Casino Hotels Market Size, Share, Trends, Growth & Forecast 2034

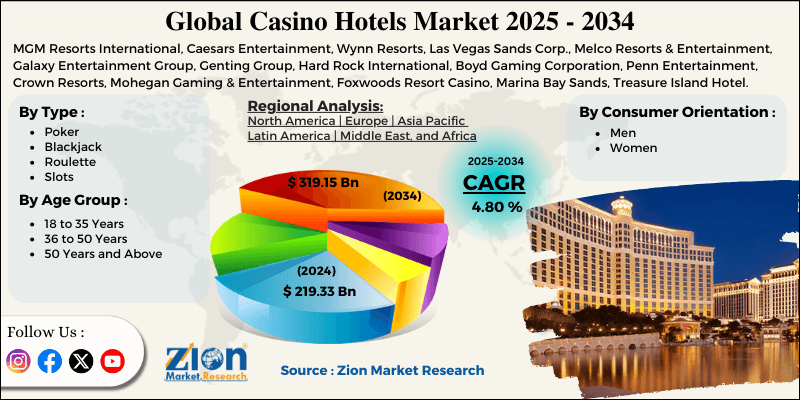

Casino Hotels Market By Type (Poker, Blackjack, Roulette, Slots, and Others), By Consumer Orientation (Men, Women), By Age Group (18 to 35 Years, 36 to 50 Years, 50 Years and Above), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

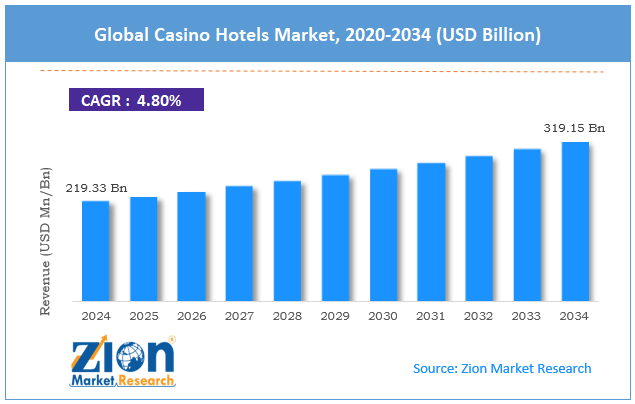

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 219.33 Billion | USD 319.15 Billion | 4.80% | 2024 |

Casino Hotels Industry Perspective:

The global casino hotels market size was worth around USD 219.33 billion in 2024 and is predicted to grow to around USD 319.15 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.80% between 2025 and 2034.

Casino Hotels Market: Overview

Casino hotels are combined establishments that assimilate gambling and lodging facilities, offering a blend of gaming options, accommodations, fine dining, leisure amenities, and entertainment shows. These venues cater to high rollers and tourists, offering an exhaustive entertainment experience that appeals to guests. The global casino hotels market is projected to witness substantial growth driven by the growth in global tourism, increasing disposable income, and the legalization of gambling in new markets. International tourist arrivals hit more than 1.3 billion in 2024, an increase of 15% from 2023, according to the UNWTO. This growth benefits casino hotels in tourist hotspots. As travel resumes, post-pandemic, integrated resort models are vastly preferred.

Moreover, rising incomes, mainly in emerging economies like Brazil, China, and India, are fueling the demand for leisure experiences. Consumers are actively spending more on luxurious entertainment, such as casino hotels. This trend is projected to continue as the middle-class population is growing notably. Also, nations like Brazil, Japan, and parts of Southeast Asia are relaxing regulations on gambling. This triggers fresh foreign investments and new casino hotel developments. Legal reforms grow industry potential and fuel investor confidence.

Although drivers exist, the global market is challenged by factors like ethical and social concerns and high operational costs. Social stigma and gambling addiction continue to hinder the global market growth. Political opposition and public backlash in conservative areas hamper licensing. In addition, CSR pressures also compel companies to spend more on responsible gaming initiatives. Running a casino hotel entails significant operating costs and substantial capital expenditure. Increasing energy costs and growing inflation further stiffen profit margins. Small operators struggle to maintain profitability.

Even so, the global casino hotels industry is well-positioned due to diversification of services and adoption of green building practices. Adding fine dining, wellness centers, family-friendly zones, and themed entertainment appeals to a larger demographic. Non-gaming revenue is growing at a rapid pace. In Las Vegas, it registered more than 60% of the total market in 2024. This diversification decreases dependency on gambling income.

Furthermore, environmentally-friendly casino hotels attract eco-conscious investors and travelers. The use of LEED-certified infrastructure, water recycling, and solar energy attracts new consumer segments. Green initiatives also aid in securing regulatory approvals.

Key Insights:

- As per the analysis shared by our research analyst, the global casino hotels market is estimated to grow annually at a CAGR of around 4.80% over the forecast period (2025-2034)

- In terms of revenue, the global casino hotels market size was valued at around USD 219.33 billion in 2024 and is projected to reach USD 319.15 billion by 2034.

- The casino hotels market is projected to grow significantly owing to the growing legalization of gambling in new regions, brand collaborations and strategic partnerships, and growth in integrated resort developments.

- Based on type, the slots segment is expected to lead the market, while the poker segment is expected to grow considerably.

- Based on consumer orientation, the men segment is the dominating segment, while the women segment is projected to witness sizeable revenue over the forecast period.

- Based on age group, the 36 to 50 years segment is expected to lead the market compared to the 18 to 35 years segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Casino Hotels Market: Growth Drivers

How is the global casino hotel market driven by the growing affluence and middle-class expansion in APAC?

The growing disposable income and speedy economic growth in APAC, mainly in nations like Vietnam, China, South Korea, and India, are fueling more individuals towards leisure activities and luxury travel, including casino tourism.

In addition, the Asian cultural emphasis on group experiences and entertainment supports the development of casino hotel infrastructure. The growing demand from the expanding upper-middle class is prompting major developers to expand in the APAC, fueling the worldwide casino hotels market. Currently, more than USD 35 billion worth of casino resort missions is under development in the Asia Pacific.

Which key technological improvements are driving the casino hotels market?

New casino hotels are leveraging superior technology to deliver enhanced guest experiences and simplified operations. Technologies like AI-based concierge services, smart room controls, contactless check-in, and check-out, and augmented reality gaming floors are becoming increasingly common in premium resorts and settings.

MGM Resorts recently introduced its AI-based 'MGM Rewards' personalization system, integrated with real-time data to customize offers, casino bonuses, and room upgrades for every visitor. Caesars Entertainment launched cashless gaming via mobile app in its United States casino properties, motivating more frequent visits and fueling convenience.

Casino Hotels Market: Restraints

Long payback periods and high capital investment negatively impact market progress

Casino hotels need significant upfront capital for land acquisition, licensing, construction, and technology integration. The average cost of constructing a large integrated resort ranges from $3 billion - $10 billion, based on scale and location. The return on investment is vulnerable to both macroeconomic variations and long-term fluctuations.

Las Vegas Sands delayed its novel Macau growth plans, citing interest rate volatility and high prices in 2024. This underscores how significant capital needs and growing borrowing costs may hinder the ongoing expansion and new entrants in the global casino hotel sector.

Casino Hotels Market: Opportunities

How does the expansion of cashless and digital gaming infrastructure benefit the casino hotels market's progress?

The worldwide inclination towards cashless and digital transactions in hospitality is offering fresh revenue models and enhancing operational efficiency, thus impacting the casino hotels industry. Casino hotels that integrate RFID-based chips, cashless slot machines, and mobile betting may offer more unified customer experiences and track user behavior in real-time.

Caesars Entertainment has expanded its digital wallet feature across all its United States properties, enabling guests to pay for rooms, purchase drinks, and place bets directly through their smartphones. This boosts convenience as well as encourages long engagement on casino floors.

The surge in demand for contactless, digital-first services, mainly from tech-savvy and younger tourists, offers a key opportunity to advance traditional gaming and gain a competitive advantage.

Casino Hotels Market: Challenges

The rising threat from online gambling platforms restricts the growth of market

Online gambling is today a stern competitive threat to brick-and-mortar casino hotels. The worldwide online gambling industry hit USD 95 billion in 2024, with enthusiasts vastly preferring anonymity, convenience, and bonuses offered by betting applications and digital casinos.

Players who earlier visited casino hotels are now actively spending time on mobile platforms, mainly in younger demographics. DraftKings, FanDuel, and Bet MGM, have all experienced rapid growth, thus fragmenting the industry share.

This inclination is helping hotels to rethink their benefit statement. If they do not integrate omnichannel gaming experiences, they risk falling behind the modern digital-native competitors.

Casino Hotels Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Casino Hotels Market |

| Market Size in 2024 | USD 219.33 Billion |

| Market Forecast in 2034 | USD 319.15 Billion |

| Growth Rate | CAGR of 4.80% |

| Number of Pages | 214 |

| Key Companies Covered | MGM Resorts International, Caesars Entertainment, Wynn Resorts, Las Vegas Sands Corp., Melco Resorts & Entertainment, Galaxy Entertainment Group, Genting Group, Hard Rock International, Boyd Gaming Corporation, Penn Entertainment, Crown Resorts, Mohegan Gaming & Entertainment, Foxwoods Resort Casino, Marina Bay Sands, Treasure Island Hotel and Casino, and others. |

| Segments Covered | By Type, By Consumer Orientation, By Age Group, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Casino Hotels Market: Segmentation

The global casino hotels market is segmented based on type, consumer orientation, age group, and region.

Based on type, the global casino hotels industry is divided into poker, blackjack, roulette, slots, and others. The slots segment holds a substantial market share, registering the highest share of the worldwide gaming revenue. These machines require no prior gambling knowledge, are easily accessible, and are easy to use. Their immersive sound effects, digital themes, and bright visuals attract a broader demographic, comprising first-time and casual gamblers. In U.S.-like markets, slots account for nearly 70% of casino gaming profit, making them more profitable than others.

Based on consumer orientation, the global casino hotels market is segmented into men and women. The men consumer orientation segment dominates the global market, generating significant gambling profits worldwide. According to studies, more than 65% of casino hotel patrons are male, especially preferring table games like blackjack, poker, and sports betting lounges. Their significant average spending and long duration fuel substantial revenues. Casino hotels also customize marketing and gaming experiences to attract this dominant demographic.

Based on age group, the global market is segmented into 18 to 35 years, 36 to 50 years, and 50 years and above. The 36 to 50 years segment held a leading share because of their high disposable income and strong interest in leisure and gaming. This group usually balances business travel with entertainment, frequently engaging in luxury services and gambling. They are expected to stay long, participate in conventions and events, and spend more on accommodations. Their loyalty and financial stability to branded experiences make them an easy target for premium casino hotels.

Casino Hotels Market: Regional Analysis

Why does North America hold a dominant position in the global Casino Hotels Market?

North America is likely to sustain its leadership in the casino hotels market due to a higher concentration of casino hotels in the United States, strong gambling revenue generation, and strong MICE and tourism infrastructure. North America, especially the U.S., boasts the largest casino hotel hubs, such as Atlantic City and Las Vegas.

Among others, Las Vegas registered for more than 1,50,000 hotel rooms and over 170 casinos in 2024. This intense concentration appeals to millions of international and domestic tourists every year. In 2023, the United States' commercial gaming revenue reached USD 66.5 billion, with casino hotels registering the maximum share. Non-gaming amenities and gaming floors impact these profits. The stable economic environment supports continuous consumer spending in the domain.

Additionally, the region boasts well-established MICE and tourism infrastructure, which appeals to global business visitors and travelers. In 2023, Las Vegas hosted more than 40 million visitors, comprising 6 million convention guests. This dual leisure business attracts overall profitability and fuels occupancy of casino hotels.

Asia Pacific continues to secure the second-highest share in the casino hotels industry owing to the presence of key casino hubs, speedy expansion of integrated resorts, and proximity to emerging tourism regions. Asia Pacific houses the leading gambling hotspots, such as Marina Bay Sands in Singapore and Macau, commonly known as the 'Gambling Capital of the World.' Macau alone produced more than USD 22.7 billion in gross gaming profits in 2023, registering the maximum income of the region. These locations appeal to millions of luxury travelers and high-rollers from across the world, particularly in Asia. In addition, the regional governments are prompting integrated resort development to drive foreign investment and tourism.

For instance, Japan approved casino resorts in Nagasaki and Osaka, expected to open in the late 2020s. Such developments are attracting billions in private investment and transforming the casino hotel outlook in the Asia Pacific. Casino hotels in the region benefit from rapid growth and proximity to densely populated tourism markets. Nations like Cambodia, the Philippines, and Vietnam are also becoming gaming hubs because of liberalizing laws and their affordability. This geographic benefit aids regional casino tourism and cross-border travel.

Casino Hotels Market: Competitive Analysis

The leading players in the global casino hotels market are:

- MGM Resorts International

- Caesars Entertainment

- Wynn Resorts

- Las Vegas Sands Corp.

- Melco Resorts & Entertainment

- Galaxy Entertainment Group

- Genting Group

- Hard Rock International

- Boyd Gaming Corporation

- Penn Entertainment

- Crown Resorts

- Mohegan Gaming & Entertainment

- Foxwoods Resort Casino

- Marina Bay Sands

- Treasure Island Hotel and Casino

Casino Hotels Market: Key Market Trends

Shift toward non-gaming revenue:

Casino hotels are generating revenue from non-gaming services, including fine dining, entertainment shows, retail, and spas. In Las Vegas, non-gaming profits presently register for more than 60% of the overall resort income. This diversification attracts a broader audience beyond customary gamblers.

Focus on responsible and sustainable gaming:

Operators are focusing on environmental sustainability and responsible gambling practices. Characteristics like self-exclusion tools, LEED-certified infrastructure, and betting limits are gaining traction. This trend aligns with the rising regulatory pressure and the expectations of socially conscious investors and travelers.

The global casino hotels market is segmented as follows:

By Type

- Poker

- Blackjack

- Roulette

- Slots

- Others

By Consumer Orientation

- Men

- Women

By Age Group

- 18 to 35 Years

- 36 to 50 Years

- 50 Years and Above

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Casino hotels are combined establishments that assimilate gambling and lodging facilities, offering a blend of gaming options, accommodations, fine dining, leisure amenities, and entertainment shows. These venues cater to high rollers and tourists, offering an exhaustive entertainment experience that appeals to guests.

The global casino hotels market is projected to grow due to the expansion of mobile and online gaming, surging interest in nightlife and entertainment offerings, and elevated demand for luxury hospitality experiences.

According to study, the global casino hotels market size was worth around USD 219.33 billion in 2024 and is predicted to grow to around USD 319.15 billion by 2034.

The CAGR value of the casino hotels market is expected to be around 4.80% during 2025-2034.

North America is expected to lead the global casino hotels market during the forecast period.

The key players profiled in the global casino hotels market include MGM Resorts International, Caesars Entertainment, Wynn Resorts, Las Vegas Sands Corp., Melco Resorts & Entertainment, Galaxy Entertainment Group, Genting Group, Hard Rock International, Boyd Gaming Corporation, Penn Entertainment, Crown Resorts, Mohegan Gaming & Entertainment, Foxwoods Resort Casino, Marina Bay Sands, and Treasure Island Hotel and Casino.

Market trends in the casino hotels market are shifting toward integrated resort experiences, combining gaming with luxury, entertainment, and wellness amenities. Consumer preferences are evolving to favor digital gaming options, personalized services, and immersive, culturally themed environments.

The competitive landscape in the casino hotels market is dominated by major players like MGM Resorts, Caesars Entertainment, and Las Vegas Sands, which leverage expansive resort portfolios and brand recognition. The market also features regional operators and emerging players investing in themed experiences, digital integration, and strategic partnerships to gain market share.

The 36 to 50 years age group holds the largest share due to higher disposable incomes and a strong preference for luxury leisure experiences. Their financial stability enables frequent spending on casino gaming, upscale accommodations, and entertainment.

The report examines key aspects of the casino hotels market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed