Data Center Precision Air Conditioning Market Size, Share, Trends, Growth & Forecast 2034

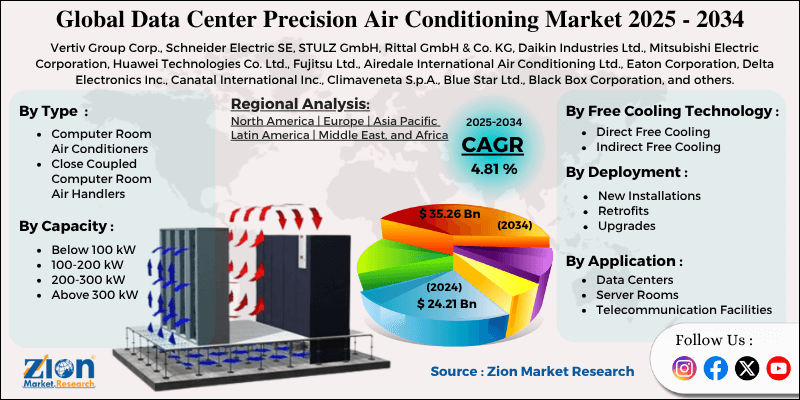

Data Center Precision Air Conditioning Market By Type (Computer Room Air Conditioners [CRACs], Close Coupled Computer Room Air Handlers [CCRAHs]), By Capacity (Below 100 kW, 100-200 kW, 200-300 kW, Above 300 kW), By Free Cooling Technology (Direct Free Cooling, Indirect Free Cooling), By Deployment (New Installations, Retrofits, Upgrades), By Application (Data Centers, Server Rooms, Telecommunication Facilities), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

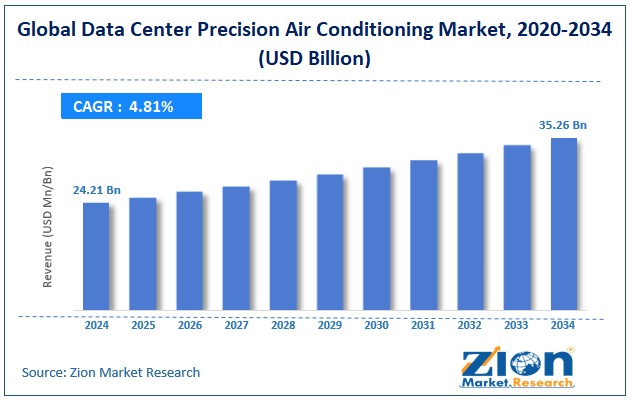

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.21 Billion | USD 35.26 Billion | 4.81% | 2024 |

Data Center Precision Air Conditioning Industry Perspective:

The global data center precision air conditioning market size was worth around USD 24.21 billion in 2024 and is predicted to grow to around USD 35.26 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.81% between 2025 and 2034.

Data Center Precision Air Conditioning Market: Overview

Data center precision air conditioning systems are dedicated cooling solutions, specially designed to maintain stable humidity and temperature levels in data centers. Unlike conventional HVAC systems, precision air cooling systems offer continuous operation, high precision, and targeted airflow to protect sensitive IT machines from overheating and promise enhanced performance. The global data center precision air conditioning market is poised for notable growth owing to growing demand for hyperscale data centers, augmented rack power loads and server density, and expansion of edge data centers. The speedy adoption of cloud services and the rise of hyperscale data centers by technology giants like Google, Amazon, and Microsoft have elevated the demand for precision cooling.

Modern data centers are utilizing high-density racks (up to 20 to 30 kW per rack), which in turn decreases the effectiveness of traditional cooling systems. PAC systems are highly preferred owing to their ability to deliver preset cooling and handle high heat densities. Moreover, the rising proliferation of edge computing is boosting the development of distributed and smaller data centers closer to users. These services demand efficient and compact PACs, thus impacting the market progress.

Nevertheless, the global market faces limitations due to factors such as high operational costs, capital, and complex installation and design requirements. Precision air conditioning systems are more expensive than standard HVAC systems in terms of ongoing maintenance and installation. The significant upfront investment could be financially challenging for medium and small-sized data centers. Also, the implementation of PAC requires accurate load calculations, careful planning, and incorporation with data center design. This complexity usually increases costs and hampers deployment.

Still, the global data center precision air conditioning industry benefits from several favorable factors, including the retrofit and upgradation of former cooling systems and demand for scalable and modular cooling systems. Several older data centers rely on inefficient cooling systems. The demand for compliance and energy saving is fueling retrofits with newer PACs, creating an opportunistic aftermarket. Furthermore, the trend towards modular data center construction propels the need for similar modular PAC units. These scalable systems can be quickly deployed, reducing time to market and improving flexibility.

Key Insights:

- As per the analysis shared by our research analyst, the global data center precision air conditioning market is estimated to grow annually at a CAGR of around 4.81% over the forecast period (2025-2034)

- In terms of revenue, the global data center precision air conditioning market size was valued at around USD 24.21 billion in 2024 and is projected to reach USD 35.26 billion by 2034.

- The data center precision air conditioning market is projected to grow significantly owing to the growing need for sustainable and energy-efficient cooling solutions, growth in micro data centers and edge data centers, and rising demand for colocation and hyper-scale data centers.

- Based on type, the Computer Room Air Conditioners (CRACs) segment is expected to lead the market. In contrast, the Close Coupled Computer Room Air Handlers (CCRAHs) segment is expected to grow considerably.

- Based on capacity, the below 100 kW segment dominates the market, while the 100-200 kW segment holds a second position.

- Based on free cooling technology, the indirect free cooling segment leads the market, while the direct free cooling segment holds second-leading rank.

- Based on deployment, the new installations segment is the dominating segment, while the retrofits segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the data centers segment is expected to lead the market compared to the server rooms segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Data Center Precision Air Conditioning Market: Growth Drivers

How does the increased adoption of high-density computing and artificial intelligence boost the growth of the data center precision air conditioning market?

High-performance computing (HPC) clusters and AI workloads produce significant heat, necessitating robust thermal management. For example, NVIDIA's H100 GPUs are widely used for artificial intelligence training and may reach power densities of over 30 kW per rack, surpassing the capabilities of traditional cooling. This has prompted data center operators to utilize PAC with enhanced airflow management and improved cooling capacity per square foot, primarily in AI training areas, thereby driving the growth of the data center precision air conditioning market.

Rapid digital transformation across industries considerably fuels the market growth

Digital transformation is forcing industries like manufacturing, healthcare, retail, and finance to adopt hybrid cloud infrastructures and digitize operations. In 2025, nearly 70% of businesses worldwide have amplified their digital transformation objectives after the pandemic, strengthening their dependency on data centers, according to IDC.

This trend is driving enterprise data centers and colocation to scale up, needing dependable cooling to prevent outages. Digital Reality declared the growth of its data center footprint in North America and Southeast Asia, integrating modernized PAC systems along with projected IT loads and uptime needs, in February 2025.

Data Center Precision Air Conditioning Market: Restraints

What are the key difficulties in retrofitting legacy data centers in the data center precision air conditioning market?

Integrating PAC systems in present data centers is technically intricate and costly. Old facilities typically lack the necessary layout, power infrastructure, or airflow dynamics to support advanced precision cooling solutions, such as liquid-assisted or in-row systems. A prominent example occurred in March 2025, when a key banking institution in Germany postponed the upgrade of its Frankfurt data center due to design incompatibility between proposed PAC units and legacy server racks. Engineering modifications needed for incorporation elevated the budget by 22%, increasing the plan's financial unsustainability. This form of ecosystem rigidity restricts wider PAC adoption.

Data Center Precision Air Conditioning Market: Opportunities

Shift toward energy-efficient and sustainable cooling solutions positively impacts market growth

The worldwide inclination for carbon neutrality and sustainability is driving data centers to adopt eco-friendly PAC systems, thereby fueling the progress of the data center precision air conditioning industry. Energy-efficient models that present free cooling solutions are now a top priority. This complies with the rising trend of achieving lower Power Usage Effectiveness (PUE) ratios, which is vital for ESG and environmental compliance.

Data Center Precision Air Conditioning Market: Challenges

How does escalating competition from alternative cooling solutions restrict the data center precision air conditioning market growth?

As advanced cooling solutions mature, the global PAC industry faces increasing competition from immersion cooling, liquid cooling, and direct-to-chip technologies, particularly in ultra-dense and AI-based computing environments. These technologies offer improved cooling performance and reduced PUE values, typically enhancing suitability for next-gen data centers. Microsoft and Meta increased the use of liquid cooling in their European and U.S. data centers, mentioning up to 25% of energy savings over air cooling.

Data Center Precision Air Conditioning Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Data Center Precision Air Conditioning Market |

| Market Size in 2024 | USD 24.21 Billion |

| Market Forecast in 2034 | USD 35.26 Billion |

| Growth Rate | CAGR of 4.81% |

| Number of Pages | 213 |

| Key Companies Covered | Vertiv Group Corp., Schneider Electric SE, STULZ GmbH, Rittal GmbH & Co. KG, Daikin Industries Ltd., Mitsubishi Electric Corporation, Huawei Technologies Co. Ltd., Fujitsu Ltd., Airedale International Air Conditioning Ltd., Eaton Corporation, Delta Electronics Inc., Canatal International Inc., Climaveneta S.p.A., Blue Star Ltd., Black Box Corporation, and others. |

| Segments Covered | By Type, By Capacity, By Free Cooling Technology, By Deployment, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Data Center Precision Air Conditioning Market: Segmentation

The global data center precision air conditioning market is segmented based on type, capacity, free cooling technology, deployment, application, and region.

Based on type, the global data center precision air conditioning industry is divided into computer room air conditioners (CRACs) and close-coupled computer room air handlers (CCRAHs). The computer room air conditioners (CRACs) segment held a leading share because of their extensive adoption in new and legacy data centers.

Conversely, the close-coupled computer room air handlers (CCRAHs) segment ranks second in the market due to their rising use in modular and high-density centers.

Based on capacity, the global market is segmented into below 100 kW, 100-200 kW, 200-300 kW, and above 300 kW. The below 100 kW segment registered a maximum share owing to its leadership in medium and small enterprise data centers, micro data centers, and edge facilities.

The 100-200 kW segment also dominates the market, fueled by large and medium-sized organizations, colocation providers, and data centers.

Based on free cooling technology, the global data center precision air conditioning market is segmented into direct free cooling and indirect free cooling. The indirect free cooling is the dominating segment. It is preferred for its ability to maintain clean internal air by utilizing heat exchangers, increasing its suitability for data centers that need controlled environments without exposing internal systems to external air pollutants.

However, the direct free cooling segment holds a second leading position due to its lower operational costs and higher energy efficiency.

Based on deployment, the global market is segmented into new installations, retrofits, and upgrades. The new installations segment held a larger market share, driven by the rapid expansion of edge data centers and global growth.

Nonetheless, the retrofits segment is expected to gain a remarkable share in the coming years as older data centers aim to improve cooling efficacy and comply with new energy standards.

Based on application, the global market is segmented into data centers, server rooms, and telecommunication facilities. The data centers category leads the global market due to substantial growth in data generation, AI workloads, and cloud adoption, which necessitates energy-efficient and precise cooling systems to ensure enhanced performance and uptime.

On the other hand, the server rooms category is expected to register a notable market since they still need humidity and precise temperature, increasing the significance of PAC systems for safeguarding critical IT infrastructure.

Data Center Precision Air Conditioning Market: Regional Analysis

Which primary factors help Asia Pacific dominate the data center precision air conditioning market over the forecast period?

Asia Pacific is projected to maintain its dominant position in the global data center precision air conditioning market, driven by the rapid expansion of data centers in major economies, the growing adoption of digital and cloud transformation, and the increasing number of smart city projects and government initiatives. Asia Pacific is experiencing a boom in data center construction, mainly in Singapore, India, Japan, and China. This progress is fueling the demand for PAC systems to support colocation, hyperscale, and enterprise data centers. The rapid digitalization of businesses and the growing adoption of cloud computing have heightened the need for reliable IT infrastructure.

In 2024, Asia Pacific cloud spending hit more than USD 200 billion, with key players like Microsoft, Google, and AWS increasing their regional dominance. This is strengthening the installation of precision cooling systems to promise efficiency and performance. Moreover, regional governments are actively investing in 5G networks, smart cities, and national digital ecosystem programs. These policy-based improvements demand efficient PAC systems to maintain energy compliance and uptime.

North America maintains its position as the second-leading region in the global data center precision air conditioning industry due to the domination of hyperscale data centers, retrofitting and upgrades of legacy infrastructures, and strict energy efficiency norms. North America, primarily the U.S., houses a majority of hyperscale data centers worldwide. The region registered for more than 40% of the global hyperscale services in 2024, according to the research. These huge facilities need energy-efficient and high-capacity precision air conditioning systems to handle their enormous thermal loads.

Additionally, North America holds a leading number of legacy data centers constructed in the early 2000s. These services are undergoing cooling upgrades and retrofits to enhance efficacy and meet the improved IT requirements. The retrofitting trend is a key growth propeller for the regional precision air conditioning systems. Regulations like energy codes and ASHRAE 90.4 from California (Title 24) states are forcing data center operators to deploy efficient cooling solutions. These policies have boosted the replacement of conventional HVAC systems with precision cooling systems that obey stringent environmental and energy standards.

Data Center Precision Air Conditioning Market: Competitive Analysis

The leading players in the global data center precision air conditioning market are:

- Vertiv Group Corp.

- Schneider Electric SE

- STULZ GmbH

- Rittal GmbH & Co. KG

- Daikin Industries Ltd.

- Mitsubishi Electric Corporation

- Huawei Technologies Co. Ltd.

- Fujitsu Ltd.

- Airedale International Air Conditioning Ltd.

- Eaton Corporation

- Delta Electronics Inc.

- Canatal International Inc.

- Climaveneta S.p.A.

- Blue Star Ltd.

- Black Box Corporation

Data Center Precision Air Conditioning Market: Key Market Trends

Adoption of immersion and liquid cooling support:

While former PAC systems are air-based, merchants are increasingly adapting units to facilitate a hybrid environment with immersion or liquid cooling. These solutions are deployed in AI-focused and high-density data centers to handle extreme heat more effectively. PAS systems are transforming to complement these modernized methods for complete thermal management.

Scalable and modular PAC deployments:

With the growth of modular facilities and edge data centers, PAC systems are dedicated to plug-and-play scalability. Vendors are offering modular and compact units that can be easily deployed and expanded with the rising IT needs. This trend backs fast deployment in urban, remote, and space-limited locations.

The global data center precision air conditioning market is segmented as follows:

By Type

- Computer Room Air Conditioners (CRACs)

- Close Coupled Computer Room Air Handlers (CCRAHs)

By Capacity

- Below 100 kW

- 100-200 kW

- 200-300 kW

- Above 300 kW

By Free Cooling Technology

- Direct Free Cooling

- Indirect Free Cooling

By Deployment

- New Installations

- Retrofits

- Upgrades

By Application

- Data Centers

- Server Rooms

- Telecommunication Facilities

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Data center precision air conditioning systems are dedicated cooling solutions, specially designed to maintain stable humidity and temperature levels in data centers. Unlike conventional HVAC systems, precision air cooling systems offer continuous operation, high precision, and targeted airflow to protect sensitive IT machines from overheating and promise enhanced performance.

The global data center precision air conditioning market is projected to grow due to the speedy expansion of 5G infrastructure, increasing rack power densities in newer data centers, and improvements in precision cooling solutions.

According to study, the global data center precision air conditioning market size was worth around USD 24.21 billion in 2024 and is predicted to grow to around USD 35.26 billion by 2034.

The CAGR value of the data center precision air conditioning market is expected to be around 4.81% during 2025-2034.

Asia Pacific is expected to lead the global data center precision air conditioning market during the forecast period.

The key players profiled in the global data center precision air conditioning market include Vertiv Group Corp., Schneider Electric SE, STULZ GmbH, Rittal GmbH & Co. KG, Daikin Industries, Ltd., Mitsubishi Electric Corporation, Huawei Technologies Co., Ltd., Fujitsu Ltd., Airedale International Air Conditioning Ltd., Eaton Corporation, Delta Electronics, Inc., Canatal International Inc., Climaveneta S.p.A., Blue Star Ltd., and Black Box Corporation.

By 2034, data centers are expected to dominate the application segment of the market. Growing demand for cloud services and a rise in hyperscale data centers are key drivers of this leadership.

Major constraints include significant energy consumption and high initial and maintenance costs, making adoption challenging for smaller facilities. Moreover, low awareness in developing regions, complex installation, and strict ecological norms hinder industry growth.

The value chain of the global data center precision air conditioning industry includes raw material/component suppliers, system integrators, manufacturers, end users, and distributors. Each stage ensures seamless design, deployment, production, and maintenance of precision cooling systems in data centers.

The report examines key aspects of the data center precision air conditioning market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

Data Center Precision Air ConditioningIndustry Perspective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesChallengesReport ScopeSegmentationRegional AnalysisCompetitive AnalysisKey Market TrendsThe global data center precision air conditioning market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed