Carded Packaging Market Size, Share, Trends, Growth and Forecast 2034

Carded Packaging Market By Product Type (Folding Cartons, Rigid Boxes, Sleeves, Trays, and Others), By Material Type (Plastic, Paper & Paperboard, Aluminum), By Technology (Thermoforming, Cold Forming), By Application (Consumer Goods, Pharmaceuticals, Electronics & Semiconductors, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.51 Billion | USD 56.06 Billion | 7.90% | 2024 |

Carded Packaging Industry Perspective:

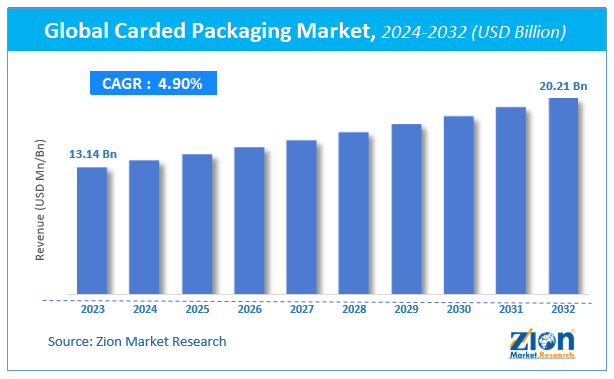

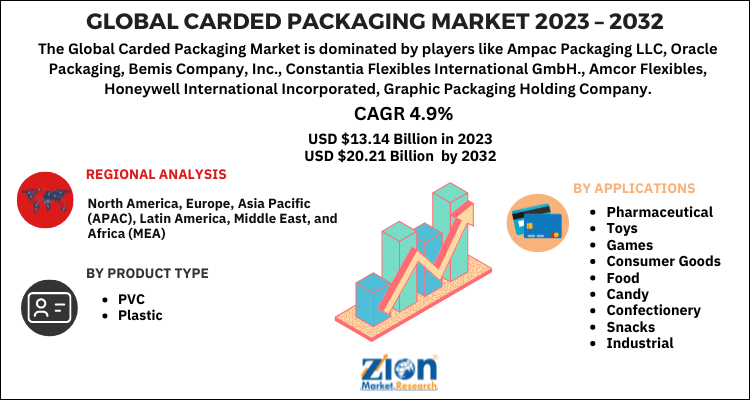

The global carded packaging market size was worth around USD 30.51 billion in 2024 and is predicted to grow to around USD 56.06 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.90% between 2025 and 2034.

Carded Packaging Market: Overview

Carded packaging is a form of retail packaging that secures a product with a supportive backing material, typically plastic or paperboard, and a clamshell or clear plastic blister to display and protect the item. It is widely used for hardware electronics, cosmetics, and toys due to its ability to offer tamper resistance, visibility, and branding space.

The growth of e-commerce and retail drives the global carded packaging market, as does the rising importance of branding and shelf appeal, as well as growing environmental awareness, which is fueling the use of sustainable materials.

The rapidly evolving e-commerce and retail sectors heavily demand tamper-proof and protective packaging that also enhances product visibility. In the previous year, the e-commerce sales market was valued at $6.3 trillion, propelling demand for visually appealing and secure packaging, such as carded formats.

Moreover, carded packaging provides space for instructions, branding, and compliance labeling, enabling brands to differentiate themselves in the retail environment. A study by Packaging Strategies revealed that 68% of purchase decisions are impacted by packaging design and visibility.

Additionally, advancements in biodegradable and recyclable cards, as well as PET-based blisters, have gained significant prominence. Leading brands such as Sonoco and Amcor are offering environmentally friendly solutions that comply with stringent packaging regulations.

Nevertheless, the global market is challenged by the complexity of recycling multi-material packs and the increasing prices of raw materials. The combination of paperboard and plastic poses a recycling challenge. Since waste management practices differ from region to region, several carded packs are disposed of in landfills, thereby violating sustainability norms.

Additionally, variations in paperboard prices and those of petroleum-based packaging affect production costs. PET prices surged by 8.5% in 2024, pressurizing revenue margins for packaging companies.

Nonetheless, the global carded packaging industry is expected to experience considerable growth over the next 5 years, driven by innovations in eco-friendly materials, the integration of smart packaging solutions, and the increasing adoption of medical devices. Rising R&D investments in recyclable paper cards, biodegradable plastics, and mono-material packs create room for ecological substitutes. Companies that use circular economy principles will benefit from this.

Additionally, NFC tags, QR codes, and AR labels can be integrated into carded packs to enhance consumer interaction, provide product authentication, and offer digital instructions. Moreover, the demand for sterile packaging and tamper-proof disposable medical devices is surging, with blister cards meeting compliance and hygiene needs.

Key Insights:

- As per the analysis shared by our research analyst, the global carded packaging market is estimated to grow annually at a CAGR of around 7.90% over the forecast period (2025-2034)

- In terms of revenue, the global carded packaging market size was valued at around USD 30.51 billion in 2024 and is projected to reach USD 56.06 billion by 2034.

- The carded packaging market is projected to grow significantly due to the increasing consumer preference for transparent packaging, the growth of the pharmaceutical sector, and rising retail shelf competition.

- Based on product type, the folding cartons segment is expected to lead the market, while the trays segment is expected to grow considerably.

- Based on material type, the plastic is the dominant segment, while the paper and paperboard segment is projected to witness sizable revenue growth over the forecast period.

- Based on technology, the thermoforming is the dominant segment, while the cold forming segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the consumer goods segment is expected to lead the market compared to the pharmaceuticals segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Carded Packaging Market: Growth Drivers

Rising use of advanced packaging technologies and thermoforming spurs the market growth

Thermoforming technology is transforming the global carded packaging market by enabling material efficiency, high-speed production, and consistent quality in large quantities.

Clamshell packaging and thermoformed blister packs offer transparency, rigidity, and customization, all of which are essential for ensuring product safety and effective branding. It is also supportive of barrier films and eco-friendly plastics, helping the market to meet ecological objectives.

Advancements like automated blister sealing lines and form-fill-seal machines have notably reduced labor costs and enhanced yield, appealing to the fresh investments in the segment.

Rapid growth in the consumer technology and electronics market considerably fuels the market growth

Carded packaging is vital in the electronics industry due to its anti-theft features, proactive nature, and ability to display both high-value and small-value products, such as batteries, headphones, USBs, and other accessories. Clamshell and blister formats prevent shoplifting and tampering while presenting products clearly for online imagery and retail shelves. These formats also enable the integration of instructions, QR codes, and branding, improving the consumer experience.

Carded Packaging Market: Restraints

Negative consumer perception and the risk of over-packaging adversely impact market progress

Carded packaging, mainly in heavy blister and clamshell formats, is often disapproved for over-packaging, as it uses excessive material for low-cost items. This creates a poor consumer experience due to the complexity of unboxing or unpacking.

Sustainability influencers and consumer advocacy groups have criticized companies for using bulky or unnecessary packaging, particularly in the toys and electronics sectors.

The social media backlash against plastic-heavy packaging has led firms to increase or revise their packaging designs to use the least packaging.

Carded Packaging Market: Opportunities

Expansion of the smart accessories and electronics segment positively impacts market growth

The progress in smart devices, such as fitness trackers, portable chargers, and earbuds, requires durable, retail-ready, tamper-resistant packaging, which carded packaging is well-suited for. Blister packs or carded clamshells also allow better brand visibility, which is vital in competitive electronics retail, thus impacting the growth of the carded packaging industry.

With consumer electronic brands pursuing packaging that secures high-value items while enhancing shelf appeal, there is an opportunity for modernized carded packaging designs featuring elements such as QR codes, NFC tags, or holographic anti-theft stamps.

Carded Packaging Market: Challenges

High capital expenditure and manufacturing costs restrict the growth of the market

Carded packaging production, primarily for heat-sealed clamshells and blister packs, involves significant setup costs for cutting, sealing machinery, and thermoforming. For producers dealing with frequently changing SKUs or small batch sizes, the capital pressure is high.

According to PMMI, the typical investment in a thermoform-fill-seal line ranges from USD 1.5 million to USD 2.5 million, depending on material handling and automation capabilities. This restricts access to small or medium-sized businesses, decreasing the overall industry adoption pace.

Supply chain disruptions and fluctuations in raw material prices challenge the industry's progress

The cost of plastic resins like PET and PVC, coated paperboard, and aluminum foils used in carded packaging is highly unstable. Trade restrictions, geopolitical stresses, or scarcity of raw materials may affect lead times and packaging costs.

The global PET prices hiked by 18% due to disturbances in resin exports from Asia and energy cost spikes. Such price instability crushes margins for packaging producers and demotivates long-term investments in carded packaging lines.

Carded Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Carded Packaging Market |

| Market Size in 2024 | USD 30.51 Billion |

| Market Forecast in 2034 | USD 56.06 Billion |

| Growth Rate | CAGR of 7.90% |

| Number of Pages | 214 |

| Key Companies Covered | Amcor plc, Sonoco Products Company, WestRock Company, Sealed Air Corporation, Display Pack Inc., Placon Corporation, Clamshell Packaging LLC, Transparent Container Company Inc., Rohrer Corporation, Dordan Manufacturing Company, FormTex Plastics Corporation, Merrill’s Packaging Inc., Algus Packaging Inc., VisiPak, Atlas Vac Machine LLC., and others. |

| Segments Covered | By Product Type, By Material Type, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Carded Packaging Market: Segmentation

The global carded packaging market is segmented based on product type, material type, technology, application, and region.

Based on product type, the global carded packaging industry is divided into folding cartons, rigid boxes, sleeves, trays, and others. The folding cartons segment registered a notable market share due to their cost-effectiveness, versatility, and compatibility with various carded formats, such as skin packs and blister packs. They offer space for product visibility, branding, and regulatory labeling. Folding cartons are largely manufactured using biodegradable and recyclable paperboard that aligns with sustainability objectives. Easy customizability and lightweight nature improve their dominance in the industry.

Based on material type, the global carded packaging market is segmented as plastic, paper & paperboard, and aluminum. The plastic segment holds a remarkable share of the market due to its widespread use in clamshells, blister packs, and thermoformed trays.

Materials like RPET, PVC, and PET are favored for their formability, transparency, strength, and tamper-proof features, which are vital for product protection and display. Plastics' prominence is evident in various sectors, including consumer goods, pharmaceuticals, electronics, and tools. Despite ecological concerns, recycled and post-consumer recycled plastics are contributing to the segmental dominance.

Based on application, the global market is segmented as consumer goods, pharmaceuticals, electronics & semiconductors, and others. Consumer goods dominate the market, backed by the extensive use of clamshells, blister packs, and skin packs for a diverse range of products. These products need packaging that offers theft deterrence, cost-efficacy, branding space, and high visibility. With the growth of e-commerce and organized retail, the demand for tamper-proof, attractive, and durable packaging continues to rise, fueling segmental growth.

By Technology, the market is divided into Thermoforming and Cold Forming.

Carded Packaging Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is projected to maintain its leadership in the global carded packaging market due to a strong retail sector and consumer goods, a developed pharmaceutical industry, and a high adoption of thermoforming technology. North America, especially the United States, has an established consumer goods and retail industry, driving demand for tamper-proof, shelf-ready, and visually appealing packaging.

Companies in the region are increasingly opting for clamshell and blister packaging for enhanced product security and visibility. Strong shelf competition and high product turnover fuel constant advances in carded packaging formats.

The region accounts for over 40% of worldwide pharmaceutical sales, with a growing emphasis on compliance and unit-dose packaging. Cold-formed cards and blister cards are widely used for OTC drugs and prescriptions, complying with FDA traceability, safety, and child-resistant packaging standards. Furthermore, North America is a leader in thermoforming technology, which dominates global carded packaging production.

Regional packaging firms benefit from improved manufacturing networks, the availability of recycled plastics, and high levels of automation. This enables the cost-effective and scalable production of clamshells and blister cards, which are widely used in the healthcare, tool, and electronic product industries.

The Asia Pacific is projected to hold a significant share in the global carded packaging industry due to its rapid e-commerce growth, robust supply chains, low-cost manufacturing, and a growing consumer electronics industry.

The region's flourishing digital economy and middle class have fueled well-arranged online and retail shopping. Nations such as Indonesia, China, and India are experiencing rapid growth in e-commerce.

The region benefits from abundant raw materials, cost-effective labor, and an expansive packaging converter network. The leading packaging companies have manufacturing bases in key economies due to low production costs and better scalability. This enables the production of thermoformed and die-cut carded packaging, as well as bulk manufacturing, for both export and local markets.

In addition, the APAC region is home to prominent electronics manufacturing centers, including South Korea, China, Taiwan, and Japan, which drive high-volume demand for clamshell and blister card packaging. Carded packaging promises product visibility, protection during cross-border shipping, and tamper resistance, which is vital for components, accessories, and compact devices.

Carded Packaging Market: Competitive Analysis

The leading players in the global carded packaging market are:

- Amcor plc

- Sonoco Products Company

- WestRock Company

- Sealed Air Corporation

- Display Pack Inc.

- Placon Corporation

- Clamshell Packaging LLC

- Transparent Container Company Inc.

- Rohrer Corporation

- Dordan Manufacturing Company

- FormTex Plastics Corporation

- Merrill’s Packaging Inc.

- Algus Packaging Inc.

- VisiPak

- Atlas Vac Machine LLC.

Carded Packaging Market: Key Market Trends

- Adoption of smart features:

RFID, QR codes, and authentication elements are added to carded packaging, mainly in the electronics and pharmaceutical sectors. These features aid anti-counterfeiting, customer engagement via smartphones, and tracking.

- Shift to sustainable materials:

Companies are using compostable plastics, RPET, and recyclable paperboard to meet revised packaging regulations and environmental goals. This shift aids circular economy initiatives and decreases dependency on PVC and other materials that cannot be recycled.

The global carded packaging market is segmented as follows:

By Product Type

- Folding Cartons

- Rigid Boxes

- Sleeves

- Trays

- Others

By Material Type

- Plastic

- Paper & Paperboard

- Aluminum

By Technology

- Thermoforming

- Cold Forming

By Application

- Consumer Goods

- Pharmaceuticals

- Electronics & Semiconductors

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Carded packaging is a form of retail packaging that secures a product with a supportive backing material, typically plastic or paperboard, and a clamshell or clear plastic blister to display and protect the item. It is widely used for hardware electronics, cosmetics, and toys due to its ability to offer tamper resistance, visibility, and branding space.

The global carded packaging market is projected to grow due to the escalating growth of e-commerce, the growing significance of branding and shelf appeal, and cost-efficiency in mass production.

According to study, the global carded packaging market size was worth around USD 30.51 billion in 2024 and is predicted to grow to around USD 56.06 billion by 2034.

The CAGR value of the carded packaging market is expected to be around 7.90% during 2025-2034.

North America is expected to lead the global carded packaging market during the forecast period.

The key players profiled in the global carded packaging market include Amcor plc, Sonoco Products Company, WestRock Company, Sealed Air Corporation, Display Pack, Inc., Placon Corporation, Clamshell Packaging, LLC, Transparent Container Company, Inc., Rohrer Corporation, Dordan Manufacturing Company, FormTex Plastics Corporation, Merrill’s Packaging, Inc., Algus Packaging, Inc., VisiPak, and Atlas Vac Machine, LLC.

The report examines key aspects of the carded packaging market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed