defense equipment to protect their land. These scenarios are highlighting the growth of military land vehicles in the world.

Military Land Vehicle Market: Competitive Space

The global Military Land Vehicle market profiles key players such as:

- BAE Systems

- Rheinmetall

- General Dynamics

- Oshkosh Corporation

The global Military Land Vehicle market is segmented as follows:

By Types

- Main battle tanks

- Infantry battle tanks

- Armored personnel carriers

- Armored combat support vehicles

- Mine protected vehicles

- Light armored vehicles

- Light utility vehicles

- Anti-aircraft

- unmanned vehicles

- Others

Global Military Land Vehicle Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Emerging nations with developing economies are showing more interest in the purchase of military land vehicles. These economies are with growing population and need more advanced defense mechanism with comparatively more numbers of land protection machines or equipment to protect its civilians and secure the national border.

According to a report from Zion Market Research, the global Military Land Vehicle Market was valued at USD 26.18 Billion in 2023 and is projected to hit USD 35.75 Billion by 2032, with a compound annual growth rate (CAGR) of 3.52% during the forecast period 2024-2032.

Developed countries such as the United States and the United Kingdom are more engaged into world politics owing to their geopolitical interest; hence, they require more defense equipment and stronger mechanisms as compared to other countries. They are cutting the number of soldiers in the services and focusing more on the use of machines. Apart from these nations, few Asian and African countries are frequently facing security issues, leading to the increase in demand of the security and defense equipment to protect their land. These scenarios are highlighting the growth of military land vehicles in the world.

Some of the key players dominating the global military land vehicles market include BAE Systems, Rhenmetall, General Dynamics, and Oshkosh Corporation. The global military land vehicles market is very dynamic as every nation and scientists around the globe are putting efforts to have more powerful and effective military vehicles with greater efficiency and minimal collateral damages

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed