Carbon Capture and Storage Market Size, Share, Trends, Growth & Forecast 2034

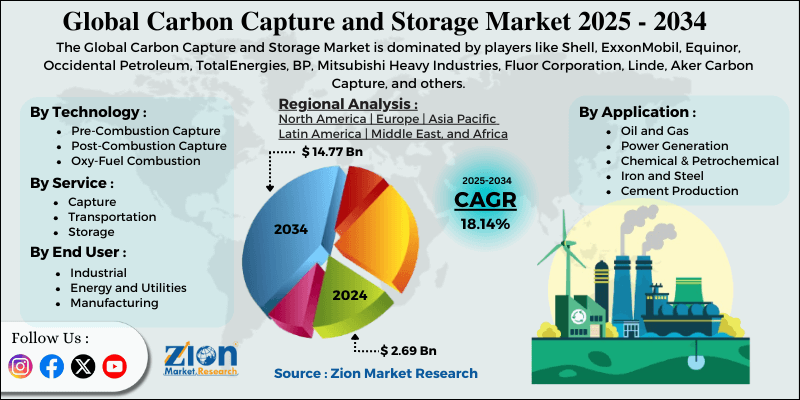

Carbon Capture and Storage Market By Technology (Pre-Combustion Capture, Post-Combustion Capture, Oxy-Fuel Combustion), By Service (Capture, Transportation, Storage), By Application (Oil and Gas, Power Generation, Chemical and Petrochemical, Iron and Steel, Cement Production), By End User (Industrial, Energy and Utilities, Manufacturing), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

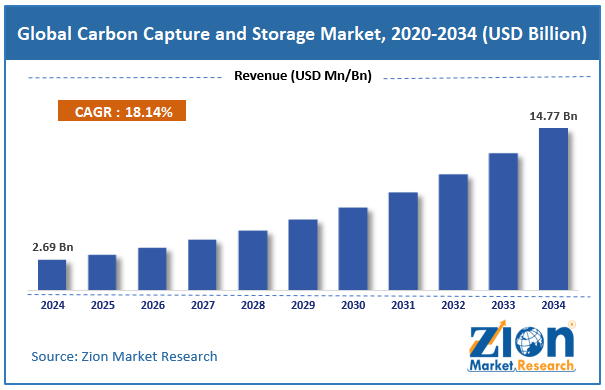

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.69 Billion | USD 14.77 Billion | 18.14% | 2024 |

Carbon Capture and Storage Industry Perspective:

What will be the size of the global carbon capture and storage market from 2025 to 2034?

The global carbon capture and storage market size was worth approximately USD 2.69 billion in 2024 and is projected to grow to around USD 14.77 billion by 2034, with a compound annual growth rate (CAGR) of roughly 18.14% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global carbon capture and storage market is estimated to grow annually at a CAGR of around 18.14% over the forecast period (2025-2034).

- In terms of revenue, the global carbon capture and storage market size was valued at approximately USD 2.69 billion in 2024 and is projected to reach USD 14.77 billion by 2034.

- The carbon capture and storage market is projected to grow significantly due to rising concerns about climate change, strengthened environmental regulations, expanding carbon pricing mechanisms, and expanding government incentives for emission-reduction technologies.

- Based on technology, the post-combustion capture segment is expected to lead the carbon capture and storage market, while the oxy-fuel combustion segment is anticipated to experience significant growth.

- Based on service, the capture segment is expected to lead the carbon capture and storage market, while the storage segment is anticipated to witness notable growth.

- Based on application, the power generation segment is the dominating segment, while the chemical and petrochemical segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the industrial segment is expected to lead the market compared to the energy and utilities segment.

- Based on region, North America is projected to dominate the global carbon capture and storage market during the estimated period, followed by Europe.

Carbon Capture and Storage Market: Overview

Carbon capture and storage is a climate technology that reduces air pollution by trapping carbon dioxide before it enters the atmosphere and storing it safely underground. This process involves capturing carbon dioxide from factories or power plants, transporting it, and storing it deep below the Earth's surface. Carbon can be captured either before or after fuel is burned, or by burning fuel in pure oxygen to produce a gas that is easier to capture. Once captured, carbon dioxide is transported via pipelines or ships to storage sites. Storage sites include deep saltwater rock layers, abandoned oil and gas fields, and coal seams deep underground. In some cases, carbon dioxide is injected into old oil fields to help produce more oil while keeping carbon underground. Carbon capture and storage is used by power plants, cement factories, steel producers, chemical plants, and oil and gas operations. This technology helps slow climate change by reducing greenhouse gas emissions. Long-term monitoring systems ensure stored carbon stays safely underground. Governments support the adoption of climate policies through regulations, subsidies, and carbon pricing. Growing climate concerns make carbon capture and storage important for achieving emission reduction and sustainability goals.

The growing urgency to address climate change and increasing government support for carbon reduction technologies are expected to drive growth in the carbon capture and storage market throughout the forecast period.

Carbon Capture and Storage Market: Technology Roadmap 2025–2034

The carbon capture and storage market is entering a critical growth phase, driven by stricter climate policies, rising carbon prices, government incentives, and urgent global efforts to reduce industrial carbon emissions. The following roadmap outlines the key development phases expected through 2034.

2025–2027: Cost Reduction and Early Deployment Phase

- Improvements in capture equipment design and materials reduce energy use and lower operating costs for power plants and industrial facilities.

- Government incentives, tax credits, and public funding support early large-scale projects, improving financial feasibility and investor confidence.

- Initial development of shared CO₂ transport and storage hubs allows multiple industries to reduce costs through shared infrastructure.

2028–2031: Infrastructure Expansion and Industrial Integration Phase

- Expansion of pipeline networks and shipping systems improves the reliable transport of captured CO₂ from industrial sites to storage locations.

- Carbon capture systems are increasingly integrated into cement, steel, chemicals, and hydrogen production facilities as standard design components.

2032–2034: Large-Scale Deployment and Carbon Utilization Phase

- Carbon utilization applications convert captured CO₂ into fuels, construction materials, and industrial products, improving project economics.

- Full integration with carbon markets enables long-term storage verification, transparent reporting, and global climate accountability.

Carbon Capture and Storage Market: Dynamics

Growth Drivers

How are strengthening climate policies driving the growth of the carbon capture and storage market?

The carbon capture and storage market is growing quickly as governments across the world take much stronger action to reduce pollution and slow the worsening effects of climate change. Countries are committing to cut greenhouse gas emissions under global climate agreements, which increases pressure on governments to act faster and more decisively. These international agreements encourage national governments to adopt stringent domestic regulations that limit the amount of pollution that industries are permitted to discharge. Carbon taxes and emissions trading systems make emitting carbon dioxide more expensive, pushing companies to seek cleaner solutions. As emissions become costly, carbon capture becomes a more realistic and financially sensible option for many industries.

Power plants, factories, and heavy industrial sites face tighter emission limits and must comply to avoid penalties. Some countries require new power plants and industrial facilities to install carbon capture systems from the beginning. Governments also support adoption through grants, tax credits, and low-interest financing programs. In the United States, expanded tax incentives significantly improve the financial returns of carbon capture projects. Clear rules for carbon storage improve safety, trust, and investor confidence. National climate plans highlight carbon capture as essential for net-zero goals.

Rising industrial pressure to reduce unavoidable carbon emissions.

The global carbon capture and storage market is growing as industries face pressure to cut unavoidable carbon emissions from core production activities. Heavy industries such as cement, steel, and chemicals release carbon through chemical processes, not only from fuel burning. Cement manufacturing emits carbon dioxide when limestone is broken down during production, creating emissions that cannot be captured. Steel production using blast furnaces produces high carbon emissions that remain part of current manufacturing methods. Chemical plants producing ammonia, methanol, and similar products release concentrated carbon streams suitable for capture systems.

Oil refineries and hydrogen production units also generate carbon byproducts that can be captured rather than released into the air. Companies must reduce emissions while maintaining output to stay competitive in global industrial markets worldwide. Trade rules, investor expectations, and customer sustainability demands increase pressure on suppliers to lower carbon footprints. Continuous technology improvements reduce capture costs, making carbon capture more affordable and practical for industrial facilities.

Restraints

High capital costs and economic viability challenges limit market growth.

A major challenge for the carbon capture and storage industry is the very high investment required and uncertainty around long-term financial returns. Carbon capture systems impose significant costs on power plants and industrial facilities, making new construction projects substantially more expensive. Installing capture equipment at existing plants requires complex modifications and often disrupts normal production for extended construction periods. Carbon capture processes consume large amounts of energy, reducing efficiency and lowering usable power output from facilities.

Transporting captured carbon dioxide requires pipelines that cost millions to build, depending on distance, terrain, and land access challenges. Storage projects require detailed geological surveys, drilling, and continuous monitoring systems before safe underground storage can begin. Long project development timelines delay revenue generation and increase financing and interest costs for developers. Unclear future carbon prices create uncertainty about long-term income from emission reductions or incentives. Changing regulations, evolving policies, and subsidy risks make financial planning difficult for investors. Competition from renewable energy solutions also affects the attractiveness of carbon capture investments.

Opportunities

How is the development of carbon utilization creating new opportunities for the carbon capture and storage market?

The carbon capture and storage industry is seeing strong growth opportunities as new carbon-use technologies turn captured carbon dioxide into valuable products rather than waste. Oil companies use captured carbon dioxide for enhanced oil recovery, where injected carbon dioxide improves production from aging fields while remaining permanently stored underground. Fuel producers convert captured carbon dioxide and clean hydrogen into synthetic fuels that work in existing vehicles without major engine changes. Chemical companies use carbon dioxide as a feedstock to produce plastics, solvents, and construction materials, thereby reducing dependence on fossil-based feedstocks. Concrete manufacturers cure cement using carbon dioxide, which locks carbon permanently into the material while also increasing strength and durability.

The food, beverage, and greenhouse industries use purified carbon dioxide for carbonation and plant growth, creating a steady demand for carbon dioxide captured from the atmosphere. Advanced technologies convert carbon dioxide into minerals, algae biomass, and industrial inputs, supporting circular economy models across multiple sectors. Direct air capture removes carbon dioxide directly from the atmosphere, expanding opportunities beyond industrial sources and supporting long-term climate goals. These carbon utilization pathways improve project profitability, attract investment, and accelerate the global adoption of carbon capture and storage solutions.

Challenges

How are public perception issues and storage concerns creating challenges for the carbon capture and storage industry?

The carbon capture and storage industry faces major challenges because many people remain worried about safety, environmental risks, and long-term responsibility for stored carbon dioxide. Communities near proposed storage sites often fear possible carbon dioxide leaks that could affect groundwater quality, air safety, and overall local environmental health. Past industrial accidents and pollution incidents have made residents skeptical of corporate promises, leading to distrust of new technologies promoted by energy and industrial firms. Strong local opposition, often called Not In My Backyard resistance, delays projects even when national governments support carbon capture for climate goals. Some environmental groups argue that carbon capture allows continued use of fossil fuels rather than fully shifting to renewable energy.

Public understanding of underground geological storage remains limited, leading to fear of unfamiliar technology and long-term underground processes. Landowners worry about property rights, future land value, and potential liability linked to underground carbon storage activities. Pipeline construction through towns raises safety concerns, visual impacts, and fears that accidents could affect nearby homes and businesses. Unclear long-term monitoring rules and liability responsibility decades after storage increase uncertainty for insurers, investors, governments, and local communities alike.

Carbon Capture and Storage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Carbon Capture and Storage Market |

| Market Size in 2024 | USD 2.69 Billion |

| Market Forecast in 2034 | USD 14.77 Billion |

| Growth Rate | CAGR of 18.14% |

| Number of Pages | 215 |

| Key Companies Covered | Shell, ExxonMobil, Equinor, Occidental Petroleum, TotalEnergies, BP, Mitsubishi Heavy Industries, Fluor Corporation, Linde, Aker Carbon Capture, and others. |

| Segments Covered | By Technology, By Service, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Carbon Capture and Storage Market: Segmentation

The global carbon capture and storage market is segmented based on technology, service, application, end-user, and region.

Based on technology, the global carbon capture and storage industry is segregated into pre-combustion capture, post-combustion capture, and oxy-fuel combustion. Post-combustion capture leads the market due to applicability to existing facilities without major process changes, proven technology maturity, and flexibility across various emission sources.

Based on service, the industry is segmented into capture, transportation, and storage. Capture leads the market due to its technical complexity, the highest capital costs, and critical importance as the initial step in the entire carbon capture and storage chain.

Based on application, the global carbon capture and storage market is classified into oil and gas, power generation, chemical and petrochemical, iron and steel, and cement production. Power generation holds the largest market share due to high CO2 emissions, concentrated sources, and regulatory pressure on the electricity sector.

Based on end-user, the global market is divided into industrial, energy and utilities, and manufacturing. Industrial holds the largest market share due to diverse emission sources, unavoidable process emissions, and growing regulatory requirements across multiple industrial sectors.

Carbon Capture and Storage Market: Regional Analysis

What factors are contributing to North America's dominance in the global carbon capture and storage market?

North America is expected to account for 41.2% of the global carbon capture and storage market, retaining its lead. North America leads the carbon capture and storage market due to strong government support, large industrial emissions, advanced technological capabilities, and the wide availability of suitable underground storage locations. The United States has long experience using carbon dioxide for enhanced oil recovery, where injected CO2 helps increase production from older oil fields while storing carbon underground. Extensive geological studies show vast storage potential in deep sedimentary basins across many states and regions.

Revenue from enhanced oil recovery improves project economics and encourages private investment in carbon capture infrastructure. The Inflation Reduction Act provides generous tax credits for carbon dioxide capture and storage, making such projects financially attractive. Federal funding through the Department of Energy supports research, pilot projects, and large-scale demonstrations. Carbon-pricing initiatives in some regions further strengthen the business case for emission-reduction technologies. Canada also supports carbon capture through investment tax credits, grants, and provincial programs. Alberta strongly promotes carbon capture to manage emissions from oil sands and heavy industry.

Existing pipeline networks reduce transportation costs for captured carbon in certain regions. Large engineering firms and technology providers headquartered in North America lead project design and system development. Universities and research institutions contribute to innovation through ongoing studies and testing programs. Industrial hubs along the Gulf Coast offer concentrated emission sources suitable for shared capture and storage systems. Manufacturing and energy companies use carbon capture to stay competitive under growing climate regulations and global trade pressures.

Europe is experiencing significant growth.

Europe is expected to account for a 33.6% share, remaining the second leading region in the global carbon capture and storage market. Europe is experiencing strong growth in the carbon capture and storage market as stringent climate goals push governments and industries to reduce emissions rapidly and at scale. The European Union aims to reach carbon neutrality by 2050, creating urgent demand for solutions that reduce emissions from heavy industry. The EU Emissions Trading System places a clear price on carbon, making carbon capture financially attractive for large emitters. The European Green Deal highlights carbon capture as essential across sectors such as cement, steel, chemicals, and refining.

Large underground storage resources in the North Sea sit close to major industrial regions, reducing transport challenges. Norway leads early adoption through strong government backing and cooperation with energy companies. Projects such as Northern Lights create shared transport and storage networks serving multiple European countries. The United Kingdom supports carbon capture clusters through long-term price guarantees that reduce investment risk. The Netherlands develops Rotterdam as a central hub linking factories, ports, and offshore storage sites. Germany invests in pilot projects to prove the viability of carbon capture in hard-to-reduce industries.

Public support for climate action across Europe increases political backing for large-scale deployment. Reducing dependence on imported energy strengthens interest in domestic low-carbon solutions. Strict environmental rules push companies to adopt carbon capture to stay compliant. European research funding supports local technology providers and engineering firms. Cross-border cooperation lowers costs by sharing infrastructure investments. Carbon capture helps European industries remain competitive while meeting climate targets.

Recent Market Developments

- In July 2025, SLB was awarded a major carbon storage contract for the Northern Endurance Partnership project in the UK, where the company will build and operate six carbon storage wells supporting CO₂ transport and storage infrastructure.

- In August 2025, the Northern Lights consortium, led by Equinor, TotalEnergies, and Shell, announced the first commercial injection and permanent storage of CO₂ under the North Sea seabed, marking a major operational milestone.

Carbon Capture and Storage Market: Competitive Analysis

The leading players in the global carbon capture and storage market are:

- Shell

- ExxonMobil

- Equinor

- Occidental Petroleum

- TotalEnergies

- BP

- Mitsubishi Heavy Industries

- Fluor Corporation

- Linde

- Aker Carbon Capture

The global carbon capture and storage market is segmented as follows:

By Technology

- Pre-Combustion Capture

- Post-Combustion Capture

- Oxy-Fuel Combustion

By Service

- Capture

- Transportation

- Storage

By Application

- Oil and Gas

- Power Generation

- Chemical and Petrochemical

- Iron and Steel

- Cement Production

By End User

- Industrial

- Energy and Utilities

- Manufacturing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed