Communications Service Providers (CSP) Market Size, Share, Trends, Growth 2034

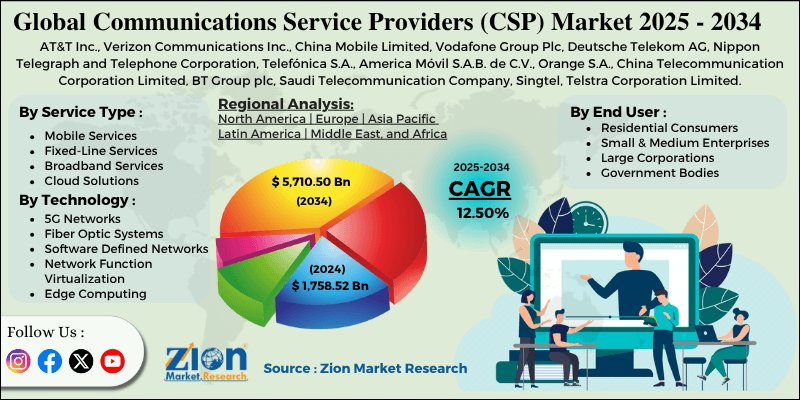

Communications Service Providers (CSP) Market By Service Type (Mobile Services, Fixed-Line Services, Broadband Services, Cloud Solutions, Managed Services, IoT Connectivity), By Technology (5G Networks, Fiber Optic Systems, Software Defined Networks, Network Function Virtualization, Edge Computing, Satellite Communications), By End-User (Residential Consumers, Small and Medium Enterprises, Large Corporations, Government Bodies, Educational Institutions, Healthcare Organizations), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

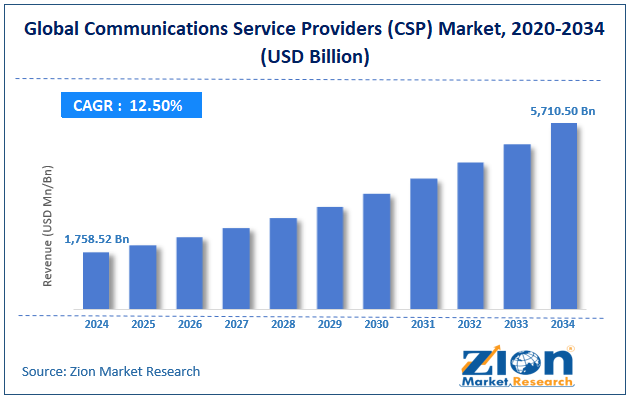

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,758.52 Billion | USD 5,710.50 Billion | 12.50% | 2024 |

Communications Service Providers Industry Perspective:

The global communications service providers market size was worth approximately USD 1,758.52 billion in 2024 and is projected to grow to around USD 5,710.50 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.50% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global communications service providers market is estimated to grow annually at a CAGR of around 12.50% over the forecast period (2025-2034).

- In terms of revenue, the global communications service providers market size was valued at approximately USD 1,758.52 billion in 2024 and is projected to reach USD 5,710.50 billion by 2034.

- The communications service providers market is projected to grow significantly due to the expansion of 5G network deployments and the rise of digital economy transformation programs.

- Based on service type, the mobile services segment is expected to lead the market, while the IoT connectivity segment is anticipated to experience significant growth.

- Based on technology, the 5G networks segment is the dominating segment, while the edge computing segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the large corporations segment is expected to lead the market compared to the educational institutions segment.

- Based on region, North America is projected to dominate the global communications service providers market during the estimated period, followed by the Asia Pacific.

Communications Service Providers Market: Overview

A Communications Service Provider (CSP) is a company offering telecommunication services, internet access, and digital communication solutions to individuals and businesses using different network technologies and platforms. These providers manage complex systems enabling voice calls, data sharing, video streaming, and cloud-based applications for homes and workplaces. Running CSP operations involves managing network capacity, maintaining service quality, and ensuring a positive customer experience while keeping pace with rapidly changing technologies. Modern CSPs use advanced network hardware, software-driven systems, and strong security measures to achieve high performance and efficiency. To maintain reliable service, they continuously monitor networks, plan for capacity needs, and follow strict regulatory standards to ensure consistent connectivity.

Additionally, telecommunication operations are governed by detailed regulations covering spectrum use, consumer protection, and data privacy, ensuring that communication services remain secure, fair, and accessible to everyone.

The increasing demand for high-speed connectivity and digital transformation initiatives is expected to drive substantial growth in the communications service providers market throughout the forecast period.

Communications Service Providers Market Dynamics

Growth Drivers

How are accelerating digital transformation and enterprise connectivity demands propelling the communications service providers market growth?

The communications service providers market is expanding as companies across all industries move toward digital operations and remote work, depending on strong network systems and high-speed internet. Businesses in both developed and developing regions are under growing pressure to use cloud-based tools, support mobile employees, and enable real-time teamwork, making reliable connectivity more critical than ever. Company leaders are seeking network services that offer steady performance, minimize downtime, and scale easily while maintaining security. To meet these needs, service providers are building advanced infrastructure to expand coverage, increase internet speed, and offer complete customer support.

Features like guaranteed uptime, flexible bandwidth options, and built-in security have boosted productivity and improved business operations. The growing need for reliable communication systems and major digital investments is also pushing demand for next-generation network technologies. These changing needs are turning communications service providers into key partners in helping businesses grow, innovate, and stay competitive.

5G network expansion and IoT proliferation

The global communications service providers market is expanding as fifth-generation (5G) wireless technology, connected devices, and smart infrastructure projects become more common. Network systems are essential for delivering ultra-fast internet speeds, connecting a large number of devices, and reducing delays in new technology applications. Modernization in telecommunications, industrial automation, and smart city projects all depend on networks managing rapidly increasing data traffic while ensuring high service quality and reliability.

Ongoing public infrastructure improvements and advancements in technology are creating new opportunities for networks with stronger performance and wider coverage. Also, the rise of autonomous systems and artificial intelligence is increasing the need for high-capacity networks that support both advanced innovation and real-world deployment needs.

Restraints

How are infrastructure investment requirements and regulatory compliance complexity limiting the growth of the communications service providers market?

A major challenge in the communications service providers industry is the high cost of upgrading network infrastructure compared to slower revenue growth. These expenses include buying spectrum, purchasing equipment, and managing deployment costs. Many telecommunication projects struggle with limited funds due to large upfront investments, ongoing maintenance needs, and strict regulatory requirements, making it difficult to plan resources effectively. To address these issues, providers must prove clear returns on investment, conduct detailed financial studies, and secure long-term funding. However, investment difficulties continue, especially when expanding networks in low-population areas or regions with uncertain demand, which requires careful market evaluation.

Opportunities

How are network virtualization and cloud-native architectures creating opportunities in the communications service providers market?

The communications service providers market is growing with the adoption of new technologies, including software-defined networking, network function virtualization, and cloud-based service delivery platforms, enabling flexible and efficient network management. Companies are developing virtual network solutions, automation tools, and programmable systems, increasing performance.

Advanced features like network slicing, dynamic resource allocation, and customizable service options are becoming increasingly widely used. There is also a rising demand for specialized solutions, as providers design industry-focused packages, sector-specific applications, and performance-optimized setups to meet different business needs. These innovations make communication services more flexible, efficient, and appealing for businesses focused on technology and innovation.

Challenges

Intense market competition and pricing pressures

The communications service providers industry is facing difficulties due to intense competition and falling prices as companies fight to gain market share. Pricing structures differ across regions, making it hard for providers to keep profits while offering affordable and competitive services. This situation affects long-term revenue, limits investment opportunities, and reduces funding for innovation, creating challenges for both established players and new entrants.

Another major issue is the growing commoditization of basic connectivity services, which reduces uniqueness and weakens customer loyalty. These challenges emphasize the need for new service ideas, better customer experiences, and strong value propositions in the telecommunications industry.

By creating unique service packages and offering excellent customer support, providers can improve customer retention, reduce churn, and ensure long-term growth. This also helps protect users and trusted providers from poor service quality and unreliable network performance.

Communications Service Providers (CSP) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Communications Service Providers (CSP) Market |

| Market Size in 2024 | USD 1,758.52 Billion |

| Market Forecast in 2034 | USD 5,710.50 Billion |

| Growth Rate | CAGR of 12.50% |

| Number of Pages | 215 |

| Key Companies Covered | AT&T Inc., Verizon Communications Inc., China Mobile Limited, Vodafone Group Plc, Deutsche Telekom AG, Nippon Telegraph and Telephone Corporation, Telefónica S.A., America Móvil S.A.B. de C.V., Orange S.A., China Telecommunication Corporation Limited, BT Group plc, Saudi Telecommunication Company, Singtel, Telstra Corporation Limited, SK Telecommunication Co. Ltd., and others. |

| Segments Covered | By Service Type, By Technology, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Communications Service Providers Market: Segmentation

The global communications service providers market is segmented based on service type, technology, end-user, and region.

Based on service type, the global communications service providers industry is divided into mobile services, fixed-line services, broadband services, cloud solutions, managed services, and IoT connectivity. Mobile services lead the market due to widespread smartphone adoption, increasing data consumption patterns, and a continuous demand for wireless connectivity requiring advanced network capabilities and extensive coverage guarantees.

Based on technology, the global communications service providers market is classified into 5G networks, fiber optic systems, software-defined networks, network function virtualization, edge computing, and satellite communications. 5G networks are expected to lead the market during the forecast period due to their superior speed capabilities and enhanced performance across various application scenarios and device connection requirements.

Based on end-user, the global market is segmented into residential consumers, small and medium enterprises, large corporations, government bodies, educational institutions, and healthcare organizations. Large corporations hold the largest market share due to their substantial connectivity requirements and ongoing investment in digital infrastructure technologies, which enables them to maintain operational efficiency.

Communications Service Providers Market: Regional Analysis

What factors are contributing to North America's dominance in the global communications service providers market?

North America leads the global communications service providers market due to its advanced telecommunications infrastructure, rapid adoption of new technologies, and strong culture of innovation. The region accounts for around 40% of global 5G network deployments, with the United States contributing the most due to its large consumer base and commitment to technological leadership. Professionals in North America prefer modern communication technologies that deliver high performance, improved capabilities, and better customer satisfaction.

The region also benefits from major technology companies conducting network research, skilled telecommunication experts, and a strong support system of industry professionals. Well-defined regulations and strict testing standards further increase confidence in launching new services. Growth is driven by rising demand for bandwidth, ongoing network upgrades, and efforts to provide broadband access for all.

North American companies are leading the development of new network technologies, creating innovative service models, and scaling them for broader use. Recently, the industry has focused more on network security, data privacy, and sustainable infrastructure. Artificial intelligence, predictive analytics, and automated network management are increasingly integrated into telecommunication systems, improving both operational efficiency and service reliability.

Asia Pacific is expected to show strong growth.

In the Asia Pacific region, the communications service providers market is expanding as the telecommunication industry adopts mobile-first approaches, integrates digital payment systems, and supports the growing use of smart devices. These services play a crucial role in urban connectivity projects, rural broadband programs, and economic development efforts by enhancing access, promoting digital inclusion, and meeting the growing needs of the population. Governments across the region have introduced detailed telecommunication policies with clear coverage goals and quality standards, helping sustain steady market growth.

As awareness of advanced connectivity increases, adoption is spreading beyond major cities into smaller towns, public infrastructure, and residential areas. Rapid urbanization and a growing middle class are encouraging regional providers to offer affordable, high-quality network services. The increasing use of mobile data, video streaming, and social media underscores the region’s emphasis on digital activities and online entertainment.

Government funding and support from development organizations are also helping expand networks and build trust in telecommunication solutions. Developers are including advanced connectivity in industrial zones, tech hubs, and commercial projects. Leading Asian companies are partnering with equipment manufacturers to improve network technologies, enhance service offerings, and ensure strong and reliable performance.

Recent Market Developments

- In October 2025, IIT-Madras’s Pravartak lab became the first lab in India authorized to test 5G core network functions and Group-I devices under the national telecom security framework, reducing dependence on foreign laboratories.

- In August 2025, India’s Bharti Airtel launched a new cloud platform and AI-driven software tools via its digital unit Xtelify, targeting businesses and telecommunication operators in domestic and international markets.

Communications Service Providers Market: Competitive Analysis

The leading players in the global communications service providers market are:

- AT&T Inc.

- Verizon Communications Inc.

- China Mobile Limited

- Vodafone Group Plc

- Deutsche Telekom AG

- Nippon Telegraph and Telephone Corporation

- Telefónica S.A.

- America Móvil S.A.B. de C.V.

- Orange S.A.

- China Telecommunication Corporation Limited

- BT Group plc

- Saudi Telecommunication Company

- Singtel

- Telstra Corporation Limited

- SK Telecommunication Co. Ltd.

The global communications service providers market is segmented as follows:

By Service Type

- Mobile Services

- Fixed-Line Services

- Broadband Services

- Cloud Solutions

- Managed Services

- IoT Connectivity

By Technology

- 5G Networks

- Fiber Optic Systems

- Software Defined Networks

- Network Function Virtualization

- Edge Computing

- Satellite Communications

By End User

- Residential Consumers

- Small and Medium Enterprises

- Large Corporations

- Government Bodies

- Educational Institutions

- Healthcare Organizations

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Communications Service Provider (CSP) is a company offering telecommunication services, internet access, and digital communication solutions to individuals and businesses using different network technologies and platforms.

The global communications service providers market is projected to grow due to increasing 5G network deployments, rising demand for high-speed internet connectivity, and growing emphasis on digital transformation initiatives and cloud service adoption strategies.

According to a study, the global communications service providers market size was worth around USD 1,758.52 billion in 2024 and is predicted to grow to around USD 5,710.50 billion by 2034.

The CAGR value of the communications service providers market is expected to be around 12.50% during 2025-2034.

North America is expected to lead the global communications service providers market during the forecast period.

The major players profiled in the global communications service providers market include AT&T Inc., Verizon Communications Inc., China Mobile Limited, Vodafone Group Plc, Deutsche Telekom AG, Nippon Telegraph and Telephone Corporation, Telefónica S.A., America Móvil S.A.B. de C.V., Orange S.A., China Telecommunication Corporation Limited, BT Group plc, Saudi Telecommunication Company, Singtel, Telstra Corporation Limited, and SK Telecommunication Co. Ltd.

The report examines key aspects of the communications service providers market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges impacting the market.

The communications service providers market is observing pricing trends where premium services, such as 5G connectivity, dedicated bandwidth solutions, and managed service packages, are priced higher than basic connectivity options, creating affordability challenges but highlighting value creation through enhanced performance and comprehensive support.

To stay competitive in the communications service providers market, stakeholders should focus on customer experience improvements, expand service portfolio offerings, invest in network automation technologies, and collaborate with technology partners to validate performance and develop customized solutions for industry-specific and enterprise requirements.

The communications service providers market will see significant growth opportunities in IoT connectivity and cloud solutions, as organizations and technology developers prioritize scalable, secure, and low-latency services for connected device deployments, edge computing applications, and digital transformation initiatives.

List of Contents

Communications Service ProvidersIndustry Perspective:Key InsightsCommunications Service Providers OverviewCommunications Service Providers Market DynamicsReport ScopeCommunications Service Providers SegmentationCommunications Service Providers Regional AnalysisRecent Market DevelopmentsCommunications Service Providers Competitive AnalysisThe global communications service providers market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed