Bulk Calcium Carbonate Market Size, Share, Trends, Growth 2034

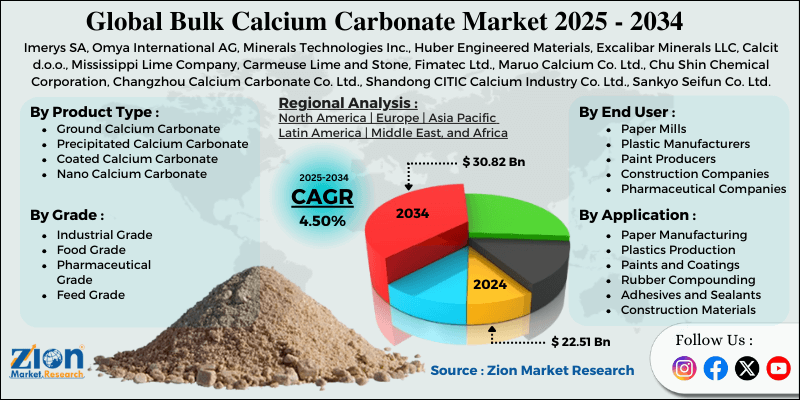

Bulk Calcium Carbonate Market By Product Type (Ground Calcium Carbonate, Precipitated Calcium Carbonate, Coated Calcium Carbonate, Nano Calcium Carbonate), By Grade (Industrial Grade, Food Grade, Pharmaceutical Grade, Feed Grade), By Application (Paper Manufacturing, Plastics Production, Paints and Coatings, Rubber Compounding, Adhesives and Sealants, Construction Materials), By End-User (Paper Mills, Plastic Manufacturers, Paint Producers, Construction Companies, Pharmaceutical Companies, Food Industry), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

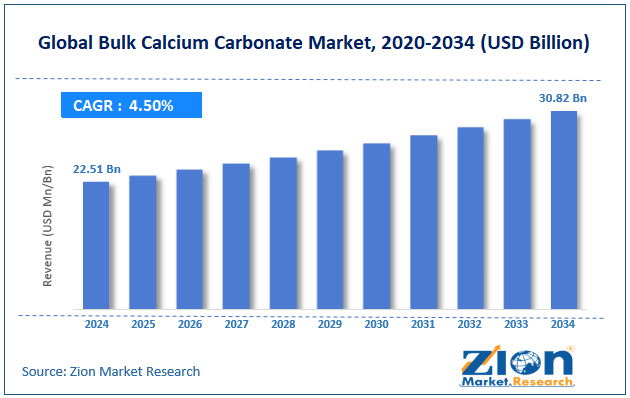

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.51 Billion | USD 30.82 Billion | 4.50% | 2024 |

Bulk Calcium Carbonate Industry Perspective:

What will be the size of the bulk calcium carbonate market during the forecast period?

The global bulk calcium carbonate market size was worth approximately USD 22.51 billion in 2024 and is projected to grow to around USD 30.82 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.50% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global bulk calcium carbonate market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034).

- In terms of revenue, the global bulk calcium carbonate market size was valued at approximately USD 22.51 billion in 2024 and is projected to reach USD 30.82 billion by 2034.

- The bulk calcium carbonate market is projected to grow significantly due to rising paper production volumes, increasing plastics consumption, expanding construction activity, growing paint and coatings demand, and ongoing technological improvements in processing methods.

- Based on product type, the ground calcium carbonate segment is expected to lead the bulk calcium carbonate market, while the precipitated calcium carbonate segment is anticipated to grow rapidly.

- Based on grade, the industrial grade segment is expected to lead the bulk calcium carbonate market, while the pharmaceutical grade segment is anticipated to grow rapidly.

- Based on application, the paper manufacturing segment is the dominating segment, while the plastics production segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the paper mills segment is expected to lead the market compared to the plastic manufacturers segment.

- Based on region, Asia Pacific is projected to dominate the global bulk calcium carbonate market during the estimated period, followed by North America.

Bulk Calcium Carbonate Market: Overview

Bulk calcium carbonate is an industrial mineral material widely used as a filler, pigment, and functional additive across many manufacturing industries. Manufacturers produce bulk calcium carbonate either by mining natural limestone and grinding it to a fine powder or by using chemical precipitation processes to achieve specific particle sizes and properties. This material supports cost reduction, improves product quality, increases brightness, and delivers functional performance benefits in industrial production. Ground calcium carbonate remains popular due to natural availability, low cost, simple processing, and reliable performance in paper, plastics, and construction materials. Precipitated calcium carbonate offers controlled particle size, high purity, smooth surface characteristics, and consistent quality for applications requiring precision performance.

Bulk calcium carbonate serves paper manufacturing, plastic production, paints and coatings, rubber compounding, adhesives, sealants, and construction materials. Paper mills, plastic processors, paint manufacturers, construction companies, pharmaceutical producers, and food processors rely on bulk calcium carbonate for efficiency improvement, performance enhancement, and stable product quality across diverse industrial applications.

The increasing demand for cost-effective functional fillers and growing consumption in emerging manufacturing markets are expected to drive significant expansion in the bulk calcium carbonate market throughout the forecast period.

Bulk Calcium Carbonate Market: Technology Roadmap 2025–2034

The bulk calcium carbonate market is entering a dynamic phase of evolution driven by advances in processing technology, improved grinding techniques, enhanced surface treatment methods, and expanding application development capabilities. The following is the technology roadmap divided into development phases expected to unfold through 2034.

2025–2027: Processing Efficiency and Quality Enhancement Phase

- New grinding machines produce finer powder faster, reducing energy use and maintaining overall quality.

- Automatic quality checks reduce mistakes, maintain batch consistency, speed production, and help factories deliver reliable calcium carbonate products globally every day.

2028–2031: Functionalization and Surface Treatment Phase

- New surface coatings help calcium carbonate mix better with plastics, improving strength, processing ease, and product performance.

- Hybrid materials combine calcium carbonate with other minerals, offering greater strength, lower costs, improved durability, and broader use in demanding industrial and specialty product applications worldwide.

- Digital sensors track production in real time, helping teams reduce waste, adjust settings quickly, and maintain consistent product quality in everyday operations.

2032–2034: Nano Technology and Sustainable Production Phase

- Scalable nano calcium carbonate production enables the production of very fine particles with controlled shape, opening new uses in high-performance plastics, coatings, medicines, and advanced materials worldwide.

- Cleaner processing uses renewable energy to cut emissions, lower costs, and improve sustainability for calcium carbonate producers.

Bulk Calcium Carbonate Market: Dynamics

Growth Drivers

The expanding paper industry increases demand in the global market.

The bulk calcium carbonate market grows steadily as paper production increases demand for low-cost fillers and coating pigments. Growth in packaging paper production, driven by expanding retail, creates strong demand for calcium carbonate, which improves the opacity, brightness, and print quality of boxes. Rising tissue paper use, driven by population growth and hygiene awareness, supports demand for calcium carbonate, which improves softness, strength, and absorption. Specialty paper, including labels, thermal paper, and decorative sheets, needs calcium carbonate to ensure stable functional performance and visual appearance. Coated paper demand for high-quality printing increases the use of precipitated calcium carbonate, delivering smooth surfaces, gloss, and sharp print results.

Lightweight paper production focuses on adjusting calcium carbonate levels and balancing filler content to maintain strength, durability, and machine efficiency. Cost pressures are prompting paper producers to increase calcium carbonate use, replacing costly materials while maintaining acceptable product quality standards. Combined growth in packaging, rising consumption, quality requirements, and pricing pressure are supporting the steady expansion of the global bulk calcium carbonate market.

How is the growing plastics industry driving the growth of the bulk calcium carbonate market?

The global bulk calcium carbonate market grows faster as plastic use increases across packaging, construction, automotive, and everyday consumer goods worldwide. Polyvinyl chloride uses calcium carbonate to improve stiffness and shape stability and to reduce costs in pipes, profiles, and cables for infrastructure applications. Polypropylene materials add calcium carbonate to improve impact strength, heat stability, surface smoothness, and reduce overall material costs for vehicles and appliances. Polyethylene film production uses calcium carbonate to improve opacity, barrier protection properties, processing ease, and visual appearance in packaging films.

Rigid packaging products, including containers, caps, and closures, gain strength, weight reduction benefits, and improved durability using calcium carbonate fillers. Flexible packaging growth, driven by convenience trends, is increasing calcium carbonate demand for films that require balanced strength, clarity, and protection. Automotive and construction plastics use calcium carbonate to lower weight, improve efficiency, increase durability, and meet environmental compliance requirements.

Restraints

How are substitution threats and raw material variability limiting the bulk calcium carbonate market expansion?

A major challenge in the bulk calcium carbonate industry is strong competition from alternative fillers and functional additives offering similar or better performance. Talc competes in plastics by providing improved heat resistance, dimensional stability, and mechanical strength for higher-value applications. Kaolin clay attracts paper manufacturers by improving print quality, controlling gloss, and enhancing smooth-coating performance for specific paper grades. Titanium dioxide replaces calcium carbonate in high-opacity applications due to its superior brightness and lower material loading requirements, despite its higher cost. Silica products compete with polymers by offering better abrasion resistance, reinforcement strength, and clarity in specialty formulations.

Glass fiber reinforcement draws demand away by delivering high strength, thermal resistance, and dimensional stability in engineering plastics. Synthetic materials such as calcium silicate and calcium sulfate serve niche functions, thereby limiting the use of calcium carbonate. Variation in limestone quality affects consistency, processing costs, and supply reliability. Regional differences in limestone deposits limit expansion options by affecting mineral composition, product performance, and achievable quality levels. Environmental mining regulations raise compliance costs, restrict capacity expansion, and reduce margins for producers operating globally, thereby undermining long-term profitability.

Opportunities

How is technology advancement creating growth potential for the bulk calcium carbonate industry?

The bulk calcium carbonate industry shows strong growth as modern processing technologies improve performance across many end-use industries. Ultra-fine grinding produces tiny particles, supporting use in specialty coatings, advanced plastics, and pharmaceutical applications requiring high precision. Surface modification using stearic acid and titanate treatments improves material compatibility and mechanical strength in polymer systems. Nano calcium carbonate enables higher value applications in rubber, plastics, and coatings by improving reinforcement, durability, and product life. Controlled crystal shapes help meet specific requirements in paper, films, tablets, and coating manufacturing processes.

Composite fillers blending calcium carbonate with other minerals improve cost efficiency and expand application flexibility across industries. Sustainable production methods that use waste materials and reduce energy consumption support environmental goals and responsible sourcing trends. Bio-based surface treatments attract manufacturers seeking environmentally friendly materials while maintaining performance and processing efficiency. Specialized product grades and technical support help customers improve productivity, strengthen partnerships, and access premium market opportunities worldwide.

Challenges

Logistics complexity and regional supply concentration create obstacles in the market.

Transportation costs pose a challenge for the bulk calcium carbonate industry due to the low product value and large shipment volumes. Dependence on rail transport limits flexibility, causes scheduling issues, and increases exposure to infrastructure disruptions affecting reliable material supply. Road transport limits, including distance costs, traffic congestion, and weight rules, reduce competitiveness for customers located far from production sites. Export shipping requires significant freight costs, bulk-handling facilities, and complex logistics, slowing international market expansion.

Large storage needs demand capital investment, increase working capital pressure, and reduce flexibility for smaller distributors and end users. Limestone deposits concentrate supply regionally, increasing transport distances, limiting competition, and raising delivered costs for customers in distant markets. Demand spikes strain capacity, cause shortages and price swings, and weaken customer confidence in long-term supply stability. Handling dust creates environmental concerns, requires significant investment in controls, complicates operations, and increases technical service costs for producers worldwide.

Bulk Calcium Carbonate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bulk Calcium Carbonate Market |

| Market Size in 2024 | USD 22.51 Billion |

| Market Forecast in 2034 | USD 30.82 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 212 |

| Key Companies Covered | Imerys SA, Omya International AG, Minerals Technologies Inc., Huber Engineered Materials, Excalibar Minerals LLC, Calcit d.o.o., Mississippi Lime Company, Carmeuse Lime and Stone, Fimatec Ltd., Maruo Calcium Co. Ltd., Chu Shin Chemical Corporation, Changzhou Calcium Carbonate Co. Ltd., Shandong CITIC Calcium Industry Co. Ltd., Sankyo Seifun Co. Ltd., GLC Minerals LLC., and others. |

| Segments Covered | By Product Type, By Grade, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bulk Calcium Carbonate Market: Segmentation

The global bulk calcium carbonate market is segmented based on product type, grade, application, end-user, and region.

Based on product type, the global bulk calcium carbonate industry is classified into ground calcium carbonate, precipitated calcium carbonate, coated calcium carbonate, and nano calcium carbonate. Ground calcium carbonate leads the market due to abundant raw material availability supporting large-scale production and established customer relationships spanning decades.

Based on grade, the industry is divided into industrial grade, food grade, pharmaceutical grade, and feed grade. Industrial-grade leads the market due to the largest volume of applications across the paper, plastics, and construction industries and to established distribution networks throughout manufacturing regions.

Based on application, the global bulk calcium carbonate market is segregated into paper manufacturing, plastics production, paints and coatings, rubber compounding, adhesives and sealants, and construction materials. Paper manufacturing is expected to lead the market during the forecast period due to large consumption volumes per ton of paper produced, cost effectiveness compared to alternative fillers, and continuing global paper demand.

Based on end-user, the global market is divided into paper mills, plastic manufacturers, paint producers, construction companies, pharmaceutical companies, and the food industry. Paper mills hold the largest market share due to the highest per-unit consumption of calcium carbonate and to the geographic distribution of facilities that support regional production networks.

Bulk Calcium Carbonate Market: Regional Analysis

What factors are contributing to Asia Pacific's dominance in the global bulk calcium carbonate market?

Asia Pacific is expected to grow at a 7.8% CAGR, keeping its lead in the global bulk calcium carbonate market. Large factories, rapid industrial growth, abundant limestone availability, and low-cost production support strong bulk calcium carbonate use across the Asia Pacific. China leads demand through high paper output, large plastics production, ongoing construction, and a strong position in global supply chains. India is experiencing rapid growth, supported by expanding paper production, rising plastic use, growing paint output, and major infrastructure development programs. Indonesia supports regional growth through rich natural resources, expanding manufacturing capacity, active construction markets, and rising domestic industrial use. Vietnam adds steady demand through fast industrial growth, foreign factory investments, export-driven production growth, and rising local consumption nationwide. Thailand holds a strong role with established industries, a central location, efficient transport systems, and regional distribution strengths.

Malaysia supports market growth through construction expansion, factory development, palm oil-related uses, and links within regional supply networks. South Korea creates demand through advanced manufacturing, high-quality standards, specialized product development, and ongoing technological innovation across industries. Japan maintains steady use, supported by mature industries, high-quality standards, specialty-grade demand, and regular replacement needs. Bangladesh and Pakistan offer new opportunities from textile growth, construction expansion, rising factory activity, and increasing local consumption.

A wide limestone supply across the Asia Pacific supports local production, lowers transport costs, improves pricing, and strengthens supply reliability. Combined industrial growth, strong resources, cost benefits, and manufacturing investment clearly position the Asia Pacific as the leading growth region for bulk calcium carbonate worldwide. Strong regional investment interest supports new plants, improved distribution networks, and stable long-term supply growth across industries.

North America maintains a significant market presence.

North America is expected to grow at a 4.3% CAGR, remaining the second-largest region in the global bulk calcium carbonate market. The region remains strong due to well-developed paper industries, steady plastic production, active construction, and advanced manufacturing quality standards. The United States leads demand with large paper mills, varied plastics production, ongoing construction activity, and rising use of paints and coatings. Canada supports the market through pulp and paper production, growing plastic use, stable construction activity, and mining operations that supply raw materials.

Mexico sustains growth through the expansion of factories, the development of the automotive industry, infrastructure projects, and cost-competitive production for regional markets. Packaging paper demand increases with online shopping, driving up calcium carbonate use in boxes, cartons, and other protective packaging materials. Plastic use in vehicle lightweighting, packaging items, and building materials keeps calcium carbonate demand steady across markets. Paint and coating producers use calcium carbonate to lower costs and improve texture in building and industrial coatings.

Construction products, including joint compounds, sealants, and adhesives, rely on calcium carbonate to improve performance and reduce costs. Pharmaceutical- and food-grade calcium carbonate supports smaller markets needing high purity, strict regulation, and consistent quality. Advanced technology in particle-size control, surface treatment, and product development supports the development of higher-value products. Trusted customer relationships, technical support, and reliable supply help producers compete against low-cost imports. Overall industrial stability, steady demand, and advanced processing continue to sustain growth in the North American bulk calcium carbonate market.

Recent Market Developments

- In May 2025, MIDROC Investment Group launched Ethiopia's first coated calcium carbonate production plant in the Afar Region, with an annual capacity of 18,000 tons to supply local industries, including pharmaceuticals and plastics.

- In March 2025, TotalEnergies ENEOS and Imerys jointly installed a 1 MWp solar power system at Imerys' calcium carbonate production facility in Ipoh, Malaysia, to cut energy costs and support sustainable manufacturing operations.

Bulk Calcium Carbonate Market: Competitive Analysis

The leading players in the global bulk calcium carbonate market are:

- Imerys SA

- Omya International AG

- Minerals Technologies Inc.

- Huber Engineered Materials

- Excalibar Minerals LLC

- Calcit d.o.o.

- Mississippi Lime Company

- Carmeuse Lime and Stone

- Fimatec Ltd.

- Maruo Calcium Co. Ltd.

- Chu Shin Chemical Corporation

- Changzhou Calcium Carbonate Co. Ltd.

- Shandong CITIC Calcium Industry Co. Ltd.

- Sankyo Seifun Co. Ltd.

- GLC Minerals LLC.

The global bulk calcium carbonate market is segmented as follows:

By Product Type

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

- Coated Calcium Carbonate

- Nano Calcium Carbonate

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

- Feed Grade

By Application

- Paper Manufacturing

- Plastics Production

- Paints and Coatings

- Rubber Compounding

- Adhesives and Sealants

- Construction Materials

By End User

- Paper Mills

- Plastic Manufacturers

- Paint Producers

- Construction Companies

- Pharmaceutical Companies

- Food Industry

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed