Beverage Essence Ingredient Market Size, Share, Growth & Forecast 2034

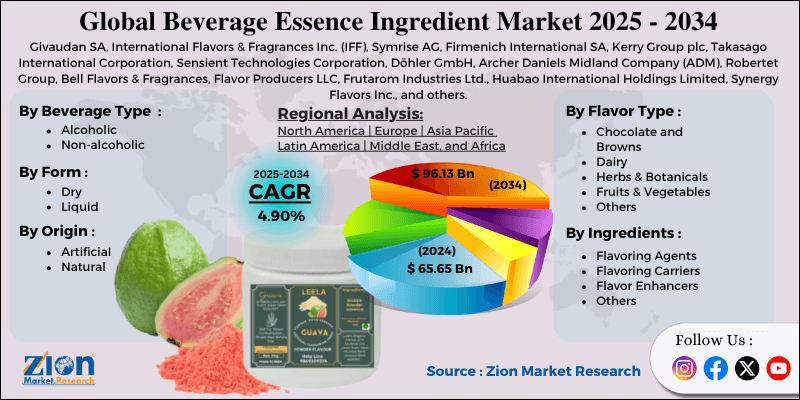

Beverage Essence Ingredient Market By Beverage Type (Alcoholic, Non-alcoholic), By Flavor Type (Chocolate and Browns, Dairy, Herbs & Botanicals, Fruits & Vegetables, and Others), By Ingredients (Flavoring Agents, Flavoring Carriers, Flavor Enhancers, and Others), By Form (Dry, Liquid), By Origin (Artificial, Natural), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

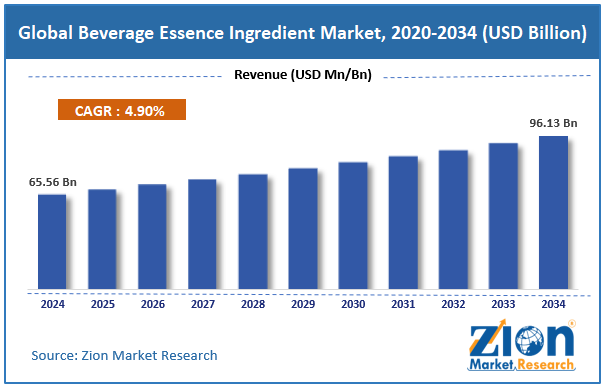

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 65.56 Billion | USD 96.13 Billion | 4.90% | 2024 |

Beverage Essence Ingredient Industry Perspective:

The global beverage essence ingredient market size was approximately USD 65.56 billion in 2024 and is projected to reach around USD 96.13 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global beverage essence ingredient market is estimated to grow annually at a CAGR of around 4.90% over the forecast period (2025-2034)

- In terms of revenue, the global beverage essence ingredient market size was valued at around USD 65.56 billion in 2024 and is projected to reach USD 96.13 billion by 2034.

- The beverage essence ingredient market is projected to grow significantly owing to the rising health consciousness among consumers, increasing use of natural and organic ingredients, and technological advancements in flavor extraction and formulation.

- Based on beverage type, the non-alcoholic segment is expected to lead the market, while the alcoholic segment is expected to grow considerably.

- Based on flavor type, the fruits & vegetables segment is the dominant segment, while the herbs & botanicals segment is projected to witness sizable revenue growth over the forecast period.

- Based on ingredients, the flavoring agents segment is expected to lead the market, while the flavor enhancers segment is expected to grow considerably.

- Based on form, the liquid segment is the dominant segment, while the dry segment is projected to witness sizable revenue growth over the forecast period.

- Based on origin, the natural segment is expected to lead the market compared to the artificial segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Beverage Essence Ingredient Market: Overview

Beverage essence ingredients are concentrated flavoring compounds that enhance the aroma, taste, and sensory appeal of beverages. These ingredients are obtained from natural sources or produced synthetically to achieve consistent flavor profiles. They play a vital role in energy drinks, soft drinks, juices, flavored waters, and alcoholic drinks by offering unique and appealing tastes. The global beverage essence ingredient market is poised for significant growth, driven by the increasing demand for clean-label and natural flavors, the expansion of nutritional and functional beverages, and trends in flavor innovation and premiumization. Consumers are increasingly preferring beverages made with natural ingredients over those containing artificial additives. The move towards botanical-based and clean-label flavors is fueling the speedy adoption of natural essences. This demand supports the global health-conscious movement, which focuses on authenticity and transparency.

Moreover, functional beverages enriched with probiotics, vitamins, and minerals are gaining popularity worldwide. Beverage essence ingredients help mask bitterness and enhance taste in such formulations, fueling the demand for essence. Furthermore, consumers are presenting a rising appetite for sophisticated and exotic beverage flavors. Manufacturers are introducing innovative essences, such as yuzu, matcha, and elderflower, to capture premium market share. These new formulations improve brand identity and support high product pricing.

Nevertheless, the global market faces limitations due to factors such as the high cost of natural essence production and strict food regulatory and safety standards. Extracting essences from natural sources, such as herbs and fruits, involves complex and expensive processes. Raw material scarcity and seasonal availability further inflate production costs. This restricts affordability and hampers adoption among small beverage manufacturers. Governments impose stringent safety, purity, and labeling regulations on flavor ingredients. Compliance with multiple regional standards adds to formulation and certification expenses. These complexities often delay product launches and restrict smaller producers.

Still, the global beverage essence ingredient industry benefits from several favorable factors, including the growing prominence of wellness and functional beverages, as well as the increasing demand for vegan and plant-based drinks. Consumers are enhancing their drinks with added health benefits, including stress relief and improved immunity. Essence producers can integrate adaptogenic and botanical flavors to target this segment. This opens fresh avenues for advancement in wellness and herbal beverages.

Additionally, the global plant-based beverage movement is driving demand for botanical and clean essences. Ingredients obtained from spices, fruits, and flowers support vegan-friendly formulations. This backs flavor diversity in dairy alternatives and plant-based energy drinks.

Beverage Essence Ingredient Market Dynamics

Growth Drivers

How does the expansion of the non-alcoholic beverage segment fuel the beverage essence ingredient market?

The rapid rise of the non-alcoholic beverage industry – comprising flavored waters, mocktails, and alcohol-free beers - has become a leading industry driver. According to Euromonitor 2024, a 6.1% YoY surge in this segment is driven by Gen Z and health-conscious consumers. Beverage essences play a crucial role in replicating authentic flavors and aromas in these drinks. Leading brands like Heineken and Diageo now use advanced essence formulations to imitate alcoholic profiles, boosting innovation in alcohol-free product development.

How is the beverage essence ingredient market driven by the rapid growth of the Ready-to-Drink (RTD) beverage sector?

The speedy growth of the RTD beverage industry – comprising teas, coffees, and energy drinks has remarkably elevated the demand for beverage essences. The segment generated over USD 110 billion in sales in 2024, according to Statista, with North America and the Asia Pacific leading the way. Brands like Monster Energy and Starbucks use botanical and fruit essences to improve flavor variety and premium appeal. This current RTD boom is fueling the need for shelf-stable and versatile essence ingredients that promise consistent taste and quality, impacting the growth of the beverage essence ingredient market.

Restraints

Short shelf life and stability issues of natural essences hamper the market progress

Despite strong demand for natural ingredients, their restricted shelf stability offers a key challenge. Natural essences usually degrade through oxidation and heat exposure, mainly in carbonated and RTD drinks. According to the Food Chemistry Journal (2024), unencapsulated citrus essence loses nearly 35% of its aroma compounds. Preservative technologies, although these solutions increase production costs, conflict with clean-label goals.

Opportunities

How do technological advancements in bio-based flavor engineering create promising avenues for the beverage essence ingredient industry growth?

Improvements in fermentations and biotechnology are facilitating the sustainable production of beverage essence ingredients. Synthetic biology now enables the replication of rare natural flavors, such as citrus or vanilla, with a low ecological impact. The Flavor and Extract Manufacturers Association's 2024 report states that bio-based flavor production can reduce emissions by nearly 40%. Prominent companies like IFF and Firmenich have already introduced bio-engineered essence lines, marking bioflavor advancement as the key growth driver of the beverage essence ingredient industry over the next five years.

Challenges

Intellectual Property (IP) and counterfeiting issues restrict the market growth

Unauthorized duplication of beverage essence formulations is rising as their complex compositions are difficult to patent. Counterfeit products are causing substantial losses, estimated at USD 1.2 billion annually, according to reports. These imitations decrease consumer trust and quality. While companies are shifting to digital watermarking and blockchain for protection, adoption remains slow due to the high costs associated with these technologies.

Beverage Essence Ingredient Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Beverage Essence Ingredient Market |

| Market Size in 2024 | USD 65.65 Billion |

| Market Forecast in 2034 | USD 96.13 Billion |

| Growth Rate | CAGR of 4.90% |

| Number of Pages | 214 |

| Key Companies Covered | Givaudan SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Firmenich International SA, Kerry Group plc, Takasago International Corporation, Sensient Technologies Corporation, Döhler GmbH, Archer Daniels Midland Company (ADM), Robertet Group, Bell Flavors & Fragrances, Flavor Producers LLC, Frutarom Industries Ltd., Huabao International Holdings Limited, Synergy Flavors Inc., and others. |

| Segments Covered | By Beverage Type, By Flavor Type, By Ingredients, By Form, By Origin, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Beverage Essence Ingredient Market: Segmentation

The global beverage essence ingredient market is segmented by beverage type, flavor type, ingredients, form of origin, and region.

Based on beverage type, the global beverage essence ingredient market is divided into alcoholic and non-alcoholic categories. The non-alcoholic segment holds a leading share, fueled by massive consumption of soft drinks, flavored waters, and functional beverages worldwide.

Based on flavor type, the global market is segmented into chocolate and browns, dairy, herbs & botanicals, fruits & vegetables, and others. The fruits & vegetables segment captured a dominating share due to its broad application in carbonated drinks, functional beverages with natural taste appeal, and juices.

Based on ingredients, the global market is segmented into flavoring agents, flavoring carriers, flavor enhancers, and others. The flavoring agents segment holds a substantial market share, driven by their crucial role in defining the aroma and core taste profile of beverages across all categories.

Based on form, the global beverage essence ingredient industry is segmented into dry and liquid. The liquid segment leads the market since it offers superior stability, mixability, and uniform flavor dispersion in beverage manufacturing.

Based on origin, the global market is segmented into artificial and natural. The natural segment holds leadership in the market, driven by consumer demand for plant-based, clean-label, and health-conscious beverage formulations.

Beverage Essence Ingredient Market: Regional Analysis

Why is North America outperforming other regions in the global Beverage Essence Ingredient Market?

North America is projected to maintain its dominant position in the global beverage essence ingredient market, driven by strong demand for healthy and functional beverages, high investment in beverage research and development (R&D) and innovation, and a growing preference for clean-label and natural flavors. Consumers in Canada and the US are moving towards drinks that offer health benefits. This trend has prompted companies to utilize advanced essence ingredients that combine taste appeal with functionality.

Moreover, leading beverage brands and flavor houses in North America invest heavily in research and development (R&D) to create natural and unique flavor profiles. Companies like ADM, Coca-Cola, and PepsiCo are actively expanding their essence portfolios to include botanical, fruit-based, and sustainable options, thereby boosting regional market growth. Consumers are majorly avoiding synthetic additives, fueling substantial demand for plant-derived and organic flavor essences. This supports the growing clean-label movement, ranking the region as the center for natural essence advancement.

The Asia Pacific region maintains its position as the second-largest in the global beverage essence ingredient industry, driven by a growing middle-class population and increasing disposable income, a shift towards healthy and natural beverages, and strong growth in energy and functional drinks. Economic growth in developing markets, such as Indonesia, China, and India, has led to changing lifestyles and rising disposable incomes. Consumers are spending more on flavored and premium beverages for refreshment and indulgence. This socio-economic move supports the regional demand for high-class beverage essences. Health-conscious individuals in APAC are actively seeking beverages made from low-sugar formulations and natural ingredients.

According to reports, more than 60% of urban consumers in the region prefer ‘no-artificial flavor’ or ‘natural’ drinks. This inclination encourages beverage producers to adopt herbal, fruit, and botanical essences for clean-label appeal. Furthermore, functional beverages such as energy boosters, vitamin-infused waters, and sports drinks are gaining significant popularity in economies like India, South Korea, and Japan. The regional functional beverage exceeded $48 billion in 2024, creating substantial demand for flavoring ingredients that improve taste and mask bitterness. Beverage essence suppliers are investing in this progressing niche.

Beverage Essence Ingredient Market: Competitive Analysis

The leading players in the global beverage essence ingredient market are:

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Firmenich International SA

- Kerry Group plc

- Takasago International Corporation

- Sensient Technologies Corporation

- Döhler GmbH

- Archer Daniels Midland Company (ADM)

- Robertet Group

- Bell Flavors & Fragrances

- Flavor Producers LLC

- Frutarom Industries Ltd.

- Huabao International Holdings Limited

- Synergy Flavors Inc.

Beverage Essence Ingredient Market: Key Market Trends

Technological innovation in flavor extraction and delivery:

Advanced methods, such as fermentation-based extraction and microencapsulation, are enhancing the stability and quality of these products. These solutions help improve the flavor and natural aroma in various beverage formulations. Manufacturers use them to provide long-lasting freshness and reduce reliance on artificial ingredients.

Customization and regional flavor localization:

Beverage companies are creating region-specific and culturally inspired essence flavors to match local preferences. Asian markets favor tea-based and tropical flavors. Western consumers prefer botanicals and berries. This localization enhances brand differentiation and global market penetration.

The global beverage essence ingredient market is segmented as follows:

By Beverage Type

- Alcoholic

- Non-alcoholic

By Flavor Type

- Chocolate and Browns

- Dairy

- Herbs & Botanicals

- Fruits & Vegetables

- Others

By Ingredients

- Flavoring Agents

- Flavoring Carriers

- Flavor Enhancers

- Others

By Form

- Dry

- Liquid

By Origin

- Artificial

- Natural

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Beverage essence ingredients are concentrated flavoring compounds that enhance the aroma, taste, and sensory appeal of beverages. These ingredients are obtained from natural sources or produced synthetically to achieve consistent flavor profiles. They play a vital role in energy drinks, soft drinks, juices, flavored waters, and alcoholic drinks by offering unique and appealing tastes.

The global beverage essence ingredient market is projected to grow due to rising demand for flavored and functional beverages, the expansion of the ready-to-drink (RTD) beverage segment, and strong demand from emerging markets in the Asia-Pacific and Latin America regions.

According to study, the global beverage essence ingredient market size was worth around USD 65.56 billion in 2024 and is predicted to grow to around USD 96.13 billion by 2034.

The CAGR value of the beverage essence ingredient market is expected to be approximately 4.90% from 2025 to 2034.

Major opportunities include rising demand for functional and natural beverages, expanding adoption of clean-label and plant-based essence formulations, and technological advancements in flavor extraction.

The flavoring agents segment holds the largest share in the market, as they form the core component responsible for defining the aroma and taste of nearly all beverage formulations.

North America is expected to lead the global beverage essence ingredient market during the forecast period.

The key players profiled in the global beverage essence ingredient market include Givaudan SA, International Flavors & Fragrances Inc. (IFF), Symrise AG, Firmenich International SA, Kerry Group plc, Takasago International Corporation, Sensient Technologies Corporation, Döhler GmbH, Archer Daniels Midland Company (ADM), Robertet Group, Bell Flavors & Fragrances, Flavor Producers, LLC, Frutarom Industries Ltd., Huabao International Holdings Limited, and Synergy Flavors, Inc.

Stakeholders should focus on innovation in natural flavor development, strategic partnerships, sustainable sourcing, and regional customization to maintain a competitive edge in the market.

The report examines key aspects of the beverage essence ingredient market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed